DIpil Das

What’s the Story?

The recovery of travel in the US from the heavy impacts of the global Covid-19 pandemic is now fully under way, with consumers who have accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. Inbound international travel will be the final piece of the puzzle to form a full rebound of leisure travel spending in the US but will depend heavily on the pace of vaccination rollouts in other countries. We analyze the slow rebound of international travel and its impacts on US retail. This report is the fourth in Coresight Research’s five-part US Travel Recovery series.Why It Matters

The travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis, according to data from the Transportation Security Administration, and restaurants and bars in areas that depend on tourism have been especially impacted. A return to travel through the summer of 2021 would result in welcome gains for tourism-driven retail sectors, as well as helping to bolster the economy as a whole.The Slow Rebound of International Travel: In Detail

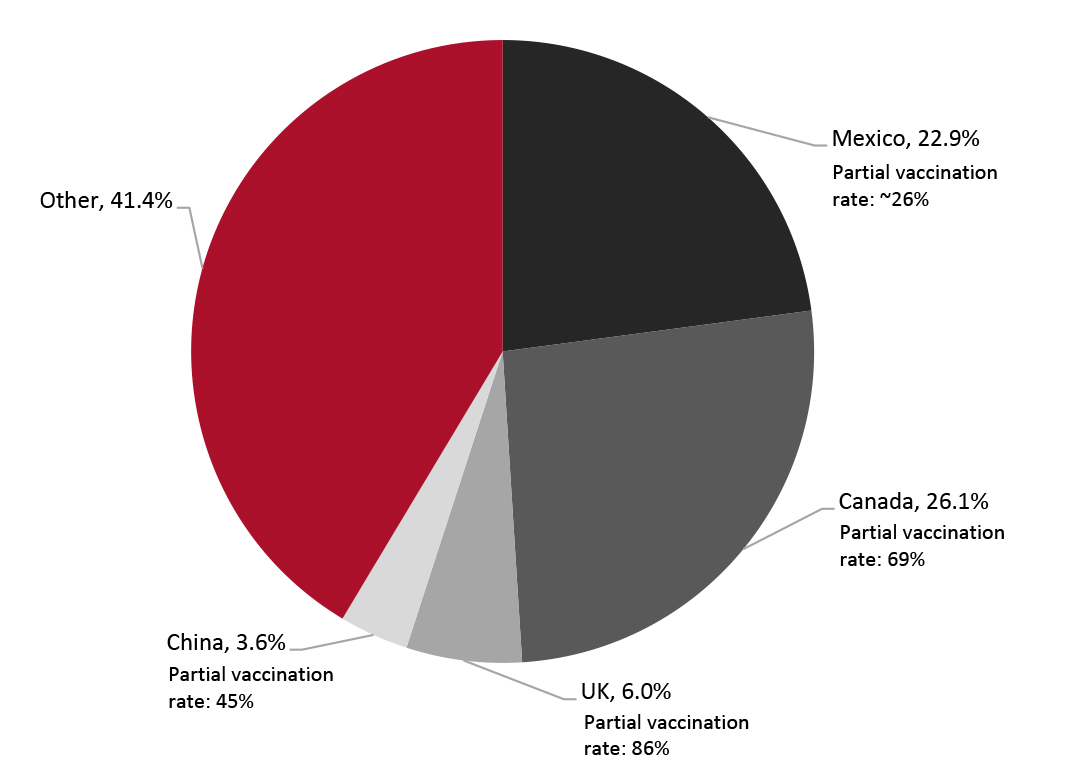

The return of international travel will be the final segment of a full recovery in leisure travel in the US. Vaccination rollouts in other countries have significant impacts on inbound tourism to the US, and these vary widely across the nation’s main travel partners. The UK, the third-biggest contributor of tourists to the US, has so far executed its rollout well, but China, Mexico and Canada are lagging behind (see Figure 1). Travelers from the UK made up just 6% of all international visitors to the US in 2019, pre-pandemic, according to the US Travel Association. Canada and Mexico, on the other hand, made up a combined 49% of all inbound tourism to the US (see figure below). Tighter travel controls within North America will likely continue until each country has controlled the spread of Covid-19, which should postpone a recovery in international travel until fall 2021 or later. Canadian and Mexican travelers to the US tend to visit and spend at a more diverse array of locations than their counterparts from overseas, according to data from the US Travel Association—making the recovery of travel from the US’s neighbors key to a unified national recovery.Figure 1. Inbound US Travel Share in 2019 (% of Tourists) and Partial Vaccination Rate as of July 7, 2021 (% of Population), by Country [caption id="attachment_129906" align="aligncenter" width="725"]

Source: US Travel Association/Gov.uk/The New York Times [/caption]

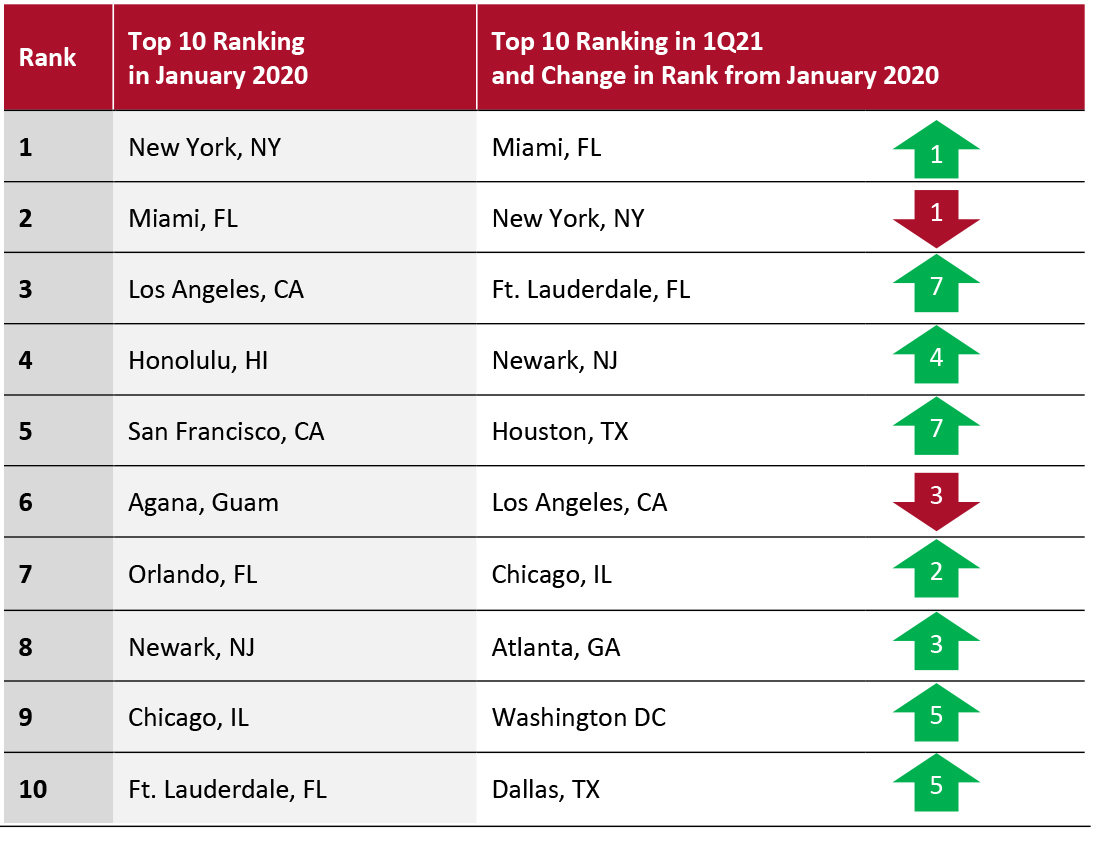

A reduction in the number of international travelers from overseas destinations in Europe (including the UK) and Asia has drastically reduced the proportion of inbound travelers entering through traditional tourist hubs such as New York, Honolulu, Los Angeles and San Francisco, while destinations in more southern states have seen more consistent travel from Central and South America.

Source: US Travel Association/Gov.uk/The New York Times [/caption]

A reduction in the number of international travelers from overseas destinations in Europe (including the UK) and Asia has drastically reduced the proportion of inbound travelers entering through traditional tourist hubs such as New York, Honolulu, Los Angeles and San Francisco, while destinations in more southern states have seen more consistent travel from Central and South America.

Figure 2. Top 10 International Ports of Entry to the US*, January 2020 vs. 1Q21 [caption id="attachment_129907" align="aligncenter" width="724"]

*By traffic, with Rank 1 representing the port through which the most people have entered the US

*By traffic, with Rank 1 representing the port through which the most people have entered the US Source: US Department of Commerce [/caption] The UK’s swift vaccinations will likely boost travel from the country to the US in the near future, especially to tourist destinations such as New York and Los Angeles, which have been hit hard by the pandemic. A normalization of travel relations between the UK and the US will help push the above rankings back toward normalcy but represents only a small first step. Travel from China is trickier to forecast. While the nation is vaccinating steadily, the sheer number of people in the country and lower efficacy rates of Chinese-developed vaccines mean that the country has a long way to go. Ensuring a return to normal travel relations between the US and China will be of paramount importance to retailers in the US—again, particularly in major coastal cities where Chinese consumers typically concentrate their travel spending. International travelers in New York as of 2017 spent on average four times as more than their domestic tourist counterparts, according to the New York City Board of Tourism, NYC & Company. Until tourists from China return to the US, other cities that rely more on domestic tourism spending than international spending will drive growth in the US market. New York City, the US city that generates the most travel and tourism GDP, typically relies on international tourism for 45% of spending, according to estimates on 2019 tourism from the World Travel and Tourism Council. Orlando, the city contributing the second-most travel and tourism GDP, relies on international travelers for just 13% of demand, instead seeing its tourism mostly from a thriving domestic tourist market, poising it and other cities like it for a far speedier tourism recovery.

What We Think

As virus concerns remain prevalent in other areas of the world more so than in the US, the outlook for international travel remains unclear and somewhat pessimistic, hampering a full recovery of the travel industry. The coupled speedy vaccine rollouts in the UK and US will soon bring welcome tourists back from one of the US’s top travel partners, but full recovery on international spending will move more slowly and depend on the resumption of normal travel patterns from Mexico, Canada and China. Implications for Brands/Retailers- While large coastal cities have come a long way from the depths of the pandemic, their reliance on international travel continues to impede their full economic recoveries: retailers cannot go back to a flagship store model in many of these areas, at least for the foreseeable future.