albert Chan

We discuss select findings and compare them to those from prior weeks: November 24, November 17, November 10, November 3, October 27, October 20, October 13, October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

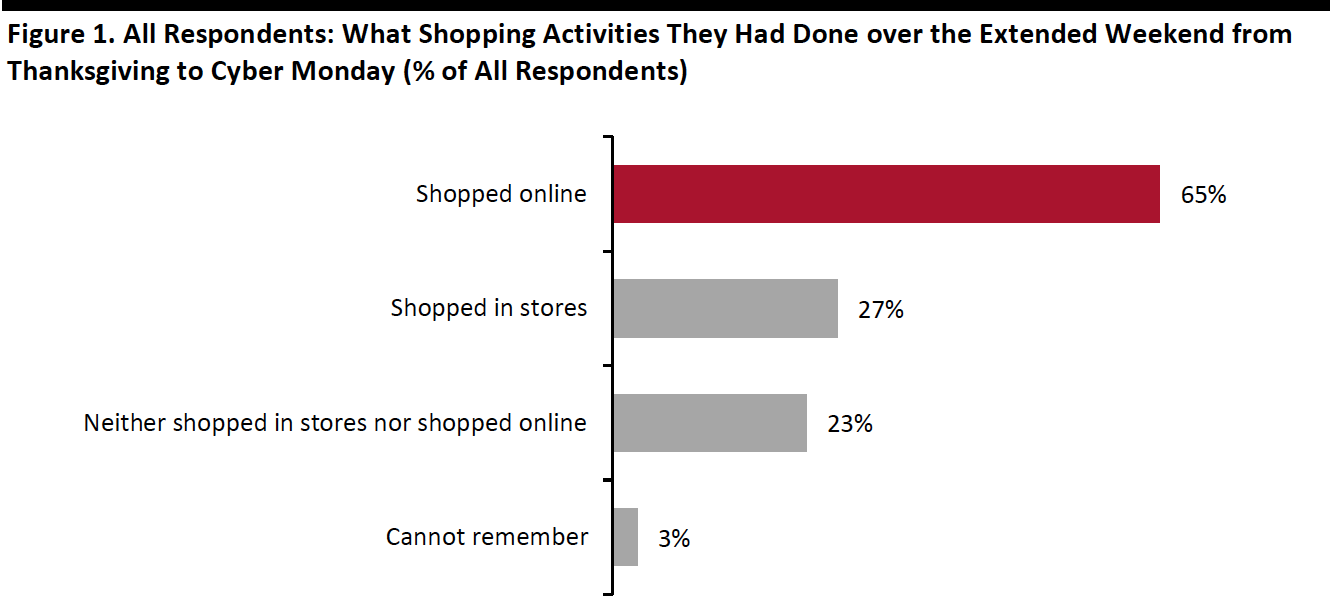

1. Consumers Opt for Online Shopping over the Thanksgiving-to-Cyber Monday WeekendThis week, we asked about consumers’ shopping activities during the weekend from Thanksgiving to Cyber Monday (November 26–30, 2020). As expected, online was the preferred channel over the extended weekend amid the pandemic. Some 65% had shopped online, compared to 27% that had shopped in stores. This supports our estimation of roughly one-third growth in e-commerce during the holiday quarter. Online shopping was driven by consumers aged under 45, with roughly seven in 10 consumers in this age group having done so.

Some 23% did not shop at all over the extended weekend, which could reflect early Black Friday deals and early holiday shopping. Elsewhere in our survey, we found that almost one-quarter of Thanksgiving weekend shoppers said they had already shopped for deals earlier in the month (not charted).

- See our full report for complete results on consumers’ shopping activities over the Thanksgiving-to-Cyber Monday weekend.

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption] 2. Apparel and Footwear Is the Most-Shopped Category

Clothing, footwear or accessories was the number-one category consumer had shopped for, whether in-store or online, over the extended weekend. Some 47% of Thanksgiving-weekend shoppers had shopped this category, which suggests a holiday-driven improvement in this hard-hit category. Clothing and footwear remains popular for holiday gifting and, even while everyday demand for apparel is likely to remain low (such as for the workplace), gifting should help ease total category declines versus pre-holiday months.

Apparel was followed by electronics (37%), which is also one of the top holiday gifting options. Another popular product category is pet products, with one-quarter of consumers having shopped for this category, likely helped by a boom in pet ownership during Covid-19.

A substantial proportion of consumers did not feel they got the best bargain on Black Friday/Cyber Monday, possibly due to the early release of deals this year: One-quarter of Thanksgiving-weekend shoppers said they were disappointed with the discounts this year.

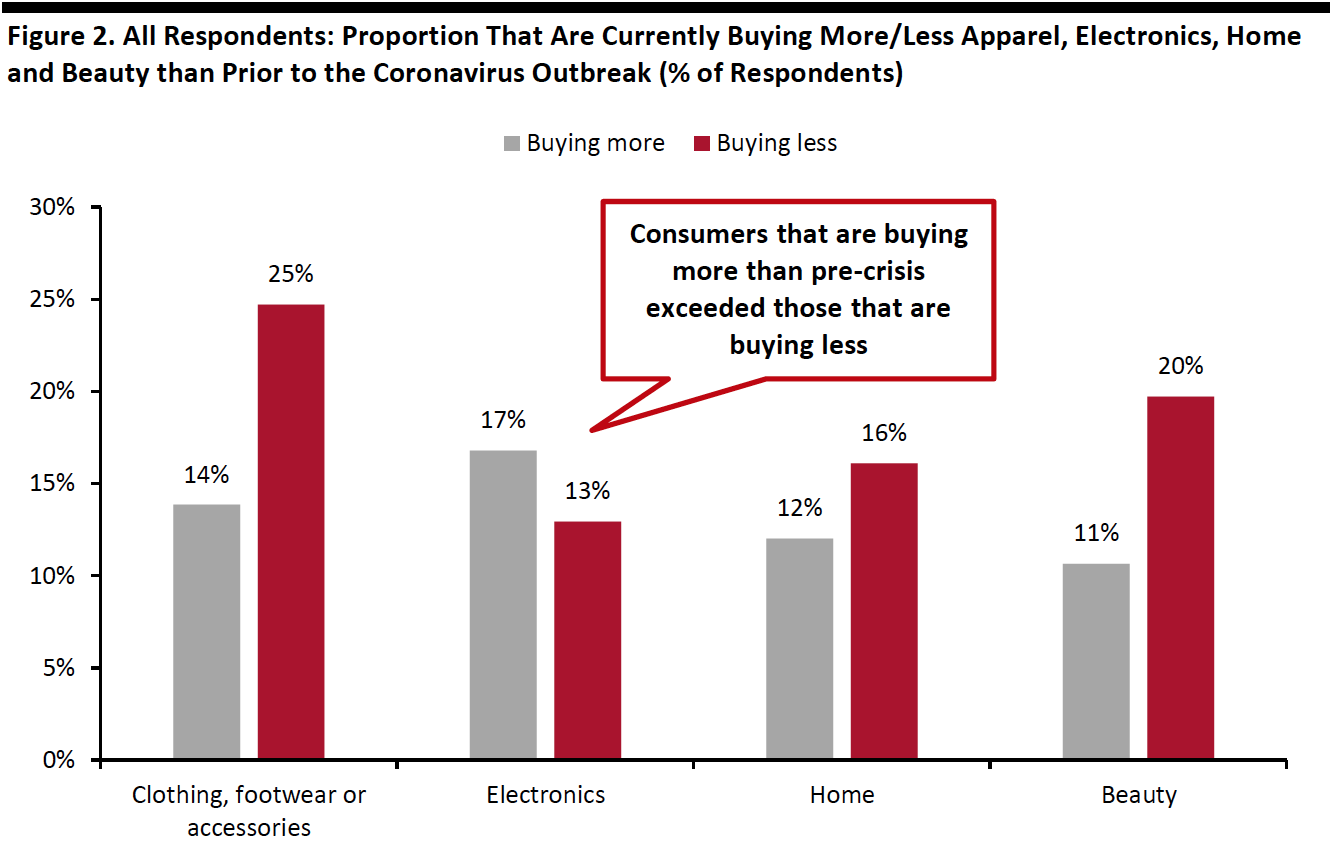

3. Improvements in Purchases of Some Discretionary CategoriesWe saw further evidence of holiday weekend-related demand in our recurring weekly questions. Some discretionary categories, such as clothing and footwear, beauty, home and electronics, all saw week-over-week improvements in purchases. This week, the proportion of consumers buying more in these categories than pre-crisis increased from last week, while the proportion for those currently buying less in these categories declined. As a result, we saw lower ratios of consumers buying less to those buying more, week over week:

- The ratio for clothing and footwear dropped to its lowest level of 1.8 this week, compared to 2.4 last week and 2.1 two weeks ago. The purchases were driven from online—around 38% of respondents reporting that they had bought apparel online, up from one-third last week.

- For the first time, the ratio for electronics ratio fell below 1 to 0.8 this week, from 1.1 last week.

- The ratio for beauty came at 1.9, versus 2.2 last week and 2.0 two weeks ago.

- The ratio for home went down to 1.3, from 1.7 last week and 3.0 two weeks before.

In the upcoming weeks, we could see demand for these discretionary categories fall back a little, as we may be past the peak of holiday shopping following Black Friday weekend.

[caption id="attachment_120364" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]