Source: Company reports

2Q16 RESULTS

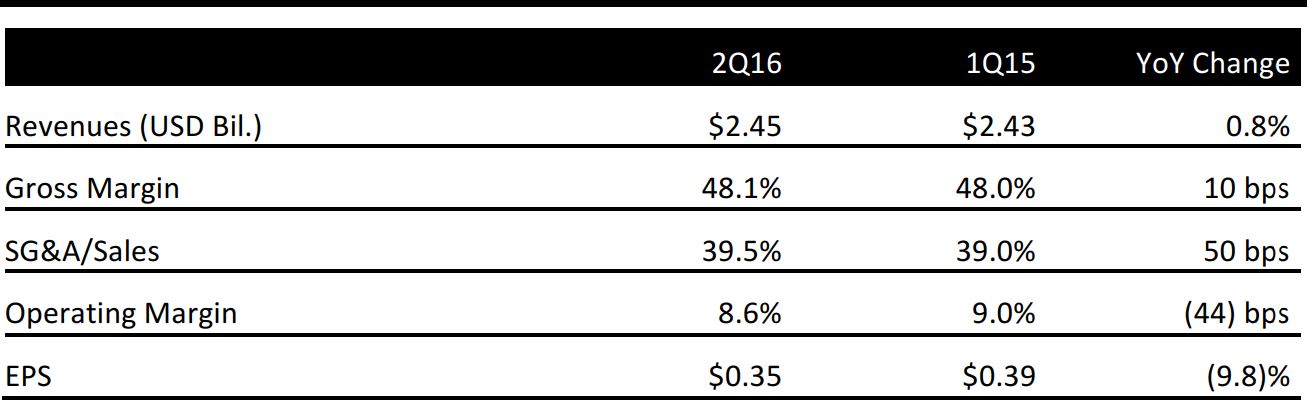

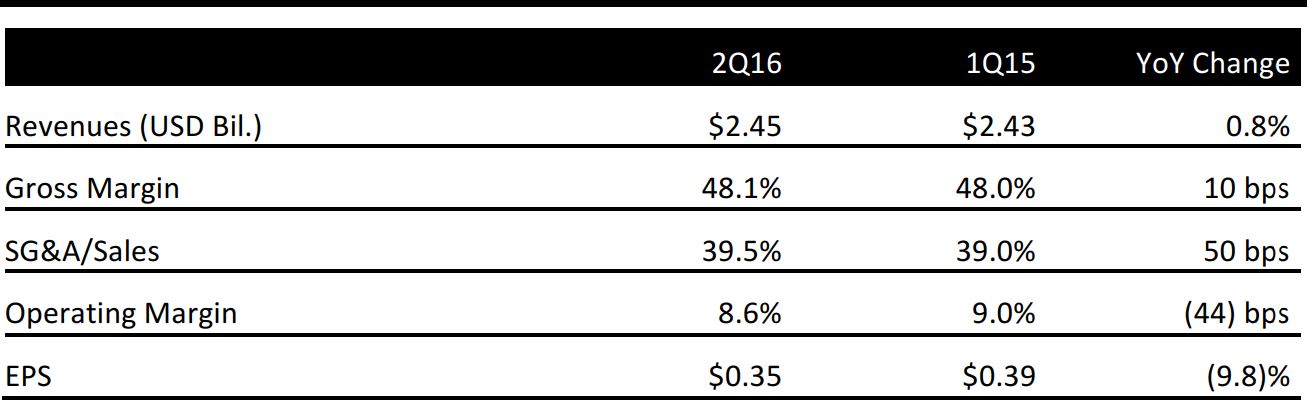

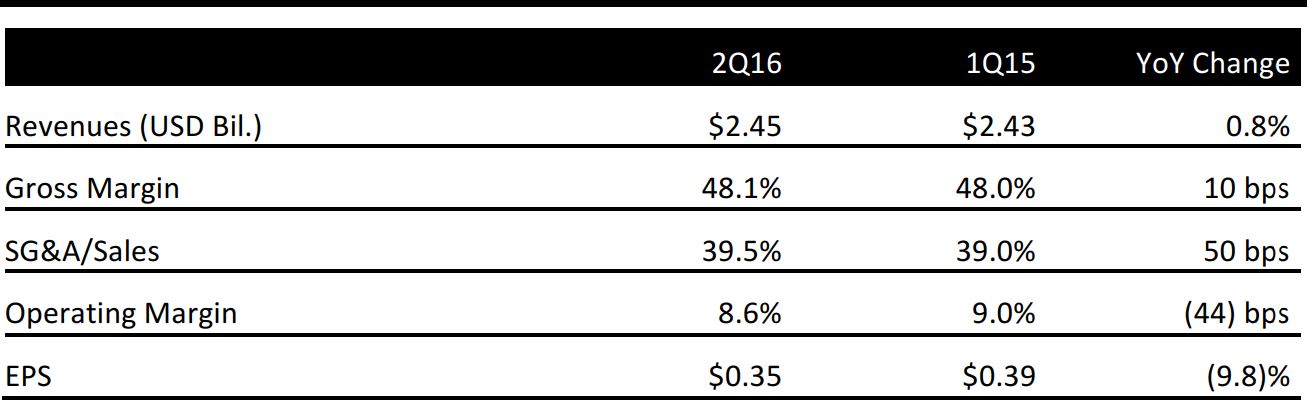

VF Corporation reported 2Q16 revenues of $2.45 billion, an increase of 1% year over year on a currency-neutral basis.

Revenues for the Outdoor & Action Sports segment rose by 2% in currency-neutral terms. The company said its fastest-growing brands within the segment were The North Face, with revenues up 2%, and Vans, with revenues up 4% (6% in currency-neutral terms). This growth offset a 7% decline in Timberland revenues during the quarter.

Jeanswear revenues grew by 3% (6% in currency-neutral terms), to $629 million. Within Jeanswear, Wrangler revenues were up 2% (4% in currency-neutral terms) and Lee

revenues were up 8% (10% in currency-neutral terms).

Imagewear revenues grew by 3%, to $255 million, due to a mid-teens percentage rate increase in the Licensed Sports Group business. This was partially offset by a high-single-digit decline in the workwear business.

Sportswear revenues declined by 19%, to $115 million, including a 20% decrease in Nautica revenues and a mid-teens decrease in the Kipling brand’s North American business. The category decline reflects ongoing challenges in the US department store and outlet channels, as well as general category demand.

International revenue was up 5% (7% on a currency-neutral basis).

The company’s e-commerce revenues increased by nearly 30%. Direct-to-consumer revenues were up 6% due to a low-double-digit increase in the Outdoor & Action Sports business, which was offset by a mid-teens decline in Sportswear.

On June 30, 2016, VF announced that it plans to sell its Contemporary Brands businesses to Delta Galil Industries for $120 million. The sale is expected to occur in the third quarter of 2016.

2016 OUTLOOK

VF lowered its FY16 revenue guidance to 3%–4% growth from mid-single-digit growth previously. The estimate does not include the Contemporary Brands coalition. Jeanswear revenues are still expected to grow at a mid-single-digit (currency-neutral) rate and Imagewear is still expected to grow at a low single-digit rate. The company lowered its Sportswear revenue guidance to a low-double-digit decline from a slight decline previously.

The company expects its gross margin to improve by approximately 50 basis points, to 48.7%, including about 70 basis points due to foreign exchange. The company forecasted an operating margin of 14.5% for the full year.

VF expects FY16 EPS to increase by 5% (11% in currency-neutral terms), to $3.20, compared to an adjusted EPS of $3.04 in FY15.