albert Chan

Introduction

What’s the Story?

Consumer and service industries such as retailers, hotels and restaurants have always faced unique challenges due to the shift-based nature of their work, as there is a high degree of employee turnover and risk of employees missing shifts. In addition to front-line workers directly affecting customer sentiment through their interactions, their activity also represents a significant expense line, since labor costs often represent the largest expense for these employers.

The Covid-19 pandemic has made meeting challenges even more difficult, with workers falling ill, having to quarantine away from work for long periods of time, relocating away from urban centers, refusing to return to work due to health concerns, and being lured away by other employers offering greater scheduling flexibility.

The combination of the need to increase employee satisfaction in an environment of labor shortages and heightened competition with the lack of visibility and control over labor costs implies the need for an intelligent, automated platform that can balance these two needs.

In this report, we analyze the results of a Coresight Research survey of 216 mid-sized to large enterprises in the retail, hotel, restaurant and other hospitality industries, conducted in September 2021. We explore the current staffing environment, including challenges in setting work schedules and views on employee sentiment, as well as future staffing-related and plans and priorities and discuss several technologies that can help solve them.

This report is sponsored by Workday, a provider of enterprise cloud applications for financial management, human resources, planning, spend management and analytics.

Why It Matters

Staffing coverage has several implications for the customer experience and the retailer’s or hospitality operator’s business. Looking at the customer experience, the staffing level has a direct effect on customer service, since customers become irritated if they cannot receive the help they need or have to wait in line for an excessive amount of time. Moreover, having too-few employees also means that nobody is there to complete the sale, hurting revenues—and many stores are reducing business hours due to lack of staff, leaving them even more susceptible to inroads by companies with online or other business models. Sufficient staffing levels are also necessary to keep shelves stocked, since out-of-stocks can lead shoppers to leave stores without making a purchase; they may share this negative experience online. In addition, customers notice high turnover rates—when their favorite associates are no longer available—and they also perceive the morale of the venues they patronize.

The business implications of staffing are enormous for retail and hospitality employers. Nearly three in 10 respondents (28%) in our survey reported that poor forecasting and scheduling lost their companies more than 10% of revenues annually, which is a significant figure given the thin margins in certain segments. With labor costs representing the largest expense for many employers, overstaffed shifts and overtime payments due to staffing shortages can significantly boost worker wages. Retailers and other mid-sized to large employers are able to take advantage of advanced workforce management solutions powered by AI and machine learning ML to better handle complex schedules spanning multiple locations, automate tasks such as creating shift schedules and assigning best-fit workers, and make accurate predictions to match supply and demand.

Staffing Challenges in Retail and Hospitality: Survey Analysis

We dive deeper into the current state of play of AI maturity in retail and hospitality staffing and look at what retail and hospitality decision-makers across key industries are saying about their organizations’ current use of tools, platforms and strategies for managing critical retail functions.

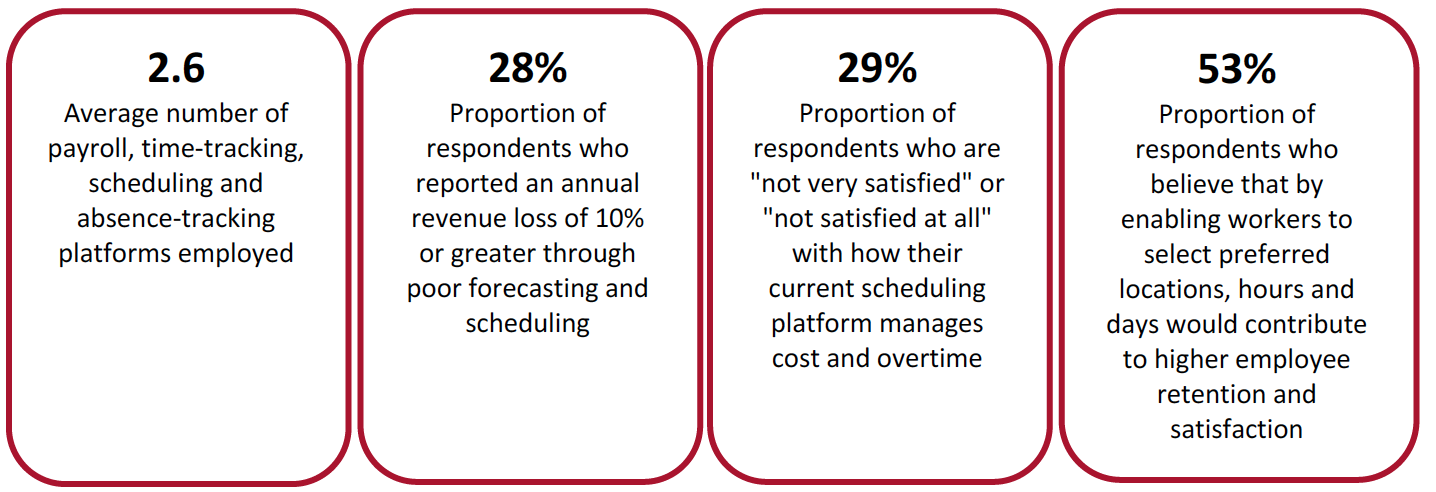

In Figure 1, we present selected key survey findings about staffing challenges before diving into the full analysis below.

Figure 1. Staffing Challenges: Key Survey Findings

[caption id="attachment_139987" align="aligncenter" width="700"] Base: 216 mid-sized to large enterprises

Base: 216 mid-sized to large enterprisesSource: Coresight Research[/caption]

Current Usage of Workforce Management Platforms

Mid-sized to large retail and hospitality employers schedule workers across multiple locations. To accomplish this, they use myriad platforms to manage payroll, time tracking, scheduling and absence tracking—averaging 2.6 platforms per employer, according to our survey (see Figure 2)—creating considerable complexity in terms of training, maintenance and integrating these platforms with accounting, enterprise resource planning (ERP) and other systems.

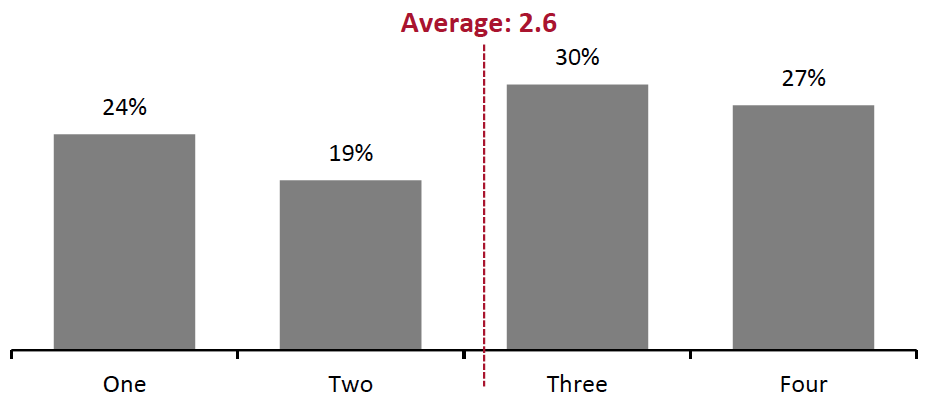

Figure 2. Total Number of Platforms for Payroll, Time Tracking, Scheduling and Absence Tracking (% of Respondents)

[caption id="attachment_139988" align="aligncenter" width="550"] Base: 216 mid-sized to large enterprises

Base: 216 mid-sized to large enterprisesSource: Coresight Research[/caption]

Significant Financial Impacts of Poor Forecasting and Scheduling

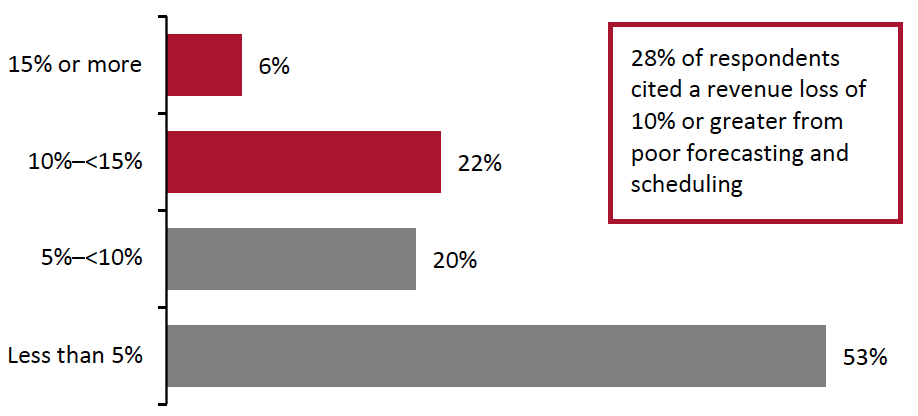

Poor labor forecasting and scheduling has a double-edged effect on an organization’s financial performance—leading to a reduction in revenue combined with additional cost due to overtime from overstaffing, plus inefficiency from the lack of transparency and the inability to align staffing with demand.

Impact on Revenues

Inefficiencies in labor forecasting and scheduling represent a significant drag on an enterprise’s revenues, in addition to requiring significant time and creating manager and employee frustration. Nearly half of all respondents reported that poor labor forecasting and scheduling created a revenue loss of 5% or greater, with 28% of respondents reporting a revenue loss of 10% or greater, which would have an enormous impact on a company’s profitability. The complete results are shown in Figure 3.

Figure 3. Annual Revenue Loss Through Poor Forecasting and Scheduling (% of Respondents) [caption id="attachment_139989" align="aligncenter" width="550"]

Base: 216 mid-sized to large enterprises

Base: 216 mid-sized to large enterprisesSource: Coresight Research[/caption]

Impact on Costs

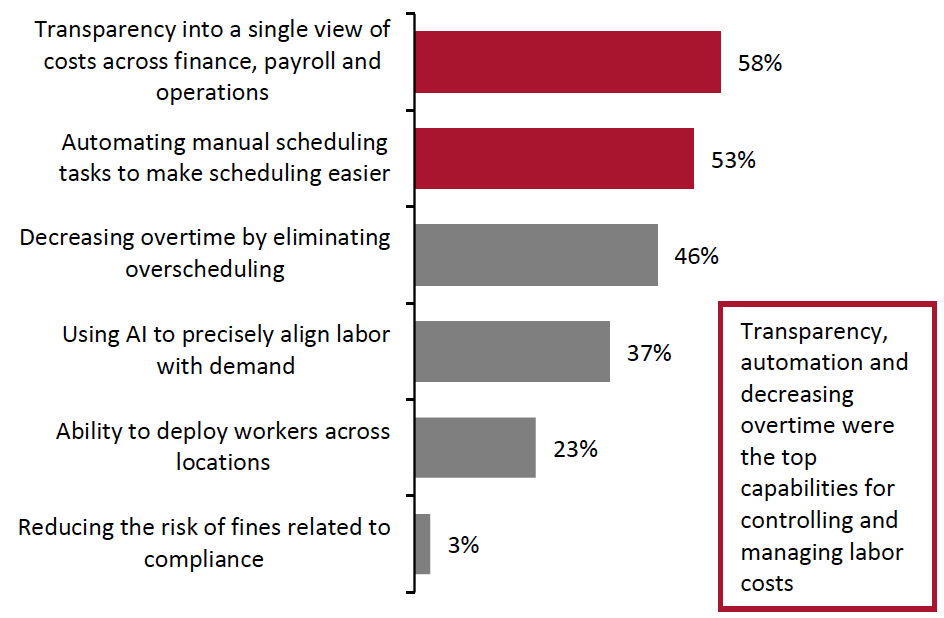

Inadequate worker staffing and scheduling creates several types of costs for an organization. More than half of our survey respondents cited the need for a single view of costs across finance, payroll and operations as key to controlling and managing labor costs, as a lack of transparency impedes an organization’s ability to connect staffing to finance.

Rounding out the top three capabilities that would best help with controlling and managing labor costs are automation in staffing (cited by 53% of respondents) and eliminating overscheduling to decrease overtime (46%). We present the full list of desired capabilities to manage labor costs in Figure 4.

Figure 4. Capabilities That Would Best Help with Controlling and Managing Labor Costs (% of Respondents) [caption id="attachment_139990" align="aligncenter" width="550"]

Respondents were asked to select one to three options

Respondents were asked to select one to three optionsBase: 216 mid-sized to large enterprises

Source: Coresight Research[/caption]

Employer Satisfaction and Dissatisfaction with Current Platforms

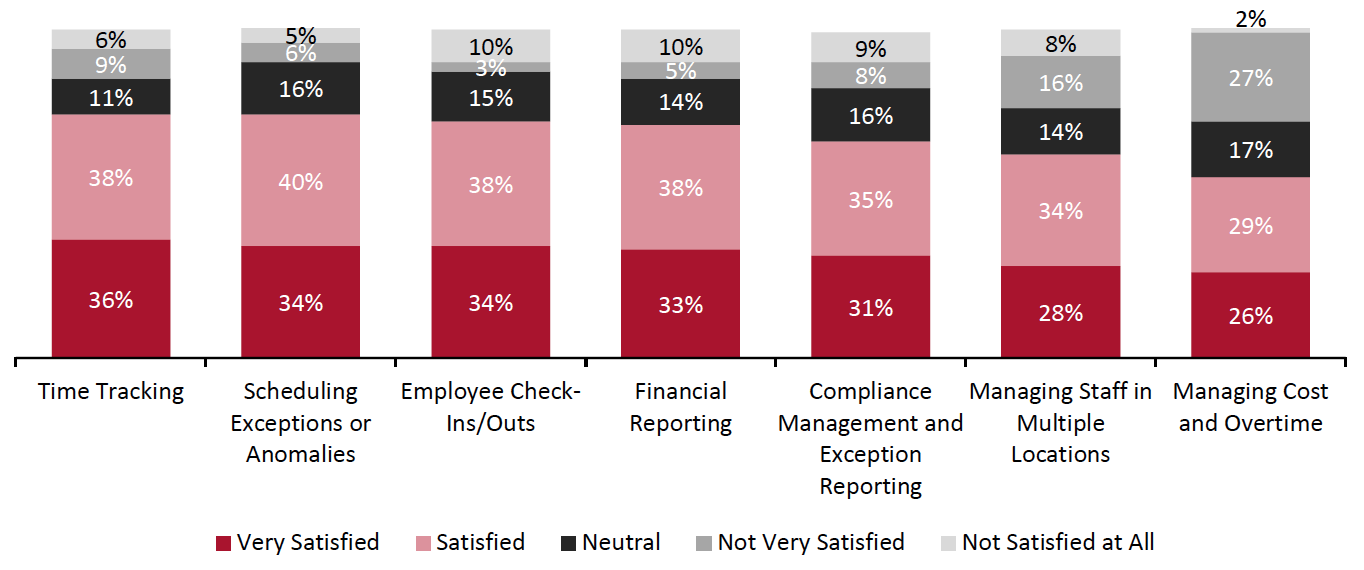

Our survey asked respondents about their current areas of satisfaction (and dissatisfaction) with their current scheduling platforms’ ability to manage select criteria—highlighting the business areas that are most impacted by current challenges such as labor shortages and workers being lured away by other employers.

The level of satisfaction with current scheduling platforms varies greatly. The operation that saw the highest level of reported satisfaction with current platforms was time tracking, but this was still reported by only three-quarters (74%) of respondents. The lowest proportion of respondents that reported they are satisfied or very satisfied was 55%, for managing cost and overtime—representing the greatest opportunity for improvement. Managing staff in multiple locations, and compliance management and exception reporting also saw levels of satisfaction rates fall under 70%; corresponding dissatisfaction levels for the bottom three categories exceeded 15% (see Figure 5).

Figure 5. Level of Satisfaction with Current Scheduling Platforms in Managing Selected Operations (% of Respondents) [caption id="attachment_139991" align="aligncenter" width="700"]

Base: 216 mid-sized to large enterprises

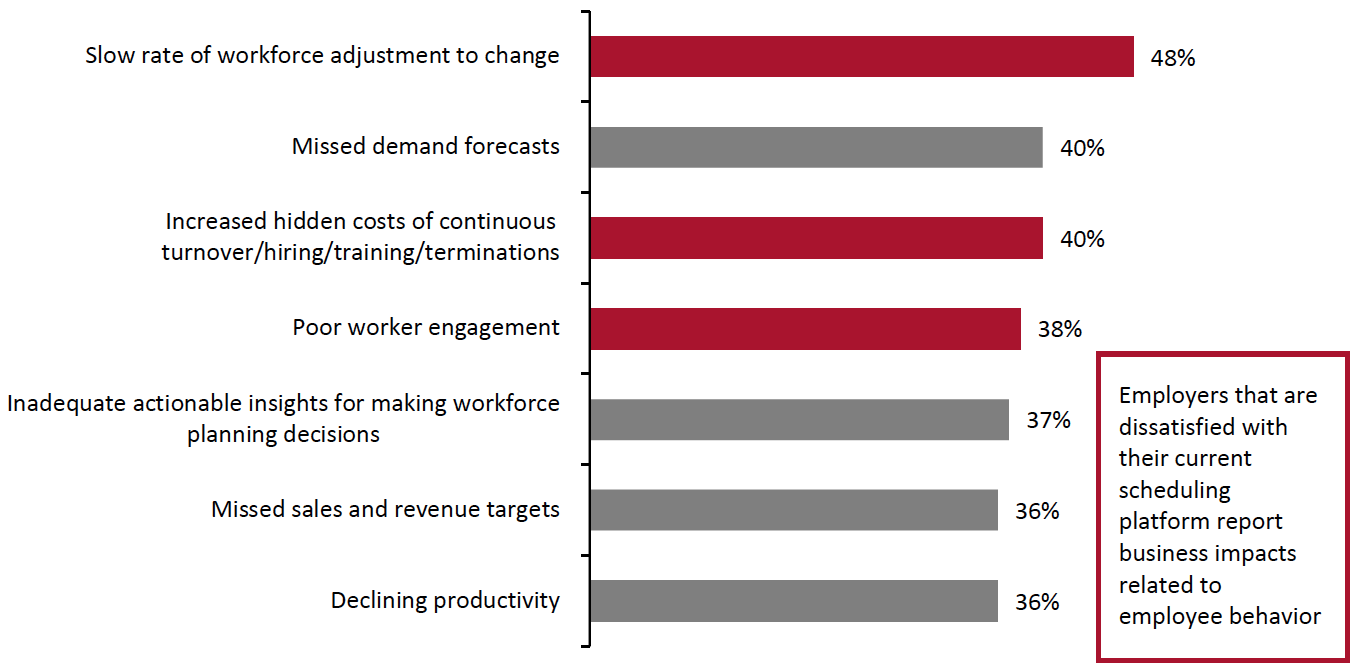

Base: 216 mid-sized to large enterprisesSource: Coresight Research[/caption] Among the respondents indicating dissatisfaction in any of the categories, much of the impact their staffing platform had on their business was related to the behavior of their employees, including slow adjustment to change, increased hidden cost from turnover/hiring/training/termination, and poor worker engagement and productivity, as shown in Figure 6.

Figure 6. Dissatisfied Employers: Business Areas Most Impacted by Issues with Current Scheduling Platform (% of Respondents) [caption id="attachment_139992" align="aligncenter" width="700"]

Base: 129 mid-sized to large enterprises that reported dissatisfaction in at least one area of their current scheduling solution

Base: 129 mid-sized to large enterprises that reported dissatisfaction in at least one area of their current scheduling solutionSource: Coresight Research[/caption]

Challenges in Setting Schedules

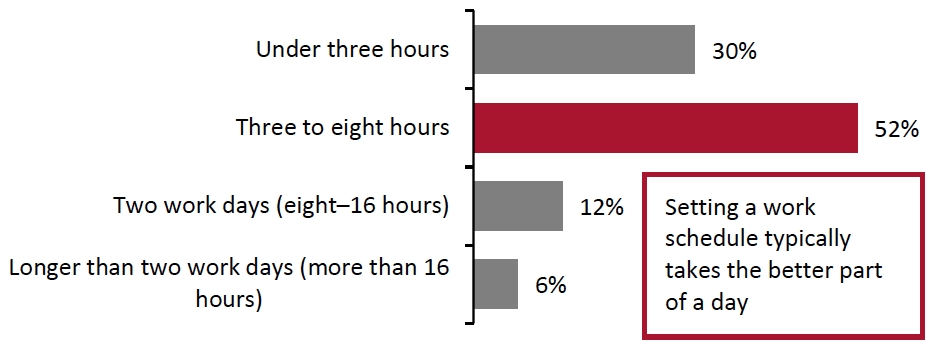

Creating work schedules is time consuming and challenging. Once they have been published, schedules are likely to change, and manual methods are typically used to find replacement workers to fill open shifts when these changes occur. We discuss the issues that surveyed employers face below.

- Setting schedules is time consuming. In our survey, more than half of all respondents reported that creating a schedule takes three to eight hours, and a further 18% of respondents said that setting a schedule takes two working days or longer, as shown in Figure 7.

Figure 7. Time Taken to Complete Weekly Work Schedules (% of Respondents)

[caption id="attachment_139993" align="aligncenter" width="550"] Base: 216 mid-sized to large enterprises

Base: 216 mid-sized to large enterprisesSource: Coresight Research[/caption]

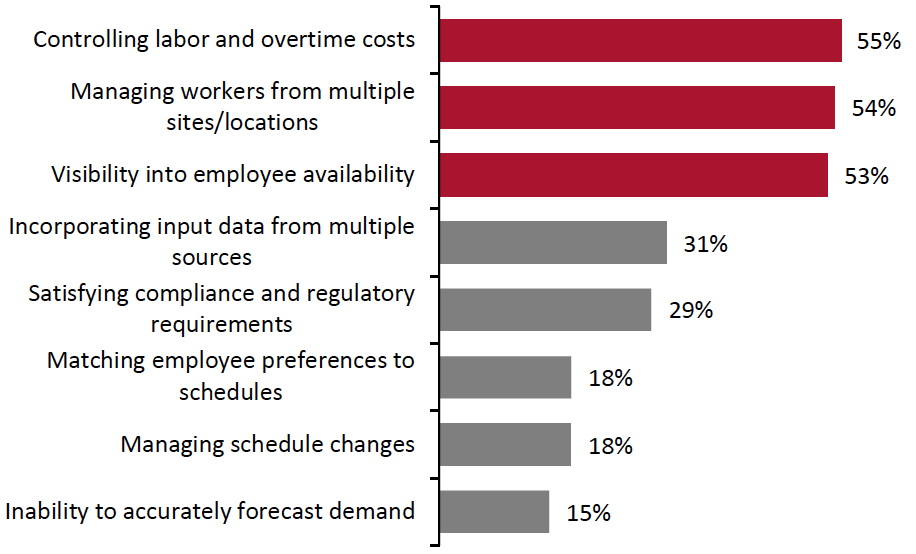

- Setting schedules is challenging. Retail and hospitality organizations face several challenges in setting a work schedule: The top three are financial, operational and informational in nature, as shown in Figure 8.

Figure 8. Challenges in Setting Work Schedules (% of Respondents) [caption id="attachment_139994" align="aligncenter" width="550"]

Respondents were asked to select their top three schedule-related challenges

Respondents were asked to select their top three schedule-related challengesBase: 216 mid-sized to large enterprises

Source: Coresight Research[/caption]

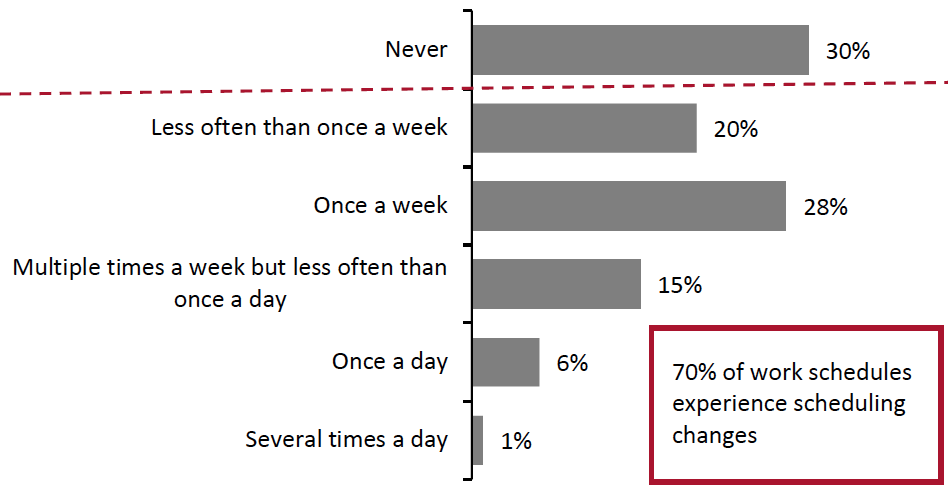

- Schedules frequently change: More than two-thirds of respondents (70%) reported that once a work schedule has been published, it will undergo change at least once—and 22% of respondents reported that schedules change at least once a week (see Figure 9).

Figure 9. Typical Frequency of Changes to a Completed Work Schedule (% of Respondents)

[caption id="attachment_139995" align="aligncenter" width="550"] Base: 216 mid-sized to large enterprises

Base: 216 mid-sized to large enterprisesSource: Coresight Research[/caption]

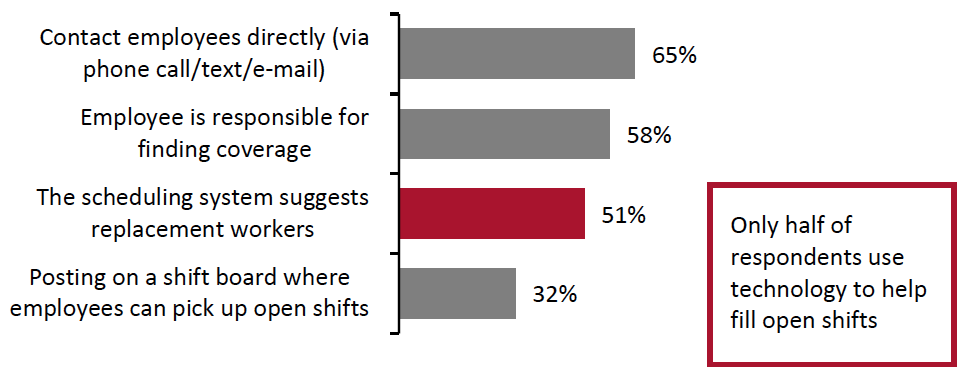

- Filling open shifts is typically done manually. When the inevitable need for worker replacements occurs (related to changes in expected demand and unexpected developments in workers’ personal lives), mid-sized to large enterprises use a variety of non-automated methods for finding replacements. Manual methods of updating schedules include contacting employees directly, having the employee find a replacement and posting open shifts on a shift board. Only 51% of respondents reported that they use automated systems for identifying replacement workers.

Figure 10. Methods Used To Fill Open Shifts Once a Schedule Is Published (% of Respondents)

[caption id="attachment_139997" align="aligncenter" width="550"] Reasons for open shifts may include call-outs, shift swaps and changes in employee availability. Respondents could select more than one option

Reasons for open shifts may include call-outs, shift swaps and changes in employee availability. Respondents could select more than one optionBase: 216 mid-sized to large enterprises

Source: Coresight Research[/caption]

Employers’ Views on Employee Sentiment

Given the historical staffing challenges of mid-sized to large employers and the particular challenges of the current environment—such as difficulties in finding and attracting workers—mid-sized to large employers have substantial financial and operational incentives to maintain employee satisfaction: to avoid the cost of turnover, training and replacement, as well as the damage to customer satisfaction from ensuing disruption to customer service.

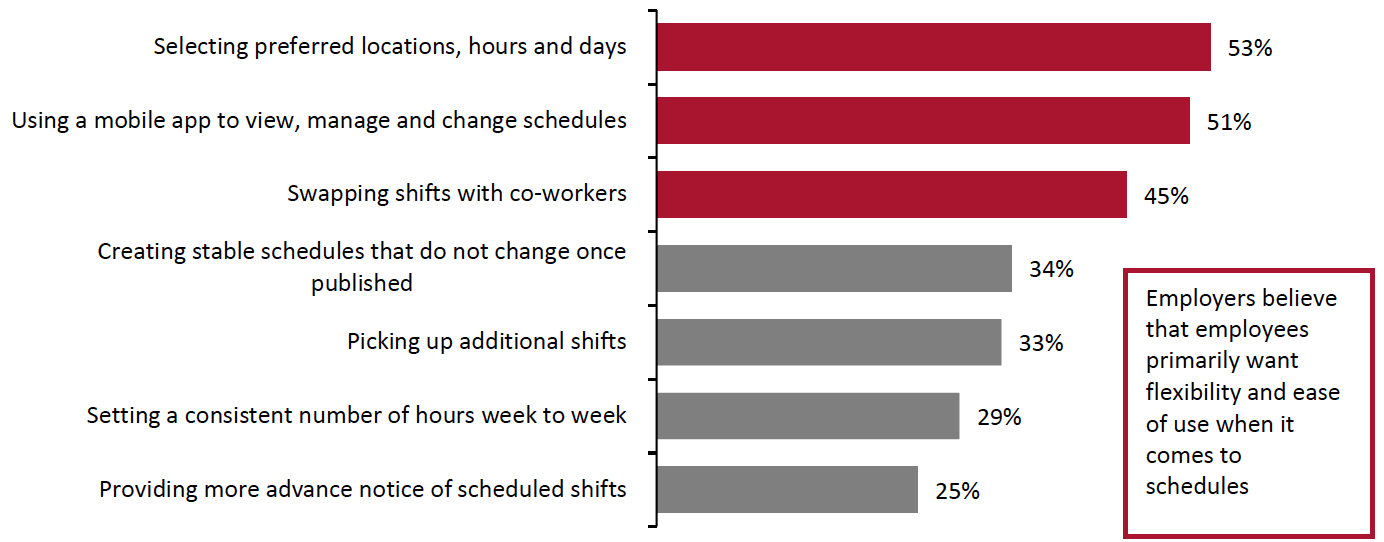

Our survey asked mid-sized to large service-industry employers about the scheduling capabilities that would most contribute to better recruitment, higher retention and higher employee satisfaction—i.e., employers were asked what factors would help improve the employee experience. The top three capabilities that employers cited include selecting preferred locations, hours and days; the ability to use a mobile app to view, manage and change schedules; and being able to swap shifts with co-workers. The full set of capabilities are shown in Figure 11.

Figure 11. Scheduling Capabilities That Would Most Contribute To Better Recruitment, Higher Retention and Higher Employee Satisfaction (% of Respondents) [caption id="attachment_139998" align="aligncenter" width="700"]

Base: 216 mid-sized to large enterprises

Base: 216 mid-sized to large enterprisesSource: Coresight Research[/caption]

Employers’ Future Plans for Workforce Scheduling Platforms

Mid-size to large service-industry employers are looking at acquiring technologies and capabilities that help them reduce time and effort in labor scheduling through automation, optimization, analytics and improved flexibility, which can improve worker sentiment. Many of these technologies are intertwined, since AI/ML offers automation and unlocks significant computing power for making predictions and forecasts, which can better match labor supply with expected demand. Analytics offers major benefits for large employers through optimizing staffing levels to ensure good customer service while minimizing costly overtime.

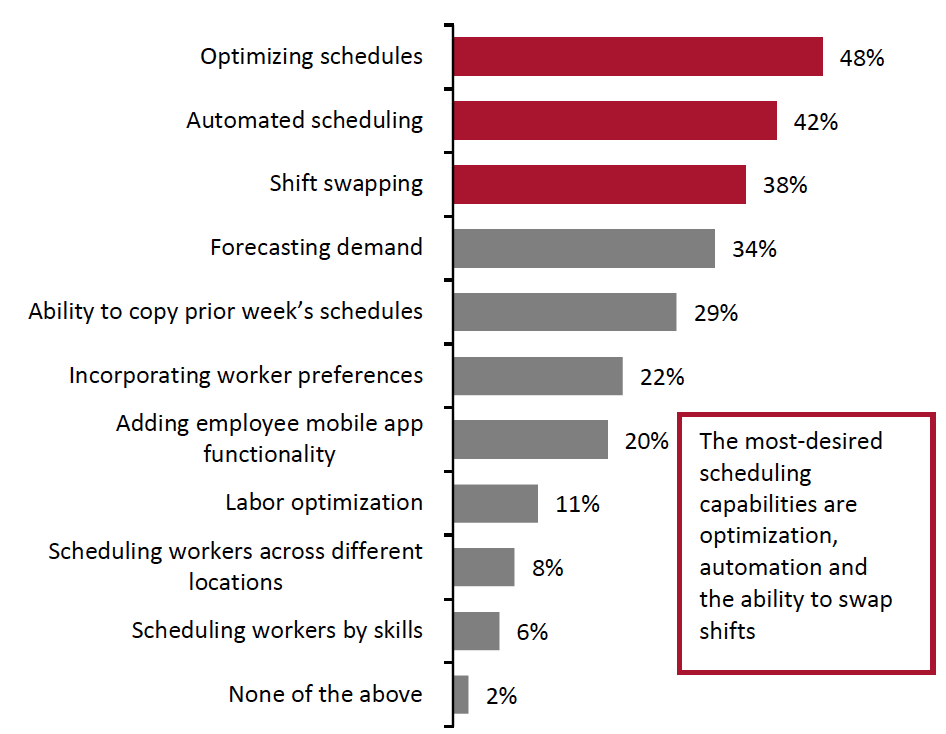

Nearly one-third (31%) of the employers surveyed said that they were considering the purchase of a new scheduling solution over the next three years. The top three desired features in a scheduling platform are optimization, automation and flexibility, as illustrated in Figure 12.

Figure 12. Most Desired Scheduling Capabilities (% of Respondents) [caption id="attachment_139999" align="aligncenter" width="550"]

Respondents were asked to select the top three scheduling capabilities that they would like to have but currently do not

Respondents were asked to select the top three scheduling capabilities that they would like to have but currently do notBase: 216 mid-sized to large enterprises

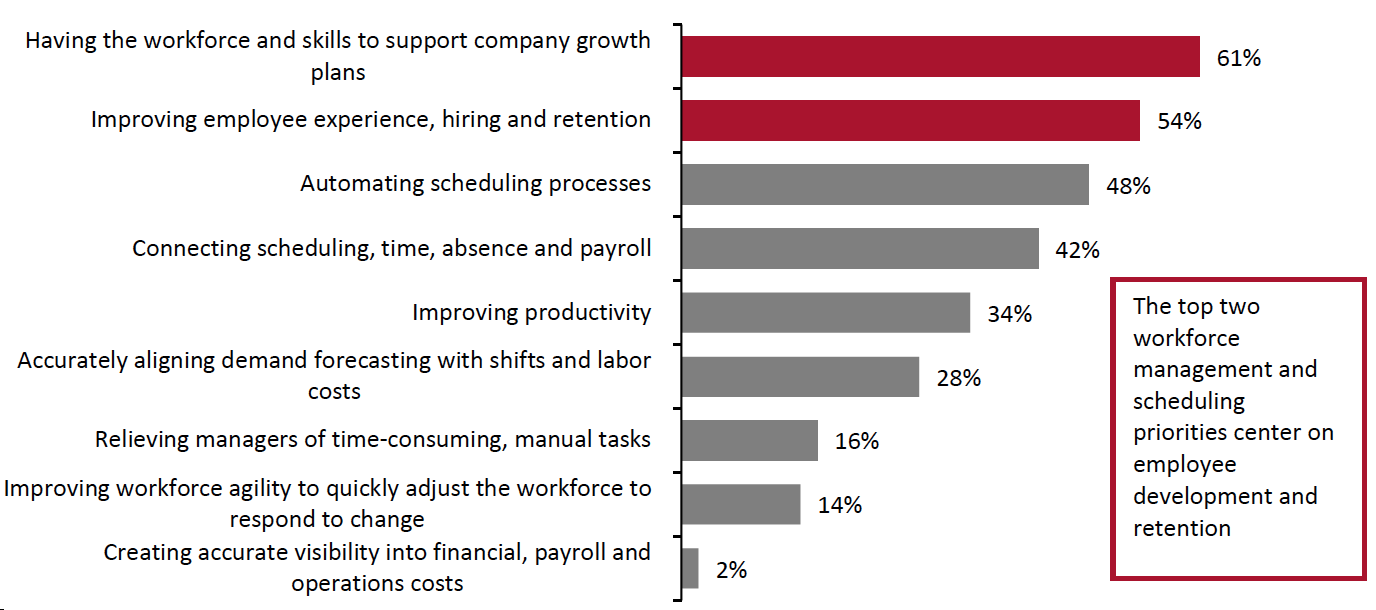

Source: Coresight Research[/caption] Employers’ top workforce management and scheduling-optimization priorities are more financial and operational in nature but echo the challenges and desired features previously outlined in this report, including worker skills, worker retention and the automation of scheduling processes.

Figure 13. Top Workforce Management and Scheduling Optimization Priorities Within the Next Three Years? (% of Respondents) [caption id="attachment_140000" align="aligncenter" width="700"]

Respondents were asked to select their top three priorities

Respondents were asked to select their top three prioritiesBase: 216 mid-sized to large enterprises

Source: Coresight Research[/caption]

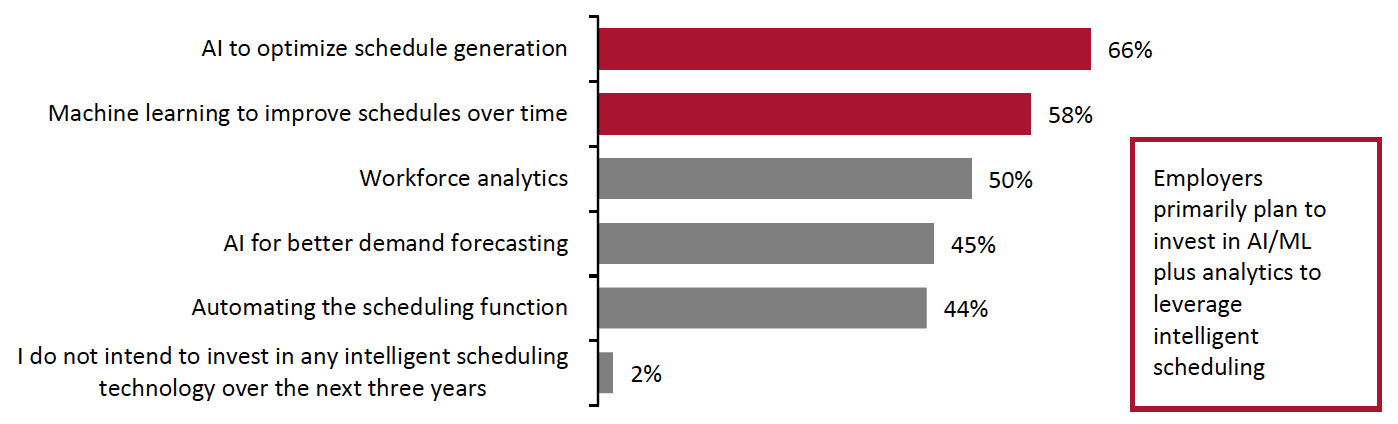

Employers’ plans for technology investment represent the foundation for the above functions they have outlined as priorities. The use of AI/ML enables the automation of forecasting, analysis and the ability to generate and execute on actionable insights from data. Demand forecasting underpins much of a retailer’s operations, connecting manufacturing, inventory and pricing, which all have implications for staffing (the number of employees and skills required to meet forecasted demand), as shown in Figure 14.

Figure 14. Intelligent Scheduling Technology Features in Which Employers Intend To Invest Over the Next Three Years (% of Respondents)

[caption id="attachment_140001" align="aligncenter" width="700"] Respondents were asked to select all applicable options

Respondents were asked to select all applicable optionsBase: 216 mid-sized to large enterprises

Source: Coresight Research[/caption]

What We Think

Many of the scheduling challenges outlined by mid-sized to large consumer and service employers—such as managing cost and overtime, managing staff in multiple locations, and compliance management and reporting—can be alleviated by the use of a comprehensive, automated platform that ties together staffing, finance and compliance:

- Software platforms excel at managing complexity such as staffing schedules for a large number of workers in multiple locations and maintaining compliance with rules and regulations that vary by location.

- A single platform offers dashboards and other tools that enable the viewing of a schedule or a summary of schedule data, on a PC or a mobile device, which enables schedules to be carried and updated by employees.

- Offering visibility and flexibility to employees on mobile devices would best improve recruitment, retention and employee satisfaction, according to mid-to-large service-industry employers.A single platform offers dashboards and other tools that enable the viewing of a schedule or a summary of schedule data, on a PC or a mobile device, which enables schedules to be carried and updated by employees.

- Connecting staffing to cost enables organizations to capture revenue that would have been lost from poor scheduling while minimizing cost from overtime and overstaffing.

Implications for HR and Operations Functions

- An automated platform could reduce the lengthy time that HR and operations employees require to complete weekly work schedules.

- Better connecting staffing and overtime and general staffing cost offers operations employees better visibility into and control over this cost.

- More flexibility and visibility for workers means higher employee engagement and retention, which in turn reduces time and expense from churn in hiring and training new employees.

- Flexibility in selecting preferred locations, hours and days, as well as the ability to swap shifts and pick up additional shifts, was highly cited as a contributor to better recruitment, retention and employee satisfaction.

- Mid-to-large service-industry employers also cited factors such as stable schedules, setting a consistent number of work hours week to week, and more advance notice on schedules as the most positive for employee recruitment, retention and satisfaction.

- The ability to view, manage and change schedules on a mobile app was also highly cited as a contributor to better recruitment, retention and employee satisfaction.

Methodology

This study is based on the analysis of data from an online survey of 216 mid-sized to large global employers conducted by Coresight Research in September 2021. Respondents in the survey satisfied the following criteria:

- Companies with 1,000+ employees

- Operating in the retail, hotel, restaurant and other hospitality industries (such as fitness centers, entertainment venues, theme parks, sports organizations, etc.)

- Locations including retail stores, warehouses or distribution centers, and corporate offices

- Responsible for scheduling; senior management roles including C-suite, presidents, vice presidents, directors, senior managers and managers

- Departments including operations, finance/payroll, human resources and information technology