Vipshop

Sector: E-commerce

Country of operation: China

Key product categories: Beauty, electronics, fashion and home products

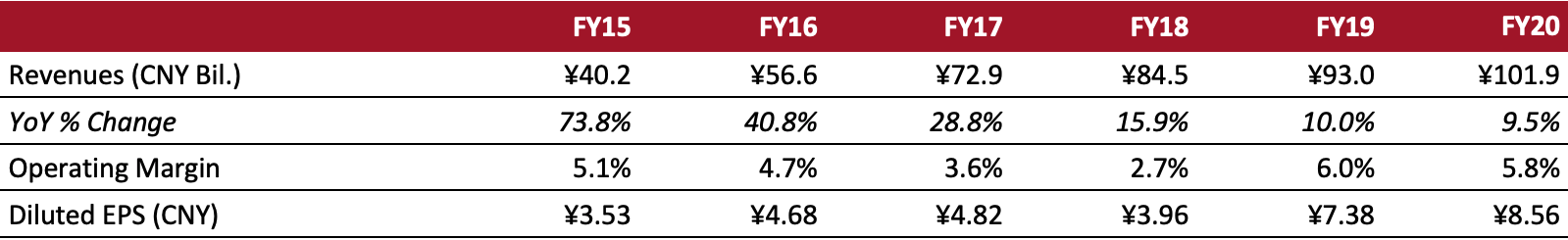

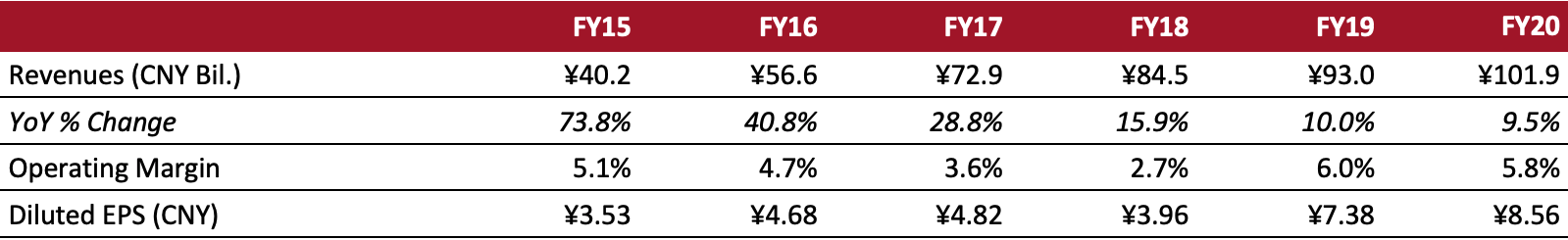

Annual Metrics

[caption id="attachment_127006" align="aligncenter" width="720"]

Fiscal year ends December 31

Fiscal year ends December 31[/caption]

Summary

Founded in 2008 and headquartered in Guangzhou, Vipshop Holdings Ltd. is an online retailer of discount merchandise in China. The company operates in four segments: Vip.com, Shan Shan Outlets, Internet Finance and Others. Vipshop sells products from over 31,000 domestic and international brands through flash sales on the Vipshop Online Platform, comprising the Vipshop app, the vip.com website and the Vipshop WeChat mini program. As of December 2020, Vipshop has 83.9 million registered members, representing a 22% year-over-year increase. The company offers internet finance services, including consumer and supplier financing, and wealth management. It also provides a range of other services, such as consulting, logistics, product procurement, research and development, technological development, and warehousing. Vipshop expanded into offline retail in 2019 with the acquisition of Shan Shan Outlets in July.

Company Analysis

Coresight Research insight: Vipshop’s current focus on branded discount products has proven to be an effective way to acquire new users amid the pandemic. In its third quarter of 2020, the number of active customers increased at a rate of 36% year over year. According to the company, its latest executive hiring, Co-Chief Technology Officer Pengjun Lu, will focus on improving customer experience adding more personalization features to its websites and apps. In the near term, we think Vipshop offers an attractive way for brands to clear their inventory, which will enrich the company’s product offerings and therefore support high customer retention.

| Tailwinds |

Headwinds |

- Consumers’ increased adoption of online shopping

- Brands and retailers will likely increase their online presence

- Increasing appeal of discounted products to consumers post pandemic

|

- Heightened competitive e-commerce environment from e-commerce companies Alibaba, JD.com and Pinduoduo

- Increased costs to acquire new consumers online

- Slowing demand for apparel post pandemic

|

Strategy

Vipshop has outlined the following four key areas in achieving long-term growth:

1. Use a flash-sales model that combines the advantages of e-commerce and discount sales

- Create a sense of “Fear of Missing Out” to boost sales—offer a new daily sales event, with a curated selection of products at discounted prices in limited quantities for a limited period of time.

2. Continue to strengthen its product offerings

- Expand into more categories and add more domestic and international brands.

3. Enhance the consumer shopping experience

- Leverage its big data and business intelligence.

- Provide more personalized recommendations and replenish out-of-stock items more efficiently.

4. Evaluate opportunities for strategic investments

- Evaluate opportunities constantly for strategic investments into or acquisition of businesses.

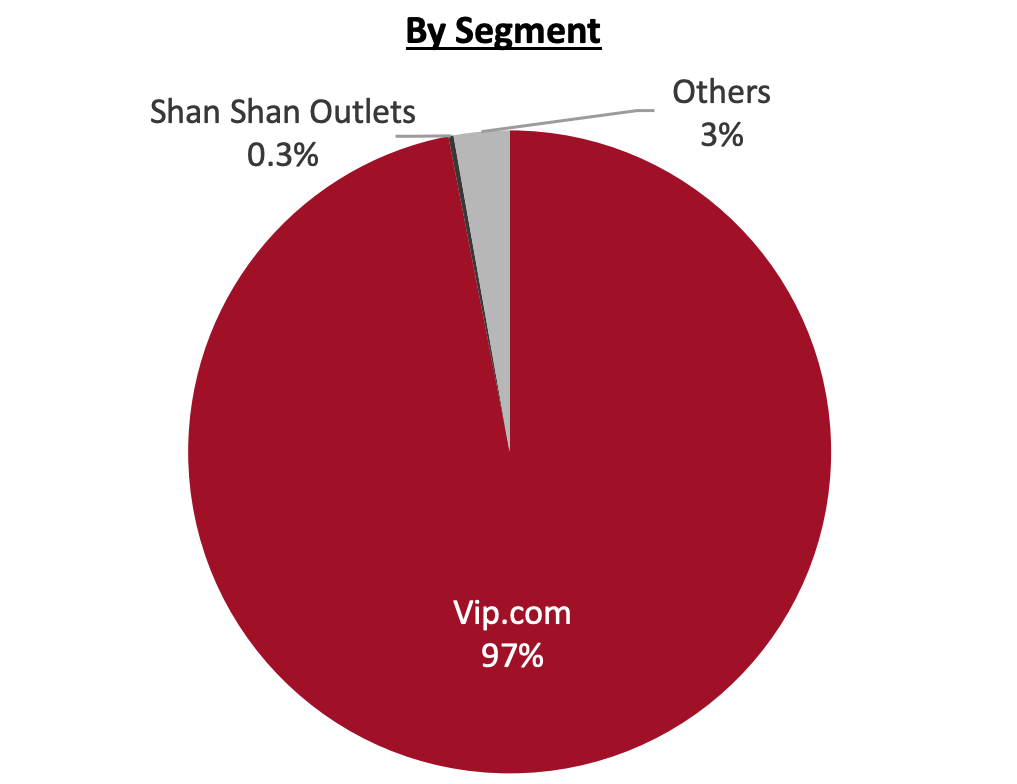

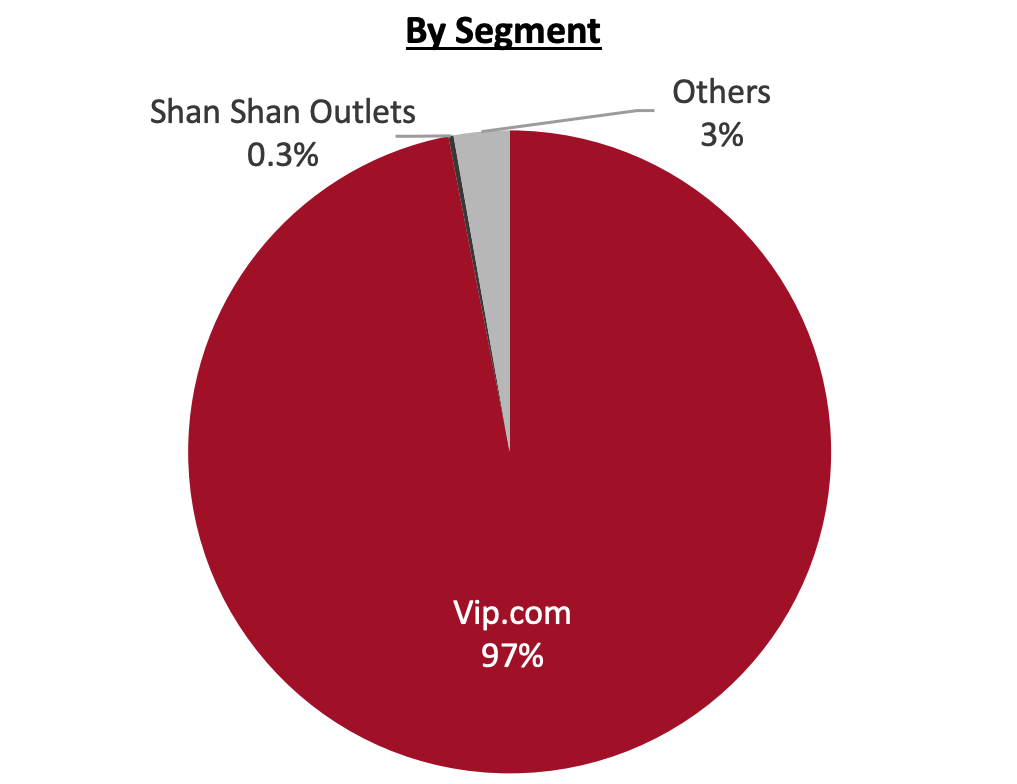

Revenue Breakdown (FY19)

Company Developments

Company Developments

| Date |

Development |

| December 2, 2020 |

Vipshop invests an up-to-20% stake in Shu Dongpo, a Chinese community group-buying platform. |

| November 2, 2020 |

Vipshop appoints Pengjun Lu as its Co-Chief Technology Officer. |

| October 19, 2020 |

Vipshop appoints David Cui as its new Chief Financial Officer. |

| June 28, 2020 |

Vipshop launches its own livestreaming channel on the Vipshop app. |

| February 12, 2020 |

Vipshop announces donations of ¥20 million (around $3 million) to Hubei province and Wuhan to combat Covid-19. |

| November 24, 2019 |

Vipshop announces that it will discontinue its delivery business operated by Pinjun in a new partnership with SF Holding.

|

Management Team

- Ya Shen—Co-Founder, CEO and Chairman

- Xiaobo Hong—Co-Founder, Vice Chairman and COO

- David Cui—Chief Financial Officer

- Tsun-ming Kao—Chief Technology Officer

- Pengjun Lu—Co-Chief Technology Officer

- Yizhi Tang—Senior Vice President of Logistics

Source: Company reports/S&P Capital IQ

Fiscal year ends December 31[/caption]

Summary

Founded in 2008 and headquartered in Guangzhou, Vipshop Holdings Ltd. is an online retailer of discount merchandise in China. The company operates in four segments: Vip.com, Shan Shan Outlets, Internet Finance and Others. Vipshop sells products from over 31,000 domestic and international brands through flash sales on the Vipshop Online Platform, comprising the Vipshop app, the vip.com website and the Vipshop WeChat mini program. As of December 2020, Vipshop has 83.9 million registered members, representing a 22% year-over-year increase. The company offers internet finance services, including consumer and supplier financing, and wealth management. It also provides a range of other services, such as consulting, logistics, product procurement, research and development, technological development, and warehousing. Vipshop expanded into offline retail in 2019 with the acquisition of Shan Shan Outlets in July.

Company Analysis

Coresight Research insight: Vipshop’s current focus on branded discount products has proven to be an effective way to acquire new users amid the pandemic. In its third quarter of 2020, the number of active customers increased at a rate of 36% year over year. According to the company, its latest executive hiring, Co-Chief Technology Officer Pengjun Lu, will focus on improving customer experience adding more personalization features to its websites and apps. In the near term, we think Vipshop offers an attractive way for brands to clear their inventory, which will enrich the company’s product offerings and therefore support high customer retention.

Fiscal year ends December 31[/caption]

Summary

Founded in 2008 and headquartered in Guangzhou, Vipshop Holdings Ltd. is an online retailer of discount merchandise in China. The company operates in four segments: Vip.com, Shan Shan Outlets, Internet Finance and Others. Vipshop sells products from over 31,000 domestic and international brands through flash sales on the Vipshop Online Platform, comprising the Vipshop app, the vip.com website and the Vipshop WeChat mini program. As of December 2020, Vipshop has 83.9 million registered members, representing a 22% year-over-year increase. The company offers internet finance services, including consumer and supplier financing, and wealth management. It also provides a range of other services, such as consulting, logistics, product procurement, research and development, technological development, and warehousing. Vipshop expanded into offline retail in 2019 with the acquisition of Shan Shan Outlets in July.

Company Analysis

Coresight Research insight: Vipshop’s current focus on branded discount products has proven to be an effective way to acquire new users amid the pandemic. In its third quarter of 2020, the number of active customers increased at a rate of 36% year over year. According to the company, its latest executive hiring, Co-Chief Technology Officer Pengjun Lu, will focus on improving customer experience adding more personalization features to its websites and apps. In the near term, we think Vipshop offers an attractive way for brands to clear their inventory, which will enrich the company’s product offerings and therefore support high customer retention.

Company Developments

Company Developments