DIpil Das

What’s the Story?

The recovery of travel in the US from the heavy impacts of the global Covid-19 pandemic is now fully under way, with consumers who have accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. Consumers all over the country are now planning trips at nearly equal rates, indicating that the regional differences in travel seen through most of the pandemic are likely to dissipate as we move into summer. We discuss this trend and its implications for retail, using proprietary survey findings to assess US consumer sentiment and behavior. This report is the second in Coresight Research’s five-part US Travel Recovery series.Why It Matters

The travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis, according to data from the Transportation Security Administration, and restaurants and bars in areas that depend on tourism have been especially impacted. A return to travel through the summer of 2021 would result in welcome gains for tourism-driven retail sectors, as well as helping to bolster the economy as a whole.What Do Dissipating Regional Travel Differences Mean for Retail?: In Detail

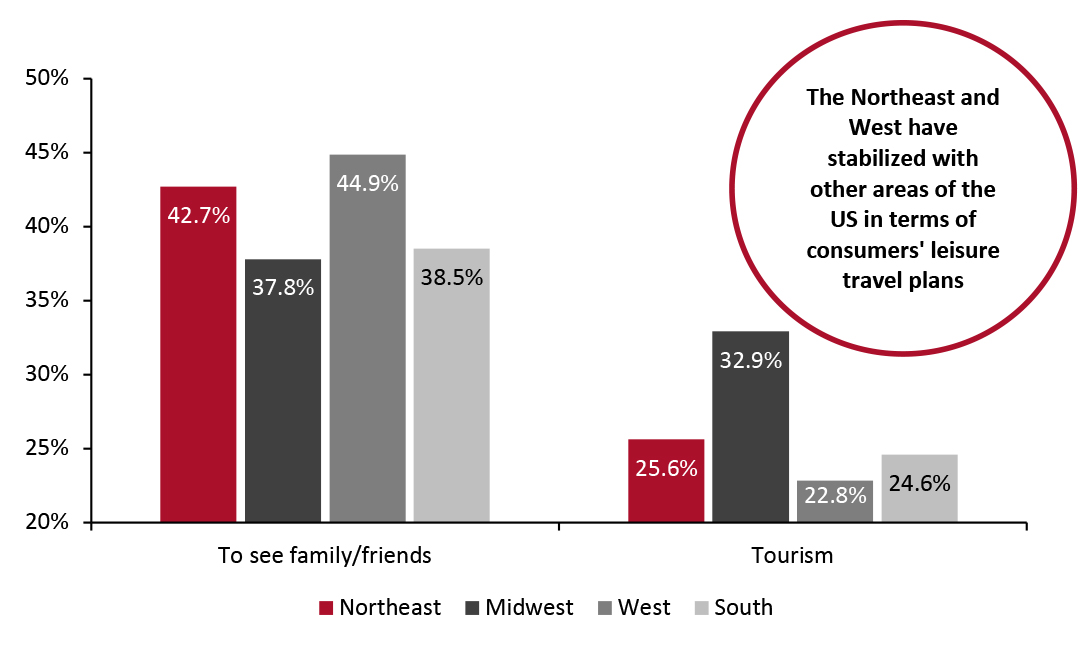

When we first discussed the bounceback of travel in our April 2021 report, we noted that initial recovery was starkly divided by region: Areas in the southern US were seeing a stronger, faster rebound in travel and related spending than the rest of the country, particularly the Northeast and West, which opened more slowly. However, we predicted that these regional differences would dissipate through the summer, and findings from our May 10 survey on US consumers’ summer travel plans suggest that this erosion of regional differences is indeed occurring. The proportions of respondents that reported plans to travel for leisure between May and September 2021—either to see family and friends or for tourism—are relatively similar across the country (see Figure 1).Figure 1. All Respondents: Selected Reasons for Planned Travel* During the Summer 2021, by Region (% of Respondents in Each Region) [caption id="attachment_129821" align="aligncenter" width="726"]

*Includes both domestic and international travel

*Includes both domestic and international travel Our survey specified the summer period as May 10–September 21, 2021

Base: 418 US respondents aged 18+, surveyed on May 10, 2021

Source: Coresight Research [/caption] These nearly equal levels in planned travel will still take some time to level the geographic disparities we noted in our previous report. For example, as shown in the figure below, there remain clear restaurant traffic variations by state.

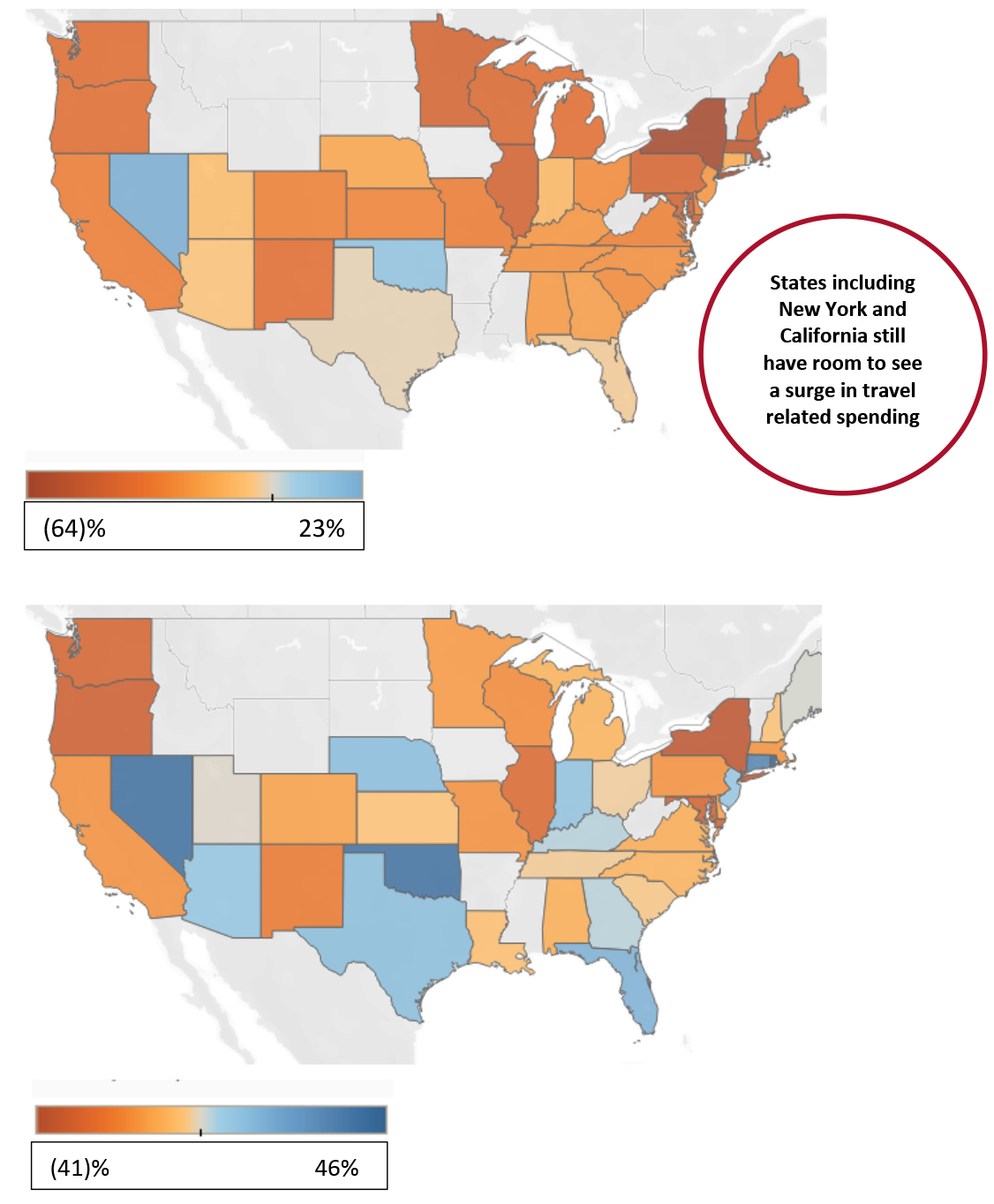

Figure 2. Seated Diners by State: Seven-Day Average at Reopened Restaurants of April 16, 2021 (Top) vs. May 26, 2021 (Bottom) (% Change from Pre-Pandemic 2019) [caption id="attachment_129830" align="aligncenter" width="725"]

Source: OpenTable[/caption]

States such as California and New York have major room for growth in domestic travel-related expenditure, as indicated by the continued lower levels of restaurant traffic shown above. We still expect these remaining regional differences to fade almost entirely by the end of the summer.

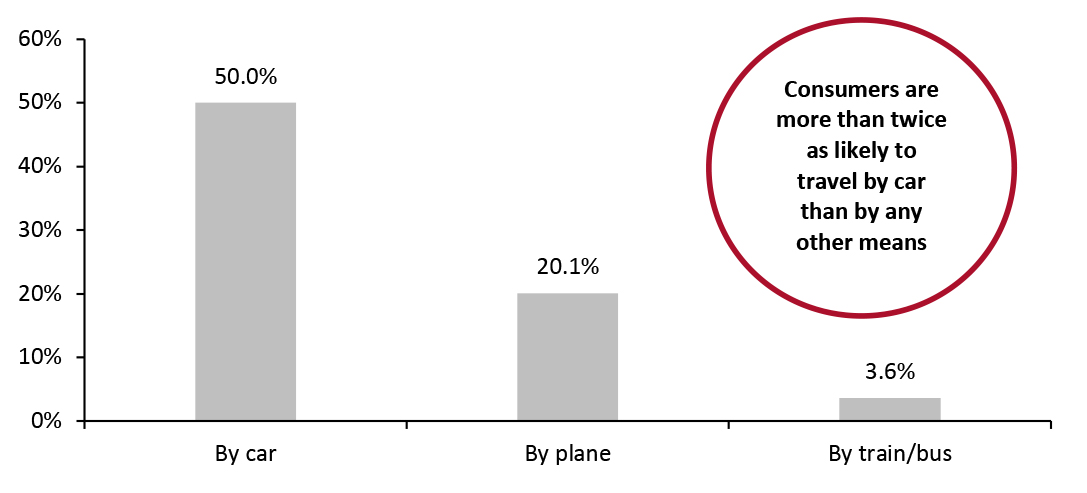

What may continue, sparking certain regional readjustments, is a focus on travel by car rather than by plane, train or bus. As shown in Figure 3, half of all consumers plan to travel domestically by car between May 10 and September 21, while only one-fifth plan to travel domestically by plane and very few consumers plan to travel by train or bus.

Source: OpenTable[/caption]

States such as California and New York have major room for growth in domestic travel-related expenditure, as indicated by the continued lower levels of restaurant traffic shown above. We still expect these remaining regional differences to fade almost entirely by the end of the summer.

What may continue, sparking certain regional readjustments, is a focus on travel by car rather than by plane, train or bus. As shown in Figure 3, half of all consumers plan to travel domestically by car between May 10 and September 21, while only one-fifth plan to travel domestically by plane and very few consumers plan to travel by train or bus.

Figure 3. All Respondents: Planned Travel* During the Summer 2021, by Transport Mode (% of Respondents) [caption id="attachment_129823" align="aligncenter" width="725"]

*Includes both domestic and international travel

*Includes both domestic and international travel Our survey specified the summer period as May 10–September 21, 2021

Base: 418 US respondents aged 18+, surveyed on May 10, 2021

Source: Coresight Research [/caption] While the propensity for consumers to travel by region are converging, this lean toward traveling by car indicates that they are still more likely to travel to nearby destinations through the summer rather than venturing further by train or plane.

What We Think

As consumers across the country now have relaxed their fears of the pandemic to an increasingly large and equal (by region) degree, we expect to see the resumption of more normal patterns in the frequency with which consumers travel. However, keeping these trips closer to home will continue a pandemic-driven shift in travel habits. Implications for Brands/Retailers- Retailers should prioritize their regional, rather than national, hubs as consumers keep travel plans closer to home.

- Large cities that typically attract consumers from far away regions of the country are likely to continue to see lower retail traffic.