Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Vans Enjoys Another Stellar Quarter, Driving Growth Across the VFC Platform

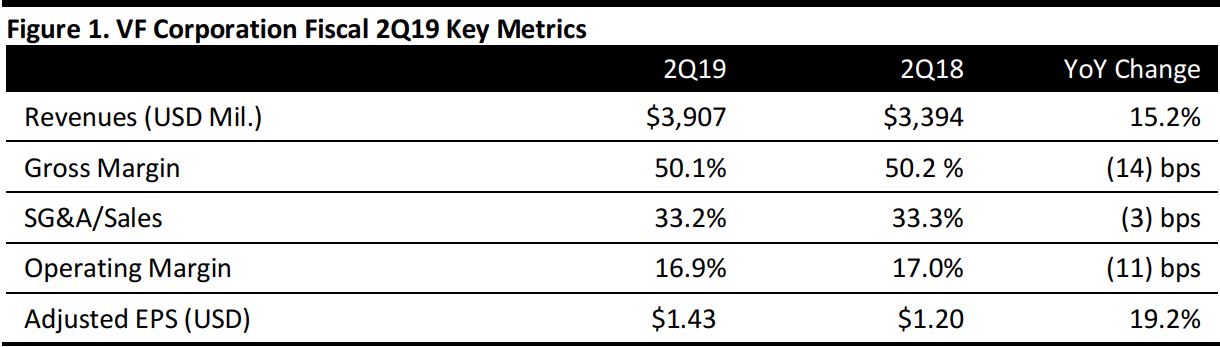

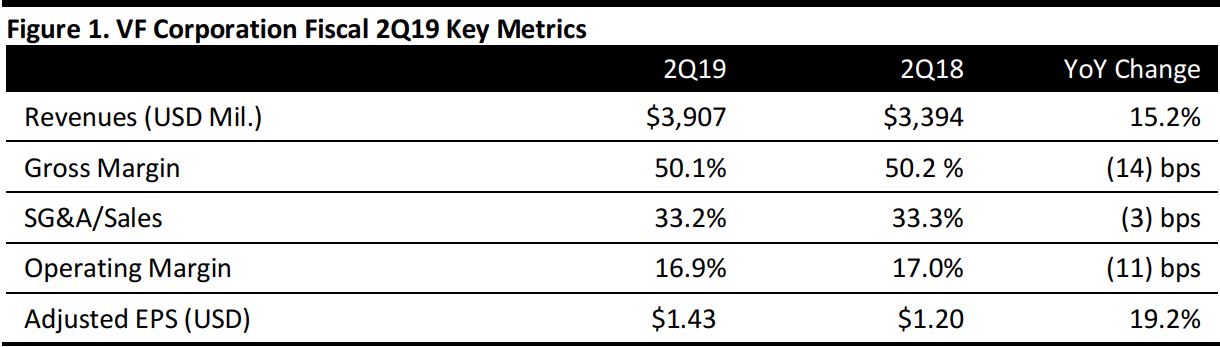

VF Corporation (VFC) reported adjusted fiscal 2Q19 EPS of $1.43, up from $1.20 in the year-ago quarter and above the consensus estimate of $1.33. Total revenues were $3,907 million, up 15.2% year over year and above the $3,870 million consensus estimate.

Outdoor segment (Altra, Icebreaker, Smartwool, The North Face (TNF) and Timberland) revenues were $1,466 million—a year-over-year increase of 6.2%—and the segment profit margin contracted 55 basis points (bps) to 17.6% of sales. TNF revenues rose 5% driven by a 13% increase in DTC sales, a double-digit comps growth and >35% growth in DTC digital; regionally, the Americas experienced 2% growth, Europe grew at a 16% pace and the APAC region was up 1% during the period. Timberland revenues declined 2%.

Active segment (Eagle Creek, Eastpak, JanSport, Kipling, Napapijri, Reef and Vans) revenues increased by 19.3% year over year to $1,300 million; and segment profits grew by 28.5%, driving a segment margin expansion of 194 bps, to 27%. Vans drove the active segment with a 26% revenue gain, up 23% wholesale and 29% DTC, footwear and apparel sales rose 25%+ and 20%+, respectively. DTC rose 29% on a 25% total comp, including 55% digital channel growth. Vans wholesale revenues increased by 23% with strong global Back-to-School demand. By region, Vans revenues rose 34% in the Americas, 8% in Europe and 26% in the APAC region.

The Jeans segment (Lees, Riders by Lee, Rock & Republic and Wrangler) disappointed with a 7.3% decline in revenues, to $633 million, accompanied by a 179 bps margin contraction to 15.4%. Sales of the Wrangler brand declined 5%; excluding the impact of currency and a customer bankruptcy, Wrangler’s sales would have been flat. In the Americas, Wrangler digital wholesale revenues rose 30%. VF intends to spin off its Jeans business with a separation date at the end of April 2019.

Outlook

The company lifted revenues and earnings guidance as follows:

- Fiscal 2019 revenues of at least $13.7 billion versus prior guidance of $13.6–$13.7 billion, reflecting a tightening of the revenue range for the Outdoor segment to 7%–8% increase from 6%–8%; a lift in the Active segment to 14%–15% from 13%–14%, offset by an expected decline of 1%–2% in Jeans revenue from prior flat guidance.

- From a channel perspective, DTC is now expected to increase 12%–14% from previous guidance of 11%–13%, with digital up 30%.

- Cash from operations guidance was lifted to approximately $1.8 billion from a little higher than $1.7 billion and capital expenditures remains unchanged at $275 million.

- Adjusted gross margin guidance of approximately 51% was reiterated and the operating margin is now expected to increase by 80 bps to approximately 13.5% on slightly higher SG&A leverage.

- EPS guidance was lifted to $3.65 versus prior guidance of $3.52–$3.57..

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research