Nitheesh NH

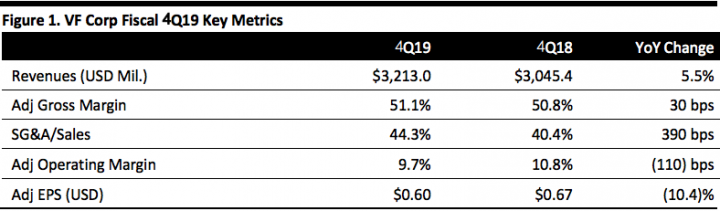

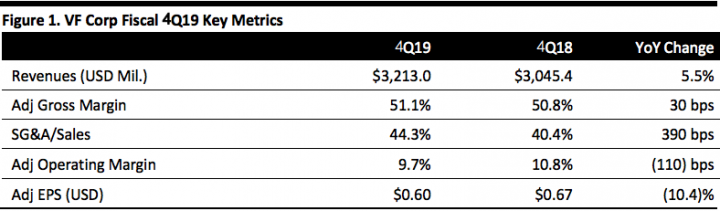

[caption id="attachment_90214" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

4Q19 Results

VF Corp. reported adjusted fiscal 4Q19 EPS of $0.60, down from $0.67 in the year-ago quarter and above the $0.58 consensus estimate. Total revenues grew 5.5% (9% at constant currency) to $3.21 billion, in line with the consensus estimate; excluding Kontoor Brands, revenues rose 8% (12% at constant currency). The company spun off Kontoor Brands and distributed 100% of the shares of Kontoor Brands, Inc. to holders of VF common stock on the record date of May 10, 2019.

By segment, Outdoor revenues rose 13% to $1.0 billion; Active revenues increased 7% to

$1.1 billion; Work revenues rose 2% to $453.0 million; and Jeans revenues declined 4% to $597.3 million. By channel, direct-to-consumer (DTC) rose 8%, Digital (within DTC) rose 21% and Wholesale increased 5%. By region, Asia Pacific sales rose 6%, led by China, up 14%; non-US Americas grew 13%, with an 8% gain in the US and 1% decline in EMEA.

Vans, The North Face and Timberland increased revenues at 14%, 8% and 1%, respectively. At constant exchange rates, revenues increased 18%, 11% and 6%, respectively. For Vans, revenue growth was led by a 21% increase in the Americas.

Adjusted gross margin expanded 30 bps to 51.1%, and adjusted operating margin decreased 110 bps to 9.7%. Both margins included 70 bps negative impact from Kontoor Brands.

Despite the strong growth in the Outdoor segment, gross profit declined 29% (21% currency-neutral). Gross profit was down 2% (up 1% currency-neutral) for Active, up 12% (13% currency-neutral) for Work, and down 54% (65% currency-neutral) for Jeans.

At the end of March 2019, inventories increased 4% year over year.

The company has been implementing mitigating actions to reduce the financial impact of incremental tariffs. Post the Kontoor spin-off (May 23), the company’s total cost of goods sold sourced directly from China to the US is 7%.

For FY19, excluding Kontoor Brands, sales growth in China was 25% on an organic basis. The company expects the momentum in China to continue at a similar pace in 2020 and says it is monitoring closely Chinese consumers, especially those in their mid-teens.

Outlook

The company adjusted guidance for continuing operations for FY20:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

VF Corp. reported adjusted fiscal 4Q19 EPS of $0.60, down from $0.67 in the year-ago quarter and above the $0.58 consensus estimate. Total revenues grew 5.5% (9% at constant currency) to $3.21 billion, in line with the consensus estimate; excluding Kontoor Brands, revenues rose 8% (12% at constant currency). The company spun off Kontoor Brands and distributed 100% of the shares of Kontoor Brands, Inc. to holders of VF common stock on the record date of May 10, 2019.

By segment, Outdoor revenues rose 13% to $1.0 billion; Active revenues increased 7% to

$1.1 billion; Work revenues rose 2% to $453.0 million; and Jeans revenues declined 4% to $597.3 million. By channel, direct-to-consumer (DTC) rose 8%, Digital (within DTC) rose 21% and Wholesale increased 5%. By region, Asia Pacific sales rose 6%, led by China, up 14%; non-US Americas grew 13%, with an 8% gain in the US and 1% decline in EMEA.

Vans, The North Face and Timberland increased revenues at 14%, 8% and 1%, respectively. At constant exchange rates, revenues increased 18%, 11% and 6%, respectively. For Vans, revenue growth was led by a 21% increase in the Americas.

Adjusted gross margin expanded 30 bps to 51.1%, and adjusted operating margin decreased 110 bps to 9.7%. Both margins included 70 bps negative impact from Kontoor Brands.

Despite the strong growth in the Outdoor segment, gross profit declined 29% (21% currency-neutral). Gross profit was down 2% (up 1% currency-neutral) for Active, up 12% (13% currency-neutral) for Work, and down 54% (65% currency-neutral) for Jeans.

At the end of March 2019, inventories increased 4% year over year.

The company has been implementing mitigating actions to reduce the financial impact of incremental tariffs. Post the Kontoor spin-off (May 23), the company’s total cost of goods sold sourced directly from China to the US is 7%.

For FY19, excluding Kontoor Brands, sales growth in China was 25% on an organic basis. The company expects the momentum in China to continue at a similar pace in 2020 and says it is monitoring closely Chinese consumers, especially those in their mid-teens.

Outlook

The company adjusted guidance for continuing operations for FY20:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

VF Corp. reported adjusted fiscal 4Q19 EPS of $0.60, down from $0.67 in the year-ago quarter and above the $0.58 consensus estimate. Total revenues grew 5.5% (9% at constant currency) to $3.21 billion, in line with the consensus estimate; excluding Kontoor Brands, revenues rose 8% (12% at constant currency). The company spun off Kontoor Brands and distributed 100% of the shares of Kontoor Brands, Inc. to holders of VF common stock on the record date of May 10, 2019.

By segment, Outdoor revenues rose 13% to $1.0 billion; Active revenues increased 7% to

$1.1 billion; Work revenues rose 2% to $453.0 million; and Jeans revenues declined 4% to $597.3 million. By channel, direct-to-consumer (DTC) rose 8%, Digital (within DTC) rose 21% and Wholesale increased 5%. By region, Asia Pacific sales rose 6%, led by China, up 14%; non-US Americas grew 13%, with an 8% gain in the US and 1% decline in EMEA.

Vans, The North Face and Timberland increased revenues at 14%, 8% and 1%, respectively. At constant exchange rates, revenues increased 18%, 11% and 6%, respectively. For Vans, revenue growth was led by a 21% increase in the Americas.

Adjusted gross margin expanded 30 bps to 51.1%, and adjusted operating margin decreased 110 bps to 9.7%. Both margins included 70 bps negative impact from Kontoor Brands.

Despite the strong growth in the Outdoor segment, gross profit declined 29% (21% currency-neutral). Gross profit was down 2% (up 1% currency-neutral) for Active, up 12% (13% currency-neutral) for Work, and down 54% (65% currency-neutral) for Jeans.

At the end of March 2019, inventories increased 4% year over year.

The company has been implementing mitigating actions to reduce the financial impact of incremental tariffs. Post the Kontoor spin-off (May 23), the company’s total cost of goods sold sourced directly from China to the US is 7%.

For FY19, excluding Kontoor Brands, sales growth in China was 25% on an organic basis. The company expects the momentum in China to continue at a similar pace in 2020 and says it is monitoring closely Chinese consumers, especially those in their mid-teens.

Outlook

The company adjusted guidance for continuing operations for FY20:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

VF Corp. reported adjusted fiscal 4Q19 EPS of $0.60, down from $0.67 in the year-ago quarter and above the $0.58 consensus estimate. Total revenues grew 5.5% (9% at constant currency) to $3.21 billion, in line with the consensus estimate; excluding Kontoor Brands, revenues rose 8% (12% at constant currency). The company spun off Kontoor Brands and distributed 100% of the shares of Kontoor Brands, Inc. to holders of VF common stock on the record date of May 10, 2019.

By segment, Outdoor revenues rose 13% to $1.0 billion; Active revenues increased 7% to

$1.1 billion; Work revenues rose 2% to $453.0 million; and Jeans revenues declined 4% to $597.3 million. By channel, direct-to-consumer (DTC) rose 8%, Digital (within DTC) rose 21% and Wholesale increased 5%. By region, Asia Pacific sales rose 6%, led by China, up 14%; non-US Americas grew 13%, with an 8% gain in the US and 1% decline in EMEA.

Vans, The North Face and Timberland increased revenues at 14%, 8% and 1%, respectively. At constant exchange rates, revenues increased 18%, 11% and 6%, respectively. For Vans, revenue growth was led by a 21% increase in the Americas.

Adjusted gross margin expanded 30 bps to 51.1%, and adjusted operating margin decreased 110 bps to 9.7%. Both margins included 70 bps negative impact from Kontoor Brands.

Despite the strong growth in the Outdoor segment, gross profit declined 29% (21% currency-neutral). Gross profit was down 2% (up 1% currency-neutral) for Active, up 12% (13% currency-neutral) for Work, and down 54% (65% currency-neutral) for Jeans.

At the end of March 2019, inventories increased 4% year over year.

The company has been implementing mitigating actions to reduce the financial impact of incremental tariffs. Post the Kontoor spin-off (May 23), the company’s total cost of goods sold sourced directly from China to the US is 7%.

For FY19, excluding Kontoor Brands, sales growth in China was 25% on an organic basis. The company expects the momentum in China to continue at a similar pace in 2020 and says it is monitoring closely Chinese consumers, especially those in their mid-teens.

Outlook

The company adjusted guidance for continuing operations for FY20:

- VF expects revenue growth of 5–6% (7–8% currency neutral) to $11.7–11.8 billion. By segment, the company expects revenues for Outdoor to increase 4–5%; Active segment revenues to grow 6–7%; Work to increase 3–5%. VF anticipates international revenues to increase 4–6% (7–9% at constant currency), led by a 12–14% (14–16% currency-neutral) increase in Asia Pacific. It expects DTC revenues to increase 911% (up 10–12% at constant currency), including 25% growth in digital, versus previous guidance of 13% and no change to digital at a 30% gain.

- VF expects adjusted the gross margin to approach 54.0%, up about 60 bps.

- Adjusted operating margin is expected to increase approximately 60 bps to 13.7%.

- It expects to log less than $400 million in capital expenditures.

- The company anticipates adjusted EPS between $3.30 and $3.35, up 15–17% (17–19% currency-neutral), versus previous guidance of $3.73.