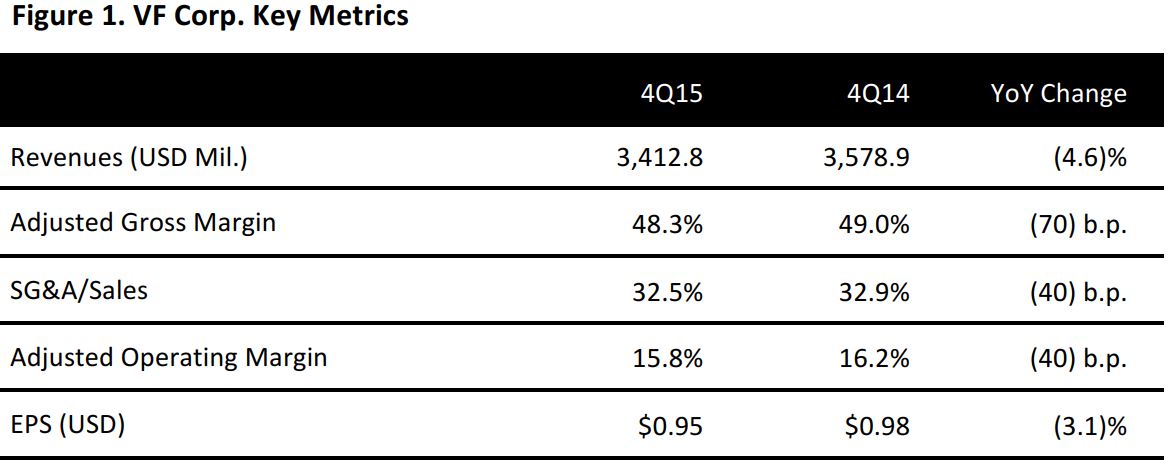

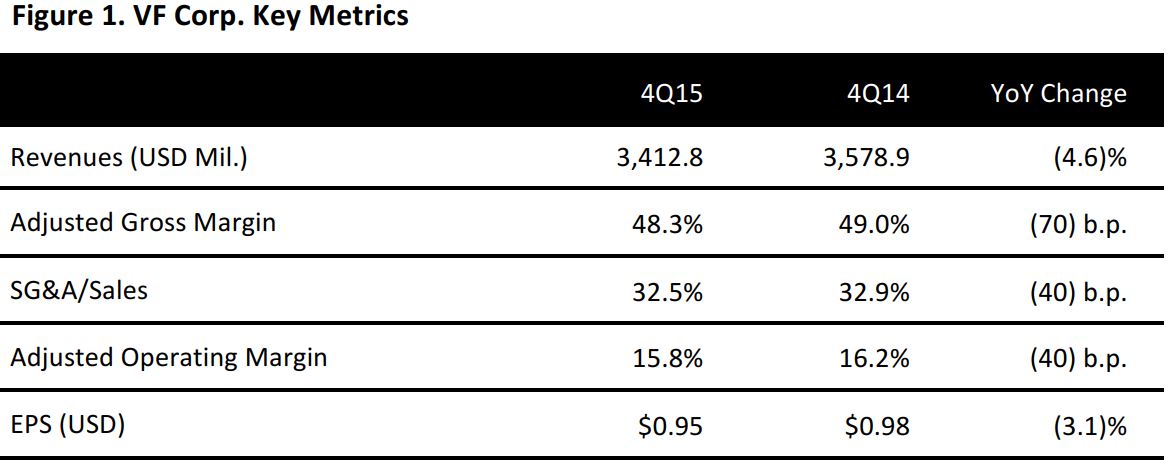

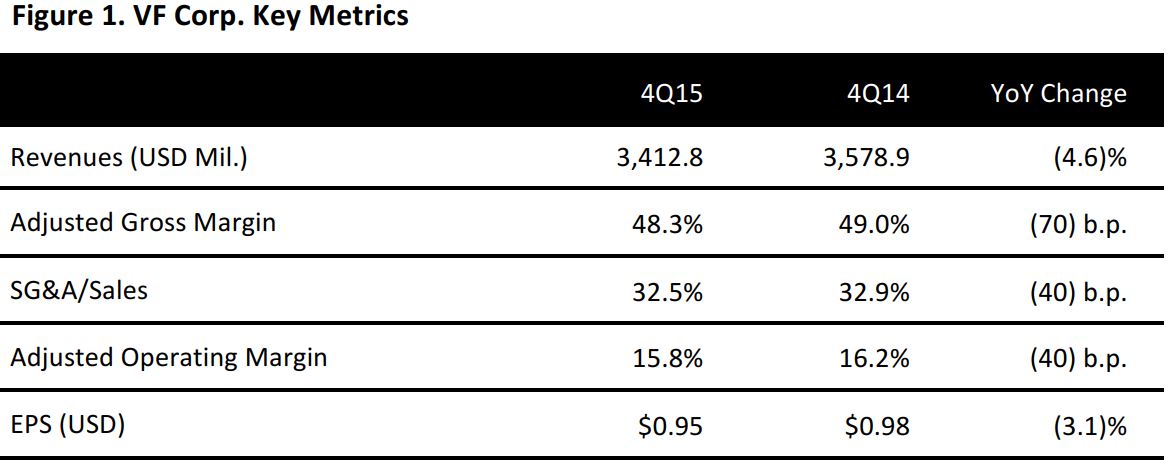

Source: Company reports

VF Corp. reported adjusted 4Q15 EPS of $0.95 versus the consensus estimate of $1.01.

Total revenue was $3.41 billion versus consensus of $3.63 billion. Management noted a softer consumer environment, unseasonably warm weather and a strengthening US dollar as headwinds it faced in the fourth quarter.

By segment, outdoor and action revenues were $2.10 billion, down 3% year over year, versus consensus of $2.24 billion. Revenues for The North Face brand were down 4% in the quarter, driven by unseasonably warm weather. In the Americas, the brand’s revenues fell at a low-single-digit rate, while they were down at a low-teens rate in Europe and down at a low-single-digit rate in the Asia-Pacific region.

Revenue for Vans in the fourth quarter was up 3%. The brand’s revenue in the Americas grew at a low-single-digit rate; it grew by more than 20% in the Asia-Pacific region and declined at a mid-single-digit rate in Europe.

Timberland revenue was down 4% in the quarter, impacted significantly by record warm weather. In the Americas, the brand’s revenue was down at a low-single-digit rate and in Europe, it was down at a high-single-digit rate. In the Asia-Pacific region, Timberland revenue was down at a mid-single-digit rate.

Jeanswear revenues were $736.5 million in the quarter, down 2%, versus consensus of $767.7 million.

Revenue for the Wrangler brand was down 4%. Mid-single-digit growth in the US mass channel was offset by weakness in the western specialty business. In Europe, Wrangler revenue was down at a low-teens rate, while it was up at a high-single-digit rate in the Asia-Pacific region.

Revenue for the Lee brand in 4Q15 was in line with revenue during the same period last year. The brand saw low-single-digit growth in the Americas, a mid-single-digit increase in the Asia-Pacific region and a high-single-digit decline in Europe.

Imagewear sales were $259.3 million, down 13%, versus consensus of $287.3 million. Low-single-digit growth in the licensed sports group business was offset by a decline of more than 20% in the workwear division’s revenue that was due primarily to the impact of considerably less oil and gas exploration activity.

Sportswear sales were $195.5 million, down 9%, versus consensus of $215.9 million. Nautica revenue was down at a low-double-digit rate and the Kipling US business was up at a low-single-digit rate. Contemporary sales were $86.5 million, down 19%, versus consensus of $96.7 million. Other revenues were $34.2 million versus consensus of $39.2 million.

At the end of the year, total inventory was up 8.7% versus the year-ago period, while sales declined by 4.6% in the fourth quarter. Management noted that cold weather items drove more than half of the increase in inventory.

FY16 guidance calls for implied EPS of roughly $3.23 versus consensus of $3.43. Total revenue is expected to increase at a mid-single-digit rate that includes a one-percentage-point negative impact related to foreign exchange. Consensus implies a 6% growth rate in sales.