DIpil Das

What’s the Story?

The recovery of travel in the US from the heavy impacts of the global Covid-19 pandemic is now fully under way, with consumers who have accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. We are likely to see a strong pickup in domestic travel in the summer of 2021. Using proprietary US consumer survey findings, we examine how this trend will impact US retail spending across luxury goods, souvenirs and at travel retail locations. This report is the third in Coresight Research’s five-part US Travel Recovery series.Why It Matters

The travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis, according to data from the Transportation Security Administration, and restaurants and bars in areas that depend on tourism have been especially impacted. A return to travel through the summer of 2021 would result in welcome gains for tourism-driven retail sectors, as well as helping to bolster the economy as a whole.Exploring the Domestic-Focused Travel Surge: In Detail

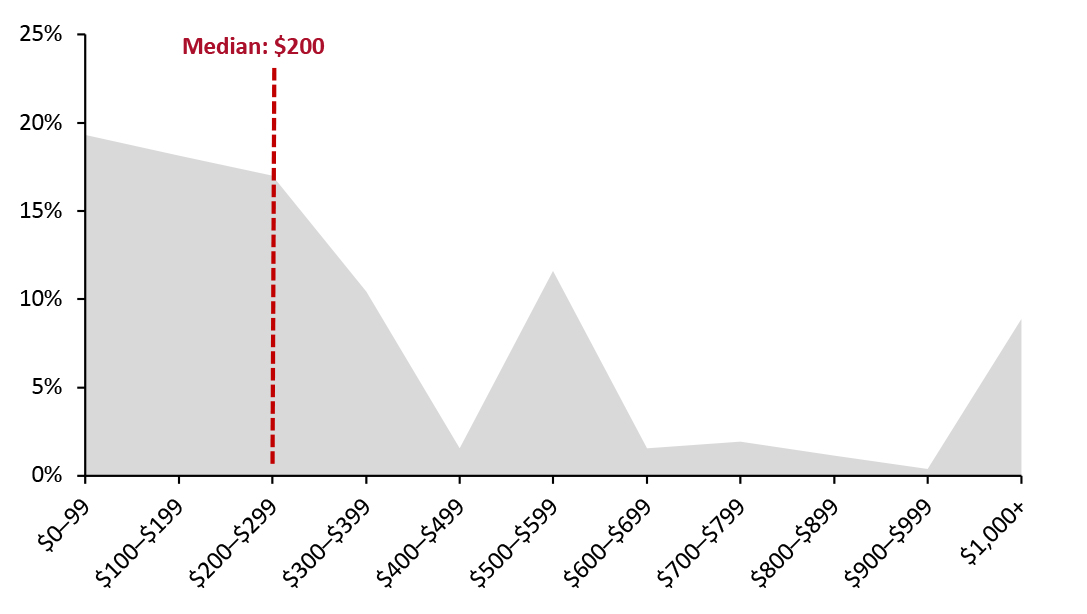

Coresight Research’s survey of US consumers conducted on May 10, 2021, found that 62% of respondents reported plans to travel during the summer (until September 21). Unsurprisingly, these travel plans were disproportionately skewed toward domestic travel, with just 7.4% of consumers indicating that they plan to travel internationally. Among consumers that plan to travel, the median expected spend on retail products during travel was $200 (the average was $534, skewed by a small number of very high spend expectations).Figure 1. US Travelers’ Expectations To Spend on Retail Products During the Summer 2021 [caption id="attachment_129883" align="aligncenter" width="726"]

Our survey specified the summer period as May 10–September 21, 2021

Our survey specified the summer period as May 10–September 21, 2021 Base: 259 US respondents aged 18+ who plan to travel (whether domestically or internationally) by September 21, 2021, surveyed on May 10, 2021

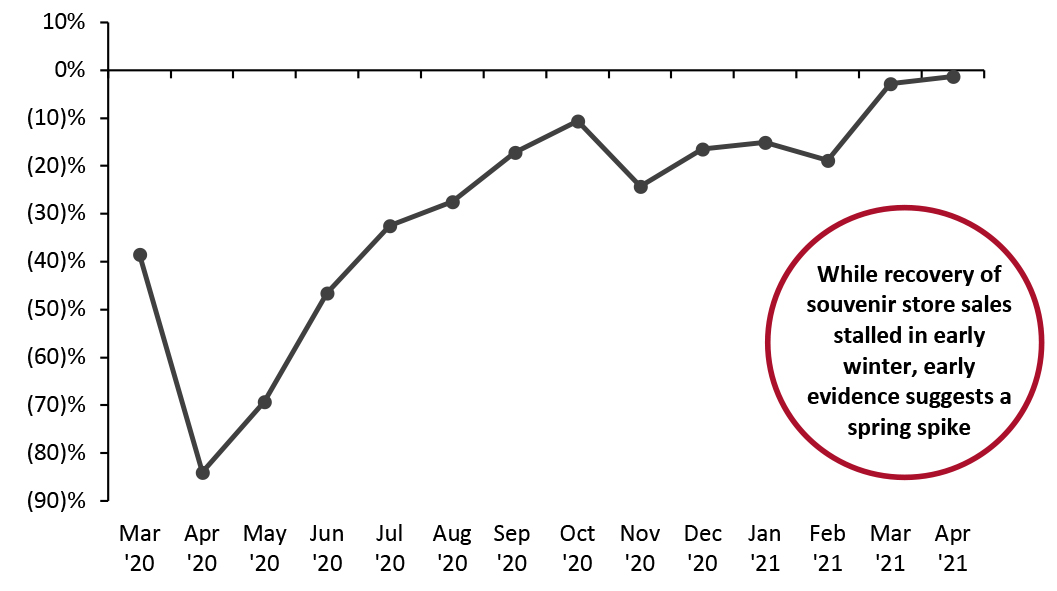

Source: Coresight Research [/caption] The most obvious beneficiaries will be retailers that cater directly and almost exclusively to tourists: gift, novelty and souvenir stores. These retailers’ sales took a drastic hit at the beginning of the pandemic, falling more than 80% year over year in April, but have since been on a largely steady path of recovery, according to US Census Bureau Data. After stalling during the early winter, souvenir store sales saw sales spike in March and April 2021, almost reaching 2019 values (see Figure 2).

Figure 2. US Gift, Novelty and Souvenir Store Sales (% Change from 2019 Values) [caption id="attachment_129891" align="aligncenter" width="724"]

Source: US Census Bureau[/caption]

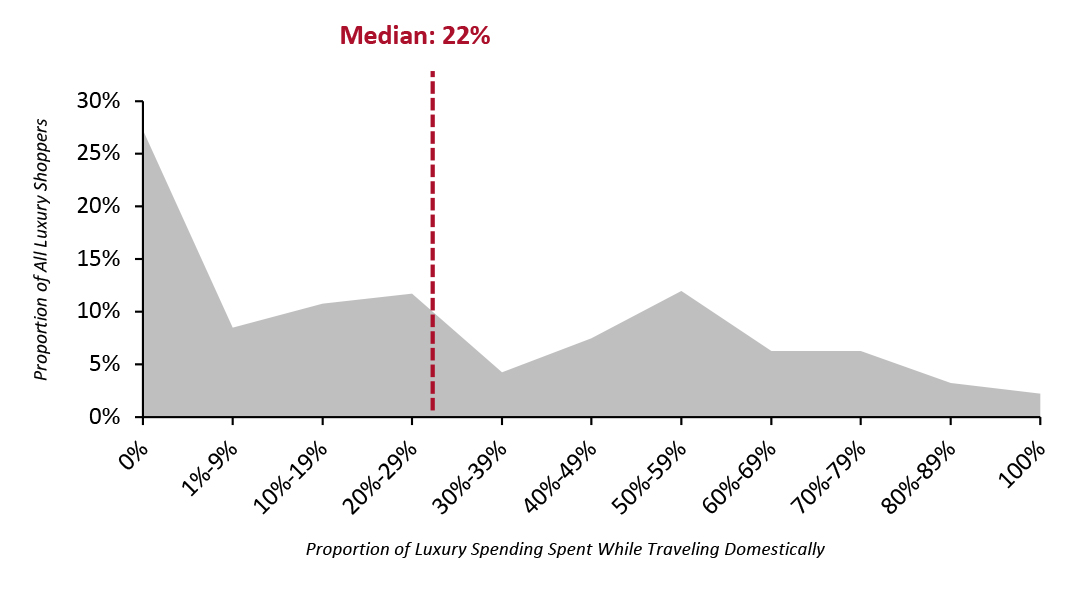

Luxury retail should also see significant growth as travel picks up, even before international travel fully resumes. US consumers tend to spend heavily on luxury while traveling domestically, according to the results of a survey we conducted in June 2020 on luxury retail. As indicated by the figure below, the median US luxury shopper spends 22% of their overall luxury budget while traveling domestically.

Source: US Census Bureau[/caption]

Luxury retail should also see significant growth as travel picks up, even before international travel fully resumes. US consumers tend to spend heavily on luxury while traveling domestically, according to the results of a survey we conducted in June 2020 on luxury retail. As indicated by the figure below, the median US luxury shopper spends 22% of their overall luxury budget while traveling domestically.

Figure 3. US Luxury Shoppers: Proportion of Luxury Spending Spent While Traveling Domestically (% of Respondents) [caption id="attachment_129885" align="aligncenter" width="725"]

Base: US consumers aged 18+ who had purchased luxury products in the past 12 months, surveyed in June 2020

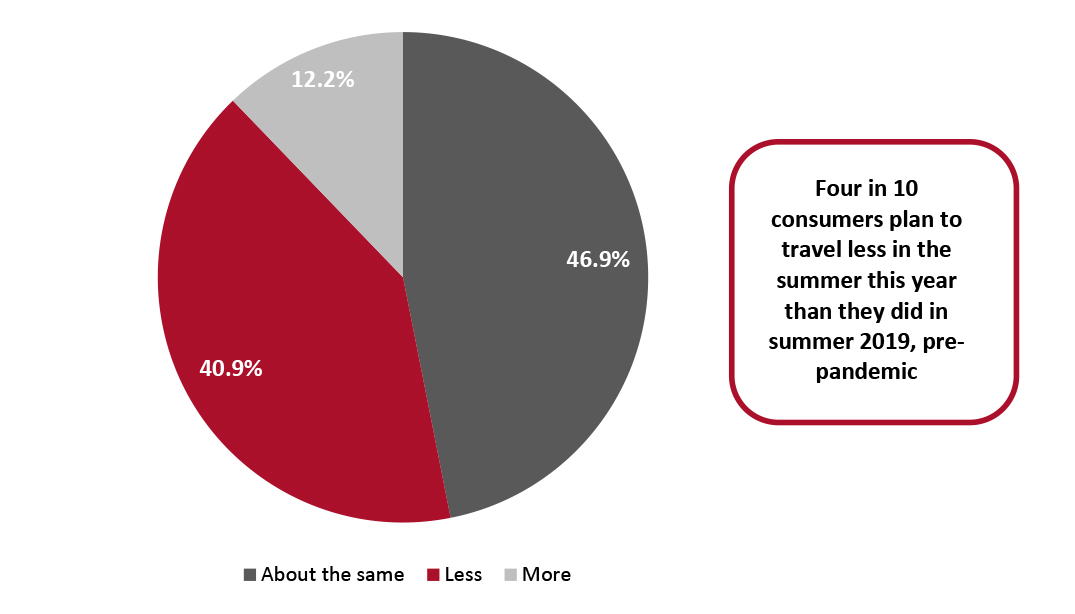

Base: US consumers aged 18+ who had purchased luxury products in the past 12 months, surveyed in June 2020 Source: Coresight Research [/caption] As luxury retailers see a major boost, so will travel retail formats—stores in airports and other travel centers that see direct benefits from increases in travelers. We estimated in 2019 that US airport retail accounted for $44 billion in sales. In 2020, we estimate that sales fell to around $17 billion—a more than 60% year-over-year drop. Even if travel recovers no further this year, we expect to see growth of nearly $10 billion in airport retail sales in 2021 versus 2020. More likely is that travel will rebound significantly over the summer, leading to an even bigger rebound in travel retail. The rebound, while guaranteed to be very impressive when compared to 2020 levels, may still be underwhelming compared to pre-pandemic travel. Just 12.2% of consumers plan to travel more than they did in 2019, with 40.9% of consumers indicating that they plan to travel less than they did before the pandemic, as illustrated by the figure below.

Figure 4. All Respondents: Travel Plans* During the Summer 2021 Compared to 2019 Travel in the Comparable Period (% of Respondents) [caption id="attachment_129886" align="aligncenter" width="725"]

*Includes both domestic and international travel

*Includes both domestic and international travel Our survey specified the summer period as May 10–September 21, 2021

Base: 418 US respondents aged 18+, surveyed on May 10, 2021

Source: Coresight Research [/caption] While a rebound in travel and related spending will certainly boost the fortunes of travel, luxury, apparel, footwear and accessories, and souvenir retailers, the summer bounce will not be an instant return to pre-pandemic travel.

What We Think

Many US consumers are staying closer to home and within the country when travelling, boosting domestic spending. We expect the burgeoning recovery of novelty and souvenir store sales to continue, accompanied by a $10 billion or more recovery in travel retail spending and a growing base of traveling luxury shoppers. Implications for Brands/Retailers- Luxury retailers can expect a strong summer despite a still low number of inbound international tourists, as US consumers already spend well on luxury while traveling domestically and are likely to ramp up spending further this summer.

- Retailers should expect a strong, but not unprecedented, summer of travel-related spending, because although most consumers plan to travel more than during the pandemic, the majority do not plan to travel more than pre-crisis.