Nitheesh NH

What’s the Story?

As part of our annual review of the US women’s plus-size apparel market, we review the latest sales data and present our expectations for the market’s future growth and its key drivers. We also examine the competitive landscape and the initiatives that major brands and retailers are undertaking to enter and better serve this market.Why It Matters

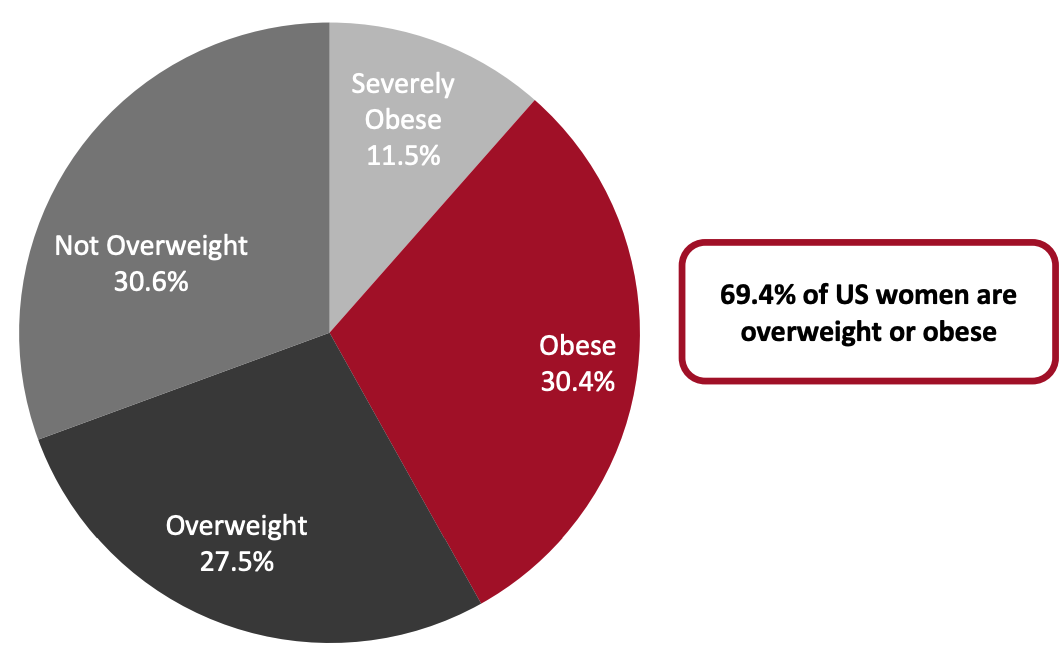

Size inclusivity is not a trend but a consumer need. The proportion of US adults that are overweight has been increasing in recent years, according to the Centers for Disease Control and Prevention. Approximately 69.4% of the 131 million women in the US are overweight or obese, according to the organization’s latest estimates in 2018 (see Figure 1). This highlights the tremendous opportunity for brands and retailers to provide extended sizes in the women’s apparel market. Furthermore, as we discuss in this report, the Covid-19 pandemic has brought about weight gain among female consumers, which will impact apparel sales in the wider market and likely present opportunity in the plus-size sector. More brands and retailers are entering the market or broadening their offerings to take advantage of the plus-size opportunity—including by going beyond the traditional extended sizes of 14–24 to offer sizes 24–40.Figure 1. US Women: Classification by Body Mass Index, 2017–2018* (% of Population) [caption id="attachment_134918" align="aligncenter" width="580"]

*Latest available data

*Latest available data“Overweight” is a body mass index (BMI) of 25.0–29.9 kg/m2; “obesity” is a BMI of 30.0 kg/m2 or above; “severe obesity” is a BMI of 40.0 kg/m2 or above. Pregnant women are excluded from the analysis.

Sources: Centers for Disease Control and Prevention[/caption]

US Women’s Plus-Size Apparel Opportunity: Coresight Research Analysis

Market Size We estimate that the US women’s plus-size apparel market has grown from $28.3 billion in 2020 to $34.3 billion in 2021, representing a year-over-year increase of 21.2%, as shown in figure 2. Our estimate factors in the number of women that browse plus-size clothing, estimated per capita spend, the apparel market trajectory and the proportion of overweight women in the US (according to the Center for Disease Control and Prevention’s) latest estimate. We expect that in 2022, the market will experience more moderate growth of around 7.6%, having been boosted this year by weak comparatives against pandemic-impacted 2020. However, we expect the plus-size market to increase at a faster rate than the total women’s apparel market and thus gain share of the total market.Figure 2. US Women’s Plus-Size Apparel Market Size [wpdatatable id=1374]

Source: Bureau of Economic Analysis (BEA)/Coresight Research

Market Drivers Below, we discuss the major drivers supporting strong growth in the US women’s plus-size apparel market. Weight Gain Amid Covid-19 We expect brands and retailers in the plus-size market to see increased demand for extended sizes as a result of the Covid-19 pandemic: 61% of Americans reported that they have gained weight since the start of the pandemic (with 42% stating that they had gained more weight than they had intended), according to The Harris Poll for the American Psychological Association conducted in February 2021. According to the survey, 45% of female respondents reported an average weight gain of 22 pounds since the start of the pandemic. Extrapolating the data to the total population, approximately 58.9 million US women will be shopping for larger clothing sizes—representing a potential addressable market of $71.3 billion. Although we are not able to determine what portion of this potential market is additive to our 2021 extended-size estimate, recent widespread weight gain is a clear market driver for the plus-size market overall as consumers are requiring new clothing in larger sizes than they were previously buying. Pandemic Recovery We expect total US women’s apparel spending to be up by 17.6% year over year in 2021, driven by vaccinations and a renewed push toward a return to normal life. This is supported by the strong 39.9% year-over-year growth in consumer spending in the first half of the year in women’s and girls’ apparel, according to data from the Bureau of Economic Analysis (BEA). While the spread of the Covid-19 Delta variant and ongoing supply chain issues pose uncertainty for spending recovery, many retailers in the Coresight 100 (Coresight Research’s focus list of brands and retailers to watch), have expressed confidence in consumer apparel spending and raised their outlook for the second half of the year. For example, the three major US department stores, which are apparel-heavy retailers, have each increased their revenue outlooks for 2021: Macy’s raised its outlook to 31% above 2020, Nordstrom to 35% revenue growth and Kohl’s to low-20s growth in percentage terms. Increased spending in the apparel industry overall bodes well for the plus-size market too. Plus-Size Initiatives by Brands and Retailers Brands and retailers are increasing their focus on launching and differentiating extended-size offerings. We present recent developments in the women’s plus-size apparel market in Figure 3. These developments cover the following key areas:- Expanding sizing beyond traditional extended sizes

- Leveraging consumer insights to inform designs

- Utilizing social media and forming social communities

- Using brand ambassadors

- Combining value and fashion offerings

- Designer and brand collaborations

Figure 3. US Women’s Plus-Size Apparel Market: Timeline of Major Developments, 2021 [wpdatatable id=1375]

Source: Company reports/Coresight Research

To provide a comprehensive overview of the plus-size retail landscape, we summarize key brand and retailer launches in the space from previous years in Figure 4.Figure 4. US Women’s Plus-Size Apparel Market: Major US Brand and Retailer Launches, 2012–2020 [wpdatatable id=1376]

Source: Company reports/Coresight Research

As we can see from Figure 4, the plus-size market provides white-space opportunity for many types of retailer, including department stores, mass market stores and specialty apparel retailers. We break down recent brand/retailers launches and category expansion initiatives by retailer type in Figure 5 to show the overall market fragmentation.Figure 5. Summary of Plus-Size Brand/Retailer Launches Over the Past 10 Years, by Major Channel [caption id="attachment_134940" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Plus-Size Opportunities

Drawing on the developments summarized above, we identify key trends and opportunities in extended sizing.

Underpenetration in the Luxury Category

Luxury has been slow to adopt extended sizes. As shown in Figure 5, there have been only two major specialty luxury brand announcements within the past 10 years, which we discuss in further detail below.

Source: Company reports/Coresight Research[/caption]

Plus-Size Opportunities

Drawing on the developments summarized above, we identify key trends and opportunities in extended sizing.

Underpenetration in the Luxury Category

Luxury has been slow to adopt extended sizes. As shown in Figure 5, there have been only two major specialty luxury brand announcements within the past 10 years, which we discuss in further detail below.

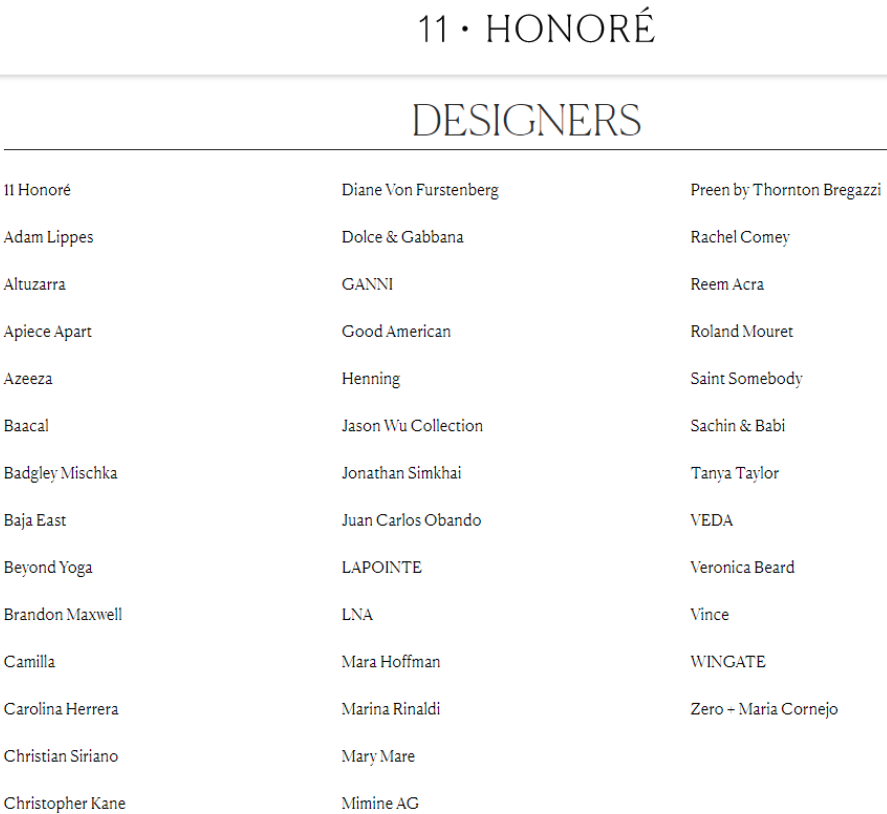

- 11 Honoré is a luxury e-commerce marketplace dedicated to extended sizes. The platform has its own private-label luxury brand, which it describes as offering “timeless staples.” The 11 Honoré website features selected pieces and offerings from luxury designers and brands.

Source: 11honore.com[/caption]

Source: 11honore.com[/caption]

- Luxury brands can collaborate on extended-size collections, as shown by the March 2021 partnership between luxury fashion brand Erdem and extended-size brand Universal Standard.

Remi Bader, a social media influencer, reviews plus-size clothing from different brands in July–August 2021

Remi Bader, a social media influencer, reviews plus-size clothing from different brands in July–August 2021Source: Remi Bader/TikTok[/caption]