Source: Company reports/Fung Global Retail & Technology

1Q17 Results

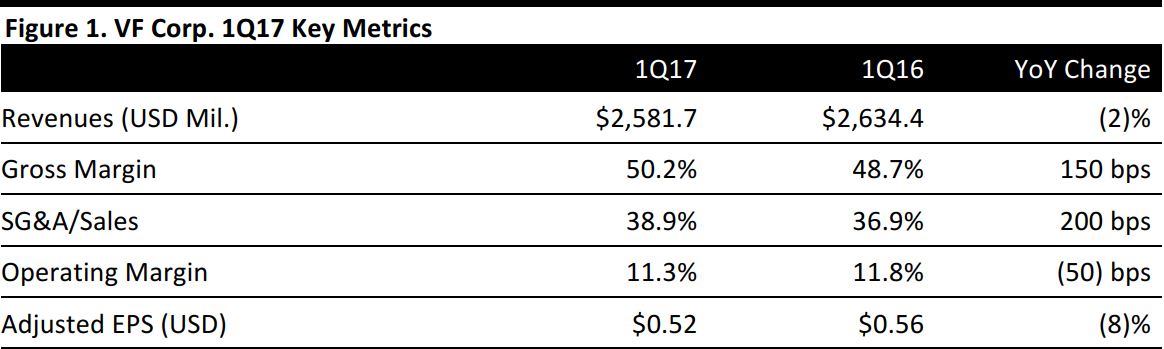

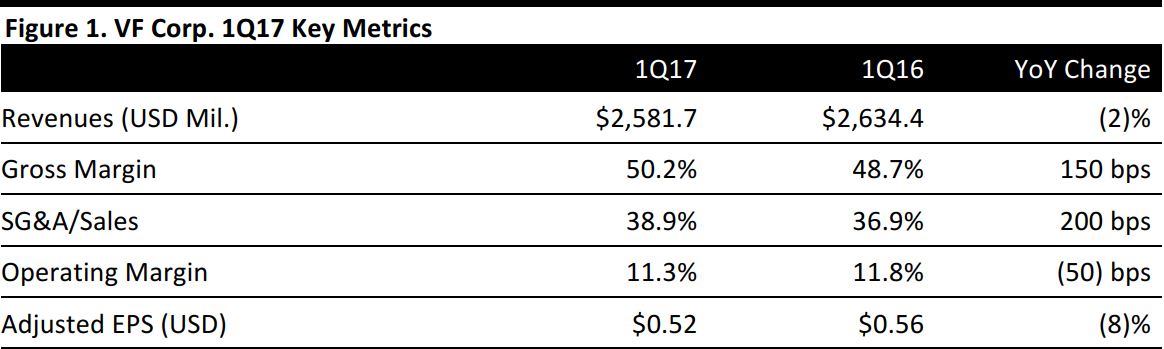

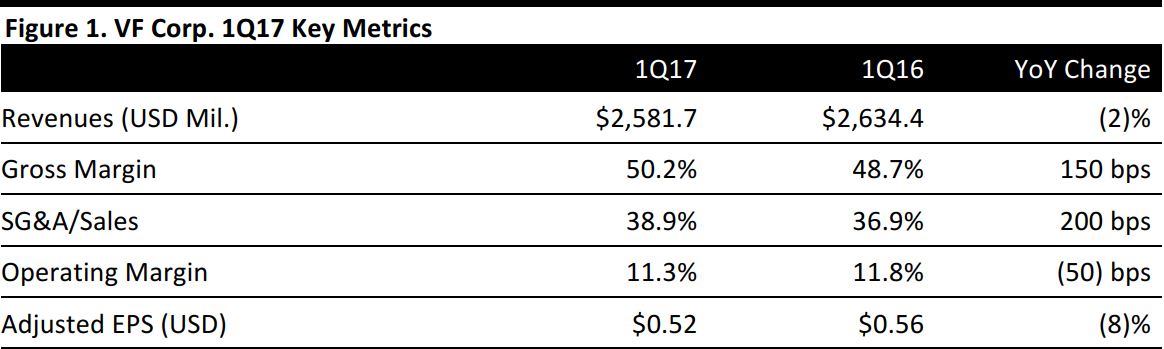

VF Corp. reported 1Q17 EPS of $0.52, which includes a $0.55 contribution from the licensing business that the company agreed to sell on April 4; consensus called for EPS of $0.55.

Total revenues were $2.58 billion, below expectations of $2.73 billion. On a continuing-operations basis, revenues were down 2%, and on a currency-neutral basis, revenues were down 1%.

Revenues in the outdoor and action sports category (which includes The North Face, Vans and Timberland brands) increased by 2%. The North Face sales were up 6% and Vans sales were up 5%, while Timberland sales were down 5% in the quarter.

Jeanswear sales were down 9%, with Wrangler and Lee sales down 10% and 7%, respectively.

International revenues increased by 2%, including 6% growth in the Americas (excluding the US), 5% growth in China, and 2% growth in both the EMEA and APAC regions. Direct-to-consumer revenues increased by 6%, with digital revenues up 25% and wholesale revenues down 5%.

2017 Outlook

The company guided for full-year EPS to decline by low single digits versus 2016’s adjusted EPS of $2.98. The company expects full-year EPS to be up by mid-single digits on a currency-neutral basis. That implies EPS of $2.89–$2.94 and EPS of $3.01–$3.07, including the contribution from the licensing business. Consensus calls for full-year EPS of $3.05.

Management reaffirmed its expectations for a revenue increase in the low single-digit range, including a two-point negative impact from foreign exchange.

VF Corp.’s EPS guidance assumes an increase of 20 basis points in gross margin. The company expects its operating margin to be approximately 14%, in line with the adjusted rate achieved in 2016.