About Vipshop

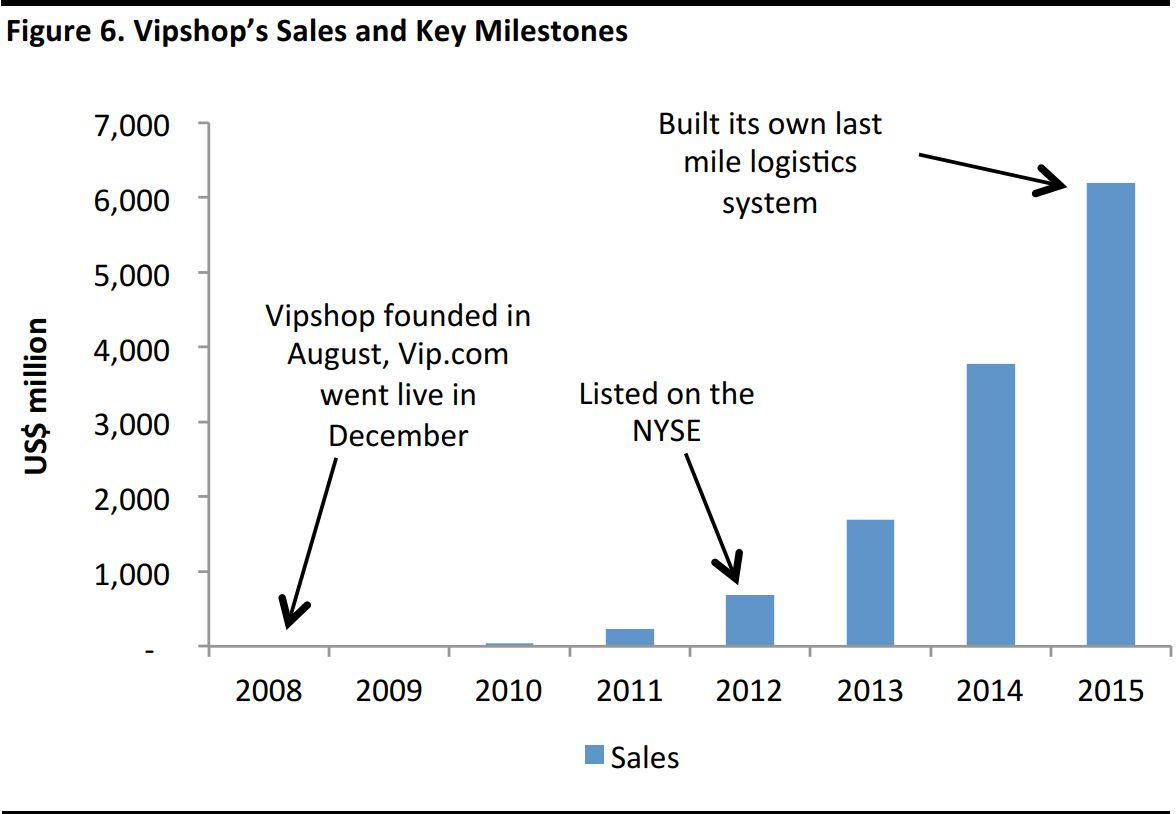

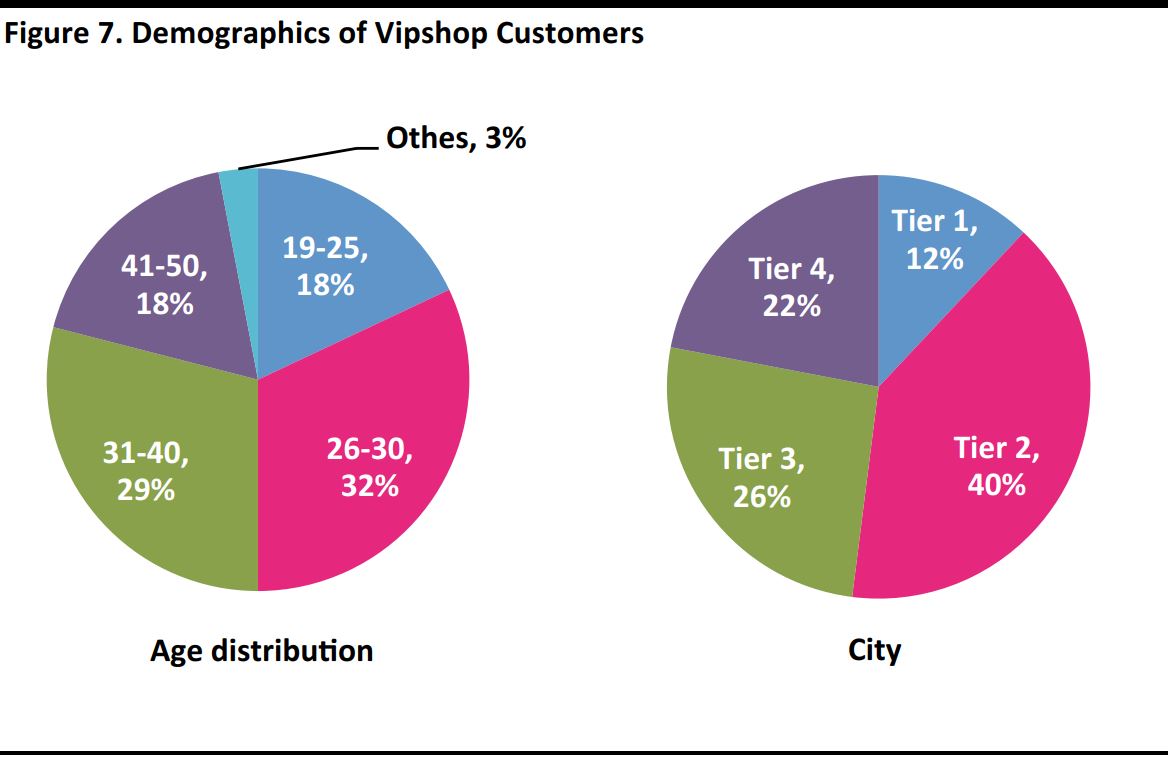

Vipshop (NYSE: VIPS) is a leading online discount retailer for brands in China. It operates an online discount retail model and offers high-quality branded products to consumers throughout China at a discount to retail prices. Vipshop’s business model is to offer online flash sales, i.e., discounted prices in limited quantities during limited time periods, creating a unique customer shopping experience.

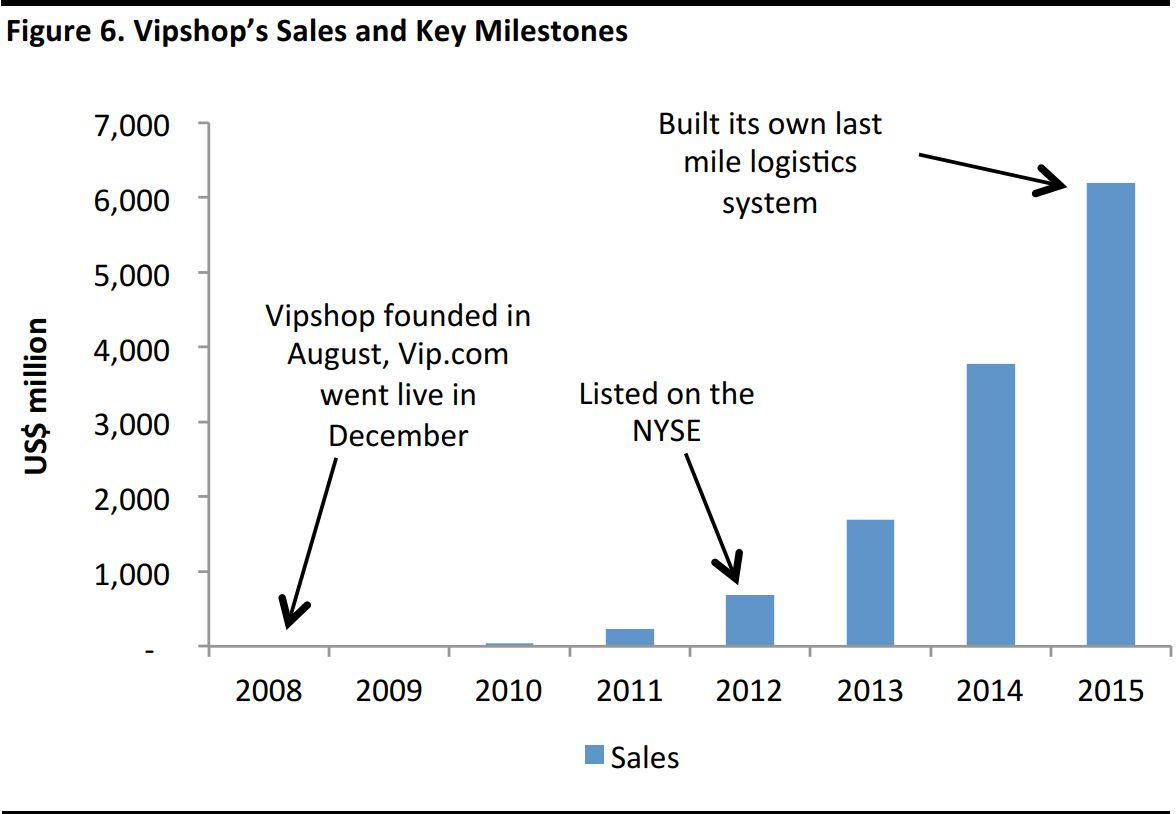

Established in 2008, the platform has built long-term relationships with over 19,000 brands and accumulated 100 million customer members. Vipshop is ranked as the third-largest B2C online platform in China, with revenue of ¥40.2 billion in 2015.

Speaker Profile

Filippo Gori joined Vipshop as Business Development Director for international brands in 2016. Prior to joining Vipshop, he was the APAC CEO of Replay, where he developed the retail, wholesale and e-commerce business in Asia. He also worked at Gucci for eight years, where he eventually held the role of CFO of Greater China. Prior to entering the fashion industry, he worked in consulting and finance.

E-Commerce Market Potential in China

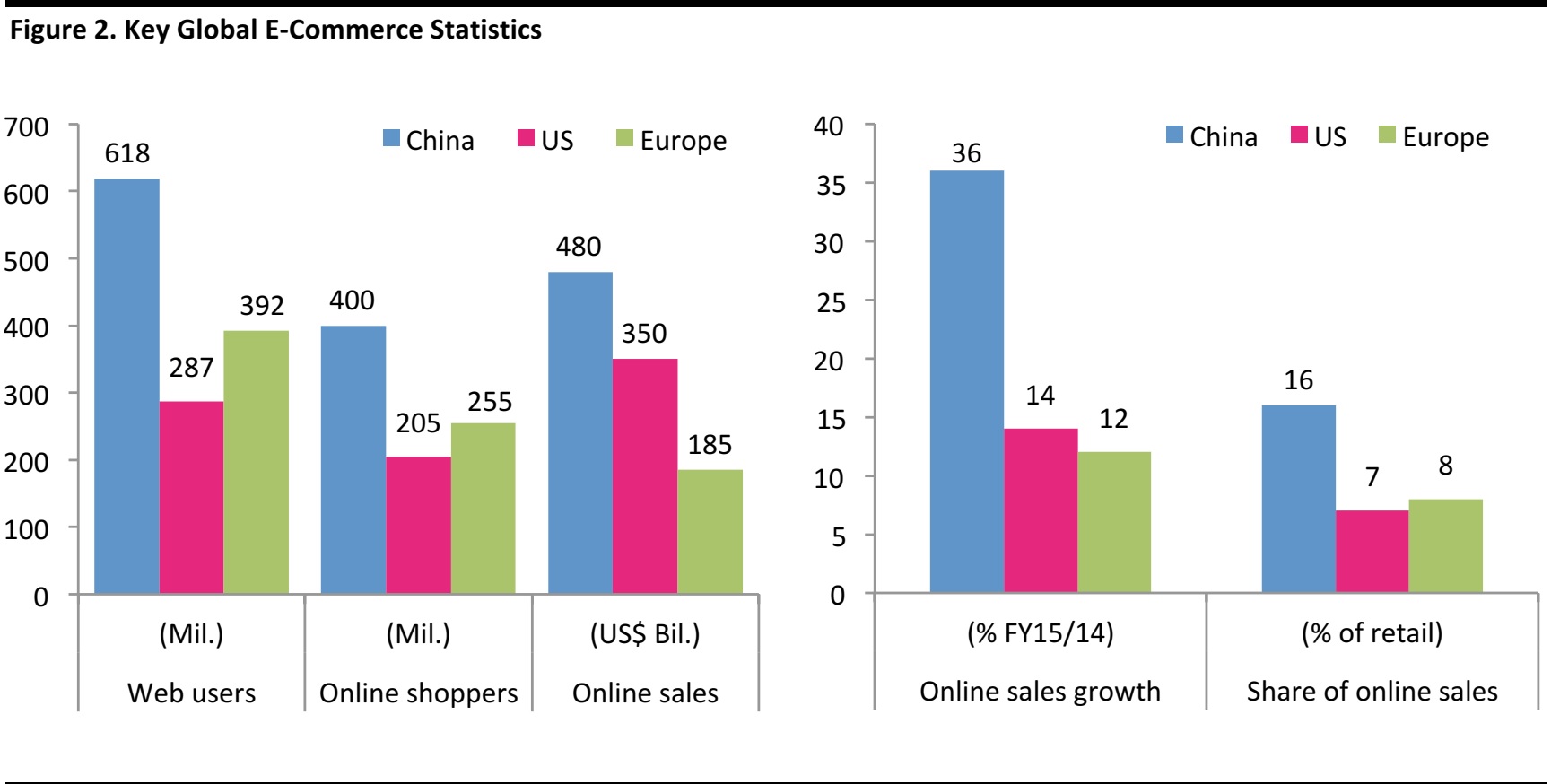

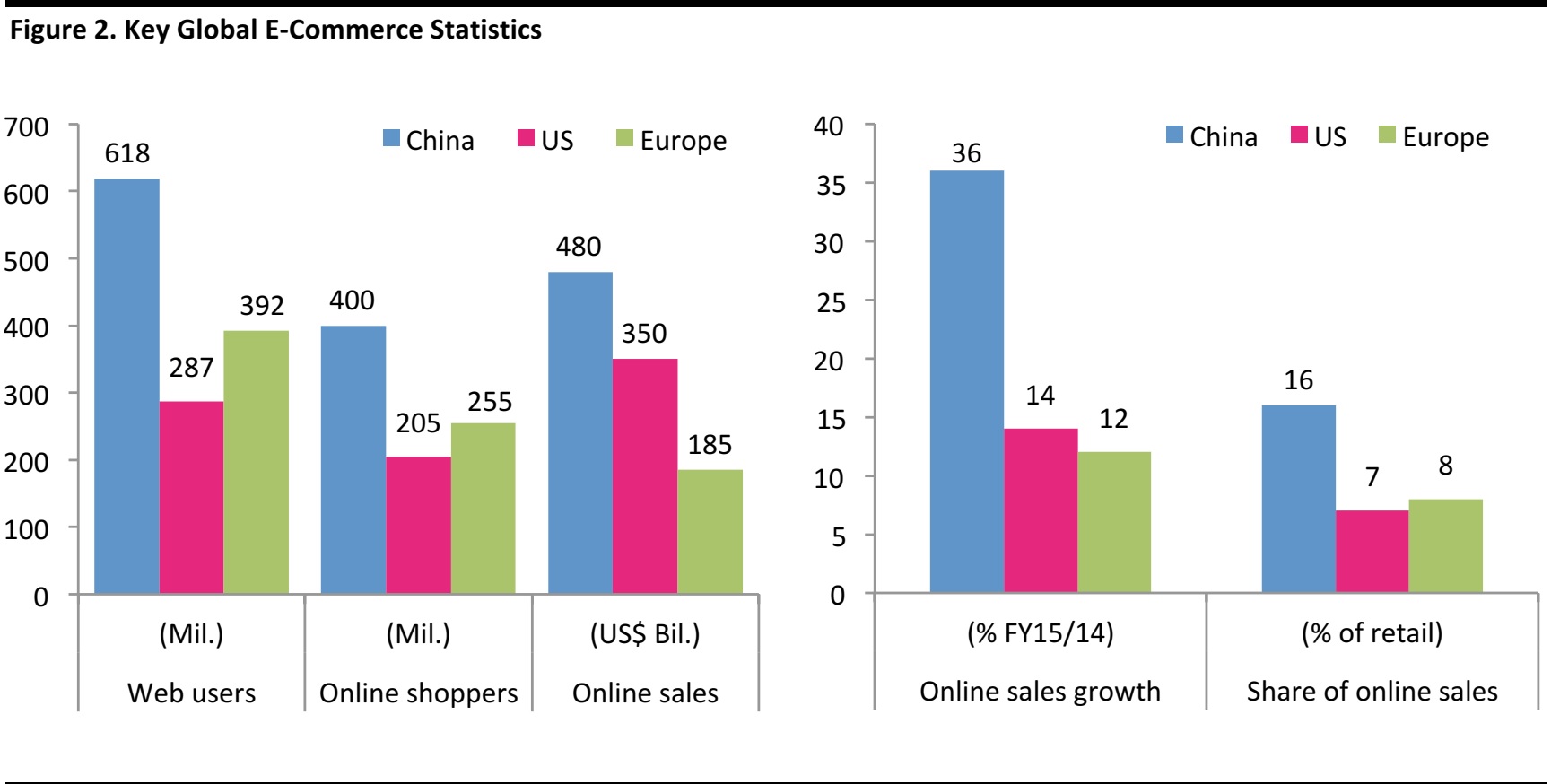

Chinese consumers are adopting e-commerce faster than in the US and Europe: Online sales in China grew 36% year over year in 2015, faster than in the US at 14% and in Europe at 12%. The faster growth in China is mainly due to the larger population of online shoppers and the leapfrogging of e-commerce relative to physical retail.

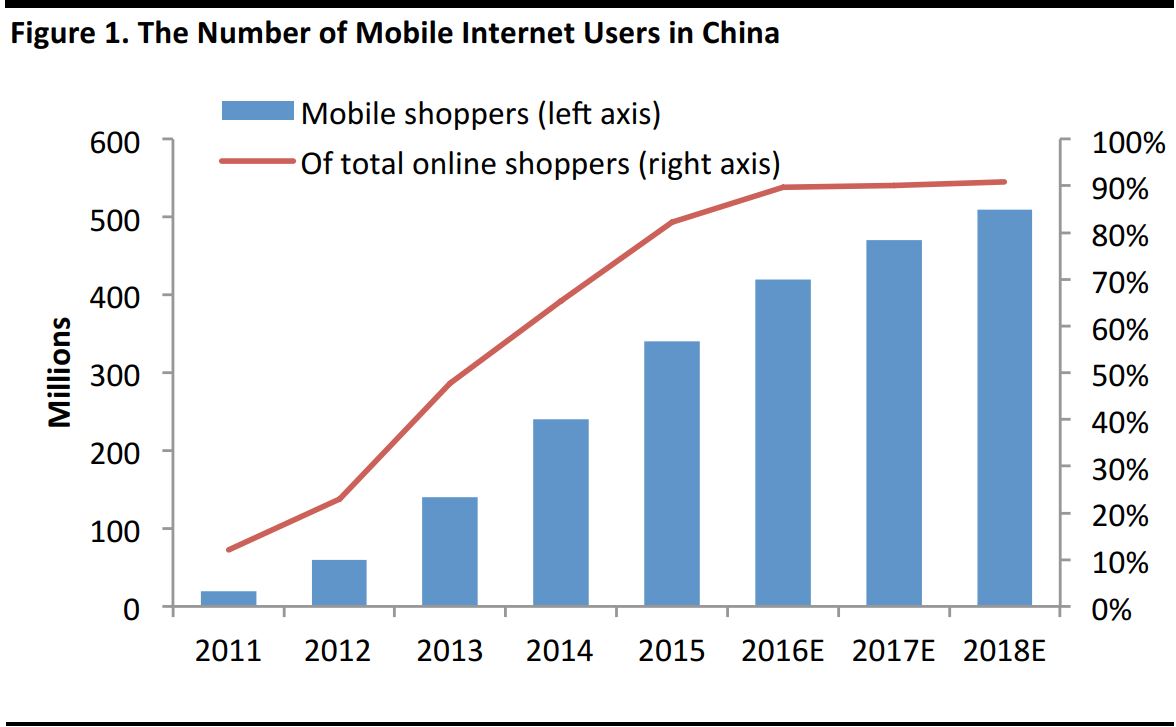

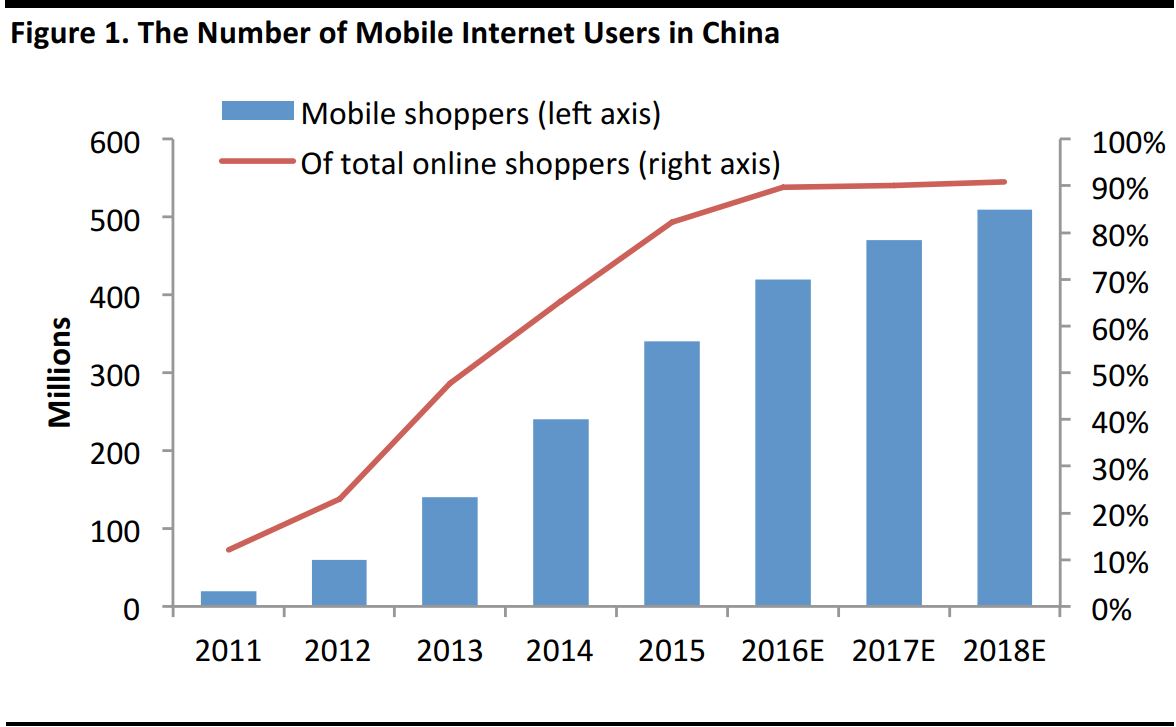

Prevalence of m-commerce in China: There were 340 million mobile shoppers in China in 2015, comprising 82% of total online shoppers, according to iResearch. This is forecast to reach 510 million in 2018, or 91% of total online shoppers.

Source: CNNIC/iResearch/Fung Global Retail & Technology

Source: Company data/Fung Global Retail & Technology

Advice for International Brands Entering the Chinese Fashion Market

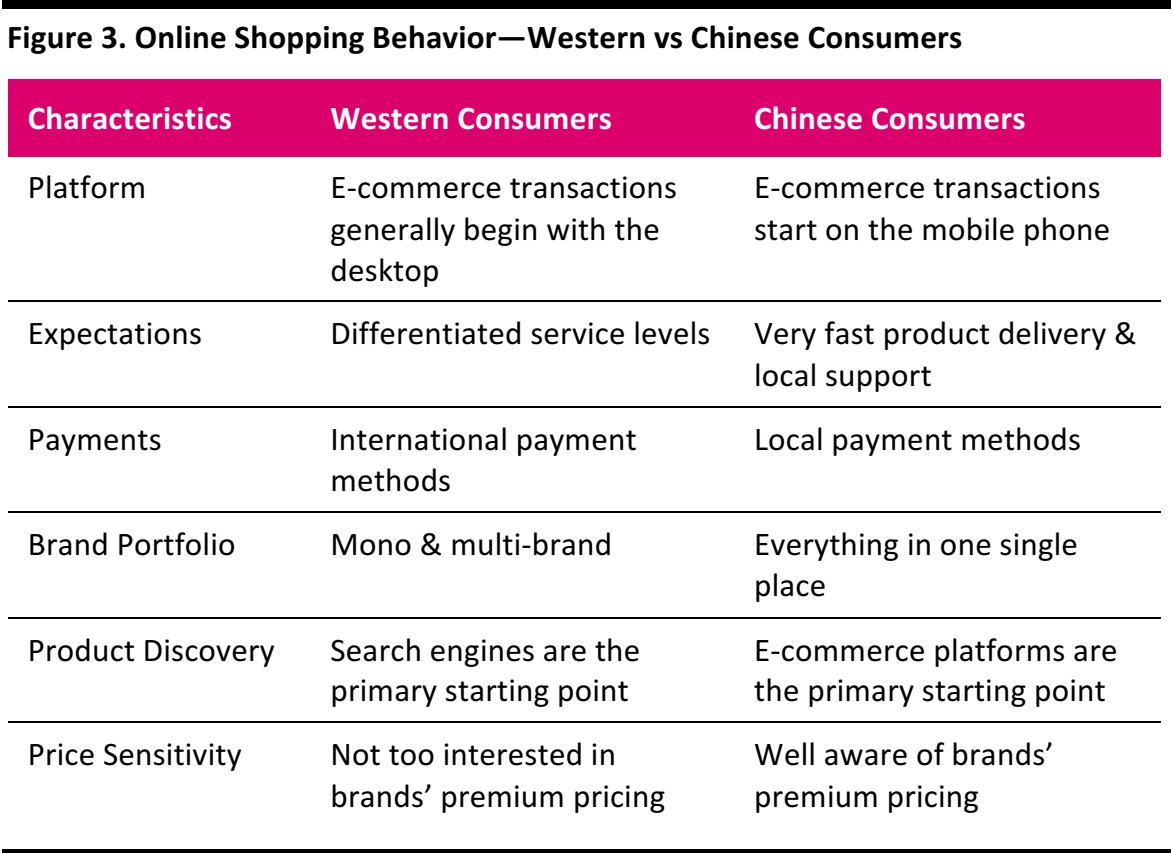

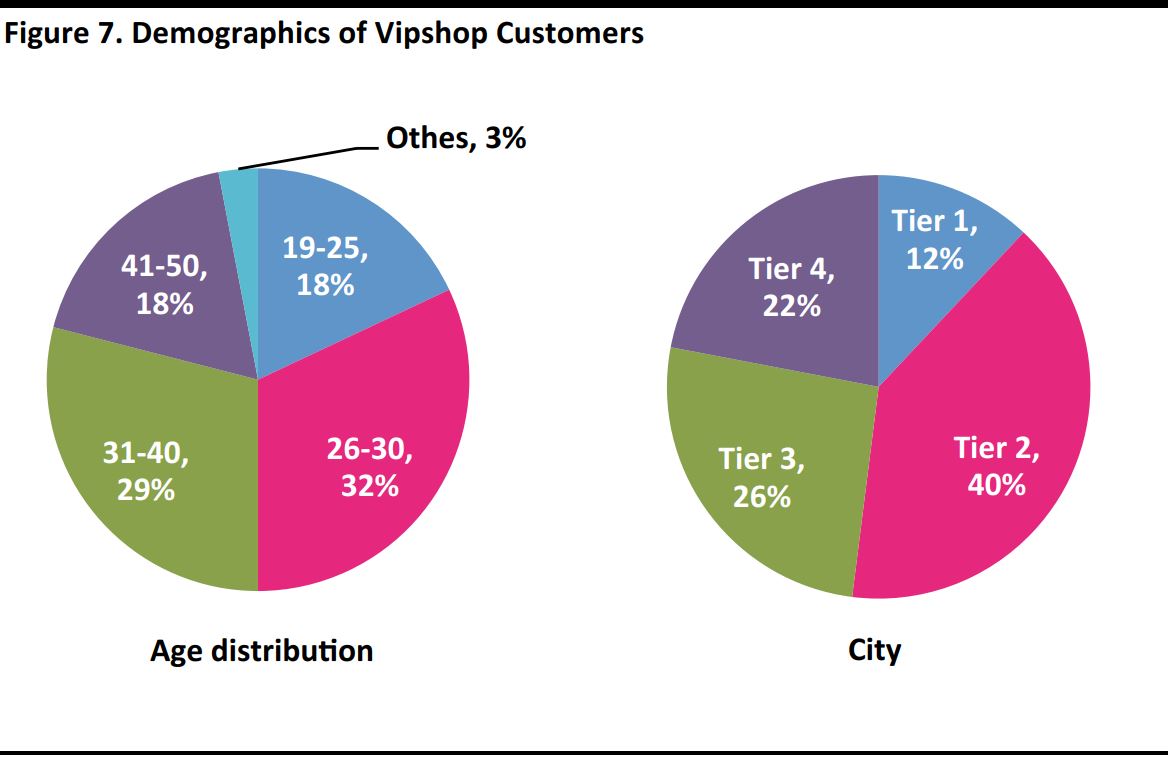

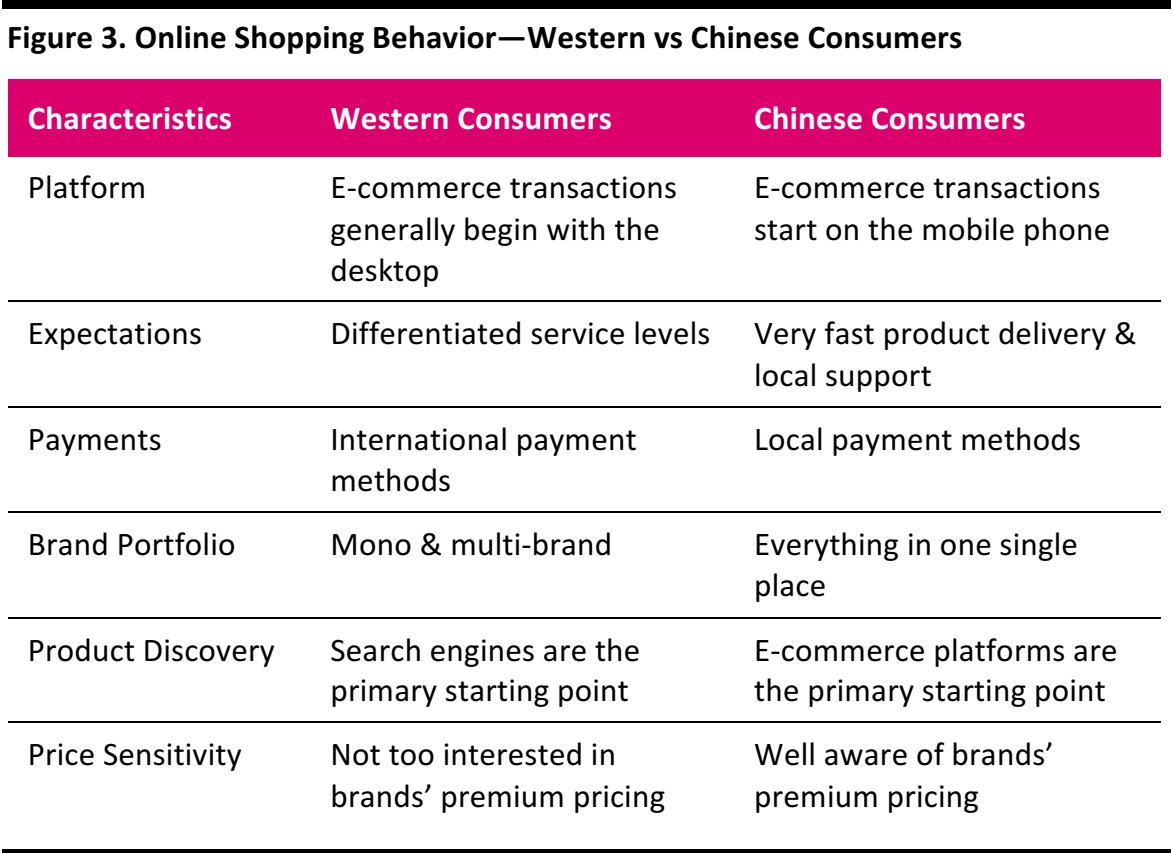

Borrowing from his vast experience marketing luxury brands to Chinese consumers, Gori summarized how Chinese online shoppers differ from their Western counterparts.

Online Shopping—How Chinese and US Shoppers Differ

- Platform: Chinese consumers are more likely to shop on their mobile phones, given the high mobile internet penetration in China.

- Product discovery: Chinese consumers search for products directly on e-commerce sites, while Western consumers typically use search engines as the starting point.

- Customers’ expectations: Chinese consumers are typically more demanding. When shopping online, they typically expect next-day delivery compared to western consumers who are receptive to different service levels. At the same time, Chinese consumers are price sensitive and aware of brands’ premium pricing.

Source: Company data

Pitfalls International Brands Should Avoid When Selling Online in China

In order to capture the opportunities of the Chinese online shopping market, international brands need to tailor their service offerings to the end market when selling online to Chinese consumers.

Source: Company data

Pockets of Strength in China’s E-Commerce Industry

According to iResearch, China’s e-commerce industry offers four key opportunities:

- Contextualization: The prevalence of the mobile internet has caused consumers to focus on experience, service and product quality, rather than purely on price. This is consistent with the increase in popularity in location-based spending.

- Internationalization: The rise of the upper middle class and increase in spending power in China has led to an increased focus on product quality, and hence demand for international brands.

- Customization: Consumers’ preference for customization has led to increased demand in product verticals such as maternity, baby and fashion.

- Socialization: The social element of commerce is consistent with the trend of cewebrities, social commerce and big data.

Source: Company data

Vipshop’s Value Propositions

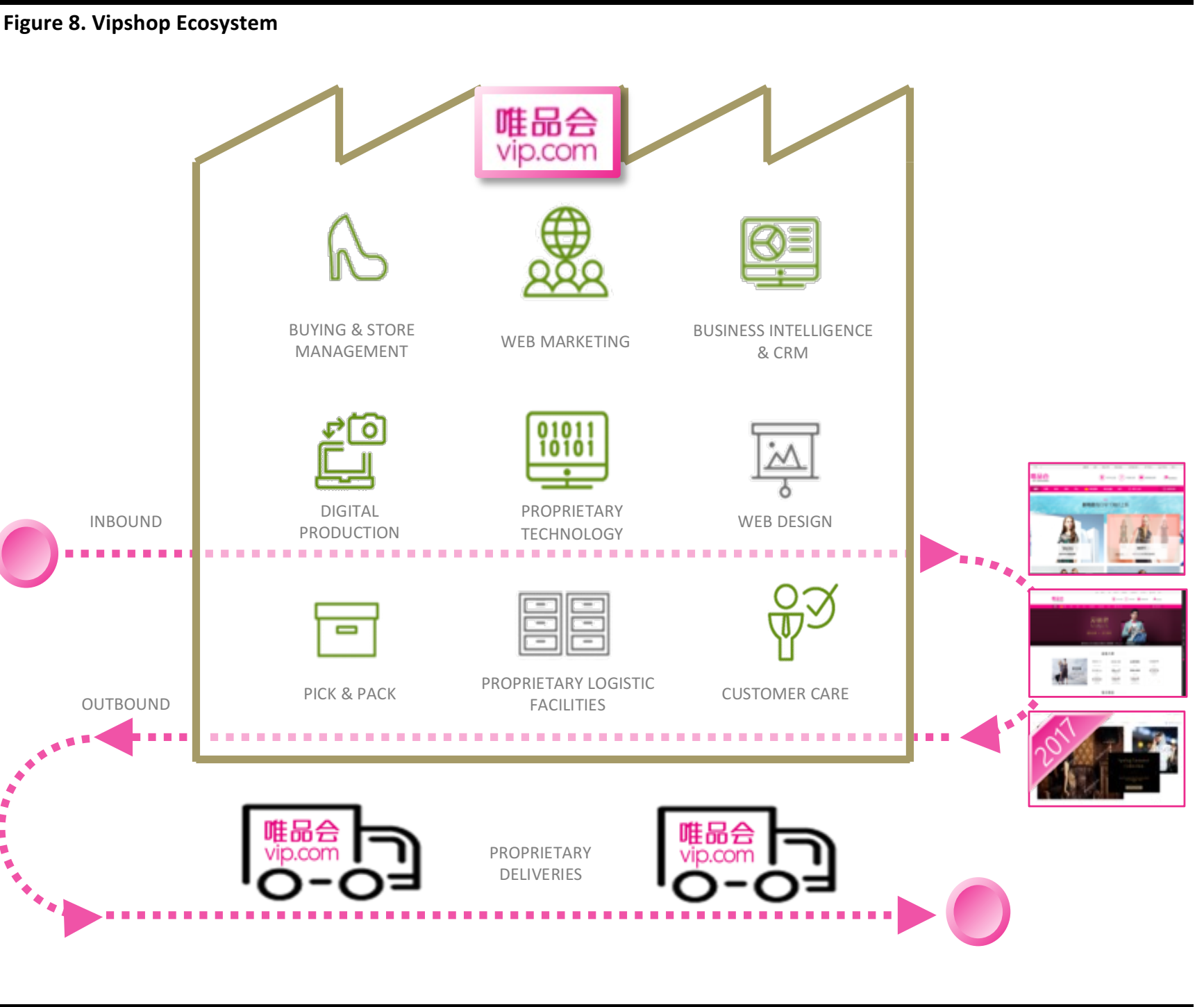

As the leading online flash sales channel in China, Vipshop offers a channel for brands to create new consumer demand for their products and the ability to monetize their inventory quickly without compromising their brand equity.

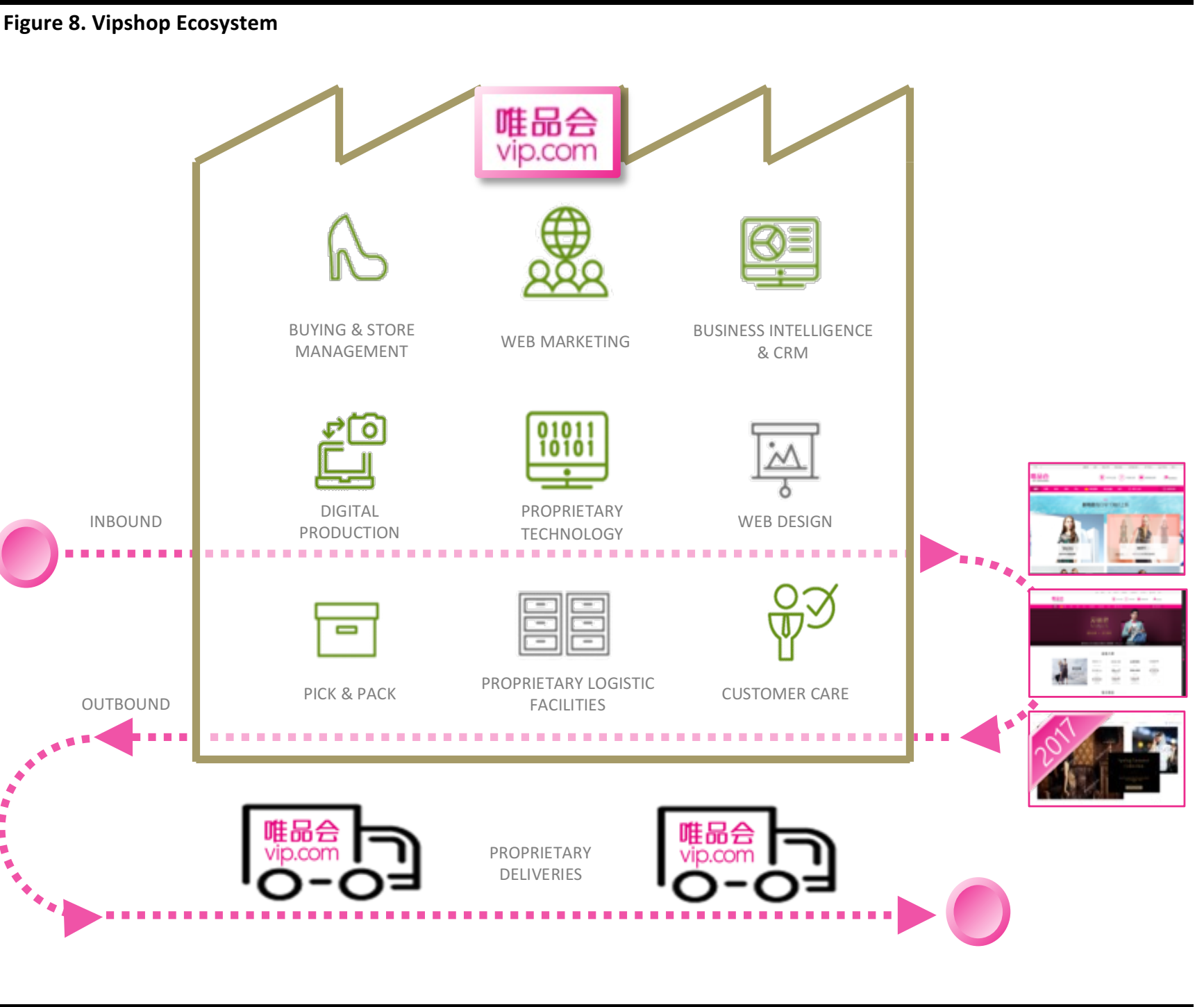

- Full service provider: Vipshop directly controls all areas of e-commerce, ensuring consistency and in accordance to brands’ guidelines. The full suite of ERP and Inventory Management solutions ensures consistency and helps brands monetize large volumes of inventory in a short period of time.

- Strong fulfilment capabilities: Vipshop’s ability to fulfil customer orders efficiently is a key differentiating factor in the customer experience. The company has built a strong infrastructure of warehouses with customized automation and logistics networks. Vipshop’s warehouse capacity is expected to reach 2 million by the end 2016, according to its 3Q16 earnings call.

- Personalization and big data to assist customer discovery: Vipshop provides an impactful marketing channel for brands to expand their addressable market and increase conversion through personalized marketing efforts.

Source: Company data

Source: Company data

Conclusion

We expect online sales of branded goods to continue to grow, despite the deceleration of China’s underlying economy. In our view, Vipshop is well positioned to benefit from the rise of Chinese online consumption, on the back of its big-data and business-intelligence capabilities, regional warehouses and last-mile delivery network, and its ability to deliver value for brands and customers.

Source: Company data