Source: Company reports/FGRT

2Q17 Results

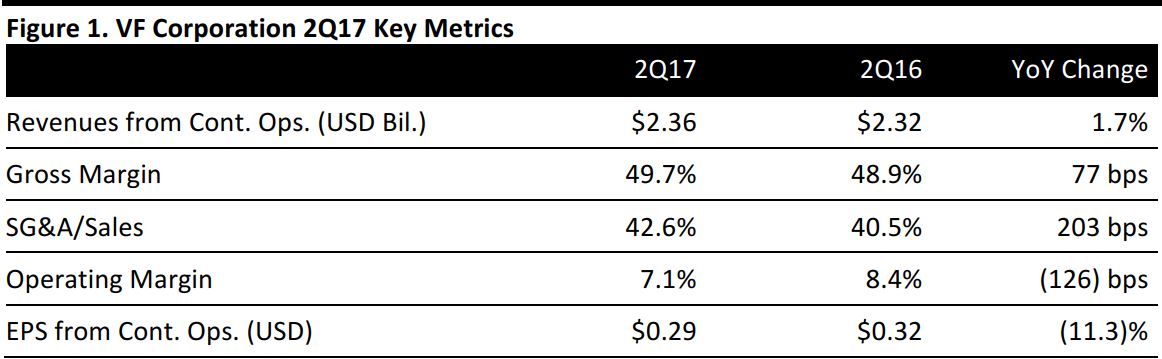

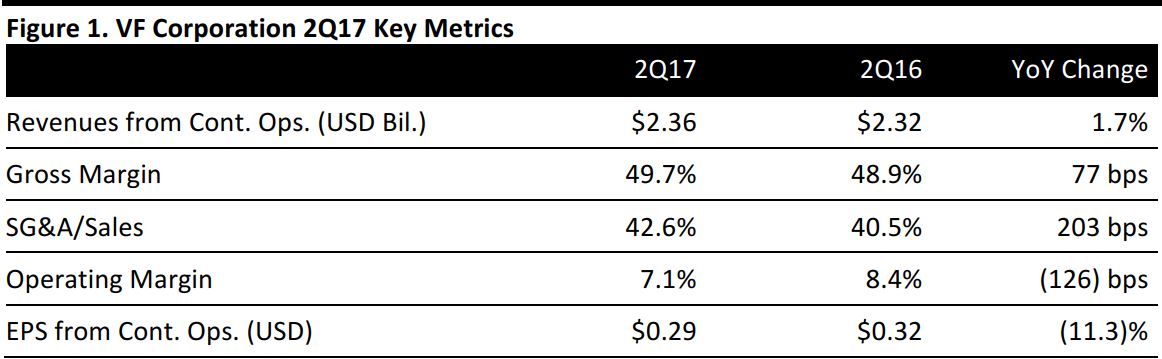

VF Corporation reported 2Q17 revenues from continuing operations of $2.36 billion, up 1.7% year over year and above the $2.29 billion consensus estimate. Total sales increased by 3% year over year on a constant-currency basis.

Changes in foreign currency negatively affected operating margin by about 70 basis points in the quarter.

EPS from continuing operations was $0.29, beating the $0.28 consensus estimate. GAAP EPS was $0.27, compared with $0.12 a year ago.

Management commented that results were consistent with expectations, driven by strong performance from the company’s largest global brands, its international and direct-to-consumer platforms, and its growing workwear businesses. Based on the strength of the first half of 2017 and raised expectations for the second half of the year, the company is making growth-focused investments in its largest brands and platforms.

Additional Details From the Quarter

Coalition Revenues:

- Revenues from Outdoor & Action Sports increased by 4% and were up 5% on a currency-neutral basis.

- Revenues from Jeanswear decreased by 5% and were down 4% on a currency-neutral basis.

- Revenues from Imagewear increased by 11% and were up 12% on a currency-neutral basis.

- Revenues from Sportswear decreased by 1% and were down 1% on a currency-neutral basis.

- Other revenues decreased by 2% and were down 2% on a currency-neutral basis.

Revenues for the Top Five Brands:

- Revenues from Vans increased by 8% and were up 9% on a currency-neutral basis.

- Revenues from The North Face increased by 5% and were up 6% on a currency-neutral basis.

- Revenues from Timberland increased by 2% and were up 3% on a currency-neutral basis.

- Revenues from Wrangler decreased by 2% and were down 2% on a currency-neutral basis.

- Revenues from Lee decreased by 7% and were down 6% on a currency-neutral basis.

Revenue Growth by Geography:

- Revenues from the Americas increased by 5% and were up 7% on a currency-neutral basis, including US growth of 1% (up 1% on a currency-neutral basis).

- Revenues from EMEA increased by 1% and were up 4% on a currency-neutral basis.

- Revenues from APAC increased by 7% and were up 9% on a currency-neutral basis, including China growth of 13% (up 18% on a currency-neutral basis).

- Total International revenues increased by 4% and were up 6% on a currency-neutral basis.

Other Channels:

- Revenues from Wholesale decreased by 3% and were down 2% on a currency-neutral basis.

- Revenues from Direct-to Consumer increased by 13% and were up 14% on a currency-neutral basis.

Discontinued Operations

The adjustments for discontinued operations included the following:

- On April 28, 2017, the company completed the sale of its Licensed Sports Group (LSG) business, including the Majestic brand.

- On August 26, 2016, the company completed the sale of its Contemporary Brands businesses, which included the 7 For All Mankind, Splendid and Ella Moss brands.

Raises Guidance

The company raised its 2017 revenue guidance by 2%, to $11.65 billion, due to the following coalition performance projections:

- Outdoor & Action Sports—Revenue is now expected to increase by approximately 5% (and by 6%–7% on a currency-neutral basis) versus the previous expectation of a mid-single-digit percentage increase.

- Jeanswear—Revenue is still expected to be flat year over year.

- Imagewear—Revenue is now expected to increase at a mid-single-digit percentage rate versus the prior expectation of a low-single-digit percentage increase.

- Sportswear—Revenue is still expected to decline at a high-single-digit percentage rate.

- Direct-to-Consumer—Revenue is now expected to increase in the range of 10%–11% versus the previous expectation of a high-single-digit increase.

- Digital—Revenue is now expected to increase by more than 25%.

EPS is now expected to be $2.94, compared with the prior outlook range of $2.89–$2.94. The updated EPS outlook includes about an $0.08 per share ($40 million pretax) impact from additional investments to drive growth.