Nitheesh NH

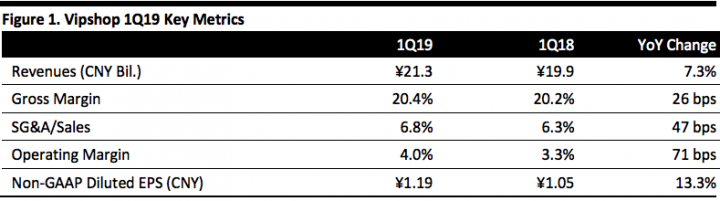

[caption id="attachment_89119" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Vipshop reported 1Q19 revenues of ¥21.3 billion, up 7.3% year over year and beating the consensus estimate of ¥20.5 billion. The growth was primarily driven by an increase in the number of total active customers. It also benefited from the emphasis on the apparel category and the discount retail model, as well as the shift of low-margin products to the marketplace platform. GMV increased 11% year over year to ¥33.8 billion.

Gross profit increased 8.7% year over year to ¥4.4 billion. Gross margin increased 26 basis points to 20.4%. Non-GAAP diluted EPS increased 13.3% to ¥1.19, beating the consensus estimate of ¥1.07.

Total operating expenses were ¥3.6 billion, up 3.9% year over year. As a percentage of total revenue, operating expenses in the quarter decreased to 16.9% from 17.4% in the same quarter last year.

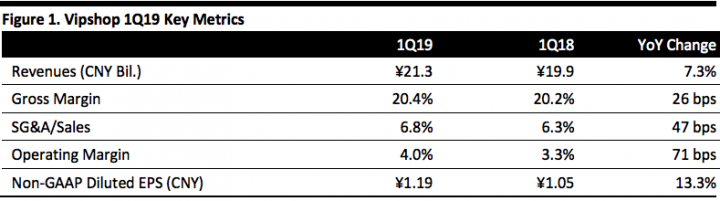

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Vipshop reported 1Q19 revenues of ¥21.3 billion, up 7.3% year over year and beating the consensus estimate of ¥20.5 billion. The growth was primarily driven by an increase in the number of total active customers. It also benefited from the emphasis on the apparel category and the discount retail model, as well as the shift of low-margin products to the marketplace platform. GMV increased 11% year over year to ¥33.8 billion.

Gross profit increased 8.7% year over year to ¥4.4 billion. Gross margin increased 26 basis points to 20.4%. Non-GAAP diluted EPS increased 13.3% to ¥1.19, beating the consensus estimate of ¥1.07.

Total operating expenses were ¥3.6 billion, up 3.9% year over year. As a percentage of total revenue, operating expenses in the quarter decreased to 16.9% from 17.4% in the same quarter last year.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Vipshop reported 1Q19 revenues of ¥21.3 billion, up 7.3% year over year and beating the consensus estimate of ¥20.5 billion. The growth was primarily driven by an increase in the number of total active customers. It also benefited from the emphasis on the apparel category and the discount retail model, as well as the shift of low-margin products to the marketplace platform. GMV increased 11% year over year to ¥33.8 billion.

Gross profit increased 8.7% year over year to ¥4.4 billion. Gross margin increased 26 basis points to 20.4%. Non-GAAP diluted EPS increased 13.3% to ¥1.19, beating the consensus estimate of ¥1.07.

Total operating expenses were ¥3.6 billion, up 3.9% year over year. As a percentage of total revenue, operating expenses in the quarter decreased to 16.9% from 17.4% in the same quarter last year.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Vipshop reported 1Q19 revenues of ¥21.3 billion, up 7.3% year over year and beating the consensus estimate of ¥20.5 billion. The growth was primarily driven by an increase in the number of total active customers. It also benefited from the emphasis on the apparel category and the discount retail model, as well as the shift of low-margin products to the marketplace platform. GMV increased 11% year over year to ¥33.8 billion.

Gross profit increased 8.7% year over year to ¥4.4 billion. Gross margin increased 26 basis points to 20.4%. Non-GAAP diluted EPS increased 13.3% to ¥1.19, beating the consensus estimate of ¥1.07.

Total operating expenses were ¥3.6 billion, up 3.9% year over year. As a percentage of total revenue, operating expenses in the quarter decreased to 16.9% from 17.4% in the same quarter last year.

- The number of active customers increased 14% year over year to 29.7 million.

- Total orders increased 29% year over year to 116.5 million.