Web Developers

On December 22, President Donald Trump signed the Tax Cuts and Jobs Act, which lowers income taxes for most consumers, slashes the corporate tax rate and encourages repatriation of overseas profits by US firms by imposing a “deemed repatriation” charge.

Retail Can Gain from Lower Income Taxes and Reduced Corporate Taxes

The Tax Cuts and Jobs Act includes four key changes that will impact retail in the US. First, the law lowers income tax rates for all but the lowest-income households (those earning less than $9,525 per year). Second, it approximately doubles the standard deduction, which is the amount that can be earned tax-free (not all taxpayers use the standard deduction—some offset their tax bill by itemizing individual expenses). Third, it lowers the corporate tax rate from 35% to 21%. Fourth, it makes companies’ overseas profits subject to a deemed repatriation charge of 15.5% for cash and cash equivalents and 8% for reinvested earnings, eliminating the tax benefits of keeping profits offshore. The law includes other notable elements, such as allowing companies to immediately expense short-lived capital investments, which we discuss at the end of this report. We anticipate that retailers will see the following benefits as a result of the new tax law: At least some of the gains from changes to income tax rates and the standard deduction are likely to flow to retailers of discretionary goods, accelerating retail.- sales growth in 2018. The near doubling of the standard deduction is likely to benefit lower- and middle-income households most, as more-affluent households tend to itemize their deductions, according to the Tax Foundation. This suggests that retailers catering to the lower- and middle-income segments stand to gain. In 2018, income taxes would be reduced by $1,610 on average, boosting after-tax income by 2.2%, on average, according to the nonpartisan Tax Policy Center.

- Tax reform will gift domestic companies sharply reduced corporate tax rates. According to The Wall Street Journal, equity analysts are anticipating an average 15% earning-per-share lift in the retail sector. And, according to Loop Capital Markets, as cited by The Wall Street Journal, Amazon, Dollar General, Best Buy, Ulta and Williams-Sonoma will see the biggest incremental free cash flow from the corporate tax cuts. However, retailers that are loss-making will enjoy no benefit from the change.

- Tax reform will drive the repatriation of overseas profits by US companies, although such profits will be taxed. This provides an opportunity for retailers that undertake such repatriation to use that cash to invest in their stores and services. However, some retailers will face a net negative impact because their overseas profits will be so high that the domestic corporate tax cuts will not offset the repatriation charge.

Tax Changes Could Prompt a Virtuous Circle if Retailers Invest Their Gains in “Better Retail”

We see the major reform of US tax law as a meaningful supporting factor for brick-and-mortar retailers this year. In the best case, the changes to income and corporate taxes could yield a virtuous circle, whereby shoppers’ increased spending and retailers’ lower taxes result in investments in “better retail” by legacy brick-and-mortar operators. Such investments would strengthen many retailers’ positions when competing against newer rivals, including Amazon. Legacy retailers could choose to spend on upgrading store environments, lowering prices, investing in store staff, enhancing marketing, or improving omnichannel services such as mobile offerings or in-store technologies. All of this, of course, depends on retailers being willing to invest in their propositions, rather than simply cashing their gains.

Source: FGRT

Not all retailers and brands stand to gain from the tax reforms:- Companies that generate a high proportion of their profits overseas will face a charge on those overseas profits, but gain relatively little offsetting benefit from lower corporate tax on US profits.

- Companies that are loss-making in the US will see no gain from changes in domestic corporate tax rates.

Summarizing the Tax Changes

Changes to Personal Taxes

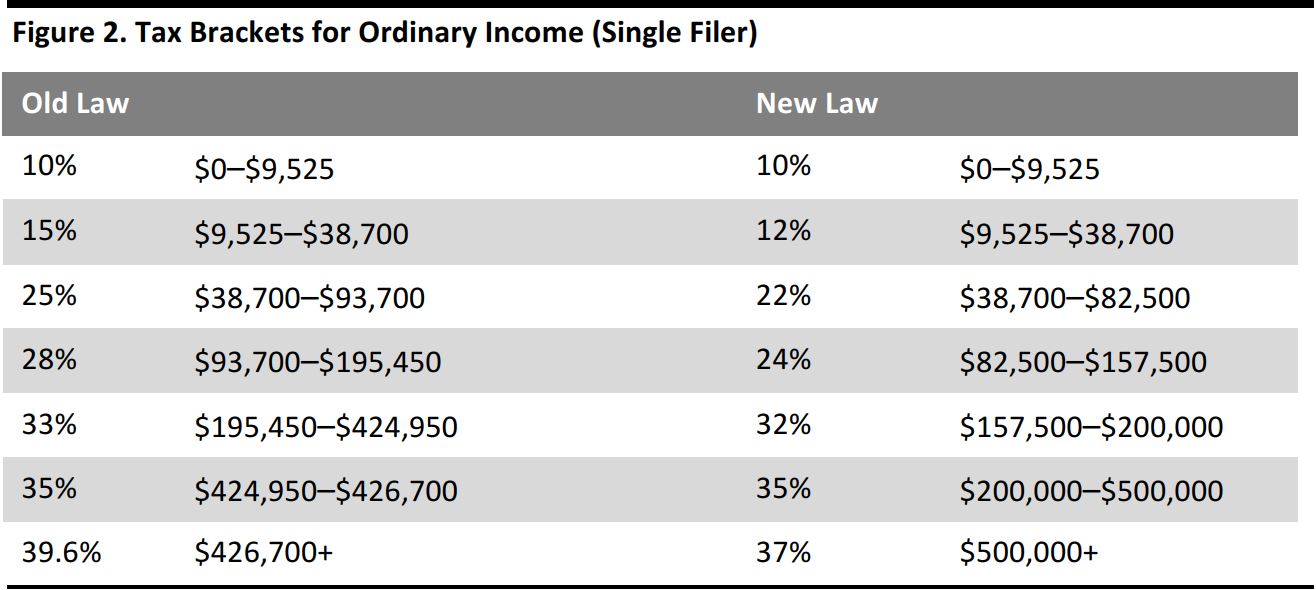

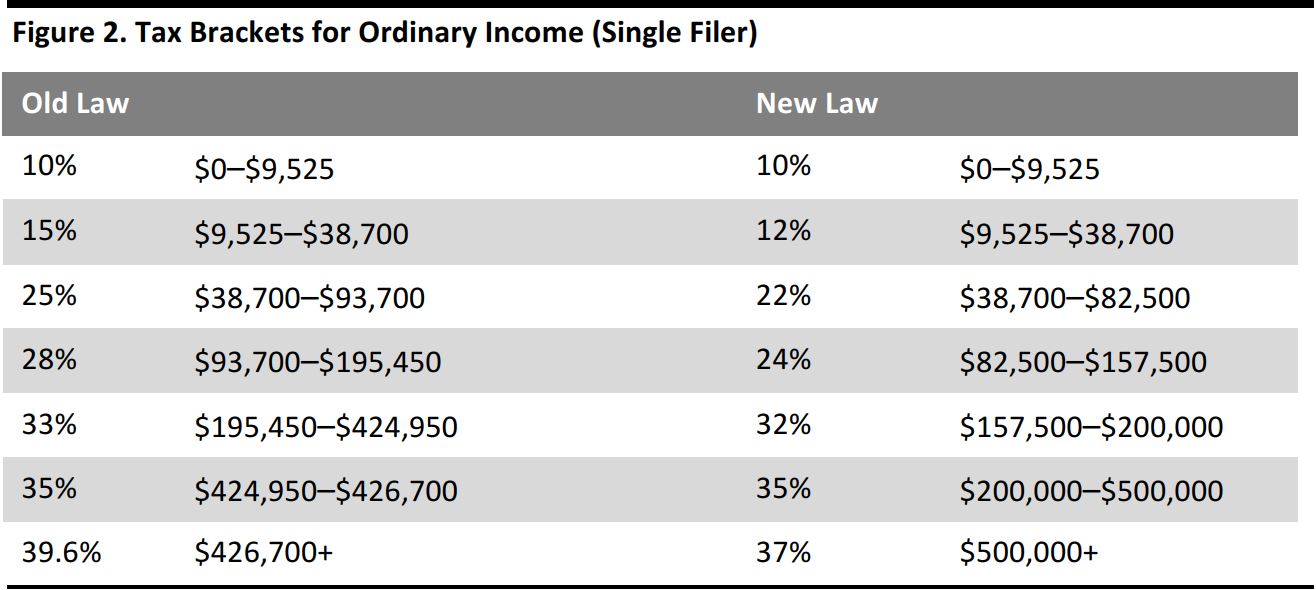

Below, we show the changes to income tax rates as a result of the Tax Cuts and Jobs Act.

Source: Tax Foundation

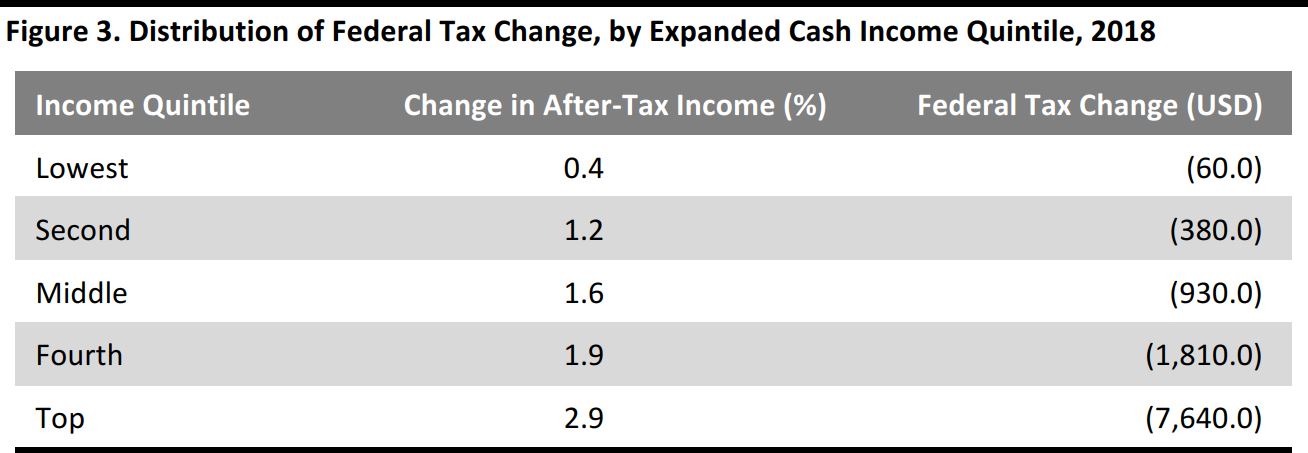

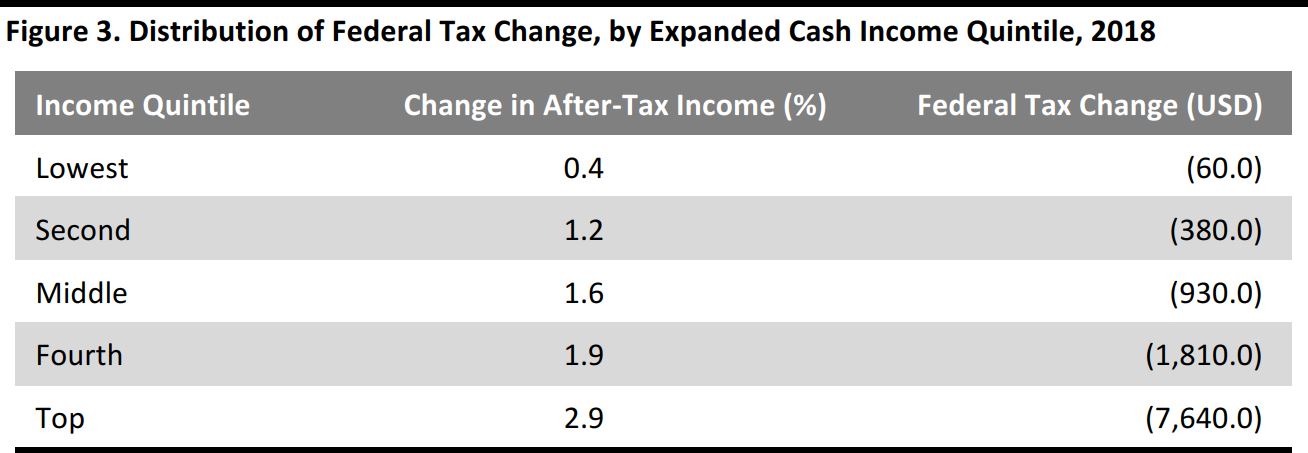

The Tax Cuts and Jobs Act increases the standard deduction in 2018 to $12,000 for single filers (up from $6,500 previously), to $18,000 for heads of household (up from $9,550) and to $24,000 for joint filers (up from $13,000). The nonpartisan Tax Policy Center estimates the gains by income quintile as shown below.

Source: Tax Policy Center

Changes to Corporate Taxes

The list below, while not exhaustive, details some of the significant changes to corporate taxes as a result of the new law’s passage:- The law permanently lowers the corporate income tax rate from 35% to 21%, starting in 2018.

- It enacts deemed repatriation of currently deferred foreign profits at a rate of 15.5% for cash and cash-equivalent profits and 8% for reinvested foreign earnings.

- The US moves to a territorial system of corporate tax, from a worldwide system. A worldwide system means US companies owe US tax on the income they generate both at home and in other countries.

- The law allows for full and immediate expensing of short-lived capital investments for five years. It limits the deductibility of net interest expense to 30% of earnings before interest, taxes, depreciation and amortization for four years, and to 30% of earnings before interest and taxes thereafter.