Source: Company reports/Fung Global Retail & Technology

Fiscal 4Q17 Results

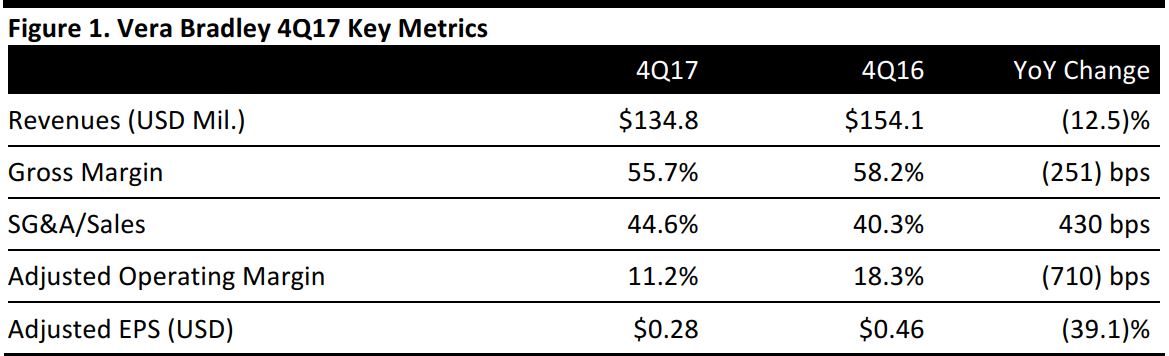

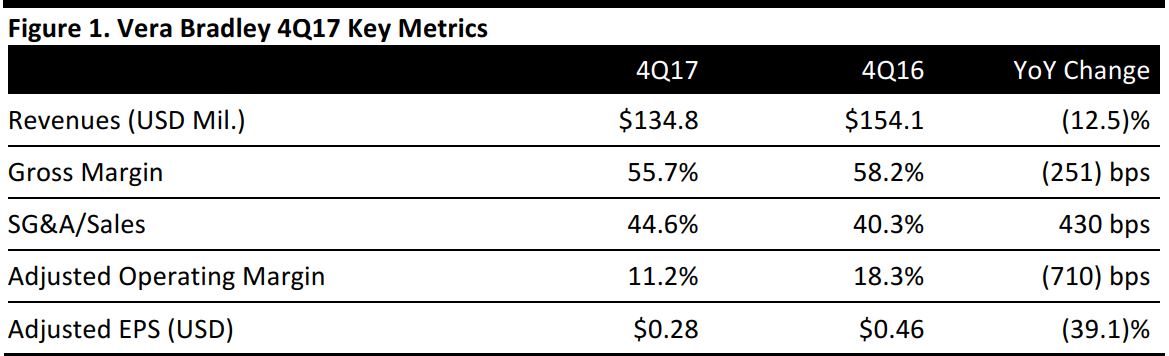

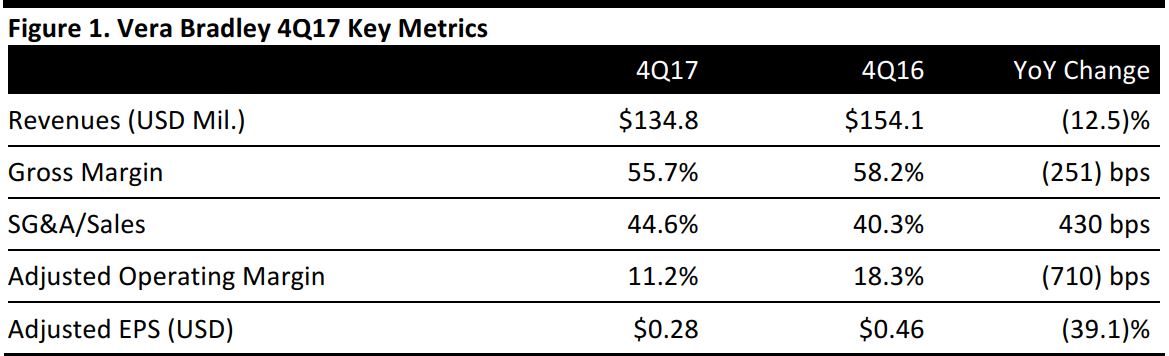

Vera Bradley reported fiscal 4Q17 revenues of $134.8 million, down 12.5% year over year. Direct segment revenues totaled $108.9 million, down 3.6% from $112.9 million in the year-ago quarter. Comparable store sales, which include e-commerce, decreased by 9.5% for the quarter; the decrease was partially offset by new store growth. Comparable store sales were negatively impacted by declines in store and e-commerce traffic.

Vera Bradley opened four full-line stores and six factory outlet stores during the past 12 months. The new full-line stores are all in the new store design and one-third of older full-line stores were refreshed with the company’s new logo and signage.

The company is focused on driving traffic into its stores. It is focusing on three areas: a robust marketing program; leveraging licensing opportunities to expand the brand’s reach; and strengthening its distribution network and focusing on driving comparable sales in its core businesses, including continuing to strengthen its digital flagship and relocating or closing underperforming stores.

In order to enhance product desirability, the company is focusing on five core categories: fashion bags and accessories, travel, campus, wellness and beauty, and home. The company plans to exploit the growth of the top 10 best-selling items.

Outlook

The company’s guidance for fiscal 1Q18 includes a decrease in net revenue, to $94–$99 million, compared with $105.2 million in the year-ago quarter. Vera Bradley expects year-over-year gross profit to decline from 56.7% to 55.0% in 1Q18.

For the full fiscal year, the company expects net revenue to decrease to $460–$480 million from $485.9 million in FY17. The company expects gross profit to decrease to 56.0%–56.5% from 56.8% in the prior year.