DIpil Das

What’s the Story?

Continuing to ride on the pandemic-driven e-commerce wave of 2020, warehouse clubs and dollar stores are likely to remain in growth mode through 2021 and beyond. In this report, we look at the omnichannel initiatives and real estate expansion plans of major warehouse clubs (BJ’s Wholesale Club, Costco and Sam’s Club) and discount variety stores (dollar stores Dollar General and Dollar Tree, as well as discount retailers Big Lots and Five Below) in the US as they aim to attract and retain consumers across the income spectrum.Why It Matters

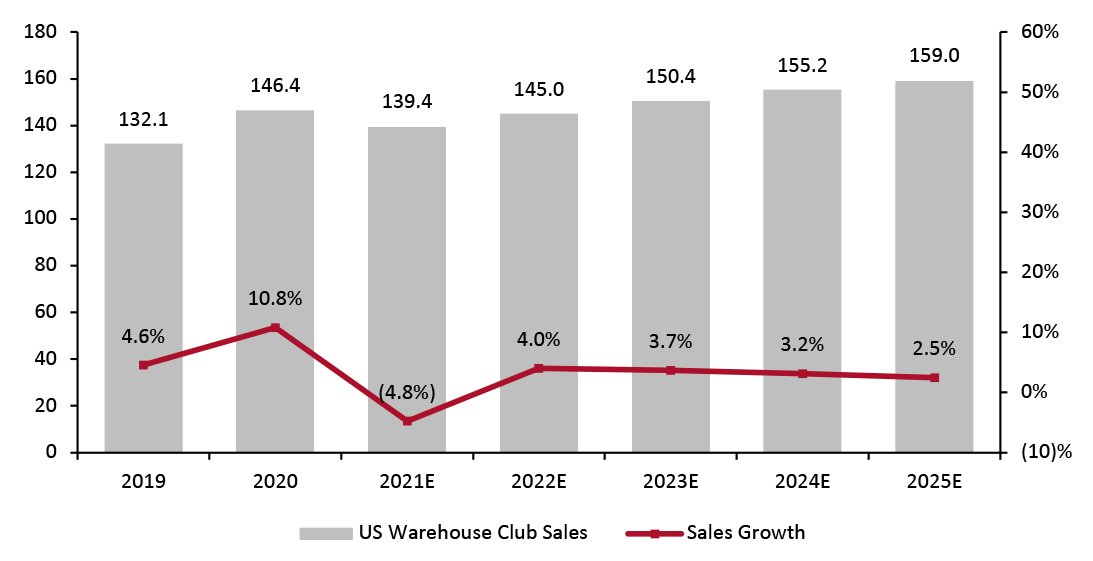

Warehouse clubs and discount variety stores have been major beneficiaries of the pandemic, capitalizing on the shift in spending behavior attracting a broad base of cost-conscious customers: Many consumers have started to trade down amid the economic uncertainty, introducing more new customers to discount variety stores. Grocery goods at these retailers were in high demand in 2020, and the discretionary merchandise category also saw strong momentum. We expect warehouse clubs and discount variety retailers to look to build on that momentum in 2021—bringing e-commerce to the center of their strategies and aggressively pushing forward with store expansion—setting up for continued long-term growth. According to Euromonitor International, the market size of the US warehouse clubs sector reached $146.4 billion in 2020, up 10.8% year over year. With some potential post-crisis normalization in spending, as well as challenging year-over-year comparatives, warehouse clubs are likely to see a decline in 2021. However, the contraction should be temporary, as channel stickiness from the pandemic will support market growth at an estimated CAGR of 3.3% between 2021 and 2025, to reach $159 billion (see Figure 1).Figure 1. US Warehouse Clubs: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_123391" align="aligncenter" width="725"]

Source: Euromonitor International Limited 2021© All rights reserved[/caption]

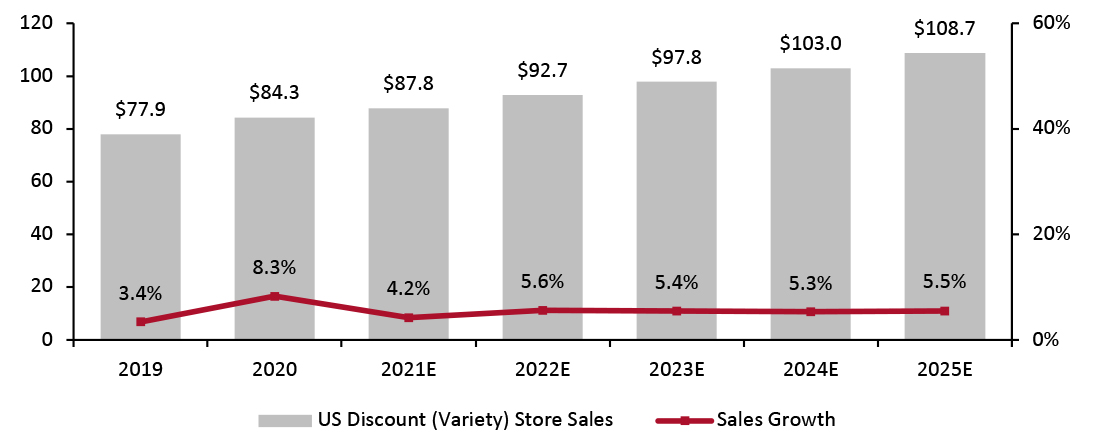

The US discount (variety) store market saw growth of 8.3% to reach $84.3 billion in 2020, and it is projected to reach $108.7 billion in 2025—representing a CAGR of 5.5% in the forecasted period 2021–2025—according to Euromonitor International.

Source: Euromonitor International Limited 2021© All rights reserved[/caption]

The US discount (variety) store market saw growth of 8.3% to reach $84.3 billion in 2020, and it is projected to reach $108.7 billion in 2025—representing a CAGR of 5.5% in the forecasted period 2021–2025—according to Euromonitor International.

Figure 2. US Discount Stores: Total Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_123392" align="aligncenter" width="725"]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

Warehouse Clubs and Dollar Stores Forge Ahead: In Detail

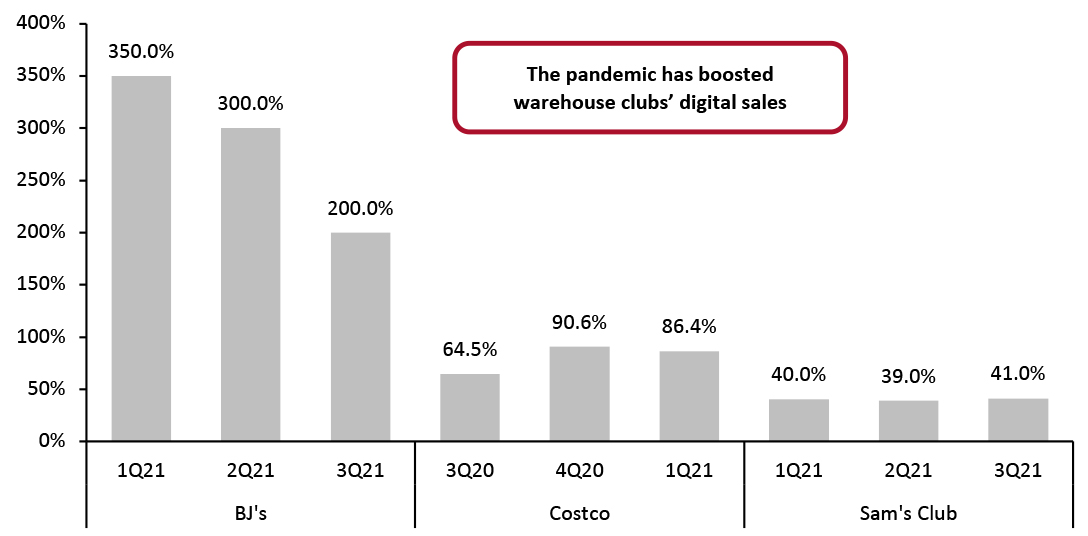

Warehouse Clubs Will Continue To Capitalize on E-Commerce While warehouse club retailers have been slower to embrace e-commerce than many other US retailers, the rapid growth in online demand in the country and growing competition from online pure plays has forced them to make concerted efforts to expand their digital capabilities in recent years. Warehouse clubs have increasingly placed greater emphasis on e-commerce and omnichannel capabilities, which has involved developing same-day and two-day grocery delivery, rolling out BOPIC (buy online, pick up in club) services and opening e-commerce fulfillment centers. Prioritization to build a strong omnichannel infrastructure gave warehouse clubs a significant leg up when the demand for e-commerce skyrocketed in 2020. Customer adoption of pickup and delivery services grew significantly with the onset of the pandemic, leading to a jump in digital sales in major clubs’ latest fiscal quarters.Figure 3. BJ’s Wholesale Club, Costco and Sam’s Club: E-Commerce Growth Rates in Their Latest Fiscal Quarters (YoY % Change) [caption id="attachment_123397" align="aligncenter" width="725"]

BJ’s 3Q21 ended on October 31, 2020; Costco’s 1Q21 ended on November 22, 2020; Sam’s Club’s (Walmart) 3Q21 ended on October 31, 2020

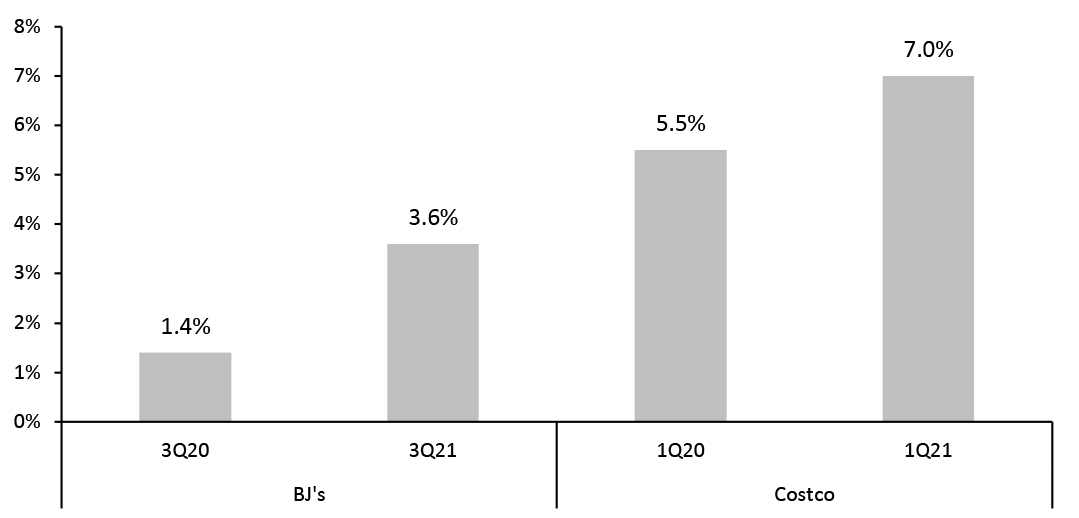

BJ’s 3Q21 ended on October 31, 2020; Costco’s 1Q21 ended on November 22, 2020; Sam’s Club’s (Walmart) 3Q21 ended on October 31, 2020 Source: Company reports [/caption] The exceptional growth of e-commerce rose the in online share of total sales for warehouse clubs. The chart below shows the estimated online share of total sales of BJ’s and Costco in their latest fiscal quarters. Costco’s online share is estimated at approximately 7% in the latest quarter, driven by 84.6% growth in digital sales.

Figure 4. BJ’s Wholesale Club and Costco: E-Commerce Penetration Rates (% of Total Sales) [caption id="attachment_123409" align="aligncenter" width="725"]

BJ’s 3Q21 ended on October 31, 2020; Costco’s 1Q21 ended on November 22, 2020

BJ’s 3Q21 ended on October 31, 2020; Costco’s 1Q21 ended on November 22, 2020 Source: Company reports/Coresight Research [/caption] With stay-at-home trends giving rise to online shopping, warehouse clubs have been making efforts to bolster their omnichannel operations:

- BJ’s Wholesale Club tested curbside-pickup and BOPIC services for fresh items at selected locations in its first quarter of fiscal 2021 (ended May 2, 2020) and launched those services for fresh and frozen grocery items at all its locations by the end of the third quarter (ended October 31, 2020). The company highlighted at the end of its third quarter that its new members are younger and engage more with its digital platform.

- Costco, which resisted offering a curbside-pickup service despite its rise in popularity as a fulfillment service, finally started testing curbside pickup at three stores in Albuquerque, New Mexico in January 2021. The service is fulfilled by Costco employees and offers around 2,000 items, including grocery and nongrocery items. According to the CEO Richard Gallanti, Costco steered clear of the practice earlier because it would reduce impulse buys and could result in a complete pivot in the way customers interact with Costco.

- Sam’s Club (owned by Walmart) was quick to deploy curbside pickup, expanding the service from just 16 locations before Covido its entire fleet of 597 stores by the end of June 2020. To meet the surge in demand for online orders over the holiday season, Sam’s Club announced the launch of a new program, “Ship from Club,” on October 8, 2020, which aimed to expedite order fulfillment by having associates pick items from club inventory to ship directly to customers.

- Big Lots has made significant strides in its omnichannel offerings in the past 12 months. On June 8, 2020, Big Lots took the first step in accelerating its e-commerce strategy by forging a partnership with Instacart. The partnership saw the discount retail chain launch same-day delivery nationwide from nearly 1,400 stores across 47 US states. In July, the company expanded this same-day delivery program by collaborating with on-demand logistics provider PICKUP to allow customers to order bigger and bulkier assortment from their local Big Lots store via biglots.com. Big Lots was also quick to add a curbside-pickup service to all its stores in mid-March when the crisis began to unfold in the US.

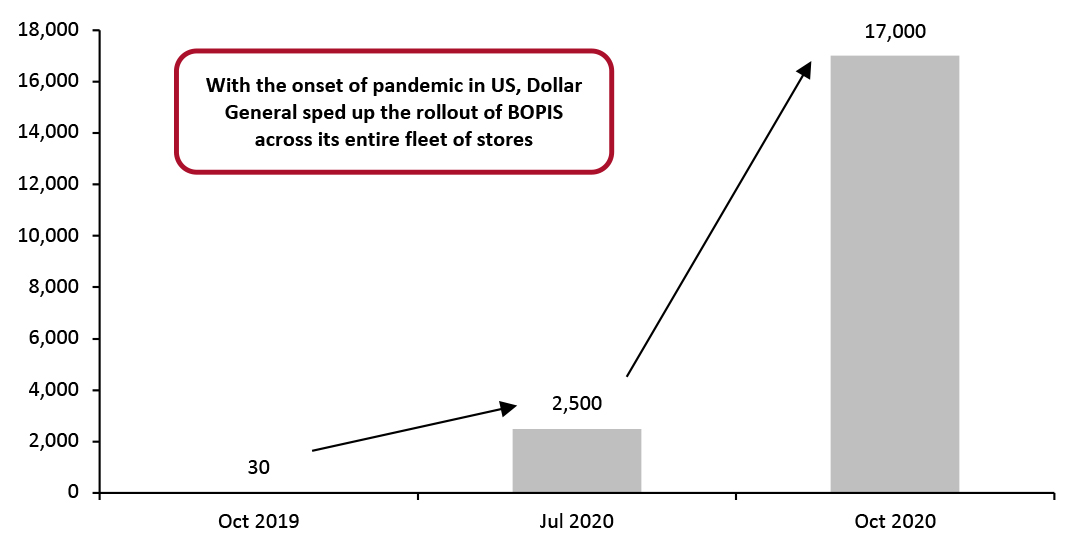

- Dollar General launched a pilot for BOPIS (buy online, pick up in store) services for 30 stores in October 2019 and was considering a more gradual rollout at that time. Since the onset of the pandemic, the company accelerated on this front and introduced the service to 2,500 stores by the end of the second quarter ended August 27, 2020, eventually rolling out the service to all of its 17,000 stores by the end of the third quarter.

Figure 5. Dollar General’s BOPIS Implementation (Number of Stores Offering the Service) [caption id="attachment_123399" align="aligncenter" width="725"]

Source: Company reports[/caption]

Source: Company reports[/caption]

- Dollar Tree launched its first e-commerce website, familydollar.com, in the third quarter ended October 31, 2020, and is testing various delivery options through Instacart and Shipt.

- Five Below is also in the process of expanding into e-commerce. The company launched an app, transitioned Hollar.com’s Ohio e-commerce fulfillment to Five Below and migrated its site to a new platform. Five Below announced a partnership with Instacart in December 2020 to offer same-day delivery and curbside pickup from 300 stores, and the company is also testing BOPIS at 40 stores.

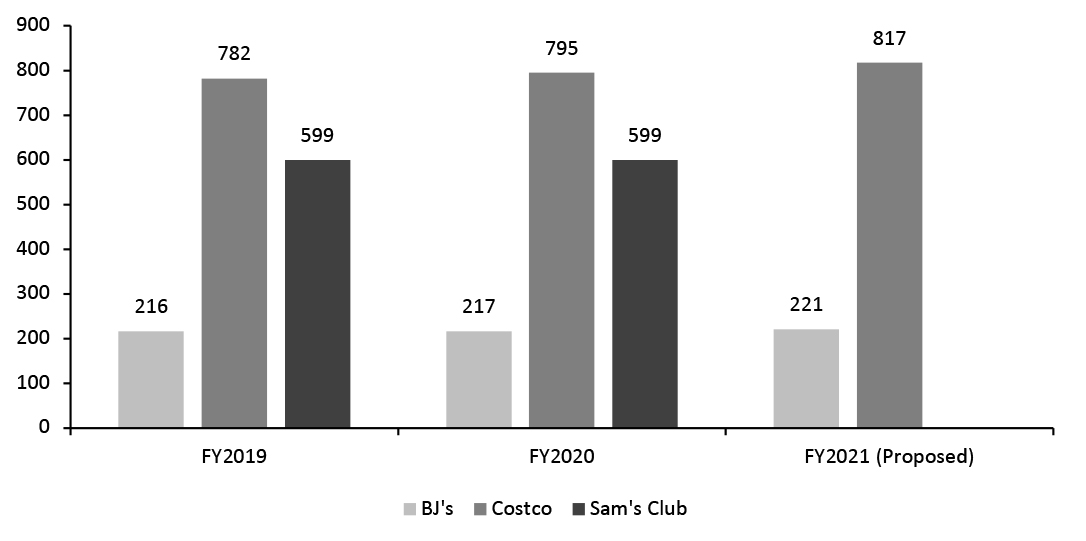

Figure 6. BJ’s, Costco and Sam’s Club Store Count (at Fiscal Year End) [caption id="attachment_123400" align="aligncenter" width="725"]

BJ’s FY2020 ended on February 1, 2020; Costco’s FY2020 ended on August 30, 2020; Sam’s Club’s (Walmart) FY2020 ended on January 31, 2020

BJ’s FY2020 ended on February 1, 2020; Costco’s FY2020 ended on August 30, 2020; Sam’s Club’s (Walmart) FY2020 ended on January 31, 2020 Sam’s Club did not provide new store opening figure for FY2021

Source: Coresight Research [/caption] Discount variety retailers’ real estate plans remain firmly in place, including store portfolio expansion plans:

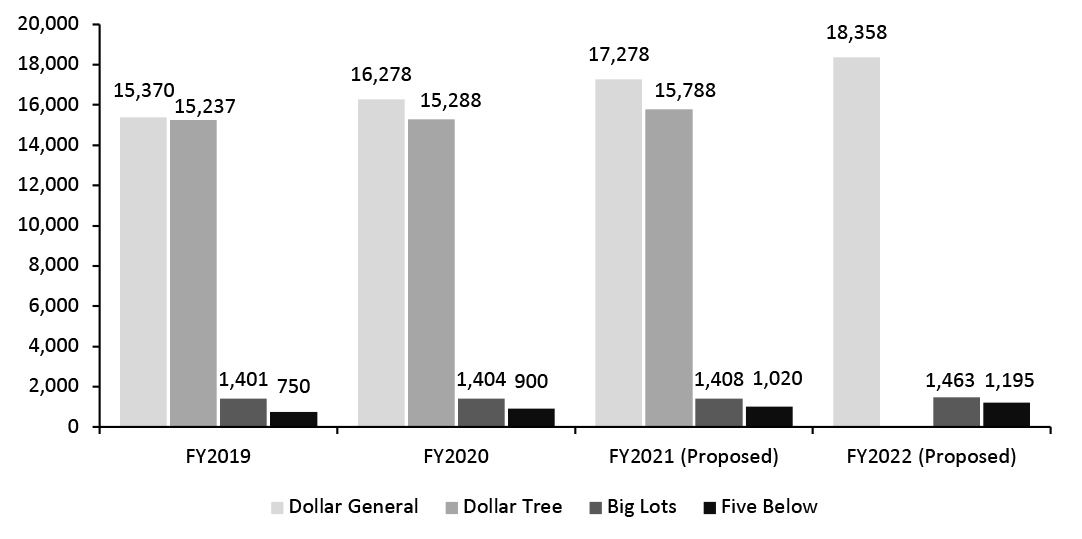

- Big Lots opened 13 new stores in the third quarter ended October 31, 2020 and expected to end fiscal 2021 with a total store count of 1,408. For fiscal 2022, Big Lots plans to open 50–60 new stores.

- Dollar General plans to launch 1,050 new stores and relocate 100 stores in fiscal 2022. The company announced remodels for 1,750 stores to significantly expand its refrigerated and frozen consumable sections—a telling indicator of its future priorities. The company also plans to add 30 new Pop Shelf locations by the end of fiscal 2022.

- Dollar Tree completed more than 550 projects in the third quarter ended October 31, 2020, including 143 new stores, 34 relocations and 371 Family Dollar H2 renovations. For fiscal 2021, the company expected to open 500 new stores (325 Dollar Tree stores and 175 Family Dollar stores) and renovate around 750 stores.

- During the third quarter ended October 31, 2020, Five Below opened 36 new stores across 20 states, bringing its year-to-quarter new store openings to 120. The company planned to end fiscal 2021 with 1,020 stores, representing growth of 13% year over year. For fiscal 2022, the company expects to open 170–180 new stores.

Figure 7. Dollar General, Dollar Tree, Big Lots and Five Below: Store Count (at Fiscal Year End) [caption id="attachment_123401" align="aligncenter" width="725"]

Dollar General’s FY2020 ended on January 31, 2020; FY2020 for Dollar Tree, Big Lots and Five Below ended on February 1, 2020

Dollar General’s FY2020 ended on January 31, 2020; FY2020 for Dollar Tree, Big Lots and Five Below ended on February 1, 2020 Dollar Tree did not provide a new store opening figure for FY2022

Dollar Tree store count includes store openings from the Family Dollar brand

Source: Company reports [/caption]