Source: Company reports

4Q15 RESULTS

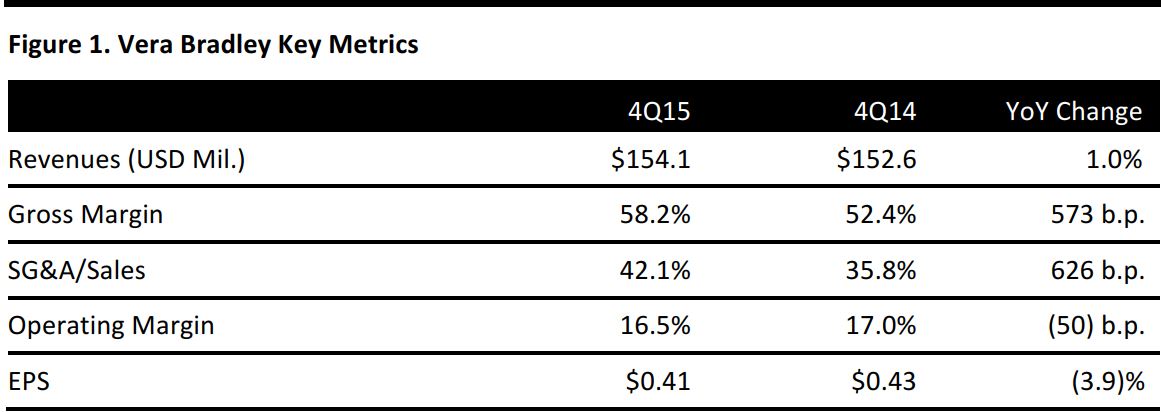

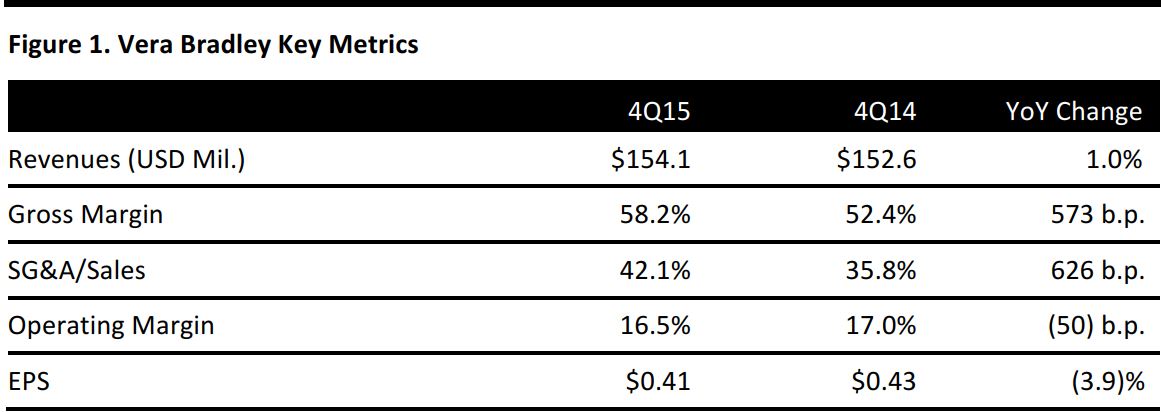

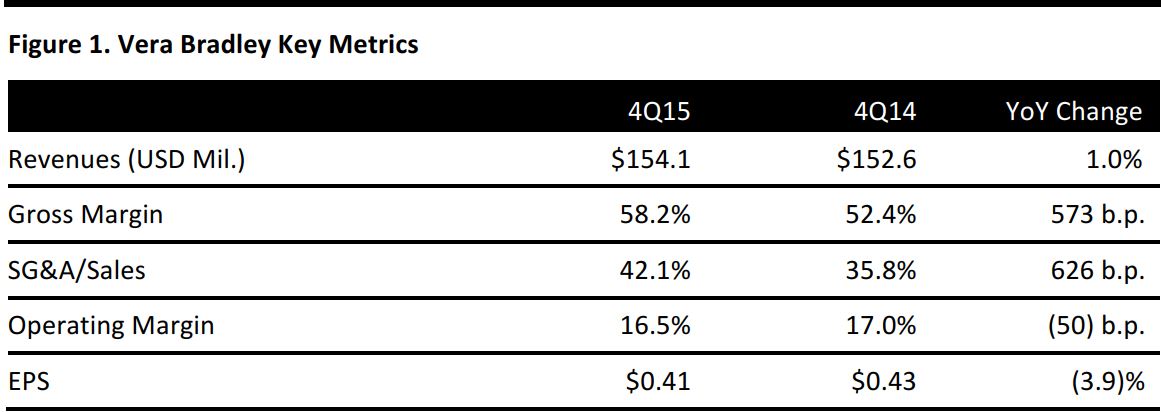

Vera Bradley’s 4Q15 revenues were up 1.0% year over year, to $154.1 million, which was at the high end of guidance. Most of the sales growth came from the indirect segment.

Total comps fell by 4.6%, largely due to hyper-promotional activities on the e-commerce side. Excluding the loss from e-commerce sales, comps were flat. However, management highlighted the sequential comps and comparable store improvement in each quarter of the past fiscal year and said it was pleased with the fourth quarter results.

The company improved gross profits through enhanced sourcing efficiencies, made-for-outlet products and by reducing promotions. It also reduced the number of sales days and hyper promotional activities.

2015 RESULTS

Revenues for 2015 were $502.6 million, down 1.3% from $509.0 million in the prior year. The figure was at the high end of the company’s guidance of revenues of $499–$503 million. Adjusted EPS was $0.82 versus $1.00 in 2014. GAAP EPS in 2015 was $0.71, which includes expenses from facility closures, employee severance, and fixed-asset acceleration charges.

During the year, Vera Bradley introduced new fabrications, expanded its jewelry collection, and opened a total of 26 stores in its full-line and factory channels. The company also doubled its presence at Macy’s and added new distribution partnerships, including with Amazon.

GUIDANCE

For 2016, the company guided for net sales of $510–$525 million and EPS of $0.90–$0.98. Management commented that five key areas of growth within the business were currently fashion bags, travel, collapsible luggage, campus and beauty. The company also said that the home category could be a significant growth opportunity in the future.