DIpil Das

What’s the Story?

The recovery of travel in the US from the heavy impacts of the global Covid-19 pandemic is now fully under way, with consumers who have accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. A rebound in travel and associated spending will benefit millions of low-income US workers who were adversely affected by the steep drop-off in travel in 2020. In this report, we examine these benefits and the ripple effects across the entire economy. This report is the final instalment of Coresight Research’s five-part US Travel Recovery series.Why It Matters

The travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis, according to data from the Transportation Security Administration, and restaurants and bars in areas that depend on tourism have been especially impacted. A return to travel through the summer of 2021 would result in welcome gains for tourism-driven retail sectors, as well as helping to bolster the economy as a whole.The Retail Impacts of a Domestic-Focused Travel Surge: In Detail

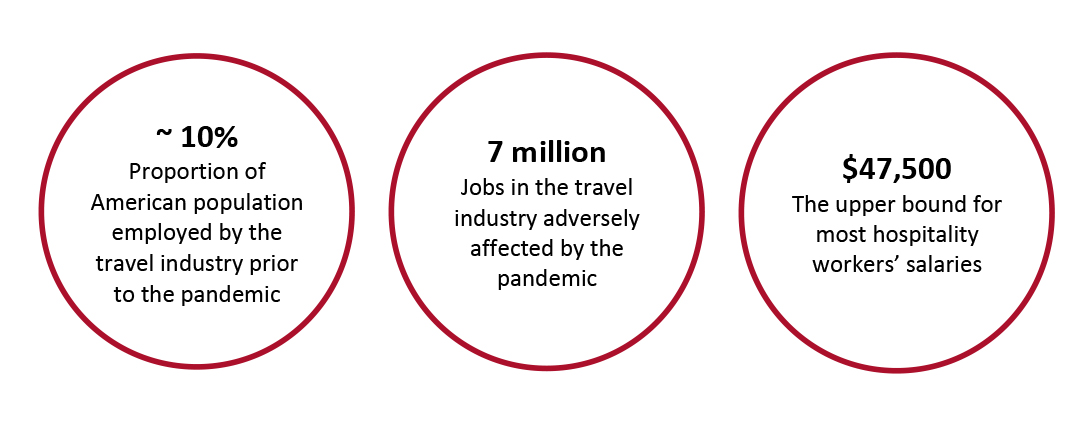

Prior to the pandemic, the travel industry in the US employed roughly one in 10 Americans, according to data from the World Travel and Tourism Council (WTTC). Catastrophic declines in travel in 2020 led to more than 7 million jobs in the industry being adversely affected, according to the WTTC. Workers in the sector tend to fall into lower income brackets: According to ZipRecruiter, most hospitality workers make less than $47,500 a year. Thus, the pandemic has contributed to eroded spending by many low-wage workers in the industry as well as high unemployment among these workers, which persists even a year after the outbreak in the US.Figure 1. An Overview of US Travel Industry Employment [caption id="attachment_130026" align="aligncenter" width="724"]

Source: WTTC/ZipRecruiter/Coresight Research[/caption]

A rebound in travel would boost spending within the industry, but it would also inject more cash and improve the velocity of money in the economy as a whole. Record savings rates during the pandemic led to a catastrophic drop in money velocity in 2020, keeping wealth concentrated in the hands of those who retained their income sources and could afford to hold onto their money.

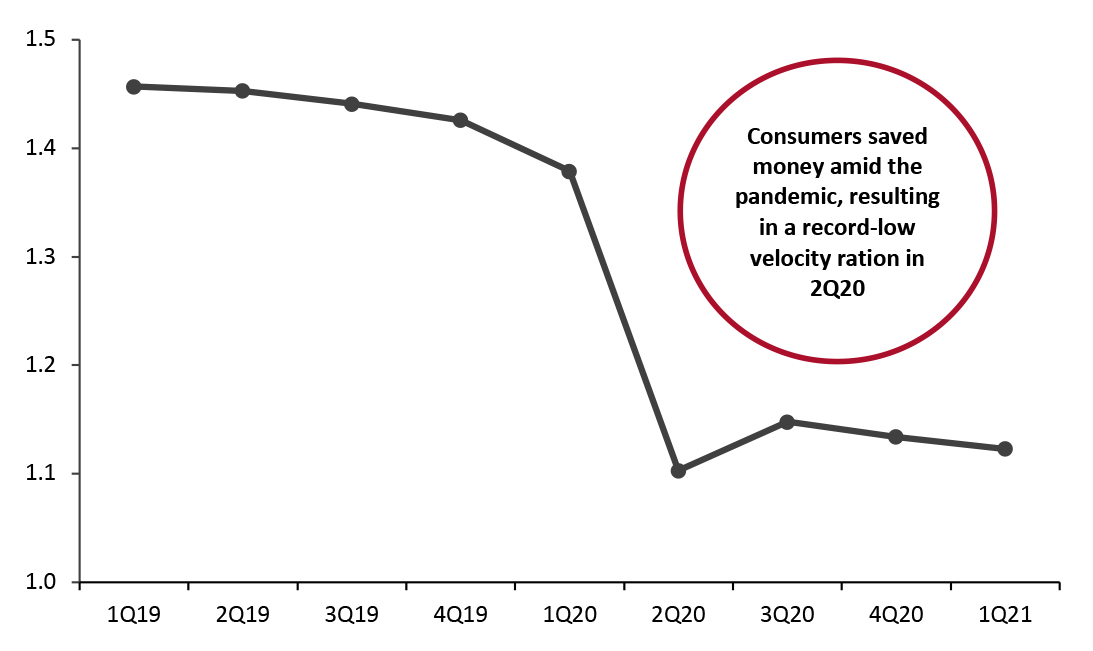

The ratio of velocity (the frequency at which one unit of currency is used to purchase domestically produced goods and services within a given time period) for the M2 money supply, the total amount of money held by the public, provides some insight into whether consumers are saving or spending their money. According to FRED (Federal Reserve Economic Data), this velocity fell to the lowest value ever recorded in the second quarter of 2020, falling by 0.28 from the previous quarter, and remains far below pre-crisis values as of 1Q21, as shown in Figure 2.

Source: WTTC/ZipRecruiter/Coresight Research[/caption]

A rebound in travel would boost spending within the industry, but it would also inject more cash and improve the velocity of money in the economy as a whole. Record savings rates during the pandemic led to a catastrophic drop in money velocity in 2020, keeping wealth concentrated in the hands of those who retained their income sources and could afford to hold onto their money.

The ratio of velocity (the frequency at which one unit of currency is used to purchase domestically produced goods and services within a given time period) for the M2 money supply, the total amount of money held by the public, provides some insight into whether consumers are saving or spending their money. According to FRED (Federal Reserve Economic Data), this velocity fell to the lowest value ever recorded in the second quarter of 2020, falling by 0.28 from the previous quarter, and remains far below pre-crisis values as of 1Q21, as shown in Figure 2.

Figure 2. Velocity of M2 Money Stock (Ratio) [caption id="attachment_130027" align="aligncenter" width="725"]

Source: FRED[/caption]

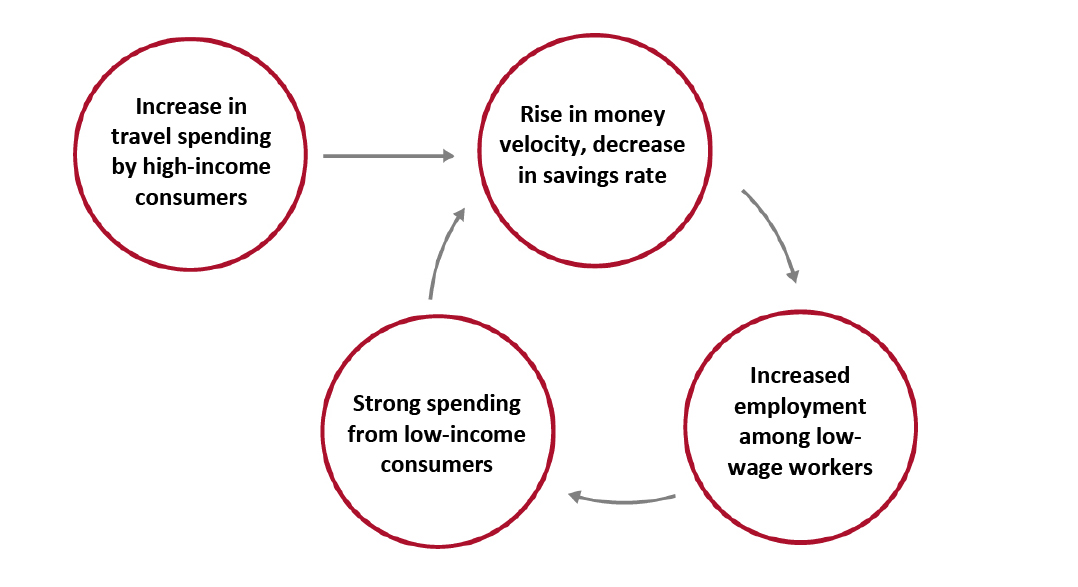

An acceleration of money velocity, led initially by increased travel spending by high-income consumers, will help even out some of the wealth gaps exacerbated by the pandemic, as money flows more freely and low-income workers in rebounding industries benefit from more frequent spending. This initial shift will be reinforced by a jump in spending among low-income travel workers regaining employment, creating a virtuous circle of recovery.

Source: FRED[/caption]

An acceleration of money velocity, led initially by increased travel spending by high-income consumers, will help even out some of the wealth gaps exacerbated by the pandemic, as money flows more freely and low-income workers in rebounding industries benefit from more frequent spending. This initial shift will be reinforced by a jump in spending among low-income travel workers regaining employment, creating a virtuous circle of recovery.

Figure 3. Virtuous Circle of Travel Spending Recovery [caption id="attachment_130028" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

However, dollar and discount stores could be on the wrong side of this trend in the long term. These stores are thriving now as many consumers pinch pennies while they remain out of work, but the return of travel—a major provider of blue-collar jobs—could put enough money in the pockets of current dollar store customers for them to trade up to stores selling at slightly higher price points. Dollar stores are currently expanding rapidly—they account for more than one-third of all store openings that we have tracked so far in 2021—but could be overexpanding, if they are opening new stores under the expectation that high numbers of consumers will remain cost-conscious. It is also worth noting, however, that these stores were expanding aggressively even prior to the pandemic.

Source: Coresight Research[/caption]

However, dollar and discount stores could be on the wrong side of this trend in the long term. These stores are thriving now as many consumers pinch pennies while they remain out of work, but the return of travel—a major provider of blue-collar jobs—could put enough money in the pockets of current dollar store customers for them to trade up to stores selling at slightly higher price points. Dollar stores are currently expanding rapidly—they account for more than one-third of all store openings that we have tracked so far in 2021—but could be overexpanding, if they are opening new stores under the expectation that high numbers of consumers will remain cost-conscious. It is also worth noting, however, that these stores were expanding aggressively even prior to the pandemic.

What We Think

The benefits of an increase in travel stretch far beyond the airline, hospitality and souvenir industry. As jobs come back in these industries, a virtuous circle of spending will begin, propelling all areas of the economy to greater heights and likely improving the performance of retail as a whole. Implications for Brands/Retailers- As a labor shortage rather than surplus now dominates and jobs spring back in the travel industry, retailers can expect improved demand from lower-income consumers.

- Dollar and discount stores thrived during the pandemic but may soon see their growth slow as financial situations improve for low-income workers, many of whom faced financial hardship during the pandemic and turned to low price-point retailers but will soon see more cash in their pockets, boosting their spending and potentially encouraging them to trade up to higher-price-point stores.