Nitheesh NH

As the Internet has become a popular platform for consumers to make purchases, they are looking for convenience in accessing servicesThe US pharmacy retail sector has seen low e-commerce penetration levels, largely due to tight regulation. However, new players are now capturing shares from traditional pharmacies. Walgreens and CVS, the two biggest drugstore chains in the US, are accelerating their investment in e-commerce and digital healthcare services to better compete with online-focused pharmacy companies as well as omnichannel competitors such as mass merchandisers. In this report, we detail the two retailers’ recent digital initiatives and review competing online pharmaceutical services.

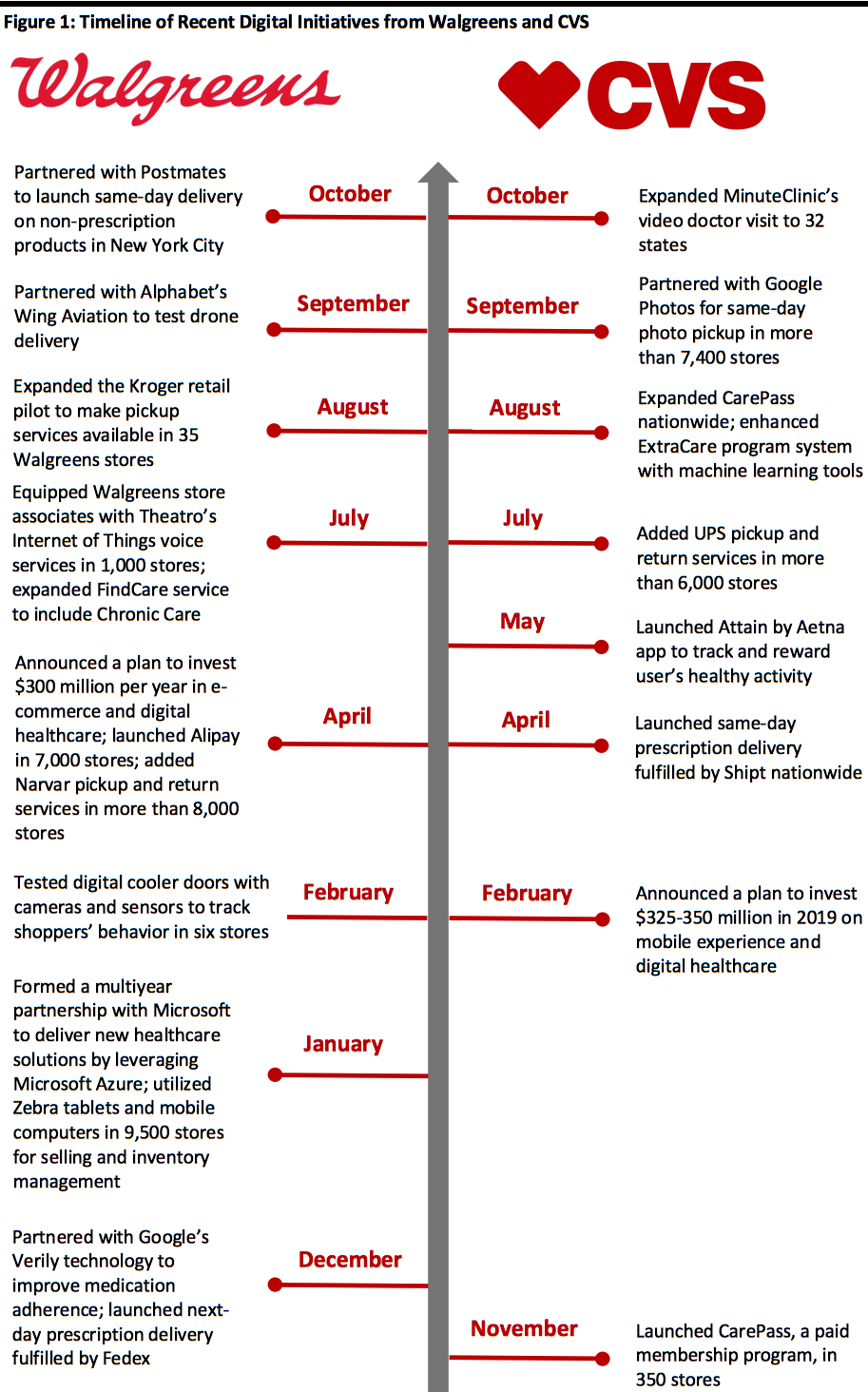

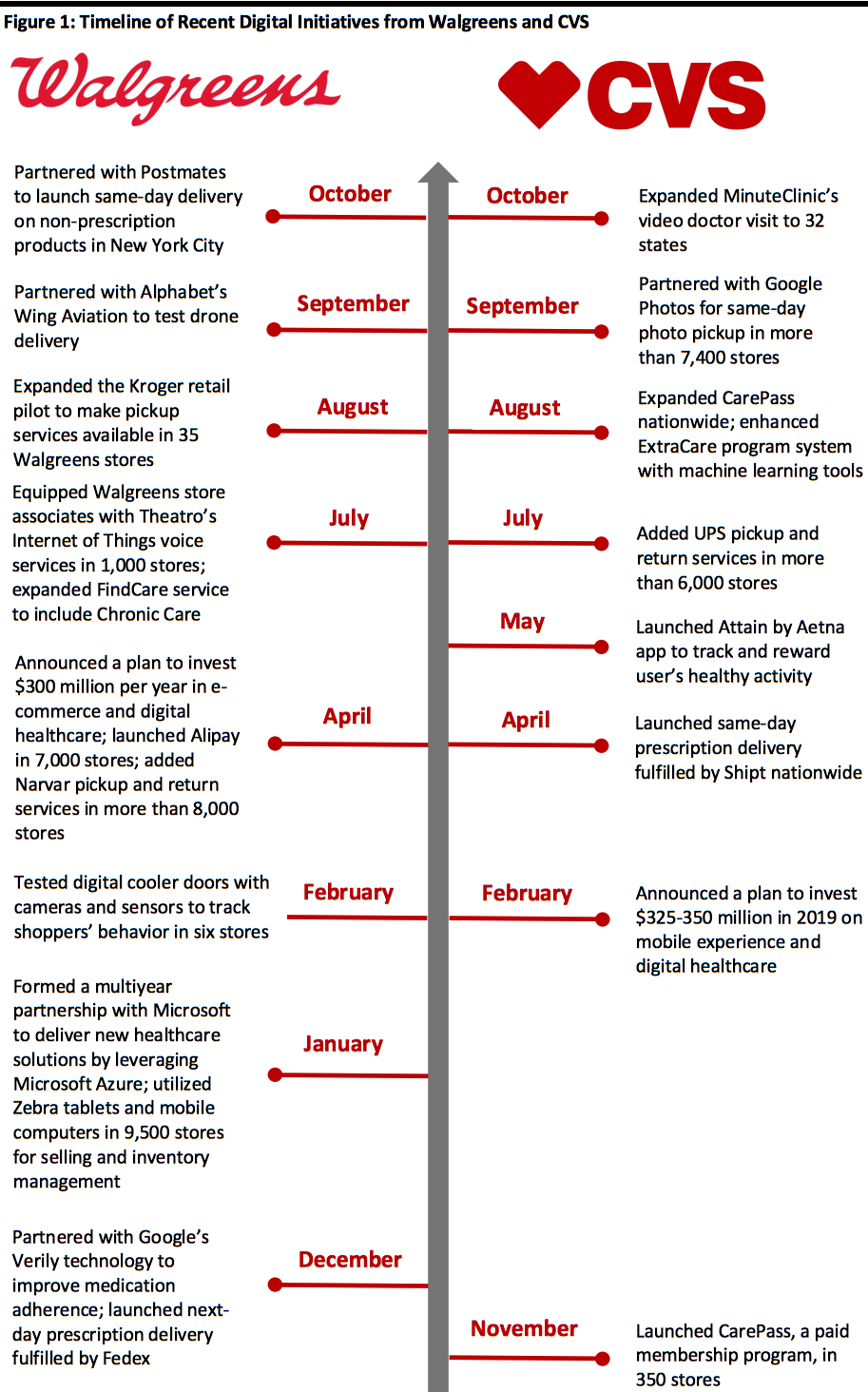

Walgreens and CVS both announced plans in 2019 to invest $300-350 million per year in digital initiatives. Walgreens and CVS each have 9,500-plus physical stores, and they are using these to provide consumers with omnichannel offerings such as pickup and delivery. Both companies are aiming to use technology to provide more accessible healthcare solutions, as shown in the timeline below.

[caption id="attachment_98344" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Intense Competition from Online Pharmacy and Mass Retailer

Giant retailer Walmart launched its healthcare website, WalmartHeath.com, in September 2019, through which customers are able to schedule medical appointments, eye/hearing tests and immunizations with prices listed. Walmart could possibly add telehealth and other services on the site to drive traffic. Consumers can refill prescription drugs and pick up orders from local Walmart stores by using the Walmart app. Recently, Walmart also announced a healthcare pilot program for its US employees, starting in January 2020. The program aims to cut healthcare costs by connecting patients with local providers and offering video chat with doctors for only $4.

PillPack, which was acquired by Amazon in June 2018, is an online full-service pharmacy that offers free monthly delivery of prescription drugs, as well as vitamins and over-the-counter medications. It also provides emergency overnight delivery. By leveraging Amazon’s logistics network, PillPack has been gaining licenses and expanding its distribution capabilities; the delivery service is now available in all US states except Hawaii. In October 2019, Amazon also launched its virtual care service via the Amazon Care app to its employees in Seattle, through a partnership with Oasis Medical Group. Although the service is only currently available to Amazon employees, the company could launch it to the public in the future.

[caption id="attachment_98345" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Intense Competition from Online Pharmacy and Mass Retailer

Giant retailer Walmart launched its healthcare website, WalmartHeath.com, in September 2019, through which customers are able to schedule medical appointments, eye/hearing tests and immunizations with prices listed. Walmart could possibly add telehealth and other services on the site to drive traffic. Consumers can refill prescription drugs and pick up orders from local Walmart stores by using the Walmart app. Recently, Walmart also announced a healthcare pilot program for its US employees, starting in January 2020. The program aims to cut healthcare costs by connecting patients with local providers and offering video chat with doctors for only $4.

PillPack, which was acquired by Amazon in June 2018, is an online full-service pharmacy that offers free monthly delivery of prescription drugs, as well as vitamins and over-the-counter medications. It also provides emergency overnight delivery. By leveraging Amazon’s logistics network, PillPack has been gaining licenses and expanding its distribution capabilities; the delivery service is now available in all US states except Hawaii. In October 2019, Amazon also launched its virtual care service via the Amazon Care app to its employees in Seattle, through a partnership with Oasis Medical Group. Although the service is only currently available to Amazon employees, the company could launch it to the public in the future.

[caption id="attachment_98345" align="aligncenter" width="700"] PillPack launched on Amazon.com

PillPack launched on Amazon.com

Source: Amazon.com[/caption] Prescription price-tracking startup GoodRx recently launched GoodRx Care, which offers online consultations with a doctor for 18 different conditions. Patients are connected with doctors for a typical cost of $20 and can then pick up their prescription from a local pharmacy. GoodRx Care was made possible by the company’s acquisition of HeyDoctor, an on-demand healthcare platform. Blink Health is an online platform that sells discounted prescription drugs. Consumers can choose to pick up their order from local pharmacies or get it delivered for free. Blink Health also recently debuted its virtual consultation service for birth control, and delivery of the prescription on a regular refill schedule is free. New York online pharmacy startup Capsule recently announced plans to launch its prescription drug delivery service across major cities in the next 18–36 months. Capsule currently offers free two-hour delivery in New York City and has accumulated 60,000 members. NowRx offers a free, same-day, prescription drug delivery service in the Bay Area. In addition, the company provides one-hour delivery for a $5 fee. NowRx recently received $7 million through crowdfunding and plans to expand its service to additional areas within California.

Source: Company reports/Coresight Research[/caption]

Intense Competition from Online Pharmacy and Mass Retailer

Giant retailer Walmart launched its healthcare website, WalmartHeath.com, in September 2019, through which customers are able to schedule medical appointments, eye/hearing tests and immunizations with prices listed. Walmart could possibly add telehealth and other services on the site to drive traffic. Consumers can refill prescription drugs and pick up orders from local Walmart stores by using the Walmart app. Recently, Walmart also announced a healthcare pilot program for its US employees, starting in January 2020. The program aims to cut healthcare costs by connecting patients with local providers and offering video chat with doctors for only $4.

PillPack, which was acquired by Amazon in June 2018, is an online full-service pharmacy that offers free monthly delivery of prescription drugs, as well as vitamins and over-the-counter medications. It also provides emergency overnight delivery. By leveraging Amazon’s logistics network, PillPack has been gaining licenses and expanding its distribution capabilities; the delivery service is now available in all US states except Hawaii. In October 2019, Amazon also launched its virtual care service via the Amazon Care app to its employees in Seattle, through a partnership with Oasis Medical Group. Although the service is only currently available to Amazon employees, the company could launch it to the public in the future.

[caption id="attachment_98345" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Intense Competition from Online Pharmacy and Mass Retailer

Giant retailer Walmart launched its healthcare website, WalmartHeath.com, in September 2019, through which customers are able to schedule medical appointments, eye/hearing tests and immunizations with prices listed. Walmart could possibly add telehealth and other services on the site to drive traffic. Consumers can refill prescription drugs and pick up orders from local Walmart stores by using the Walmart app. Recently, Walmart also announced a healthcare pilot program for its US employees, starting in January 2020. The program aims to cut healthcare costs by connecting patients with local providers and offering video chat with doctors for only $4.

PillPack, which was acquired by Amazon in June 2018, is an online full-service pharmacy that offers free monthly delivery of prescription drugs, as well as vitamins and over-the-counter medications. It also provides emergency overnight delivery. By leveraging Amazon’s logistics network, PillPack has been gaining licenses and expanding its distribution capabilities; the delivery service is now available in all US states except Hawaii. In October 2019, Amazon also launched its virtual care service via the Amazon Care app to its employees in Seattle, through a partnership with Oasis Medical Group. Although the service is only currently available to Amazon employees, the company could launch it to the public in the future.

[caption id="attachment_98345" align="aligncenter" width="700"] PillPack launched on Amazon.com

PillPack launched on Amazon.comSource: Amazon.com[/caption] Prescription price-tracking startup GoodRx recently launched GoodRx Care, which offers online consultations with a doctor for 18 different conditions. Patients are connected with doctors for a typical cost of $20 and can then pick up their prescription from a local pharmacy. GoodRx Care was made possible by the company’s acquisition of HeyDoctor, an on-demand healthcare platform. Blink Health is an online platform that sells discounted prescription drugs. Consumers can choose to pick up their order from local pharmacies or get it delivered for free. Blink Health also recently debuted its virtual consultation service for birth control, and delivery of the prescription on a regular refill schedule is free. New York online pharmacy startup Capsule recently announced plans to launch its prescription drug delivery service across major cities in the next 18–36 months. Capsule currently offers free two-hour delivery in New York City and has accumulated 60,000 members. NowRx offers a free, same-day, prescription drug delivery service in the Bay Area. In addition, the company provides one-hour delivery for a $5 fee. NowRx recently received $7 million through crowdfunding and plans to expand its service to additional areas within California.