Nitheesh NH

[caption id="attachment_93508" align="aligncenter" width="700"] Source: Company reports/Coresight Research [/caption]

1Q20 Results

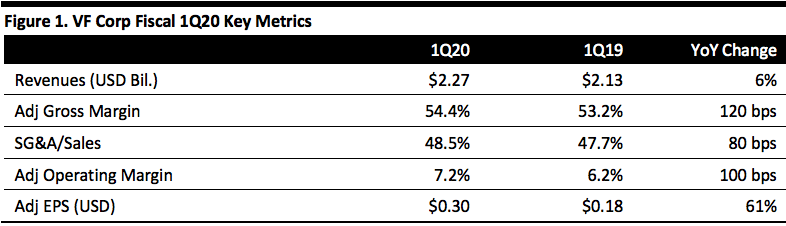

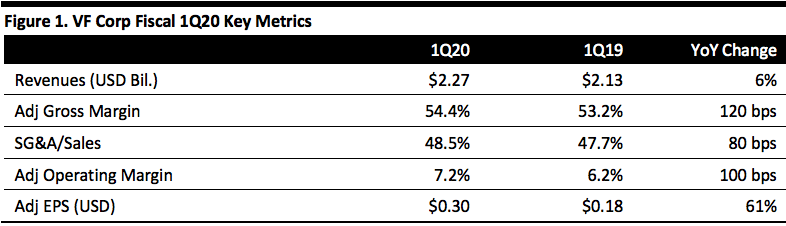

VF Corp reported adjusted fiscal 1Q20 EPS of $0.30, up from $0.18 in the year-ago quarter and above the $0.29 consensus estimate. Total revenues grew 6% (9% at constant currency) to $2.27 billion, beating the consensus estimate of $2.24 billion. Excluding acquisitions and divestitures, adjusted revenue increased 9%, 11% currency neutral.

By segment, outdoor revenues rose 7% (11% at constant currency) to $610.6 million. Revenue in the active division increased 8% (11% at constant currency) to $1.2 billion. The company’s work segment revenues declined 0.2% (up 1% at constant currency) to $422.5.0 million.

By channel, direct to consumer (DTC) rose 14% (17% constant currency), digital (within DTC) rose 24% (28% constant currency) and wholesale increased 2% (4% constant currency). By region, Asia Pacific sales rose 13% (19% constant currency), led by China, up 21% (29% constant currency). Non-US Americas grew 5% (10% constant currency), the US grew 9%, and EMEA fell 5% (1% growth currency neutral).

Vans increased revenues 20%, The North Face 9% and Dickies 1%. Timberland’s revenue declined 1%. At constant foreign exchange rates, revenues increased 23%, 12%, 2% and 2% for Vans, The North Face, Timberland and Dickies respectively. For Vans, revenue growth was led by a 33% increase in Asia Pacific.

Adjusted gross margin expanded 120 bps to 54.4%, and adjusted operating margin increased 100 bps to 7.2%.

Additionally, gross profit was up 4% (2% currency neutral) in the outdoor business, up 14% (17% currency neutral) for active and down 4% (3% currency neutral) for work.

At the end of June 2019, inventories increased 9.4% year over year.

The company launched FUTURELIGHT, a breathable-waterproof outerwear technology, for The North Face.

Outlook

The company adjusted guidance for continuing operations for FY20:

Source: Company reports/Coresight Research [/caption]

1Q20 Results

VF Corp reported adjusted fiscal 1Q20 EPS of $0.30, up from $0.18 in the year-ago quarter and above the $0.29 consensus estimate. Total revenues grew 6% (9% at constant currency) to $2.27 billion, beating the consensus estimate of $2.24 billion. Excluding acquisitions and divestitures, adjusted revenue increased 9%, 11% currency neutral.

By segment, outdoor revenues rose 7% (11% at constant currency) to $610.6 million. Revenue in the active division increased 8% (11% at constant currency) to $1.2 billion. The company’s work segment revenues declined 0.2% (up 1% at constant currency) to $422.5.0 million.

By channel, direct to consumer (DTC) rose 14% (17% constant currency), digital (within DTC) rose 24% (28% constant currency) and wholesale increased 2% (4% constant currency). By region, Asia Pacific sales rose 13% (19% constant currency), led by China, up 21% (29% constant currency). Non-US Americas grew 5% (10% constant currency), the US grew 9%, and EMEA fell 5% (1% growth currency neutral).

Vans increased revenues 20%, The North Face 9% and Dickies 1%. Timberland’s revenue declined 1%. At constant foreign exchange rates, revenues increased 23%, 12%, 2% and 2% for Vans, The North Face, Timberland and Dickies respectively. For Vans, revenue growth was led by a 33% increase in Asia Pacific.

Adjusted gross margin expanded 120 bps to 54.4%, and adjusted operating margin increased 100 bps to 7.2%.

Additionally, gross profit was up 4% (2% currency neutral) in the outdoor business, up 14% (17% currency neutral) for active and down 4% (3% currency neutral) for work.

At the end of June 2019, inventories increased 9.4% year over year.

The company launched FUTURELIGHT, a breathable-waterproof outerwear technology, for The North Face.

Outlook

The company adjusted guidance for continuing operations for FY20:

Source: Company reports/Coresight Research [/caption]

1Q20 Results

VF Corp reported adjusted fiscal 1Q20 EPS of $0.30, up from $0.18 in the year-ago quarter and above the $0.29 consensus estimate. Total revenues grew 6% (9% at constant currency) to $2.27 billion, beating the consensus estimate of $2.24 billion. Excluding acquisitions and divestitures, adjusted revenue increased 9%, 11% currency neutral.

By segment, outdoor revenues rose 7% (11% at constant currency) to $610.6 million. Revenue in the active division increased 8% (11% at constant currency) to $1.2 billion. The company’s work segment revenues declined 0.2% (up 1% at constant currency) to $422.5.0 million.

By channel, direct to consumer (DTC) rose 14% (17% constant currency), digital (within DTC) rose 24% (28% constant currency) and wholesale increased 2% (4% constant currency). By region, Asia Pacific sales rose 13% (19% constant currency), led by China, up 21% (29% constant currency). Non-US Americas grew 5% (10% constant currency), the US grew 9%, and EMEA fell 5% (1% growth currency neutral).

Vans increased revenues 20%, The North Face 9% and Dickies 1%. Timberland’s revenue declined 1%. At constant foreign exchange rates, revenues increased 23%, 12%, 2% and 2% for Vans, The North Face, Timberland and Dickies respectively. For Vans, revenue growth was led by a 33% increase in Asia Pacific.

Adjusted gross margin expanded 120 bps to 54.4%, and adjusted operating margin increased 100 bps to 7.2%.

Additionally, gross profit was up 4% (2% currency neutral) in the outdoor business, up 14% (17% currency neutral) for active and down 4% (3% currency neutral) for work.

At the end of June 2019, inventories increased 9.4% year over year.

The company launched FUTURELIGHT, a breathable-waterproof outerwear technology, for The North Face.

Outlook

The company adjusted guidance for continuing operations for FY20:

Source: Company reports/Coresight Research [/caption]

1Q20 Results

VF Corp reported adjusted fiscal 1Q20 EPS of $0.30, up from $0.18 in the year-ago quarter and above the $0.29 consensus estimate. Total revenues grew 6% (9% at constant currency) to $2.27 billion, beating the consensus estimate of $2.24 billion. Excluding acquisitions and divestitures, adjusted revenue increased 9%, 11% currency neutral.

By segment, outdoor revenues rose 7% (11% at constant currency) to $610.6 million. Revenue in the active division increased 8% (11% at constant currency) to $1.2 billion. The company’s work segment revenues declined 0.2% (up 1% at constant currency) to $422.5.0 million.

By channel, direct to consumer (DTC) rose 14% (17% constant currency), digital (within DTC) rose 24% (28% constant currency) and wholesale increased 2% (4% constant currency). By region, Asia Pacific sales rose 13% (19% constant currency), led by China, up 21% (29% constant currency). Non-US Americas grew 5% (10% constant currency), the US grew 9%, and EMEA fell 5% (1% growth currency neutral).

Vans increased revenues 20%, The North Face 9% and Dickies 1%. Timberland’s revenue declined 1%. At constant foreign exchange rates, revenues increased 23%, 12%, 2% and 2% for Vans, The North Face, Timberland and Dickies respectively. For Vans, revenue growth was led by a 33% increase in Asia Pacific.

Adjusted gross margin expanded 120 bps to 54.4%, and adjusted operating margin increased 100 bps to 7.2%.

Additionally, gross profit was up 4% (2% currency neutral) in the outdoor business, up 14% (17% currency neutral) for active and down 4% (3% currency neutral) for work.

At the end of June 2019, inventories increased 9.4% year over year.

The company launched FUTURELIGHT, a breathable-waterproof outerwear technology, for The North Face.

Outlook

The company adjusted guidance for continuing operations for FY20:

- Revenue growth of 6% (8% currency neutral) to $11.8 billion, up from the previous $11.7-11.8 billion. By segment, the company expects revenue for outdoor to increase 5% (6% currency neutral); active to grow 7-8% (10-11% currency neutral); and, work to increase 3-5% (4-6% currency neutral). International revenue is expected to climb 4-6% (7-9% currency neutral). DTC revenue is expected to increase 10-12% (11-13% currency neutral), including 25% growth in digital, versus the previous guidance of 9-11% growth (10-12% in constant currency).

- Adjusted gross margin to increase around 80 bps to 54.1%, up from the previous guidance of 54.0%.

- Adjusted operating margin to increase approximately 90 basis points to 13.8%, up from the previous guidance of 13.7%.

- Approximately $400 million in capital expenditures.

- Adjusted EPS between $3.32 and $3.37, up 15-17% (17-19% currency neutral), versus the previous guidance of $3.30-3.35.