albert Chan

Coresight Research attended the VM Global Leadership Summit on March 20 in New York City. CEO Deborah Weinswig delivered the keynote address Consumers at the Crossroads of Tech and Retail and moderated the panel discussion titled Tactics and Insights for Decoding Consumer Behavior. Panel participants included David Hoodis, CEO at Mood Media; Nevin Raj, Cofounder and COO at Grata Data; Heike Young, Senior Manager, Strategy & Insights: Retail & Consumer Goods at Salesforce; and, Karl Haller, Partner, Consumer Center of Competency at IBM.

In her keynote address, Weinswig spoke to retail’s reinvention, from spectacular flagships to shorter leases and an agile approach to retail real estate including shorter leases and pop-ups.

New Retail, an idea made famous by Alibaba’s founder Jack Ma, or boundaryless retail, is being powered by mobile apps that provide a seamless transition from online to offline and is the basis for Hema, Alibaba’s experiential grocery store that is setting records with its 20X conversion rate from online to offline.

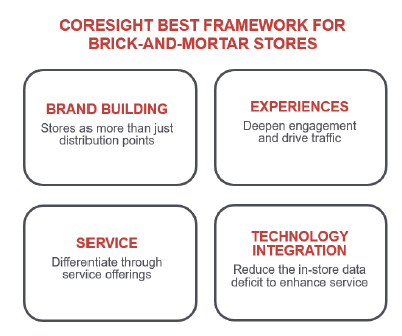

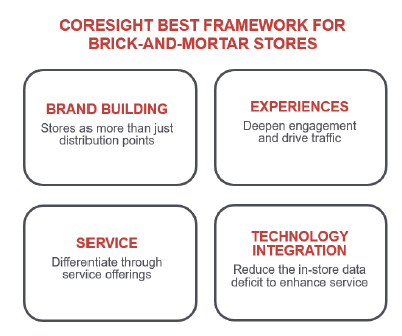

Coresight Research’s BEST Framework provides a format for reshaping retail: To make the store experience rich with services and customization that build brands and customer loyalty. BEST is an anacronym for Brand Building, Experiences, Services and Technology Integration.

[caption id="attachment_81686" align="aligncenter" width="402"] Coresight Research’s BEST Framework

Coresight Research’s BEST Framework

Source: Coresight Research[/caption] Western retailers could take another lesson from the east: shopping festivals. Alibaba created the Singles’ Day or 11.11 shopping event 10 years ago, and it has since grown to be far bigger than Black Friday, generating some $31 billion in gross merchandise value (GMV) for Alibaba in 2018. Amazon followed suit a few years later with Prime Day. Shopping events create buzz, generate excitement – and drive sales. It doesn’t matter what business you are in, celebrate it, create limited edition products, use social media to generate the buzz. Shopping events shared on social media are easy to create and use to build brands. Alibaba’s Tmall Innovation Center is achieving a virtually unheard of 95% success rate with product introductions based on brand adaptations. In a customer-to-business (C2B) feedback loop, they are tapping into customer preferences during product development and design and creating products tailored to current local tastes: Retail 101 powered by technology. Global brands such as Estée Lauder, L’Oréal, Mars and P&G are using the innovation platform to create locally relevant products for the China market. Tactics and Insights for Decoding Consumer Behavior Coresight Research CEO Deborah Weinswig moderated the panel discussion Tactics and Insights for Decoding Consumer Behavior, with David Hoodis, CEO at Mood Media; Nevin Raj, Cofounder and COO at Grata Data; Heike Young, Senior Manager, Strategy & Insights: Retail & Consumer Goods at Salesforce; and, Karl Haller, Partner, Consumer Center of Competency at IBM. [caption id="attachment_81687" align="aligncenter" width="662"] Coresight Research CEO Deborah Weinswig moderated the panel discussion Tactics and Insights for Decoding Consumer Behavior, with David Hoodis, CEO at Mood Media; Nevin Raj, Cofounder and COO at Grata Data; Heike Young, Senior Manager, Strategy & Insights: Retail & Consumer Goods at Salesforce; and, Karl Haller, Partner, Consumer Center of Competency at IBM.

Coresight Research CEO Deborah Weinswig moderated the panel discussion Tactics and Insights for Decoding Consumer Behavior, with David Hoodis, CEO at Mood Media; Nevin Raj, Cofounder and COO at Grata Data; Heike Young, Senior Manager, Strategy & Insights: Retail & Consumer Goods at Salesforce; and, Karl Haller, Partner, Consumer Center of Competency at IBM.

Source: Coresight Research[/caption] Here are some highlights of the discussion. Experience matters. The panel agreed that physical retail is far from dead, with more than 80% of US transactions occurring at physical retail and the anecdotal evidence of filled parking lots across the US. That said, panelists all agreed that service can be a key differentiator that builds customer loyalty. Young acknowledged physical retail is far from dead, and “retailers are finding their feet in today’s digitally transformed era. The biggest opportunity is in service-led retail experiences and experiences with a capital E, experiences you can’t find anywhere else.” Hoodis concurred. “Evolving, growing and innovating, and making stores fresh and a fun place to shop is part of the solution. A lot of the stores that are growing are showrooms that are creating experiences that make you want to come back and be a part of the experience. When data, experience, social media and videos as they relate to the consumer in the store, all come together, we capture the customer and they are more likely to come back. Two-thirds of 18 to 24 year olds are likely to come back based on experience more than anything else.” Service is a 2019 focus. Data-driven insights are helping brands maintain customer service levels, according to Raj. With several million online reviews, he noted the evolution from feedback that was product-focused 10 years ago, to reviews that address the customer service component of commerce, such as engaging with customer service, returns or customization. Retail business models should evolve in tandem with the shoppers’ service focus. Data-driven insights are foundational to the decision of many digitally native brands to open physical stores to drive customer engagement. Young commented, “Service is the new marketing and can lead retail differentiation.” From wow to mainstream. Haller spoke to challenges high-end retailers have capturing survey data from customers. He posited that within three to four years, using natural language processing, retailers would be able to capture conversations between customers and staff in the store and use that data to create a rich database. By analyzing text in its natural form, we can capture tone and sentiment data that provides additional insights. Haller said “Retailers have lots of data not fully collected or not used sitting in the cloud. Sometimes there are relatively quick wins by combining a retailer’s data with outside data, such as localized events and weather around stores to understand the opportunities for assortment, marketing, depth of product or staffing. Spaciotemporal data that is attached to a given moment will be important in the near future.” Never satisfied with the status quo. Many firms are “data rich and action poor,” according to Young, who recommends cross-functional work groups to share information and develop action plans. Hoodis referred to his time at Walmart, saying “Walmart is a becoming a tech company with a legacy retail fleet around the world. They have to reinvent themselves. What is takes is people making really tough decisions and taking action. Complacency is one of my biggest fears in my business and across all of retail.” “Ask yourself who you compare yourself to. We see retailers compare themselves to some of the least innovative players, because they are the largest, most established. That can drive the wrong results,” according to Raj, suggesting benchmarking against tech leaders such as Microsoft, IBM, Amazon and Intel if you want to be thought of as a tech company.

Coresight Research’s BEST Framework

Coresight Research’s BEST FrameworkSource: Coresight Research[/caption] Western retailers could take another lesson from the east: shopping festivals. Alibaba created the Singles’ Day or 11.11 shopping event 10 years ago, and it has since grown to be far bigger than Black Friday, generating some $31 billion in gross merchandise value (GMV) for Alibaba in 2018. Amazon followed suit a few years later with Prime Day. Shopping events create buzz, generate excitement – and drive sales. It doesn’t matter what business you are in, celebrate it, create limited edition products, use social media to generate the buzz. Shopping events shared on social media are easy to create and use to build brands. Alibaba’s Tmall Innovation Center is achieving a virtually unheard of 95% success rate with product introductions based on brand adaptations. In a customer-to-business (C2B) feedback loop, they are tapping into customer preferences during product development and design and creating products tailored to current local tastes: Retail 101 powered by technology. Global brands such as Estée Lauder, L’Oréal, Mars and P&G are using the innovation platform to create locally relevant products for the China market. Tactics and Insights for Decoding Consumer Behavior Coresight Research CEO Deborah Weinswig moderated the panel discussion Tactics and Insights for Decoding Consumer Behavior, with David Hoodis, CEO at Mood Media; Nevin Raj, Cofounder and COO at Grata Data; Heike Young, Senior Manager, Strategy & Insights: Retail & Consumer Goods at Salesforce; and, Karl Haller, Partner, Consumer Center of Competency at IBM. [caption id="attachment_81687" align="aligncenter" width="662"]

Coresight Research CEO Deborah Weinswig moderated the panel discussion Tactics and Insights for Decoding Consumer Behavior, with David Hoodis, CEO at Mood Media; Nevin Raj, Cofounder and COO at Grata Data; Heike Young, Senior Manager, Strategy & Insights: Retail & Consumer Goods at Salesforce; and, Karl Haller, Partner, Consumer Center of Competency at IBM.

Coresight Research CEO Deborah Weinswig moderated the panel discussion Tactics and Insights for Decoding Consumer Behavior, with David Hoodis, CEO at Mood Media; Nevin Raj, Cofounder and COO at Grata Data; Heike Young, Senior Manager, Strategy & Insights: Retail & Consumer Goods at Salesforce; and, Karl Haller, Partner, Consumer Center of Competency at IBM.Source: Coresight Research[/caption] Here are some highlights of the discussion. Experience matters. The panel agreed that physical retail is far from dead, with more than 80% of US transactions occurring at physical retail and the anecdotal evidence of filled parking lots across the US. That said, panelists all agreed that service can be a key differentiator that builds customer loyalty. Young acknowledged physical retail is far from dead, and “retailers are finding their feet in today’s digitally transformed era. The biggest opportunity is in service-led retail experiences and experiences with a capital E, experiences you can’t find anywhere else.” Hoodis concurred. “Evolving, growing and innovating, and making stores fresh and a fun place to shop is part of the solution. A lot of the stores that are growing are showrooms that are creating experiences that make you want to come back and be a part of the experience. When data, experience, social media and videos as they relate to the consumer in the store, all come together, we capture the customer and they are more likely to come back. Two-thirds of 18 to 24 year olds are likely to come back based on experience more than anything else.” Service is a 2019 focus. Data-driven insights are helping brands maintain customer service levels, according to Raj. With several million online reviews, he noted the evolution from feedback that was product-focused 10 years ago, to reviews that address the customer service component of commerce, such as engaging with customer service, returns or customization. Retail business models should evolve in tandem with the shoppers’ service focus. Data-driven insights are foundational to the decision of many digitally native brands to open physical stores to drive customer engagement. Young commented, “Service is the new marketing and can lead retail differentiation.” From wow to mainstream. Haller spoke to challenges high-end retailers have capturing survey data from customers. He posited that within three to four years, using natural language processing, retailers would be able to capture conversations between customers and staff in the store and use that data to create a rich database. By analyzing text in its natural form, we can capture tone and sentiment data that provides additional insights. Haller said “Retailers have lots of data not fully collected or not used sitting in the cloud. Sometimes there are relatively quick wins by combining a retailer’s data with outside data, such as localized events and weather around stores to understand the opportunities for assortment, marketing, depth of product or staffing. Spaciotemporal data that is attached to a given moment will be important in the near future.” Never satisfied with the status quo. Many firms are “data rich and action poor,” according to Young, who recommends cross-functional work groups to share information and develop action plans. Hoodis referred to his time at Walmart, saying “Walmart is a becoming a tech company with a legacy retail fleet around the world. They have to reinvent themselves. What is takes is people making really tough decisions and taking action. Complacency is one of my biggest fears in my business and across all of retail.” “Ask yourself who you compare yourself to. We see retailers compare themselves to some of the least innovative players, because they are the largest, most established. That can drive the wrong results,” according to Raj, suggesting benchmarking against tech leaders such as Microsoft, IBM, Amazon and Intel if you want to be thought of as a tech company.