Introduction: Talking Before Shopping

Only a few years ago, devices with speech recognition could understand only simple commands such as “increase the volume.” Now, smart devices can comprehend and follow complicated instructions such as “tell a joke.” With AI-powered personal assistants, also called intelligent personal assistants (IPAs), consumers can purchase items by just speaking with their devices, without having to log in and check out. Voice shopping is expected to be an important driving force for e-commerce.

The New Online Shopping Medium

Recent developments in AI are the catalyst for voice-activated online shopping. AI-enabled personal assistants can simplify the online shopping process.

Using IPAs with voice recognition capabilities allows users to purchase items by simply speaking into their devices. For example, consumers can say “purchase Colgate toothpaste” and complete the transaction through the AI-enabled personal assistant. For items consumers are familiar with, voice shopping can reduce the friction in transaciton and improve the shopping experience.

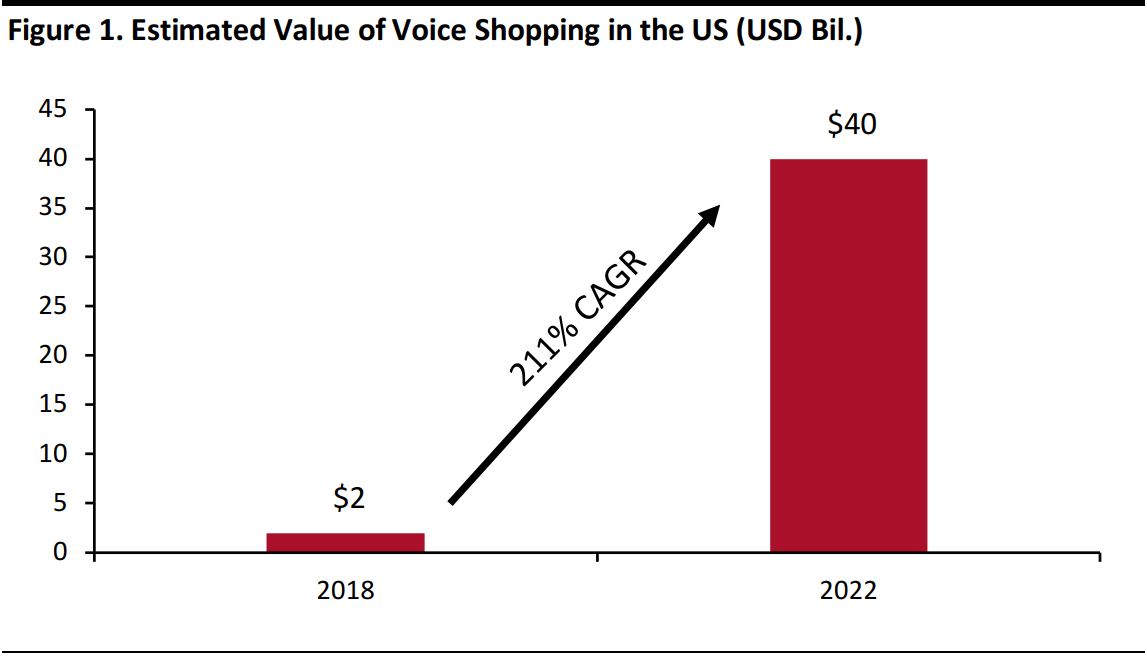

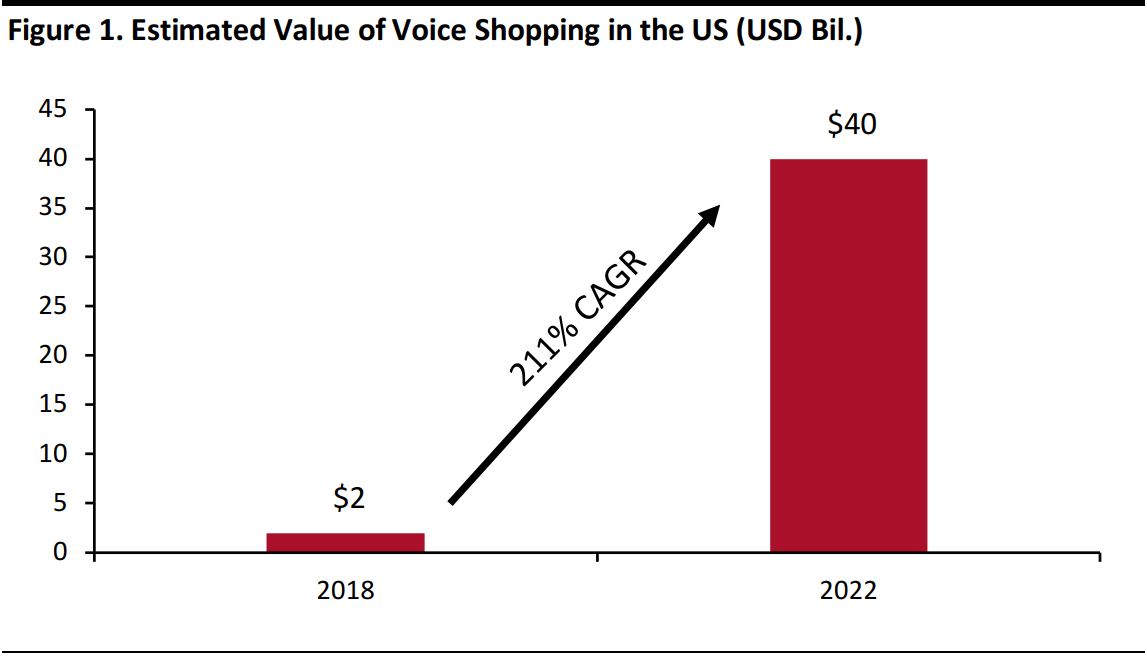

Voice shopping could become meaningful niche in e-commerce: OC&C Strategy Consultants estimate the voice-shopping market in the US will increase from $2 billion this year to $40 billion by 2022.

- $2 billion in 2018 equates to approximately 0.5% of the estimated $420 billion US e-commerce market recorded by Euromonitor International for the current year.

- $40 billion in 2022 equates to approximately 5.5% of the $730 billion in Internet retail sales the US will see in 2022, according to Euromonitor.

Source: OC&C Strategy Consultants/Coresight Research

However, voice shopping is about more than just shopping through in-home voice devices such as Amazon Echo and Google Home. In fact, more than 50% of voice shopping is done through smartphones, based on a survey conducted by Voicebot and Voysis in 2018. Consumers are getting more comfortable with IPAs. According to a survey by Statista, there will be 238 million US smart phone users by the end of this year. As AI-enabled personal assistants become more accessible, all smart phone owners could be potential voice shoppers.

Google has been working with various retailers to promote voice shopping.

- Google announced in February 2017 that Google Home users can order from those US retailers which partner with Google Express, including Costco, Whole Foods Market and Walgreens.

- Google partnered with Sephora to bring beauty tutorials to Google Home Hub in November 2018. Sephora shoppers can activate the device to play videos like “tips for foundation” through voice commands.

- In June 2018, French retailer Carrefour partnered with Google to allow consumers to buy products via Google Assistant, which offers voice interaction on Google Home devices, an app and online.

Challenges Facing Voice Shopping

Despite much-improved skillsets, AI-enabled personal assistants have not been widely accepted by users. A report from website The Information in August revealed that only 2% of owners of Alexa-enabled devices had used it for shopping so far in 2018.

While voice commerce looks set to grow (from a small base), we see the channel as presenting a number of challenges for retailers and shoppers alike. These come from the absence of visual information as well as the intermediation of the shopping process by the tech firms that control the voice channel.

- Retailers will likely struggle to get shoppers to build larger basket sizes through voice. By removing the traditional browsing process, voice limits retailers’ abilities to drive incremental purchases, complementary purchases and trading up to more expensive items. Respondents will typically ask for what they are looking for and just buy that (or add it to their basket). Smaller baskets have less favorable economies of scale, especially when it comes to shipping.

- This absence of browsing and comparison options means shoppers are likely to use voice to buy specific brands, which removes other options. For example, shoppers are more likely to say “Buy Tide” than “Buy laundry detergent” because if they say the latter, they will face uncertainty over what product they will receive or face a complex process to refine their choice further. This funnels shoppers into making repeat purchases of the same brands, disrupting the traditional shopper-retailer relationship, in which the retailer seeks to curate brands for the customer.

- Similarly, the inability to showcase a number of product options to shoppers prevents retailers from encouraging shoppers to switch to more profitable alternatives, notably private labels.

- Finally, shoppers have to choose products without seeing them or enjoying a traditional comparison process. As a result, they may have less confidence when buying via voice. The absence of visuals means it is more difficult to double check the quantity, flavor or edition of the product ordered—let alone choose something as complex as an item of clothing.

Depite these challenges, those companies that control the voice channels are likely to encourage users to use voice commands, because it positions them as an intermediary in the shopping process, between the retailer and the consumer—which positions tech companies to grow revenues from advertising. For companies such as Amazon that are both a voice channel and a retailer, it means the process can nudge shoppers toward more profitable items, such as private label products, as the default option when a brand is not specified.

The Growth of Voice Devices

Recent advances in AI have increased the accuracy of speech recognition programs to an almost-human level. Google says that its achieved a 95% word accuracy rate for the English language in 2017, up from 70% in 2010.

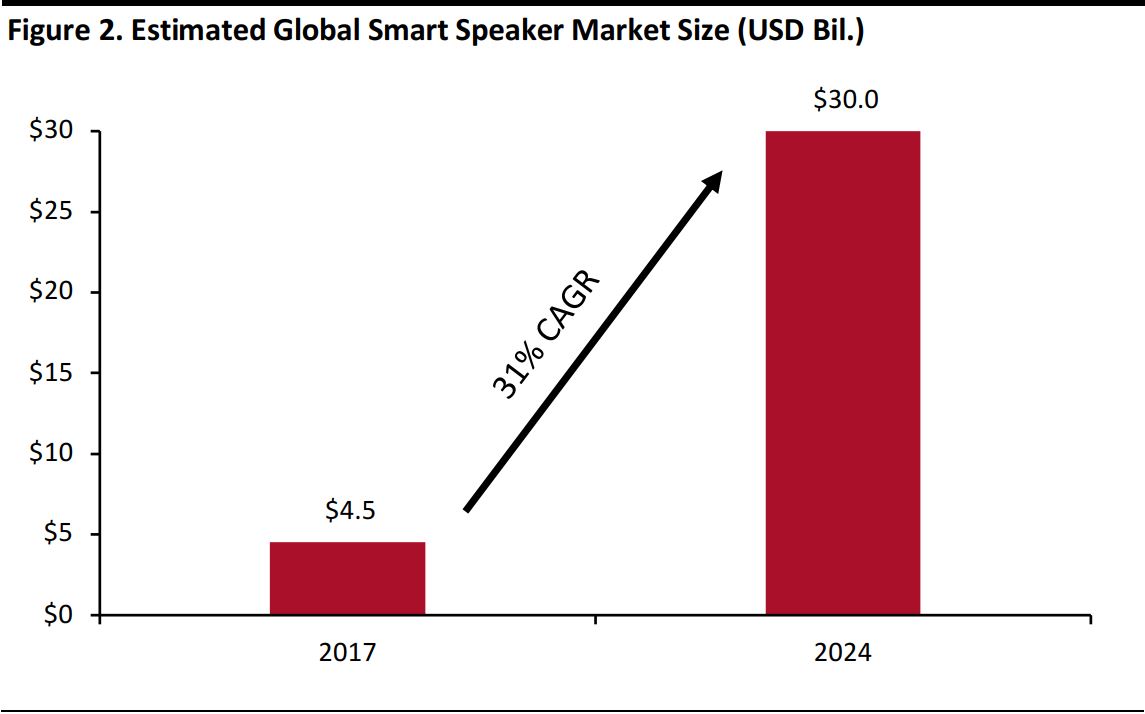

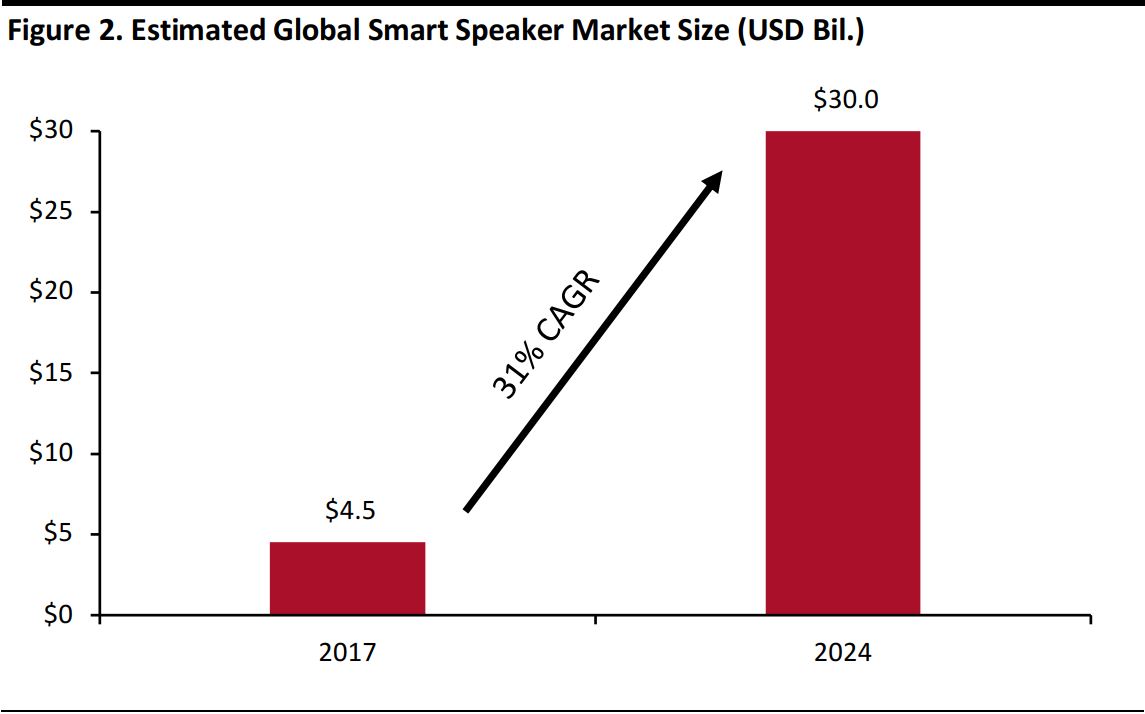

Developments in speech recognition have prompted companies such as Google, Amazon and Apple to design and manufacture more products, especially smart speakers, incorporated with IPAs. The global market for smart speakers is predicted to grow at a CAGR of 31%, from $4.5 billion in 2017 to $30 billion in 2024, according to Global Market Insights. In the second quarter of 2018, the total number of smart speaker shipments reached 16.8 million units globally, according to leading technology market analyst firm Canalys.

Source: Canalys/Coresight Research

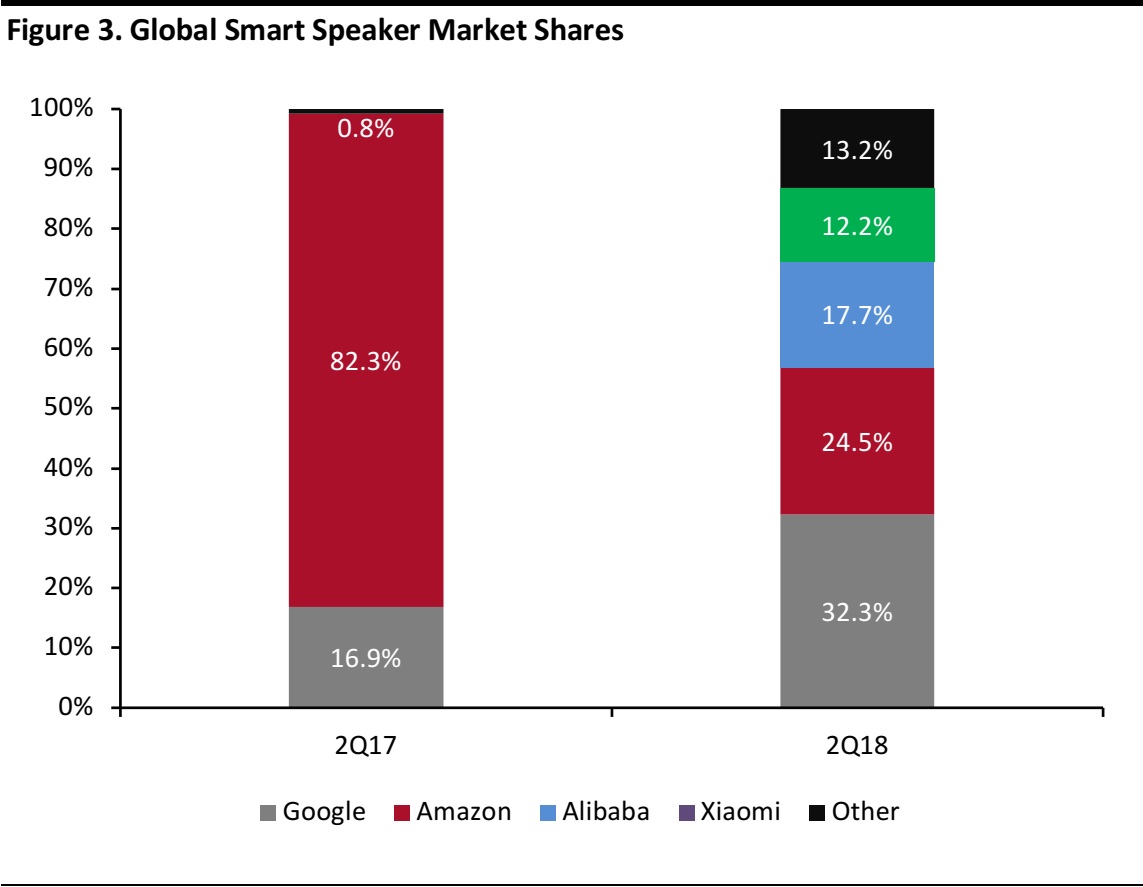

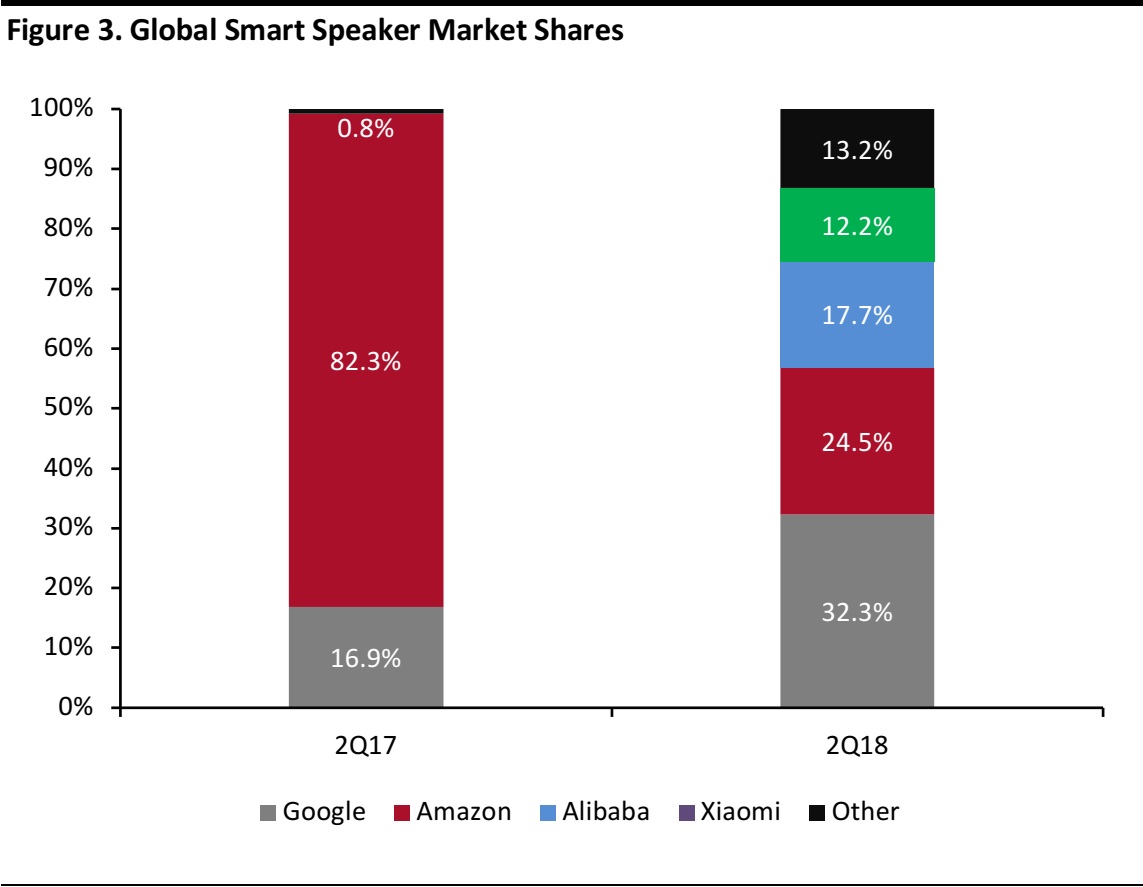

Amazon’s share of the global smart-speaker market declined to 24.5% in the second quarter of 2018 from 82% in the second quarter of 2017, according to Canalys. Google increased its smart-speaker production by 449% year over year in the second quarter of 2018, says Canalys. Chinese companies Alibaba and Xiaomi were late entrants, but quickly captured around 30% of the world’s smart-speaker market in the second quarter of 2018. Chinese website Sina reported that Xiaomi’s smart speaker Xiao Ai had over 30 million monthly active devices in August 2018.

Source: Canalys/Coresight Research

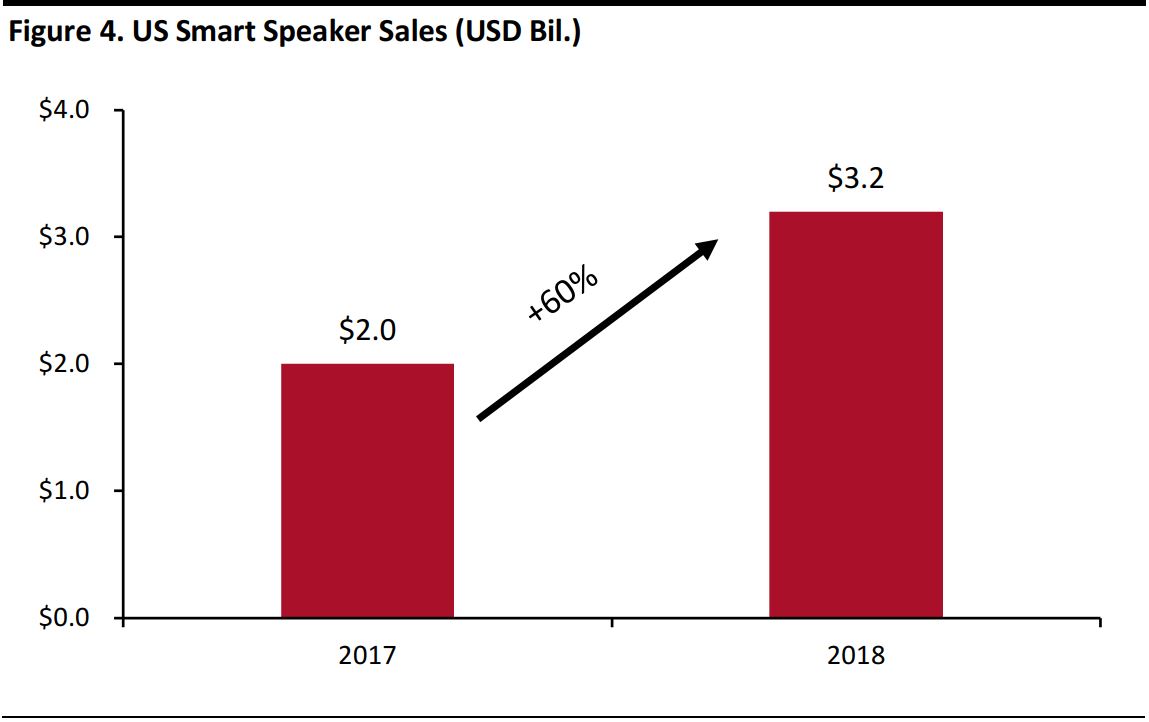

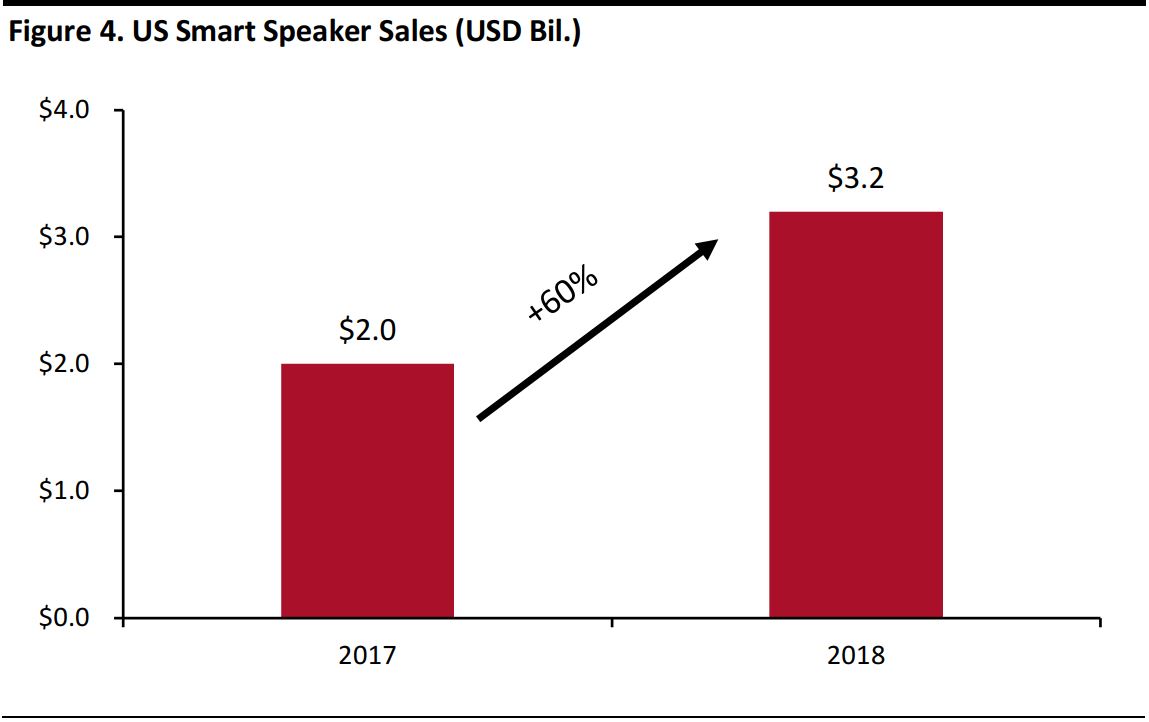

The Consumer Technology Association expects sales of smart speakers in the US to reach $3.2 billion in 2018, a 64% increase from $2.0 billion last year. The total number of units sold is forecast to be 39.2 million this year, up 44% from 2017.

Source: Consumer Technology Association

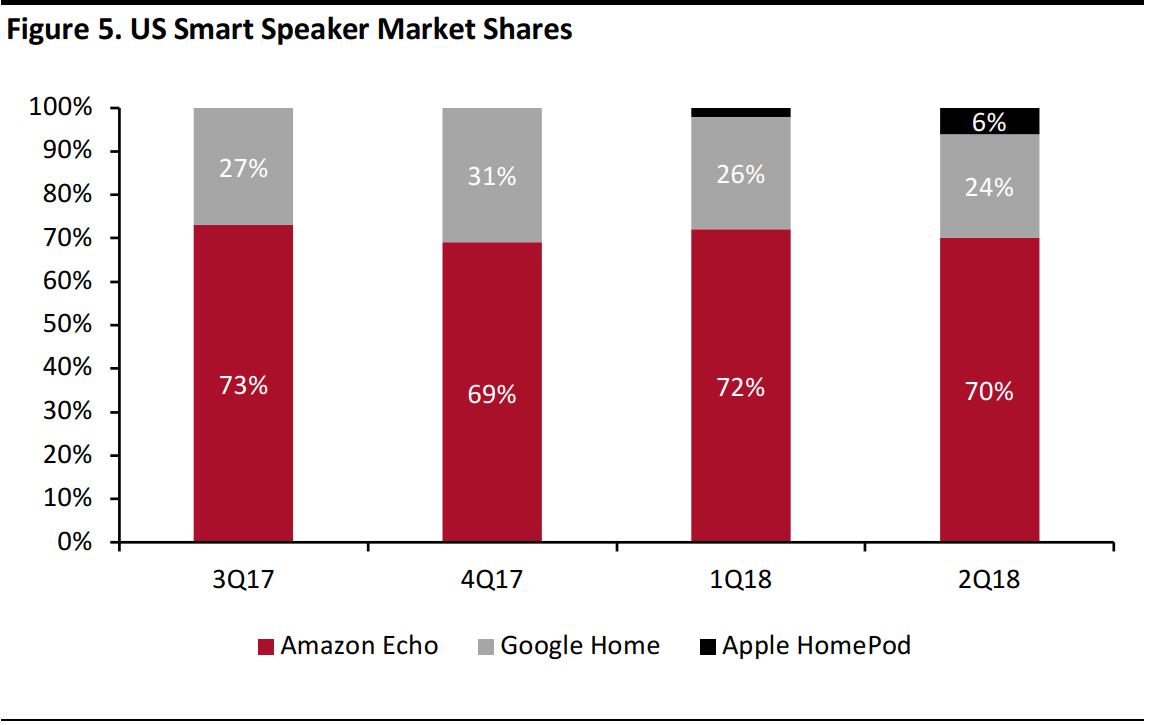

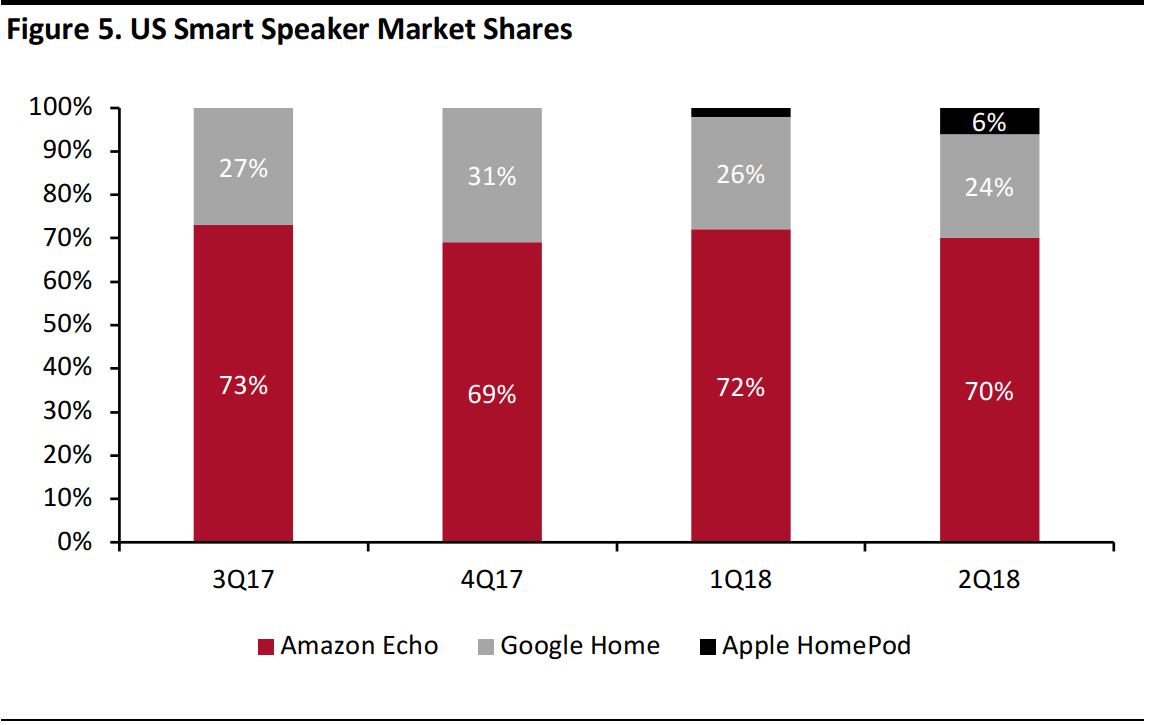

Since September 2018, both Google and Amazon have announced a series of new and updated products with incorporated IPAs. Google Home, Amazon Echo and Apple HomePod, collectively, account for over 90% of the US smart-speaker market, according to Consumer Intelligence Research Partners.

Source: Consumer Intelligence Research Partners

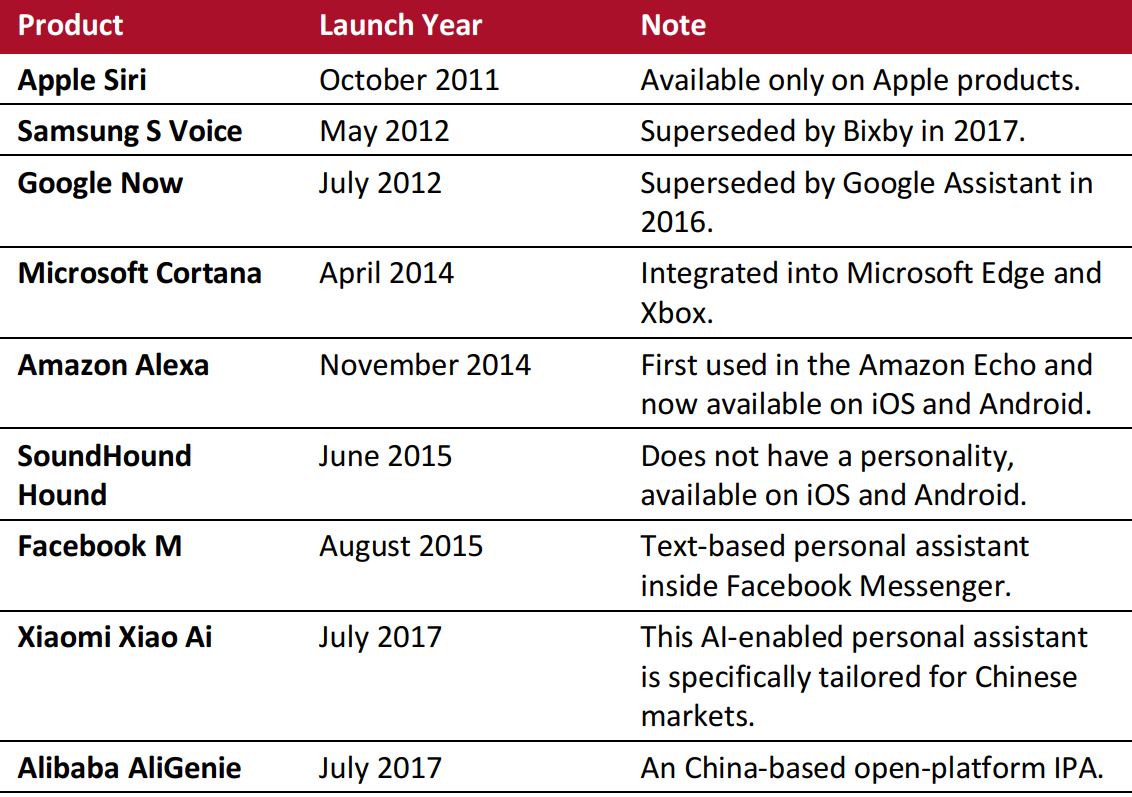

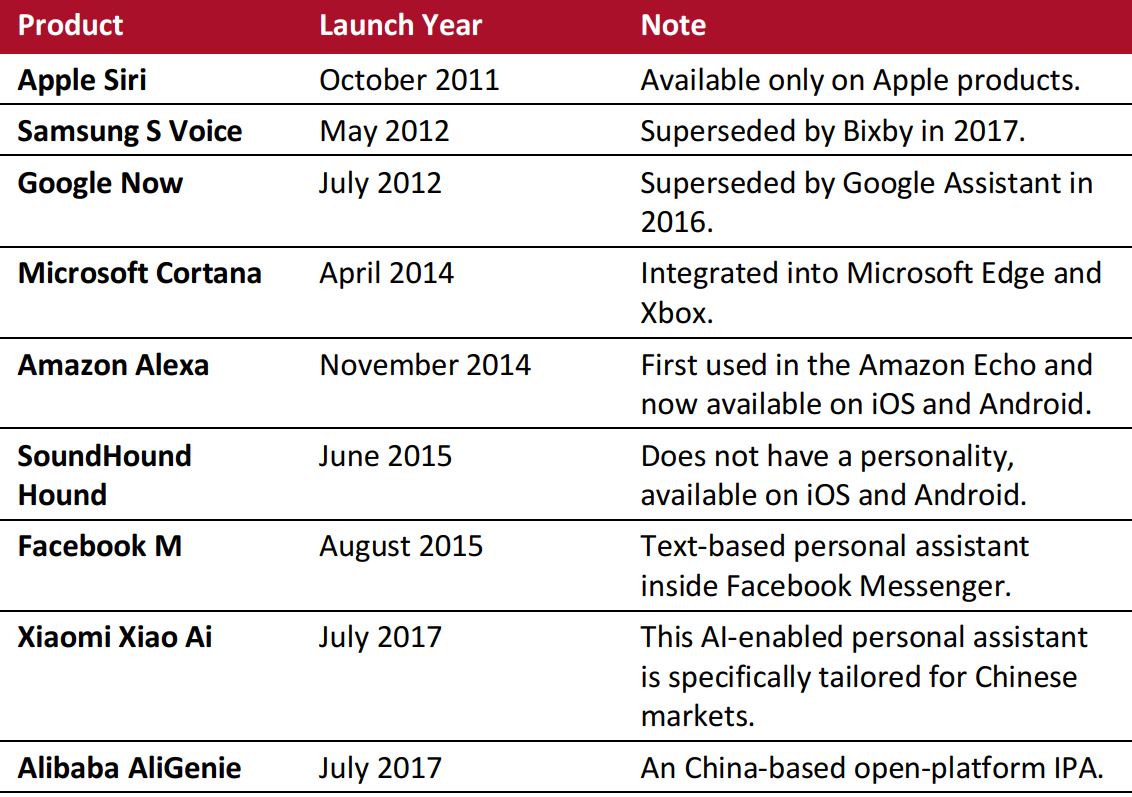

The Rise of AI-Enabled Personal Assistants

AI-enabled personal assistants are integral to all smart devices. These personal assistants are software that have been developed to perform tasks for the user. The ability of these devices to interact with users differentiates them from traditional smartphones. After Apple introduced Siri in October 2011, companies such as Google and Amazon followed suit and launched similar products. Google reported voice searches accounted for 20% of all mobile searches in the US in 2016 and comScore—a US-based media measurement and analytics company—has projected that 50% of all mobile searches will be voice searches by 2020.

Source: Company websites/Financial Times

Tech companies have made big investments in IPAs and R&D. For example, Google spent $400 million to acquire DeepMind, a company that focuses on machine learning and systems neuroscience, while Apple has spent over $50 million to acquire VocalIQ, a speech technology startup. The investments have driven significant breakthroughs, such as the speech recognition accuracy for Google machine learning word accuracy increasing from 70% in 2010 to 95% in 2017 (according to Google). Alexa now has 50,000 skills in 2018 compared to 135 skills in 2016, according to Voicebot.

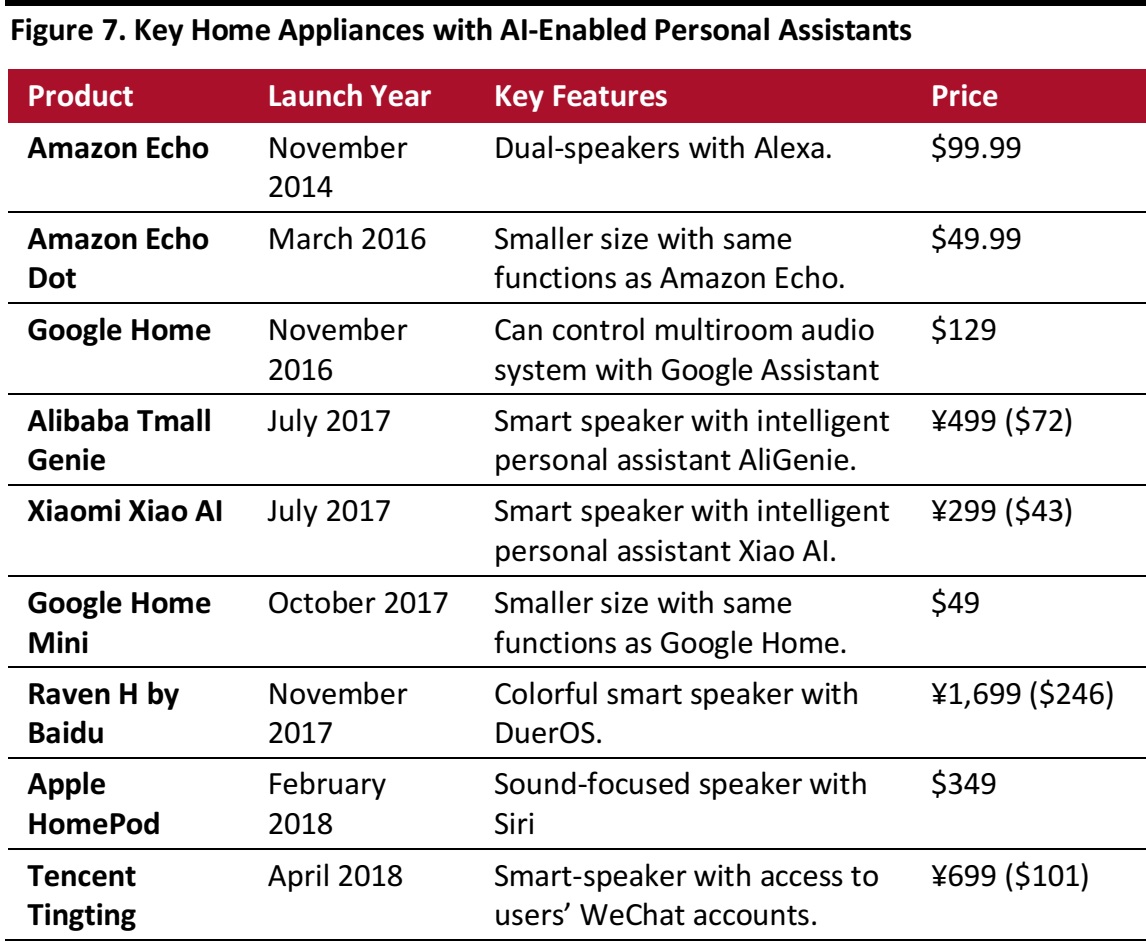

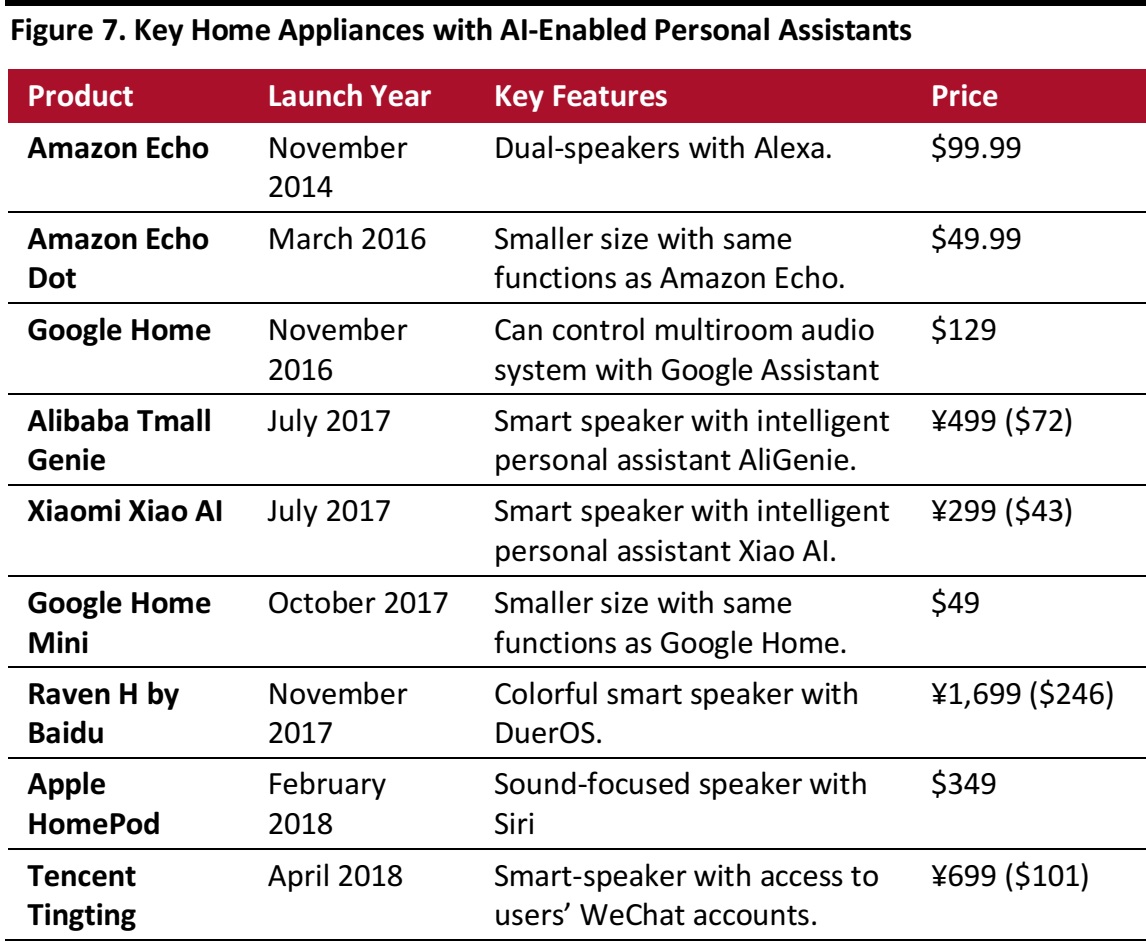

Household Appliances with AI-Enabled Personal Assistants

The total number of smart speaker unit shipments worldwide reached 16.8 million in the second quarter of 2018 and the total number of smart speakers in use will reach 100 million this year, growing to 225 million in 2020, according to Canalys.

Although Amazon has not released the official number of devices sold with Alexa, website

The Information reported that the number was more than 50 million in August 2018.

Various players are in the race to manufacture more devices with IPAs incorporated and these devices are powered by two core components: language recognition software, which enables the device to understand human languages and interact with users; and, predictive learning capability, which enables the software to proactively provide information to the user and make suggestions based on user input and data.

Source: Company websites

In September 2018, Amazon announced over a dozen new products that integrate with Alexa, including Amazon Basics Microwave, Echo Auto, Echo Input and Link. The products demonstrate Amazon’s ambition to innovate old technologies using Alexa. Echo Input and Link can be plugged to stereos, turning them into smart speakers. To compete with

Amazon, Google announced that Google Assistant works with 10,000 smart devices across 1,000 brands and revealed several new products including Google Home Hub with built-in smart assistant in October 2018.

Amazon’s new voice-controlled microwave

Source: Amazon

In addition, a recent survey by Voicebot and Voysis revealed that around 75% of smartphone owners have tried the voice assistant function on their devices, with 46% of them using Siri, 28.7% using Google Assistant and 13.2% using Amazon Alexa.

Key Takeaways

From a very small base, the voice-shopping market in the US is estimated to grow at a CAGR of 211% between 2019 and 2022, to become a $40 billion sales channel, according to OC&C Strategy Consultants. However, the channel presents a number of challenges for shoppers and retailers. Shoppers cannot see products or browse easily, and retailers’ opportunities to cross-sell products and build larger, basket sizes (which yield more favorable economics) are highly limited. The absence of visuals alters the traditional browsing process to the disadvantage of both parties, and the tech firms that control the voice channel to some degree disrupt the traditional shopper-retailer relationship.