Nitheesh NH

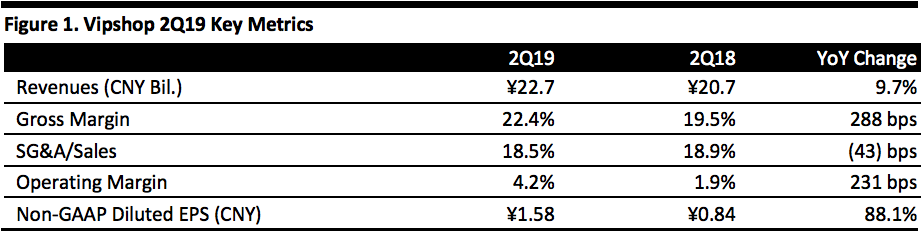

[caption id="attachment_94859" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Vipshop reported 2Q19 revenues of ¥22.7 billion, up 9.7% year over year and beating the consensus estimate of ¥21.6 billion. Growth was primarily driven by an increase in the number of total active customers, but also benefited from the emphasis on high-margin apparel, in which the gross merchandise value (GMV) grew 19% year over year – the fastest of all major categories. GMV for the quarter increased 11% year over year to ¥35.1 billion.

Gross profit increased 25.9% year over year to ¥5.1 billion. Gross margin expanded 288 basis points (bps) to 22.4%. Non-GAAP diluted EPS increased 88.1% to ¥1.58, beating the consensus estimate of ¥0.98.

Total operating expenses were ¥4.2 billion, up 7.2% year over year. .

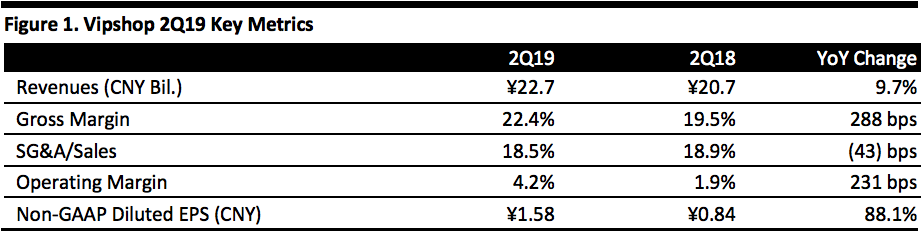

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Vipshop reported 2Q19 revenues of ¥22.7 billion, up 9.7% year over year and beating the consensus estimate of ¥21.6 billion. Growth was primarily driven by an increase in the number of total active customers, but also benefited from the emphasis on high-margin apparel, in which the gross merchandise value (GMV) grew 19% year over year – the fastest of all major categories. GMV for the quarter increased 11% year over year to ¥35.1 billion.

Gross profit increased 25.9% year over year to ¥5.1 billion. Gross margin expanded 288 basis points (bps) to 22.4%. Non-GAAP diluted EPS increased 88.1% to ¥1.58, beating the consensus estimate of ¥0.98.

Total operating expenses were ¥4.2 billion, up 7.2% year over year. .

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Vipshop reported 2Q19 revenues of ¥22.7 billion, up 9.7% year over year and beating the consensus estimate of ¥21.6 billion. Growth was primarily driven by an increase in the number of total active customers, but also benefited from the emphasis on high-margin apparel, in which the gross merchandise value (GMV) grew 19% year over year – the fastest of all major categories. GMV for the quarter increased 11% year over year to ¥35.1 billion.

Gross profit increased 25.9% year over year to ¥5.1 billion. Gross margin expanded 288 basis points (bps) to 22.4%. Non-GAAP diluted EPS increased 88.1% to ¥1.58, beating the consensus estimate of ¥0.98.

Total operating expenses were ¥4.2 billion, up 7.2% year over year. .

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Vipshop reported 2Q19 revenues of ¥22.7 billion, up 9.7% year over year and beating the consensus estimate of ¥21.6 billion. Growth was primarily driven by an increase in the number of total active customers, but also benefited from the emphasis on high-margin apparel, in which the gross merchandise value (GMV) grew 19% year over year – the fastest of all major categories. GMV for the quarter increased 11% year over year to ¥35.1 billion.

Gross profit increased 25.9% year over year to ¥5.1 billion. Gross margin expanded 288 basis points (bps) to 22.4%. Non-GAAP diluted EPS increased 88.1% to ¥1.58, beating the consensus estimate of ¥0.98.

Total operating expenses were ¥4.2 billion, up 7.2% year over year. .

- The number of active customers increased 11% year over year to 33.1 million.

- Total orders increased 33% year over year to 147.8 million.