Source: Company reports

FINANCIAL HIGHLIGHTS

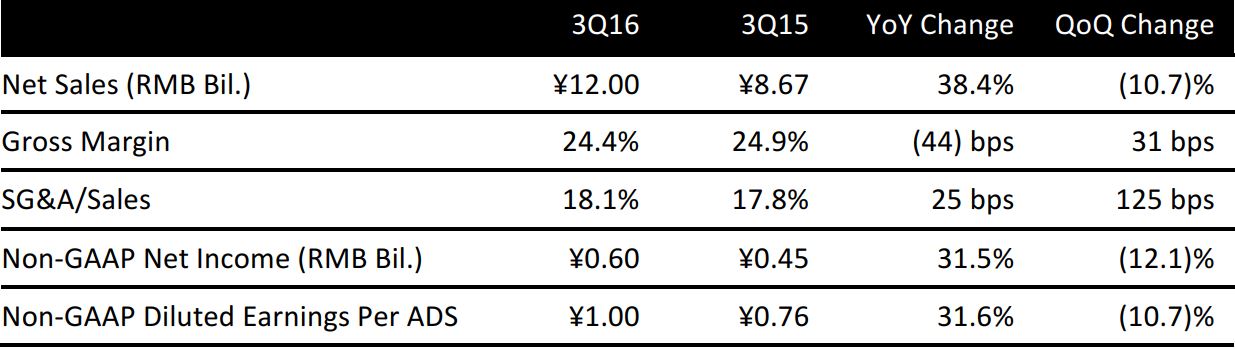

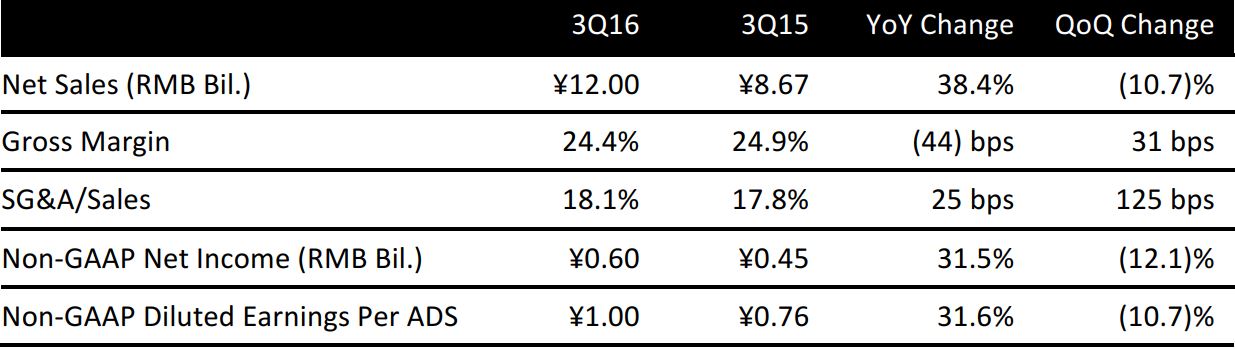

Vipshop reported revenue of ¥12 billion for 3Q16, an increase of 38.4% versus the prior year. Non-GAAP net income for the quarter rose 31.5% to ¥0.60 billion. Non-GAAP earnings per ADS were ¥1.00, up 31.6% year over year.

COSTS AND MARGINS

Gross margin for 3Q declined to 24.4% from 24.9% a year ago, due to investments in the buildout of the Internet finance segment and other advanced technologies such as data analytics. Fulfilment expenses as a percentage of revenues decreased to 8.5% in 3Q16 compared with 9.0% a year ago, due to scale effects. Fulfilment expenses represented 40.3% of operating costs.

Marketing expenses, which represent 25.2% of operating costs, decreased to 5.3% of total revenue in 3Q16 from 5.4% in 3Q15. In absolute terms, marketing expenses rose 36.6% to ¥0.6 billion. Vipshop’s strategy is to sustainably invest in the business to drive long-term growth to strengthen brand awareness, attract new users and expand market share.

GUIDANCE AND OUTLOOK

Vipshop guided for 4Q revenue of ¥18.0-18.5 billion, representing year-over-year growth of approximately 30-33%.

For the rest of 2016 and beyond, Vipshop plans to drive growth through the following:

- Develop its consumer financing program to increase stickiness and enhance the overall customer experience to boost average spend per customer and repeat purchases.

- Expand and target new users in a wider age-group range – millennials and Gen Z customers – while maintaining user quality, i.e. those with high spending and making repeat purchases.

- Continue to strengthen its logistics capabilities in order to improve order fulfilment. Vipshop has made initial progress in introducing customized automation at its warehouses, and has added approximately 1.7 million square meters as of September 30, 2016. The company is on track to reach 2 million square meters of warehousing capacity by the end of 2016.