Nitheesh NH

Introduction

Of all the apparel categories, underwear is the most essential. A revolution in how women think of underwear is driving growth in this category. The US women’s underwear market includes items worn next to the skin and under women’s outer clothing: bras and briefs separates, lingerie sets, corsets, camisoles, slips, suspender belts, garters and shapewear. The category also includes thermals and sports bras. Underwear accessories such as lingerie tape or bra inserts are excluded. We discuss the market factors driving the sector growth in 2022 and expectations for the US women’s underwear market through 2026.US Women’s Underwear Market: Performance and Outlook

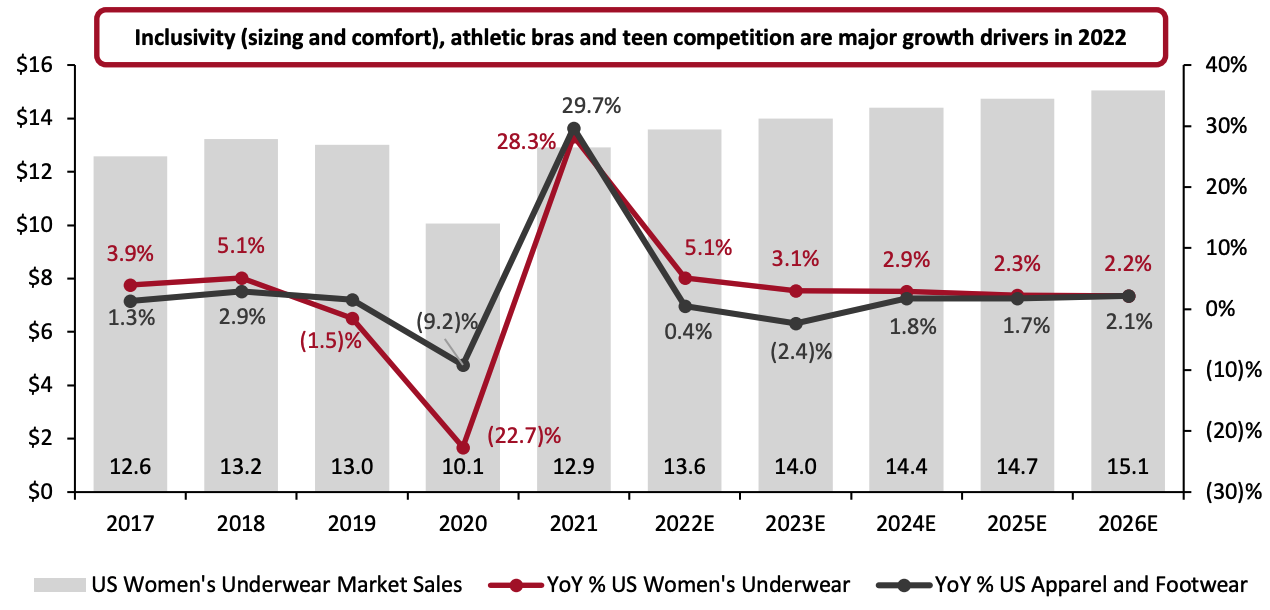

Market Size- The US women’s underwear market will grow 5.1% in 2022, shown in Figure 1, according to Coresight Research estimates. This is slightly higher than our estimated low-single-digit growth in fiscal year 2022 for the total clothing market, driven by several interrelated factors. These factors are inclusivity which includes both extended sizing and less “sexy” underwear and more comfortable styles, athletic bras and competition within the teen segment – all of which we expect will drive growth over the next five years. Coresight Research expects the market to reach $15.1 billion in 2026, a 3.1% CAGR from 2021.

- Additionally, we expect shapewear, an emerging category, to become a more prominent underwear category; while this category represents only 3% of total sales in 2021 it is quickly going mainstream. We expect more consumers to discover and seek out shapewear, incorporating it into their routines as brands innovate with new styles, colors and fabrics.

- We also expect companies to enter emerging and underpenetrated categories. We see opportunities for companies to expand their portfolios and expect the US women’s underwear category to grow both within the category and through adjacent category expansions. We are seeing category expansion in maternity, mastectomy bras and other adaptive categories. Sustainable designs are underrepresented in mainstream brands and retailers, and they are an opportunity for expansion. Finally, we see expansion opportunities in adjacent apparel categories to increase consumer traffic and average unit retail (AUR).

Figure 1. US Women’s Underwear Market Size (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_146418" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All Rights Reserved/ Coresight Research[/caption]

Source: Euromonitor International Limited 2022 © All Rights Reserved/ Coresight Research[/caption]

Market Factors

We identify the main factors driving growth in the US women’s underwear market. Comfort Extends to Underwear, Overtaking “Traditional” Underwear Consumers’ desire for comfort has expanded to underwear. Casualization was a well-known trend prior to the pandemic, with consumers seeking styles that are both functional and comfortable. This has led to new materials and styles including “comfort support bras” with softer materials that incorporate fresh designs. According to NPD data, wire-free styles today comprise over 50% of non-sport bra sales—growing by 7 percentage points versus 2019. Along with this casualization, consumers embraced a new definition of “sexy” and continued the trend of being who you are, where being comfortable in one’s skin is beautiful. This has also helped to bring on a new era of underwear – “less sexy” and “more comfortable” – where comfortable underwear is repositioned as representative of confidence and beauty. Comfort is also closely linked with inclusivity and body positivity, as it embodied an entire movement, not just of comfortable fabrics but of a comfortable mindset. For example, Aerie launched its #Aeriereal hashtag in 2014, encouraging consumers to post untouched images of themselves and encouraging consumers to be “happy in their own skin.” Aerie is often credited with launching this inclusivity movement on social media and the trend towards comfortable, less sexy styles. Comfortable styles have become an expectation from consumers, as traditional US women’s underwear companies have been losing market share to inclusive brands, athletic brands and direct to consumer (DTC) brands. Six traditional US women’s underwear companies ranked among the top ten have lost 8.0% in market share from 2016 to 2021. Growing Number of Plus-Size Customers Undergarments are wardrobe essentials and need replacing frequently, particularly when sizes change. The proportion of US adults that are overweight has been increasing in recent years, according to the Centers for Disease Control and Prevention. Approximately 69.4% of the 131 million women in the US are overweight or obese, according to the organization’s latest estimates in 2018, highlighting the opportunity for underwear of all sizes. The US women’s underwear market has a further opportunity as consumers gained weight due to the Covid pandemic. 42% of US adults reported undesired weight gain since the start of the pandemic, with an average gain of 29 pounds, according to an American Psychological Association survey conducted in February 2021. We expect this will impact bra and underwear sales as women may require new sizes. Additionally, this may present opportunities for the shapewear market as consumers seek out shapewear for its ability to help one feel taut and smooth. Athletic Bras Are Becoming Everyday Bras As more consumers become active, the sports bra category is growing as a lucrative category with brands and retailers increasing their offerings. Due to comfort and fit, some consumers report that they are wearing sports bras as everyday bras. This is heralding in a new alternative as consumers are wearing an entirely different category as their everyday bra. The athletic bra category is one of the fastest growing categories, besides shapewear. Non-traditional underwear brands including Adidas, Lululemon and Under Armour plus Nike are steadily growing their market presence in the athletic bra space, with a combined market share in the US women’s underwear market of 5.5% in 2021, up from 4.1% in 2016. Nearly all the major US companies have entered the athletic bra category and reported they are expanding their offerings; thus, we expect the athletic bra category to continue to grow significantly by 2026. Shapewear Goes Mainstream The shapewear industry has become a driving force in the US women’s industry. Coresight Research estimates that shapewear accounted for approximately 3% of total US women’s revenues in 2021; however, we expect this category to be one of the fastest growing for several reasons. First, consumers of all ages and sizes are seeking out shapewear for its smoothing properties. Second, many consumers are new to shapewear. Finally, brands and retailers are increasing shapewear innovations and offerings and the category is expanding to include more styles and colors. Shapewear is no longer considered a niche offering but is mainstream as evidenced by Spanx $1.2 billion valuation when the company sold a majority stake in October 2021 to Blackstone. Kim Kardashian’s Skims shapewear brand, which launched in 2019, has expanded into underwear, loungewear, maternity, accessories and even childrenswear, and it has collaborated with luxury designer Fendi. Skims was valued at $3.2 billion as of its latest investment of $600 million in January 2022, up from $1.6 billion in January 2021. In April 2022, it hired former Victoria’s Secret models to star in its social media campaign. In March 2022, American rapper and body-positive influencer Lizzo announced a collaboration with Fabletics to launch Yitty, a shapewear line ranging in sizes from XS to 6X. The brand is helping to change the perception of shapewear, using bright colors that consumers can feel confident revealing not just as undergarments but as outer garments. [caption id="attachment_146419" align="aligncenter" width="700"] Source: Yitty.com[/caption]

Inflation

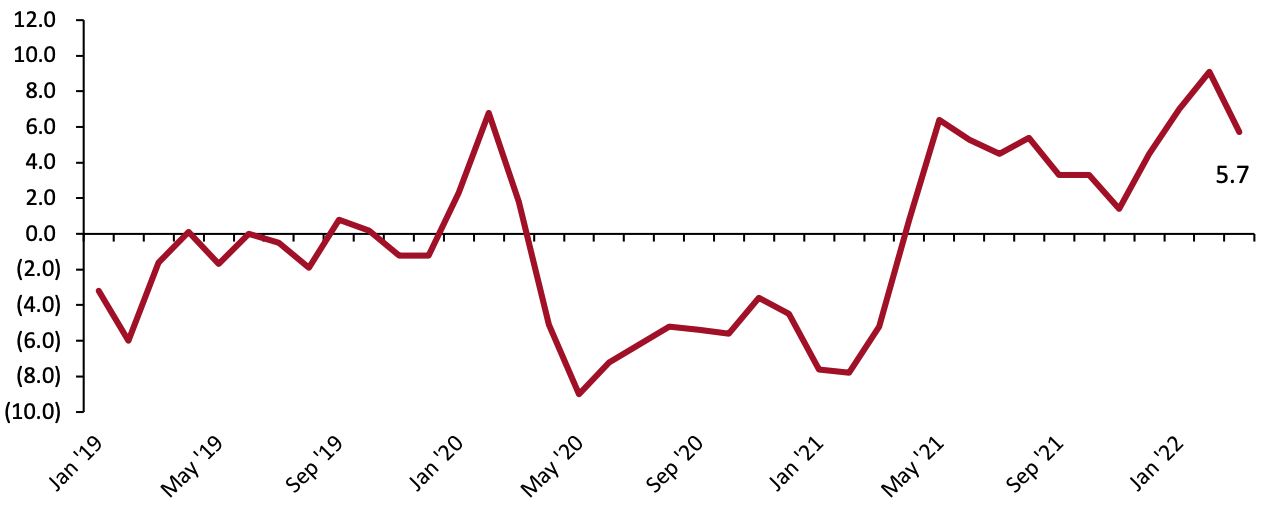

Inflation is a market driver for the entire apparel market, causing prices to increase. Inflation has been rising over the past year due to bottlenecks in the supply chain and shortages of materials. In February 2022, inflation in the underwear, nightwear, swimwear and accessories category rose steeply to 9.1%. According to the US Bureau of Labor Statistics, the figure declined to 5.7% in March 2022, but is still elevated. We expect that inflation will contribute to higher prices and will also contribute to higher retail revenues in 2022.

Source: Yitty.com[/caption]

Inflation

Inflation is a market driver for the entire apparel market, causing prices to increase. Inflation has been rising over the past year due to bottlenecks in the supply chain and shortages of materials. In February 2022, inflation in the underwear, nightwear, swimwear and accessories category rose steeply to 9.1%. According to the US Bureau of Labor Statistics, the figure declined to 5.7% in March 2022, but is still elevated. We expect that inflation will contribute to higher prices and will also contribute to higher retail revenues in 2022.

Figure 2. YoY Changes in Consumer Price Index in Underwear, Nightwear, Swimwear and Accessories for All Urban Consumers (%, Seasonally Adjusted) [caption id="attachment_146420" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

We are also seeing price increases in imported textile and textile articles, which will drive US apparel prices. The import price index of textiles and textile articles rose 4.4% in March 2022, a slight slowdown from its increase of 4.8% in February 2022 which was the highest increase since March 2012, according to the Bureau of Labor Statistics.

Source: US Bureau of Labor Statistics[/caption]

We are also seeing price increases in imported textile and textile articles, which will drive US apparel prices. The import price index of textiles and textile articles rose 4.4% in March 2022, a slight slowdown from its increase of 4.8% in February 2022 which was the highest increase since March 2012, according to the Bureau of Labor Statistics.

Competitive Landscape

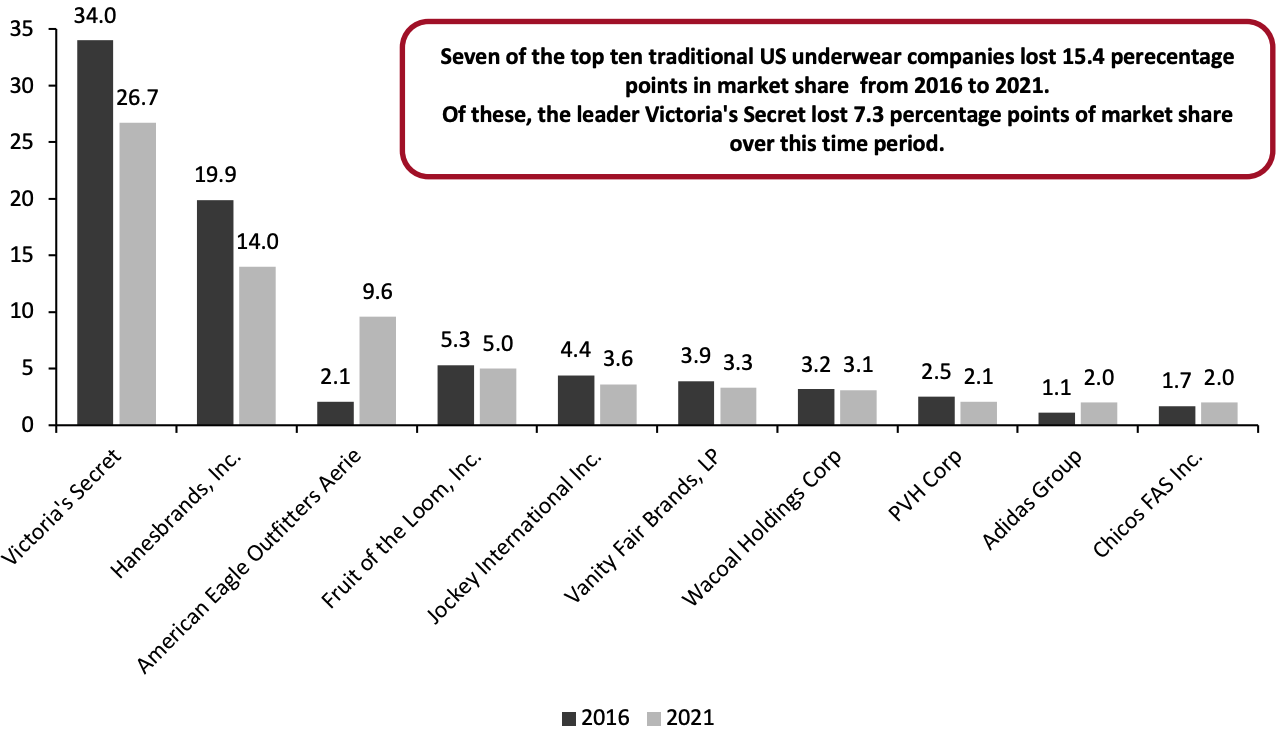

The US women’s underwear market is concentrated compared to the total apparel market (where the top 10 apparel brands account for less than 20% of US apparel sales), with the top 10 US women’s underwear companies accounting for 71.4% of US women’s underwear sales in 2021, according to data firm Euromonitor International. The market has become less concentrated over the past five years; in 2016 the top ten US women’s underwear companies accounted for 78.4% of US underwear sales. Here we provide highlights which we discuss further in the report.- Traditional US women’s underwear companies are losing market share. Seven traditional US women’s companies in the top ten brands and companies, have lost 15.4 percentage points in market share over the past five years, most notably to inclusive brands, athletic brands, and DTC brands.

- The market leader Victoria’s Secret has lost 7.3 percentage points in market share from 2016 to 2021. However, in 2021, Victoria’s Secret overhauled its image to become more inclusive and relevant with the modern woman. Victoria’s Secret also spun off from its parent company, L. Brands, in an IPO as its own public entity, VSCO, on August 2, 2021.

Figure 3. Top 10 US Women’s Underwear Brands’ and Companies’ Market Share (%) [caption id="attachment_146421" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All Rights Reserved/ Coresight Research[/caption]

Source: Euromonitor International Limited 2022 © All Rights Reserved/ Coresight Research[/caption]

- American Eagle Outfitters’ Aerie Brand is the fastest growing underwear brand capturing 9.6% of the market share in 2021, up from 2.1% in 2016, a 37.1% compound annual growth rate. The company has reported 29 consecutive quarters of double-digit growth.

- We expect the athletic market to gain more shares as this sector has been gaining momentum over the past five years and saw growth in 2021 as compared to other underwear brands and retailers.

Figure 4. Top 10 US Women’s Underwear Brands’ and Companies’ Revenues (USD Bil.) [wpdatatable id=1931]

Source: Euromonitor International Limited 2022 © All Rights Reserved/ Coresight Research

The Top Three US Underwear Companies Focus on Younger Consumers, Inclusivity and Broadening Portfolios Here we provide further analysis of the top three US women’s underwear companies, Aerie, Hanesbrands and Victoria’s Secret.Figure 5. Top Three US Women’s Underwear Companies and Brands [wpdatatable id=1932]

Source: Company reports/Euromonitor International Limited 2022 ©All Rights Reserved/Coresight Research

Hanesbrands Seeks To Double Business with Under 39-Year-Old Customers By Emphasizing E-Commerce Hanesbrands is an underwear company with a portfolio of brands including Bali, Champion, Hanes, Just My Size (JMS), Maidenform and Playtex, which sells its products in mass merchants and mid-tier department stores. In 2021, Walmart was its largest customer representing 17% of its total net sales (across all its brands). At the company’s last Investor Day held on May 11, 2021, management reported that prior to the pandemic, it was struggling to grow its underwear business and management said it had been losing market share in bras. The company assessed the US market opportunity to revitalize its business and discovered that younger consumers spend nearly 30% more on underwear than those over 39. The company is targeting younger consumers by improving the quality and visibility of its e-commerce sites. In its 4Q21 earnings report dated February 3, 2022, management reported that the changes it is making (particularly media investments and reducing SKU count) are paying off. Underwear sales increased 19% over 2019 with double-digit growth in each of its underwear businesses, including socks, kids, women's and men's. It continues to see strong results with growth across the Bali, Hanes and Maidenform brands. Aerie Appeals to Teens and Broadens Categories Beyond Intimates Aerie had its 29th consecutive quarter of double-digit growth in the fourth quarter of fiscal year 2021 with revenues up 39% compared to 2020. Aerie is regarded as a pioneer in the inclusivity movement of body positivity and consumers feeling confident and comfortable with their bodies. This movement also helped to propel the comfortable new era of women’s underwear styles; for example Aerie was one of the first brands to introduce the bralette, a soft unpadded bra that does not include underwire. The company has grown its portfolio extensively from intimates to comfortable, casual apparel and activewear. In July 2020, Aerie introduced Offline, an activewear brand featured in its Aerie stores; in the fourth quarter of fiscal year 2021, Aerie opened 43 stores and 20 of the stores included its Offline activewear brand. Management reported on its fourth-quarter earnings call of fiscal year 2021 dated March 2, 2022 that the company is seeing average unit retail in the low 20s driven by higher full-price selling, more strategic promotional activity and the category mix shift into higher ticket items. Demand was strong across core Aerie apparel and intimates as well as its Offline activewear. Victoria’s Secret Rebrands To Be Inclusive and Diverse and Targets Teen with Brand Launch The market leader Victoria’s Secret rehauled its image to become more inclusive and relevant to the modern woman. Victoria’s Secret also spun off from its parent company, L. Brands, in an IPO as its own public entity, VSCO, on August 2, 2021. In 2021, Victoria’s Secret went through a brand overhaul to become a ‘less-sexy’ version of itself that is more inclusive and diverse after criticism that its brand offered only smaller sizes and represented skinny models on social media. The company cancelled its Victoria’s Secret runway show and enlisted the Victoria’s Secret Brand Collective, a group of influencers, to represent the brand. The brand opened its store of the future in Chicago in December 2021 with a new image including plus size mannequins and sizes. The company also ran marketing campaigns featuring plus-size models. The company reported on its fourth- quarter of fiscal year 2021 earnings call that it plans to partner with Elomi, a pioneer in the plus-size intimate space, later this year. The company is also expanding its offerings into new categories, most notably the tween/teen market with the launch of Happy Nation in April 2022, which we expect will be direct competition to Aerie. Victoria’s Secret is also expanding other apparel categories, such as swimwear, with an $18 million investment in Frankies Bikinis in March 2022. The retailer had a very strong swimwear presence but exited the category in 2016. Victoria’s Secret also reported it plans to amplify its active, lounge and sleep offerings.Themes We Are Watching

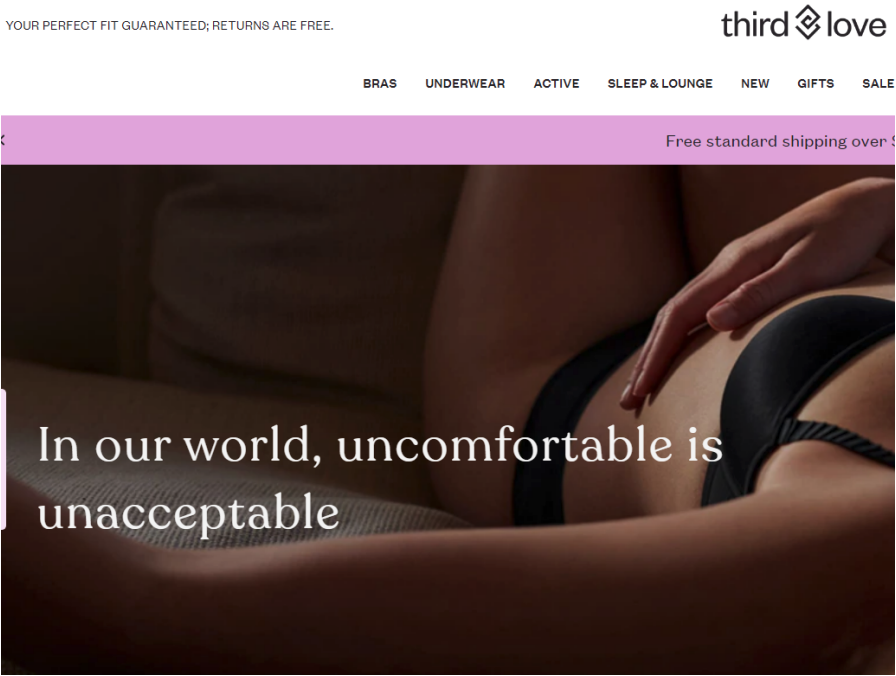

Inclusivity Continues Growing More brands and retailers are focusing on inclusivity which encompasses catering to the plus-size consumer, incorporating body positivity and comfort. As evidenced by direct-to-consumer (DTC) brands and inclusive brands gaining market share, body positivity and size inclusion are essential to remain competitive. From 2016 to 2021, DTC brands gained 5.6% of market share in the US women’s underwear market; over this time period digitally native underwear brand market entrants created competition by focusing on fit, body positivity and inclusivity. For example, ThirdLove, which offers a digitally native e-commerce store that is credited with inventing half-cup sizes and has more than 80 bra sizes (compared with 30 sizes that are offered by many brands) launched in 2013. The company developed a Fit Finder, which over 20 million women have taken, and has aggregated over 100 million data points to help the company to develop its products for the “perfect fit” for every size. The company’s homepage reads “In our world, uncomfortable is unacceptable.” [caption id="attachment_146423" align="aligncenter" width="700"] ThirdLove digitally native underwear brands has over 80 sizes, focused on fit, extended sizes and comfort

ThirdLove digitally native underwear brands has over 80 sizes, focused on fit, extended sizes and comfortSource: ThirdLove.com[/caption] Brands and companies are responding, as inclusivity is the new normal. Victoria’s Secret “Store of the Future,” which it launched in December 2021 in Chicago, includes more spacious drawers for its new sizes and plus-size mannequins as part of the retailer’s transformation. As mentioned previously, the company plans to partner with Elomi, a pioneer in the plus-size intimate space, later this year. While inclusivity is not new, more brands are embracing extended sizing. We expect more competition in the inclusive category as demand rises; Rihanna’s Savage x Fenty brand, which is founded on diversity and inclusion, plans to launch its IPO in 2022 with an expected value of nearly $3 billion. Competition Will Heat Up in the Tween/Teen Market We expect competition to heat up in the teen and tween underwear market. Aerie has been the dominant market leader, nearly unrivaled over the past five years. Victoria’s Secret launched Happy Nation, a tween/teen-focused brand, in April 2022, Happy Nation offering bras, underwear and comfort apparel for pre-teen consumers. On April 25, 2022 digitally native brand, ThirdLove announced it is acquiring Kit Undergarments, an intimates brand founded by celebrity stylists Jamie Mizrahi and Simone Harouch. In its press release, ThirdLove’s co-founder and CEO Heidi Zak said that she wanted to create a sub-brand that targets a younger demographic and “rather than leveraging our team’s time and effort on creating a new brand from scratch, our solution was to find an incredible existing brand we could scale through the backing of ThirdLove.” Additionally, Coresight Research sees increasing competition from fast fashion retailer Shein. While its market share is still small, the retailer is one of the fastest growing. Its year-over-year sales in 2021 grew 66.4%, second highest only to Aerie at 67.2%. Shein is a huge draw for teens and tweens as it offers inexpensive and trending merchandise; thus, we see Shein as a competitor to watch in the tween and teen market. [caption id="attachment_146424" align="aligncenter" width="700"]

Victoria’s Secret launched Happy Nation, a brand targeted to teens and tweens, in April 2022

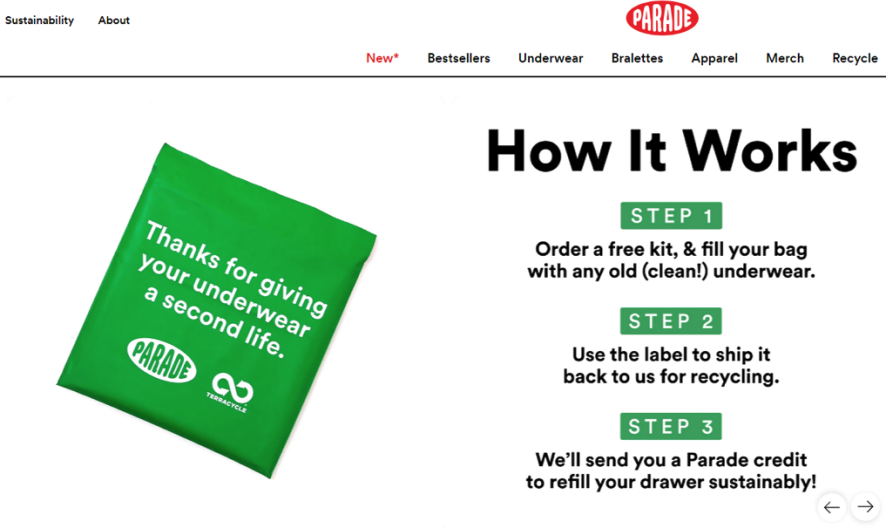

Victoria’s Secret launched Happy Nation, a brand targeted to teens and tweens, in April 2022 Source: Happynation.com[/caption] Adjacent Apparel Categories Will Expand To Include Activewear, Comfort Apparel and Loungewear We expect brands and retailers to continue to expand their portfolios beyond underwear into apparel to include activewear, loungewear and comfort apparel to complement their underwear collections, like the model Aerie has implemented. Offering apparel will be a way to increase consumer visits. This will help to drive average unit retail and will also help to bring customers to the store more often. Sustainability Is a White Space Opportunity for Major Brands and Retailers Sustainability is a growing movement in the underwear space. We expect this to be a growth opportunity. For example, Parade underwear brand is rooted in sustainability with 80%–95% of its products made from recycled materials. The brand also has an underwear recycling program, where consumers receive 20% off a purchase when they send their old underwear to the company for recycling. [caption id="attachment_146425" align="aligncenter" width="700"]

Parade’s sustainability program offers consumers a discount toward a future purchase when they send used underwear to the company

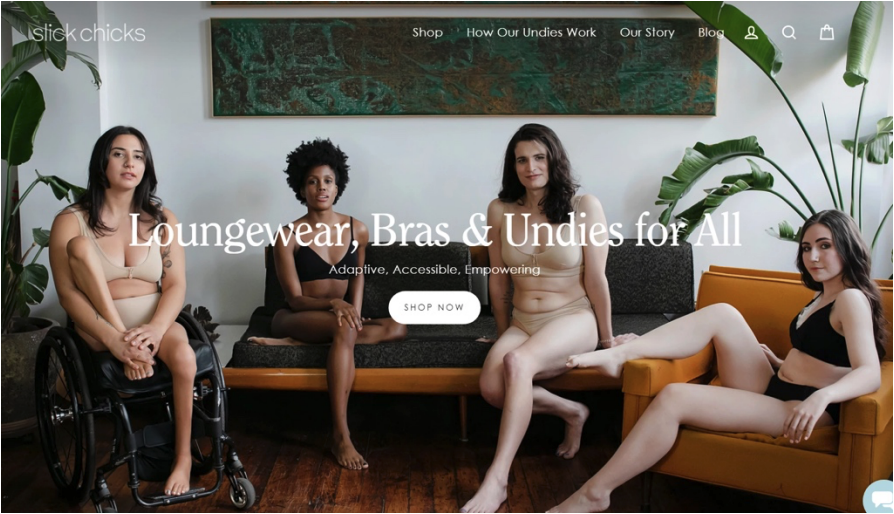

Parade’s sustainability program offers consumers a discount toward a future purchase when they send used underwear to the companySource: Yourparade.com[/caption] Expected Underwear Category Expansions Include Athletic, Maternity and Adaptive Segments We expect athletic bras to be one of the biggest categories to watch within the underwear space. We expect there to be new design innovations within the athletic sports bra space that include both technical and style innovations combining active and athleisure, further transitioning the athletic bra into an everyday bra. We also expect more innovations in growing niche categories including maternity and mastectomy bras and other adaptive categories in the underwear market. Victoria’s Secret reported on its fourth-quarter earnings call of fiscal year 2021 dated March 3, 2022 that it launched a maternity bra (with no marketing and very little store signage) in February 2022 and it sold 100,000 units within its first week, highlighting the growth potential of the market. To date, the adaptive apparel category has been underserved, but growing. Slick Chicks is an adaptive underwear brand that serves persons with disabilities. Its underwear provides side closures for persons to easily take off when seated, lying down or standing. [caption id="attachment_146426" align="aligncenter" width="700"]

Slick Chicks is an adaptive underwear brand; its underwear has side closures for persons to easily take off when seated, lying down or standing

Slick Chicks is an adaptive underwear brand; its underwear has side closures for persons to easily take off when seated, lying down or standingSource: Slickchicksonline.com[/caption]

What We Think

Casualization, inclusivity and changing lifestyles including more active consumers are all influencing trends in the US women’s underwear market. There has been a sustained movement over the past several years away from traditional sexy underwear styles to ones that are more modern and comfort-based. Implications for Brands and Retailers: Shapewear Competition Increasing as the Category Grows- We expect shapewear to become a major underwear category. Today there are several dominant companies; however, with modern technology and fabric innovation the category is changing rapidly, and consumers are seeking it out.

- Second, the image of shapewear is changing, with influencers like Lizzo that are encouraging consumers to wear shapewear as outerwear or to “reveal” their shapewear – which is altering the colors and styles of shapewear.

- We expect more underwear brands and retailers to enter adjacent apparel categories, as this will help to increase consumer traffic and average unit retail. This model has been a success story for Aerie, as the company has continued to grow its intimates’ brand with 29 quarters of double-digit growth by also offering consumers cozy lounge apparel and activewear.

- We see category expansion within the underwear market to include competitive categories including active, shapewear and growth categories including maternity, mastectomy bras, and adaptive underwear.

- We see sustainability as a growing opportunity as this has been an untapped area.

- We expect that there will be more competition in the teen and tween apparel market due to Victoria’s Secret’s announcement of Happy Nation.

- While Victoria’s Secret has Pink, a brand that is geared to a younger, teen consumer, its brand is heavily logo-ed; we expect the Happy Nation brand will offer the teen/tween an aesthetic that is more like the Aerie consumer.

- Companies will have to offer plus sizes to be competitive.

- Underwear portfolios have moved towards more modern comfort-based fabrics and styles as compared to uncomfortable “sexy” styles.

- We see growth opportunities for real estate firms as US women’s underwear brands and retailers are opening stores in 2022. Aerie plans to open between 60–65 stores between fiscal years 2022 and 2023 and Victoria’s Secret plan to open 15 stores in fiscal year 2022 – three of which are stores of the future (it will also close 20 stores), and shapewear brand Savage x Fenty is opening its first stores.

- There are opportunities for real estate firms to work with retailers and emerging brands on shop-in-shop opportunities. For example, Spanx and Skims have both worked with multi-brand retailers and department stores to create significant shop-in-shops.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved