Source: Company reports/Fung Global Retail & Technology

4Q16 Results

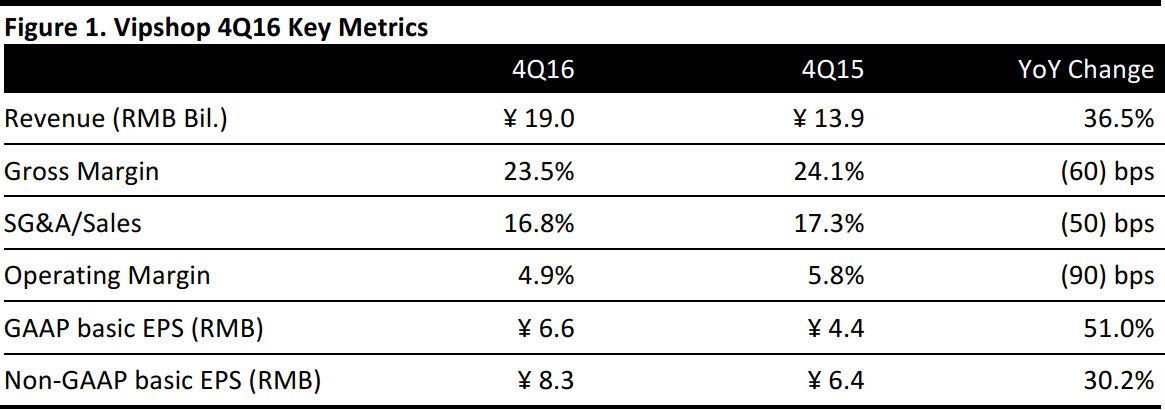

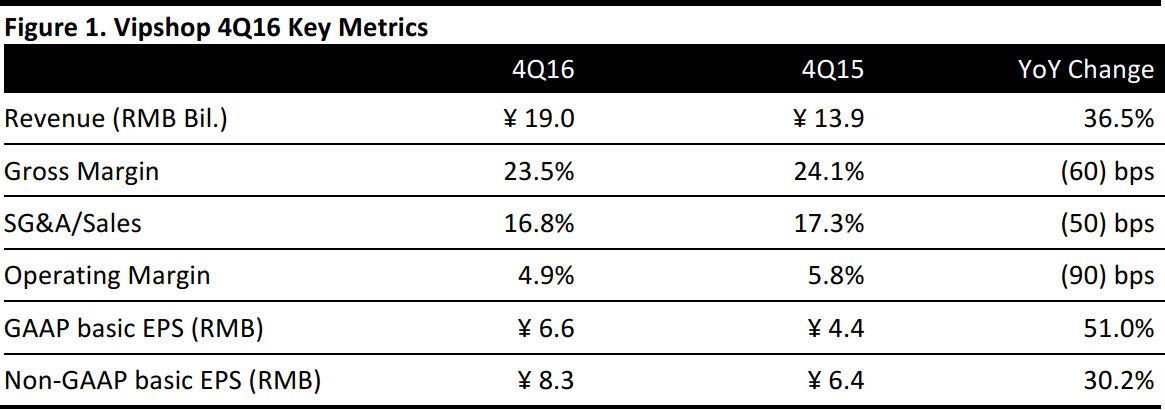

Vipshop reported 4Q16 revenue of ¥19.0 billion, up 36.5% year over year, to beat consensus by 4%. This was primarily driven by the growth in the number of total active customers and total orders. The operating margin decreased to 4.9% from 5.8%, while the gross margin decreased by 60 bps to 23.5%. GAAP basic EPS was ¥6.6, up 51.0% year over year. Non-GAAP basic EPS was ¥8.3, up 30.2% year over year.

Customers and Orders

Source: Company reports/Fung Global Retail & Technology

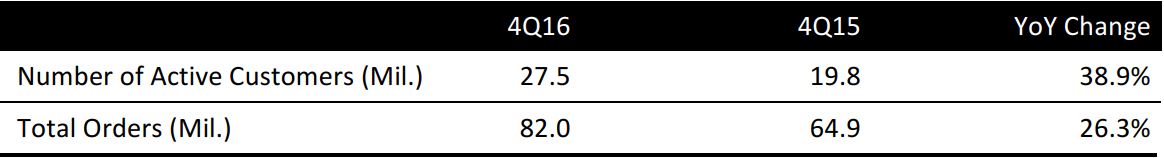

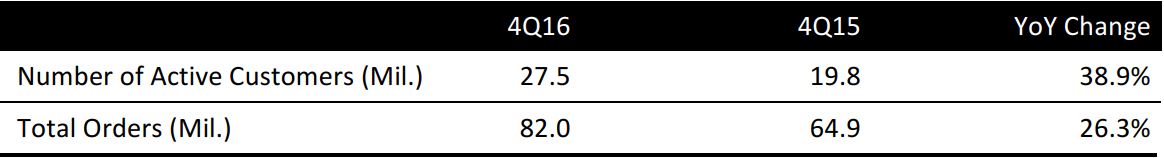

Total orders: In 4Q16, total orders grew 26.3% year over year to 82 million from 64.9 million in 4Q15.

Number of active customers: The number of active customers surged by 38.9% to reach 27.5 million from 19.8 million in the year-ago period.

Management noted on the call that 50% of new customers adds this quarter are from the post-90s generation, the APRU for which has grown 40%–50% over the past seven quarters, based on historical data. Repeat customers remain the core component of Vipshop’s user base, contributing to 92% of total orders, while the repeat purchase rate was around 75% in 4Q16.

In addition to acquiring new customers, Vipshop is focused on improving the quality of customers. Its personalization efforts have enabled a better shopping experience, which in turn has led to a higher retention rate this quarter. This year, the personalization of the consumer group has increased to 16 categories from 4 categories, which allows the company to better target and markets its products.

In-House, Last-Mile Logistics

More than 90% of Vipshop’s orders are delivered through its in-house logistics team, with an average delivery time of less than 48 hours. The service is currently supported by 2,000+ self-operated delivery stations and 20,000+ full-time delivery staff. Five distribution centers were added to shorten the delivery time and improve the efficiency of its distribution network. More centers are expected to be completed in the coming two years. Management also noted that the service is no longer a cost center, as 20% of its revenue is generated from external clients.

Internet Finance Business

Technology and content expenses for 4Q16 were ¥470.9 million, compared to ¥321.6 million in 4Q15. This increase is attributed to Vipshop’s continuous efforts in developing new business opportunities such as the Internet Finance business.

Management noted on the call that the focus of the Internet Finance business is to supplement its core e-commerce business. The Internet Finance business contributed to <10% of total gross merchandise value (GMV) of the company in 4Q16. The business’s average loan period is 3–6 months at an interest rate of 10–12%.

Outlook

Vipshop guided for 1Q17 revenue growth of approximately 26%–30% year over year, which translates to RMB15.0–15.8 billion in revenue. It expects capex for 2017 and 2018 to remain at a similar level to 2016, primarily due to continuous investment to expand its warehouses and logistics centers. Management expects capex to be significantly lower in 2019 once the expansion has been completed, thus resulting in a higher free cash flow.