albert Chan

We discuss select findings and compare them to those from prior weeks: July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

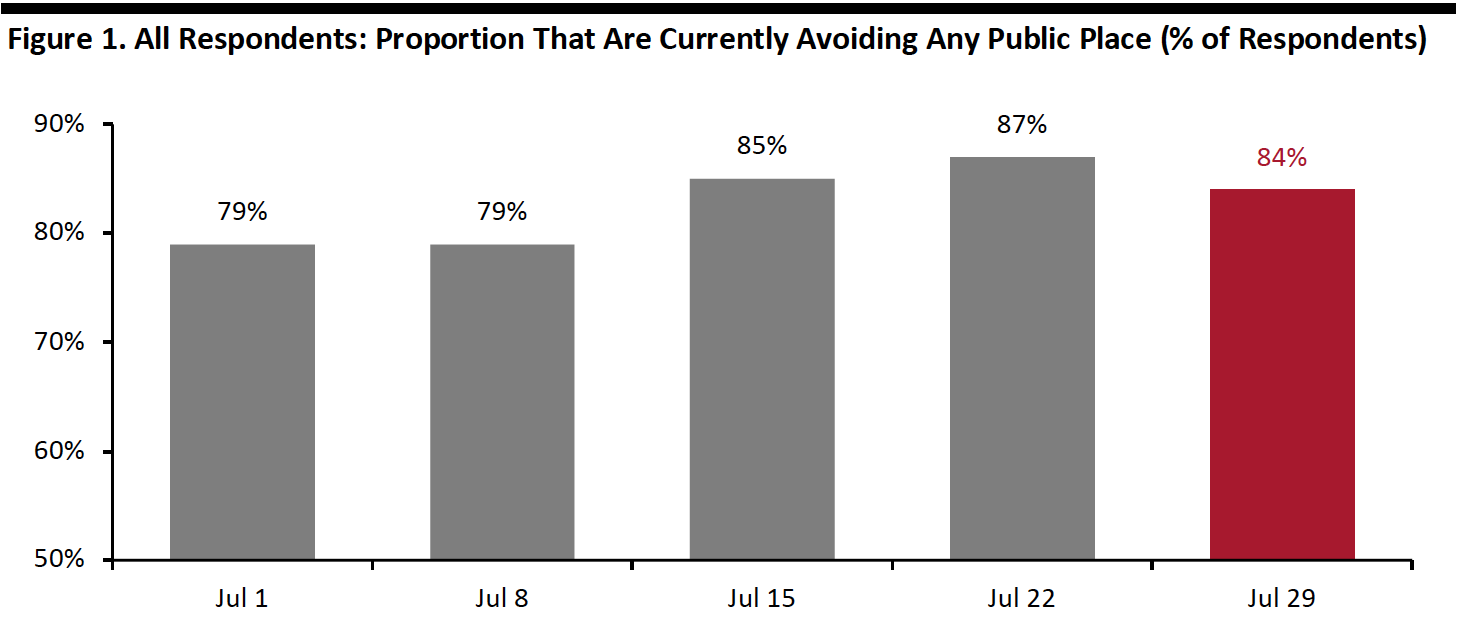

1. Avoidance of Public Places Remains HighThis week, the proportion of respondents saying that they are avoiding any public area remains high at 84%, although this is slightly below last week’s 87%. The avoidance rate has jumped by five percentage points since the beginning of July, reflecting consumers’ increasing concerns over rising coronavirus cases in several states.

We saw decreases of avoidance in some of the 14 options provided:

- The proportion of respondents that are currently avoiding shopping centers/malls went down slightly this week, after increases for two consecutive weeks before. Some 64% said they are currently avoiding these places, versus two-thirds from last week.

- Food-service locations are the second-most-avoided public places, with more than six in 10 respondents currently avoiding these, broadly level with the proportion from last week.

- Grooming service providers, including barbers and salons, saw the highest decline in avoidance this week, of four percentage points.

See our full report for complete results of what public places US consumers are currently avoiding.

[caption id="attachment_113850" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 2. More Consumers Are Buying Less of Discretionary Product Categories

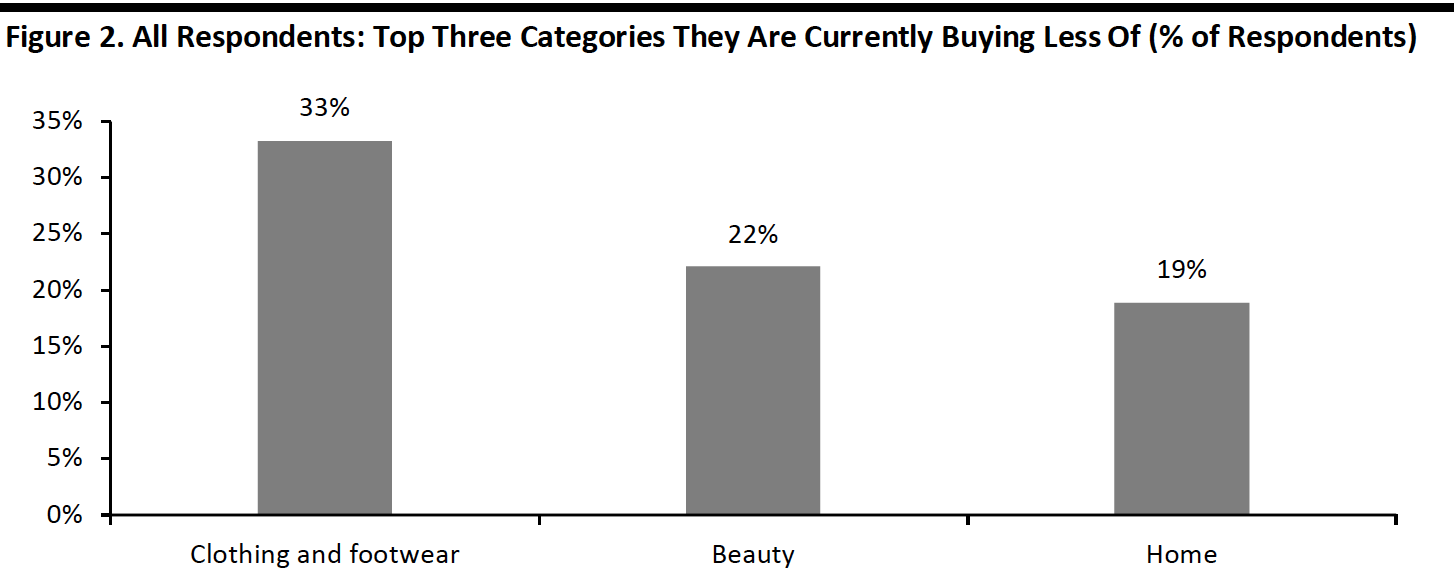

This week, the proportion of respondents who are currently buying less of any categories jumped by nine percentage points.

Looking at product categories, we saw that more consumers are buying less in most of the discretionary categories, including clothes and footwear, beauty, home products and electronics. One-third are currently spending less on apparel, up six percentage points from 27% last week. Beauty is the second most-cut category, with a little over one-fifth currently buying less. Some 19% of respondents are buying less in home categories.

[caption id="attachment_113851" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 3. Fewer Consumers Are Buying More Online than They Used To

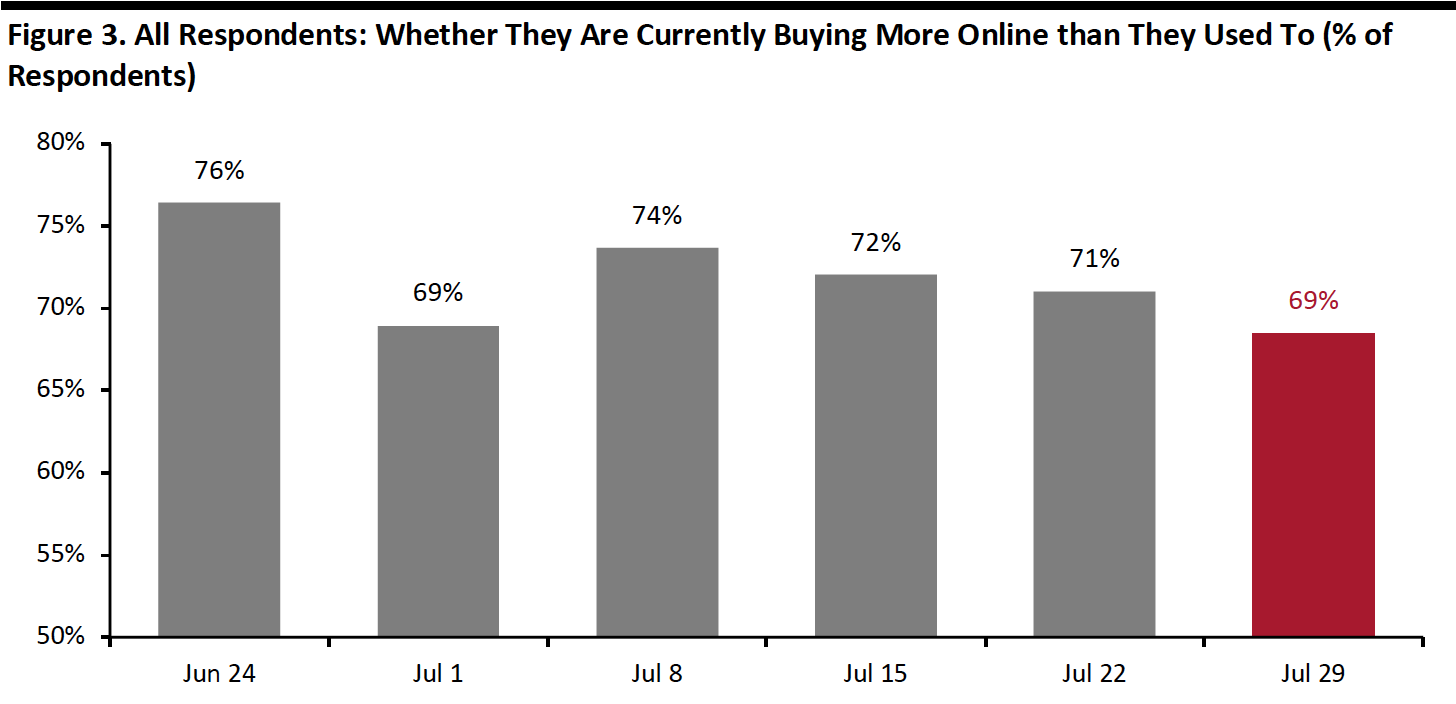

This week, the proportion of consumers switching their spending to e-commerce slid to the lowest level since late May. Some 69% of consumers stated that they are buying more online this week—a seven-percentage-point fall from the peak of 76% in the week of June 24. The declining trend might suggest that consumers are gradually switching some of their spending back to stores, despite the high avoidance of public places noted earlier.

We saw slightly fewer consumers are buying apparel online this week—28% versus 31% last week. However, other discretionary categories, including beauty, home and electronics, all saw increases in the proportion of respondents buying more online this week.

[caption id="attachment_113852" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]