Nitheesh NH

[caption id="attachment_66199" align="aligncenter" width="672"] Source: Company reports/Coresight Research[/caption]

Momentum at Vans, The North Face, Direct-to-Consumer and International Mark Fiscal 3Q19 Results

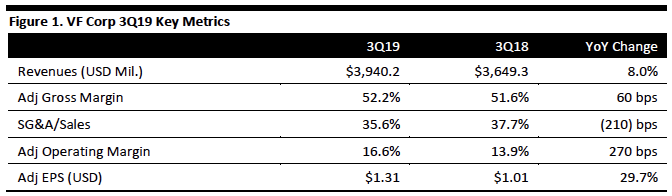

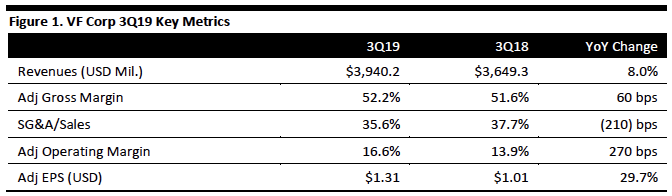

VF Corp. reported adjusted fiscal 3Q19 EPS of $1.31, up from $1.01 in the year-ago quarter and above the $1.10 consensus estimate. Total revenues were $3.94 billion, up 8.0% year over year (10% at constant currency). Excluding Kontoor Brands (scheduled to be spun off at the end of April), revenues rose 12%.

By segment, Outdoor revenues rose 11% to $1.61 billion; Active revenues increased 16% to $1.14 billion; Work segment revenues rose 9% to $62.6 million and Jeans revenues declined 27% to $67.8 million. By channel, direct-to-consumer (DTC) rose 9%, Digital (within DTC) rose 21% and Wholesale increased 6%. By region, Asia Pacific sales rose 16%, led by China, up 23%; followed by a 9% gain in the U.S., 7% in the Americas (non-U.S.) and 4% in EMEA.

The three big bands, The North Face, Timberland and Vans, increased revenues at a combined rate of 16% in 3Q19. Highlights include a same-store sales lift of 20% at Vans with digital up 53%; The North Face revenues rose 16% as the U.S. returned to double-digit growth and brand DTC expanded 11% propelled by 20% growth in digital; and Timberland returned to growth with a 3% gain, driven by high single digit growth in the U.S. and 30% growth in China.

Gross margin expanded 60 basis points to 52.2%, reflecting a favorable mix shift among the top brands in the VF portfolio and the increased proportion of DTC versus wholesale. The 210-basis-point decline in the SG&A rate, to 35.6% of sales, reflects strong operating leverage. Operating margin expanded 270 basis points to 16.6%. Operating income grew 28% on an organic basis, which includes the impact of a slight decline in operating profit in Kontoor Brands.

Adjusted EPS rose 29.7% to $1.31 from $1.01, beating the $1.10 consensus estimate.

Outlook

The company lifted guidance for FY19.

Source: Company reports/Coresight Research[/caption]

Momentum at Vans, The North Face, Direct-to-Consumer and International Mark Fiscal 3Q19 Results

VF Corp. reported adjusted fiscal 3Q19 EPS of $1.31, up from $1.01 in the year-ago quarter and above the $1.10 consensus estimate. Total revenues were $3.94 billion, up 8.0% year over year (10% at constant currency). Excluding Kontoor Brands (scheduled to be spun off at the end of April), revenues rose 12%.

By segment, Outdoor revenues rose 11% to $1.61 billion; Active revenues increased 16% to $1.14 billion; Work segment revenues rose 9% to $62.6 million and Jeans revenues declined 27% to $67.8 million. By channel, direct-to-consumer (DTC) rose 9%, Digital (within DTC) rose 21% and Wholesale increased 6%. By region, Asia Pacific sales rose 16%, led by China, up 23%; followed by a 9% gain in the U.S., 7% in the Americas (non-U.S.) and 4% in EMEA.

The three big bands, The North Face, Timberland and Vans, increased revenues at a combined rate of 16% in 3Q19. Highlights include a same-store sales lift of 20% at Vans with digital up 53%; The North Face revenues rose 16% as the U.S. returned to double-digit growth and brand DTC expanded 11% propelled by 20% growth in digital; and Timberland returned to growth with a 3% gain, driven by high single digit growth in the U.S. and 30% growth in China.

Gross margin expanded 60 basis points to 52.2%, reflecting a favorable mix shift among the top brands in the VF portfolio and the increased proportion of DTC versus wholesale. The 210-basis-point decline in the SG&A rate, to 35.6% of sales, reflects strong operating leverage. Operating margin expanded 270 basis points to 16.6%. Operating income grew 28% on an organic basis, which includes the impact of a slight decline in operating profit in Kontoor Brands.

Adjusted EPS rose 29.7% to $1.31 from $1.01, beating the $1.10 consensus estimate.

Outlook

The company lifted guidance for FY19.

Source: Company reports/Coresight Research[/caption]

Momentum at Vans, The North Face, Direct-to-Consumer and International Mark Fiscal 3Q19 Results

VF Corp. reported adjusted fiscal 3Q19 EPS of $1.31, up from $1.01 in the year-ago quarter and above the $1.10 consensus estimate. Total revenues were $3.94 billion, up 8.0% year over year (10% at constant currency). Excluding Kontoor Brands (scheduled to be spun off at the end of April), revenues rose 12%.

By segment, Outdoor revenues rose 11% to $1.61 billion; Active revenues increased 16% to $1.14 billion; Work segment revenues rose 9% to $62.6 million and Jeans revenues declined 27% to $67.8 million. By channel, direct-to-consumer (DTC) rose 9%, Digital (within DTC) rose 21% and Wholesale increased 6%. By region, Asia Pacific sales rose 16%, led by China, up 23%; followed by a 9% gain in the U.S., 7% in the Americas (non-U.S.) and 4% in EMEA.

The three big bands, The North Face, Timberland and Vans, increased revenues at a combined rate of 16% in 3Q19. Highlights include a same-store sales lift of 20% at Vans with digital up 53%; The North Face revenues rose 16% as the U.S. returned to double-digit growth and brand DTC expanded 11% propelled by 20% growth in digital; and Timberland returned to growth with a 3% gain, driven by high single digit growth in the U.S. and 30% growth in China.

Gross margin expanded 60 basis points to 52.2%, reflecting a favorable mix shift among the top brands in the VF portfolio and the increased proportion of DTC versus wholesale. The 210-basis-point decline in the SG&A rate, to 35.6% of sales, reflects strong operating leverage. Operating margin expanded 270 basis points to 16.6%. Operating income grew 28% on an organic basis, which includes the impact of a slight decline in operating profit in Kontoor Brands.

Adjusted EPS rose 29.7% to $1.31 from $1.01, beating the $1.10 consensus estimate.

Outlook

The company lifted guidance for FY19.

Source: Company reports/Coresight Research[/caption]

Momentum at Vans, The North Face, Direct-to-Consumer and International Mark Fiscal 3Q19 Results

VF Corp. reported adjusted fiscal 3Q19 EPS of $1.31, up from $1.01 in the year-ago quarter and above the $1.10 consensus estimate. Total revenues were $3.94 billion, up 8.0% year over year (10% at constant currency). Excluding Kontoor Brands (scheduled to be spun off at the end of April), revenues rose 12%.

By segment, Outdoor revenues rose 11% to $1.61 billion; Active revenues increased 16% to $1.14 billion; Work segment revenues rose 9% to $62.6 million and Jeans revenues declined 27% to $67.8 million. By channel, direct-to-consumer (DTC) rose 9%, Digital (within DTC) rose 21% and Wholesale increased 6%. By region, Asia Pacific sales rose 16%, led by China, up 23%; followed by a 9% gain in the U.S., 7% in the Americas (non-U.S.) and 4% in EMEA.

The three big bands, The North Face, Timberland and Vans, increased revenues at a combined rate of 16% in 3Q19. Highlights include a same-store sales lift of 20% at Vans with digital up 53%; The North Face revenues rose 16% as the U.S. returned to double-digit growth and brand DTC expanded 11% propelled by 20% growth in digital; and Timberland returned to growth with a 3% gain, driven by high single digit growth in the U.S. and 30% growth in China.

Gross margin expanded 60 basis points to 52.2%, reflecting a favorable mix shift among the top brands in the VF portfolio and the increased proportion of DTC versus wholesale. The 210-basis-point decline in the SG&A rate, to 35.6% of sales, reflects strong operating leverage. Operating margin expanded 270 basis points to 16.6%. Operating income grew 28% on an organic basis, which includes the impact of a slight decline in operating profit in Kontoor Brands.

Adjusted EPS rose 29.7% to $1.31 from $1.01, beating the $1.10 consensus estimate.

Outlook

The company lifted guidance for FY19.

- The company now expects revenue to be at least $13.8 billion, up 12% (13% at constant currency), ahead of previous guidance of 11%; by segment, the company expects revenue for Outdoor to increase 8% versus the previous guidance of a 7-8%; the company expects Active segment revenue to grow 16% versus the 14-15% previous expectation; the company expects revenue for the company’s Work segment to increase 39% versus the previous guidance of 35%+ and revenue guidance for Jeans is now a 3% decline, versus previous guidance of a 1-2% decline. VF Corp anticipates international revenue to increase 10-11% (13% at constant currency) versus previous guidance of a 12-13% increase; the company expects DTC revenue to increase 13% (up 14% at constant currency) versus previous guidance of 12-14% and no change to digital at a 30% gain.

- Adjusted gross margin guidance is at least 51%.

- Guidance for adjusted operating margin is to increase 90 basis points to 13.6%.

- Adjusted EPS guidance is $3.73 versus previous guidance of $3.65.