Source: Company reports/FGRT

Fiscal 3Q18 Results

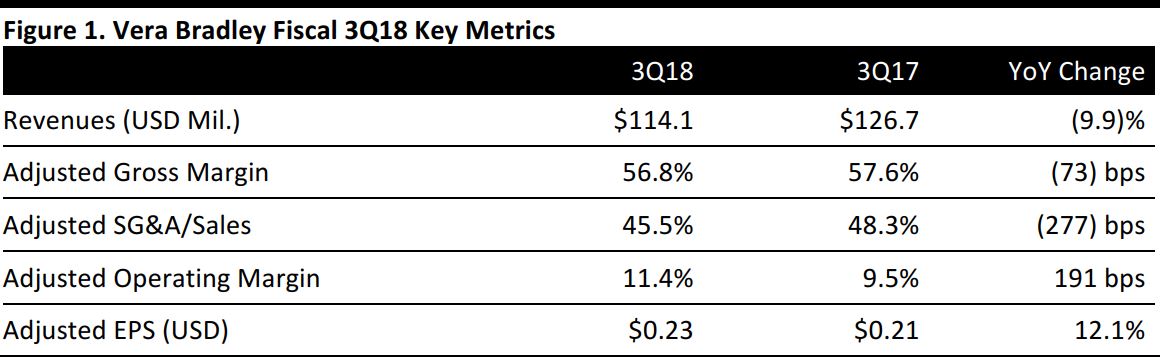

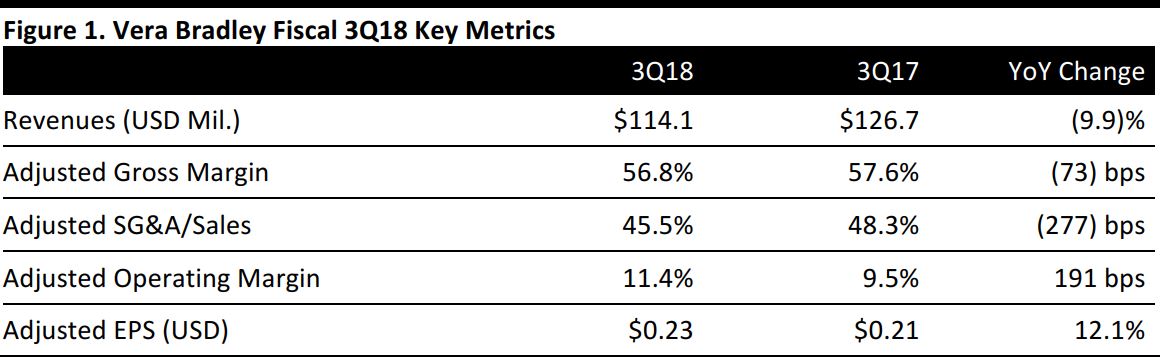

Vera Bradley reported fiscal 3Q18 revenues of $114.1 million, down 9.9% year over year and shy of the $114.8 million consensus estimate. Company guidance called for revenues of $112–$117 million.

Direct segment revenues totaled $83.2 million, a 3.4% decrease from $86.1 million in the year-ago quarter. Indirect segment revenues decreased by 23.8%, to $30.9 million from $40.6 million in the year-ago quarter, due to a reduction in the number of specialty accounts and a reduction in orders from both specialty accounts and certain key accounts.

Comps decreased by 7.4% in the quarter, reflecting a negative 6.9% comp for in-store sales and a negative 8.6% comp for e-commerce sales. The decline was partially offset by new store growth. Comps continue to be negatively impacted by declines in store and e-commerce traffic.

The company’s year-over-year decline in gross profit was primarily due to increased promotional activity at factory outlet stores, channel mix changes and an adjustment for slow-moving inventory, and was partially offset by a reduction in product cost.

Adjusted EPS was $0.23, handily beating the $0.14 consensus estimate and up 12.1% year over year. GAAP EPS was $0.01, compared with $0.24 in the year-ago quarter. GAAP figures include store impairment charges of $3.7 million, severance charges of $1.8 million, strategic plan consulting fees of $1.5 million and other charges of $0.9 million, including inventory adjustments related to product categories being discontinued and a net lease termination charge.

The company opened one full-line store and seven factory outlet stores during the past 12 months.

Management commented that the company’s ability to implement expense reductions and to implement its Vision 20/20 plan more quickly than originally expected, along

with diligent expense management, drove third-quarter adjusted EPS meaningfully ahead of guidance.

Looking Ahead

The company recently launched Vision 20/20, a plan to turn around the business over the next three years. The plan aims to restore the brand’s and company’s health by moving to a business model that is less driven by clearance and by making a meaningful reduction in SG&A expense.

The majority of the product and pricing initiatives will be implemented beginning in fiscal 2019; management expects these initiatives to negatively impact annualized revenues by $30–$50 million in fiscal 2019 versus fiscal 2018 levels.

Management expects to reduce annual net SG&A spending by up to $30 million from the baseline fiscal 2017 level of $236 million (excluding severance, Vision 20/20 and other disclosed charges from all periods) by right-sizing the organization to better align with the reduced size of the business. Management expects that $20–$25 million of the annualized SG&A reductions will be made by the end of fiscal 2019.

The company will provide more complete financial guidance for fiscal 2019 in conjunction with its fourth-quarter and fiscal year-end earnings release on March 14, 2018.

Outlook

Management provided the following guidance:

For 4Q18, the company expects:

- Net revenues of $127–$132 million, below the $138.7 million consensus estimate.

- EPS of $0.30–$0.33, at or above the $0.30 consensus estimate.

For FY18, the company expects

- Net revenues of $450–$455 million, compared with the $461.8 million consensus estimate.

- EPS of $0.57–$0.60, at or above the $0.57 consensus estimate.