DIpil Das

What’s the Story?

The recovery of travel in the US from the heavy impacts of the global Covid-19 pandemic is now fully under way, with consumers who have accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. Consumers eager to get back to vacationing are flooding back to airports, but business travelers now accustomed to digital meeting tools seem to be in no rush to return. In this report, we discuss these dichotomous recovery patterns of leisure travel versus business trips, using proprietary survey findings to assess US consumer sentiment. This report is the first of Coresight Research’s five-part US Travel Recovery series.Why It Matters

The travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis, according to data from the Transportation Security Administration, and restaurants and bars in areas that depend on tourism have been especially impacted. A return to travel through the summer of 2021 would result in welcome gains for tourism-driven retail sectors, as well as helping to bolster the economy as a whole.A Dichotomous Return to Leisure and Business Travel: In Detail

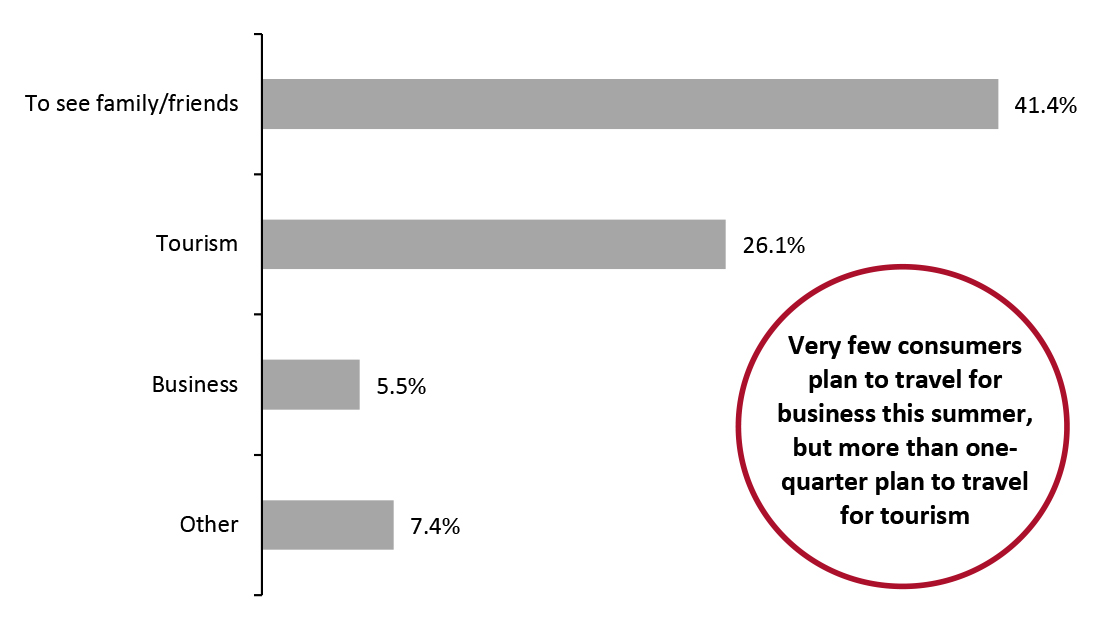

The rise of online meeting platforms and other digital tools for business communication has made much of corporate travel unnecessary. Companies are likely to continue to take advantage of these digital channels to reduce transportation costs and boost efficiency while also limiting the risk of employees being exposed to Covid-19 (thus also protecting corporate image). As such, Coresight Research’s survey of US consumers, conducted on May 10, found that only 5.5% of respondents planned to travel for business—both domestically and internationally) over the summer (see Figure 1). Retailers that cater to business travelers are therefore unlikely to see a return to spending levels seen prior to the pandemic in the near- to mid-term future, posing a continued threat to the 2.5 million jobs that relied on business travel prior to the pandemic, according to the US Travel Association. On the other hand, consumers are ramping up leisure travel, with plans to visit to family and friends and for tourism purposes far outpacing any expected return to business travel this summer, as shown in the figure below.Figure 1. All Respondents: Reason for Planned Travel During the Summer 2021 (% of Respondents) [caption id="attachment_129800" align="aligncenter" width="725"]

*Includes both domestic and international travel

*Includes both domestic and international travel Our survey specified the summer period as May 10–September 21, 2021;

Base: 418 US respondents aged 18+, surveyed on May 10, 2021

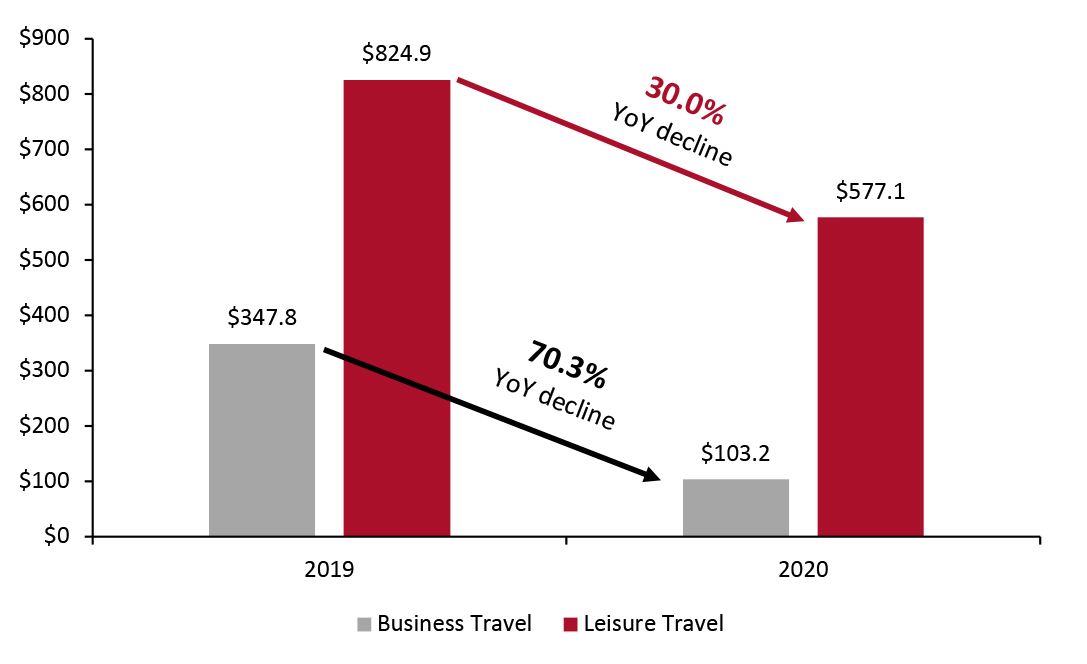

Source: Coresight Research [/caption] Pre-pandemic, business travelers made up just 12% of airline passengers but were typically twice as profitable as leisure travelers, accounting for up to 75% of certain airlines’ revenues, according to a study released in October 2020 by Trondent Development Corporation. In 2019, the average spend per trip for business travelers was $595, more than 60% higher than the average spend per trip by leisure travelers, at $366, according to the US Travel Association. As a result, the decline in business trips in 2020 had an outsized negative impact on spending (see Figure 2)—and we do not expect spending to recover in 2021.

Figure 2. Total Spend on Travel by Type (USD Bil.) [caption id="attachment_129777" align="aligncenter" width="725"]

Source: US Travel Association[/caption]

Moving through the rest of 2021, higher levels of domestic leisure travel and rising prices will fight a continuous battle against the struggles of business travel to bring travel revenues back to 2019 levels.

Source: US Travel Association[/caption]

Moving through the rest of 2021, higher levels of domestic leisure travel and rising prices will fight a continuous battle against the struggles of business travel to bring travel revenues back to 2019 levels.

What We Think

Any rebound in business travel will be both slower and less extensive than the recovery in leisure travel. In addition, while a decline in leisure travel means that consumers are free to spend the money they would have spent on travel on other items and experiences, business travel often comes at the expense of companies, not individuals, making it unlikely that we will see this money shift to other consumer-facing industries. However, the very strong ongoing rebound in leisure travel should do a decent job of compensating for this lost spending. Implications for Brands/Retailers- Retailers in business districts of major corporate hubs are likely set to see a continued slow recovery and may consider a major pivot if they have not done so already.