albert Chan

We discuss select findings and compare them to those from prior weeks: September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

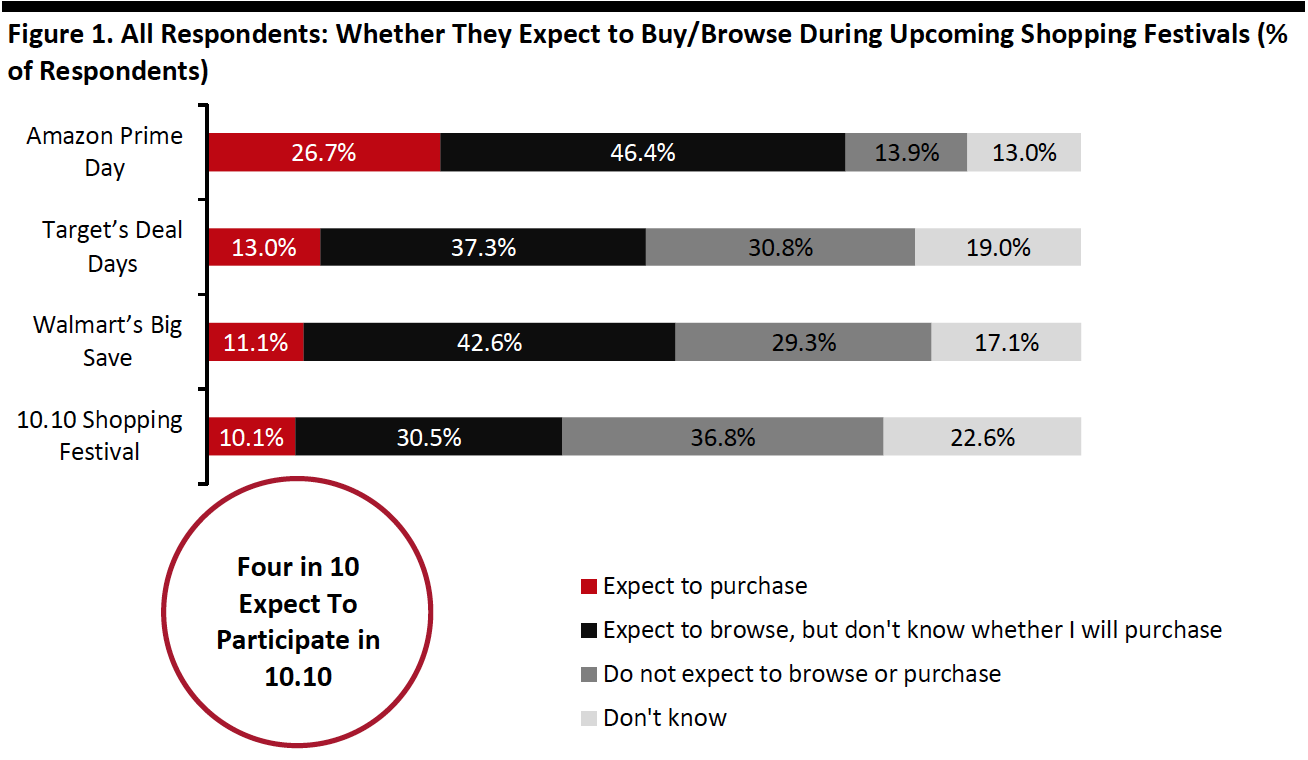

1. Seven in 10 Expect To Join Amazon’s Prime Day This YearThis week, we asked consumers whether they will participate in retailers’ shopping festivals, as the 10.10 Shopping Festival takes place on October 9–12 and Amazon’s Prime Day will take place on October 13–14, as well as Target’s Deal Days on October 13–14 and Walmart’s Big Save event on October 11–15. The 10.10 Shopping Festival is a global shopping festival powered by Coresight Research in partnership with Shopkick and Fashwire.

Roughly seven in 10 respondents said that they expect to purchase from or browse Amazon’s Prime Day promotions. Around four in 10 expect to buy from or browse retailers’ 10.10 promotions. Major names participating in 10.10 include Guess? and Kroger. The 10.10 Shopping festival is a new event, but it sees levels of purchase intent that are close to Target’s more established Deal Days and Walmart’s Big Save event—with approximately one in 10 shoppers expecting to buy from retailers’ promotions on 10.10. As a still-new event, 10.10 sees the highest proportion of “don’t knows,” suggesting opportunities for greater participation than consumers expected.

- See our full report for complete results on which promotion event consumers will join this year, and see our Holiday 2020: US Shopper Survey—How Shifting Spending Patterns Will Impact Retail report for more data and analysis.

Base: 416 US Internet users aged 18+

Base: 416 US Internet users aged 18+Respondents were given brief descriptions of events and their timings

Source: Coresight Research[/caption] 2. Half Plan To Browse/Purchase Apparel Products During Shopping Festivals

We expect consumers to use these festivals for early holiday shopping, and so discretionary categories lead the rankings for expected purchases or browsing. The top expected browsing/purchasing options are clothing and footwear, electronics, and beauty.

- Apparel is the top expected purchasing/browsing category. Around half of respondents reported that they expect to browse or purchase clothing or footwear during the shopping festivals.

- Electronics comprise the second-most-expected browsing/purchasing category during any of these shopping festivals, at 41%.

- Around one-third expect to shop for beauty products during these festivals.

The top two categories reflect their popularity for gift purchases for the holidays—as our new holiday survey report outlined, the top categories that US shoppers expect to buy as gifts are (in descending order of popularity) clothing, footwear or accessories, gift cards and vouchers, electronics, and toys and games.

Beauty and home-improvement rank meaningfully higher for festival shopping than for holiday gift shopping, implying that consumers are mixing up personal purchases with early holiday gift purchases during these shopping festivals

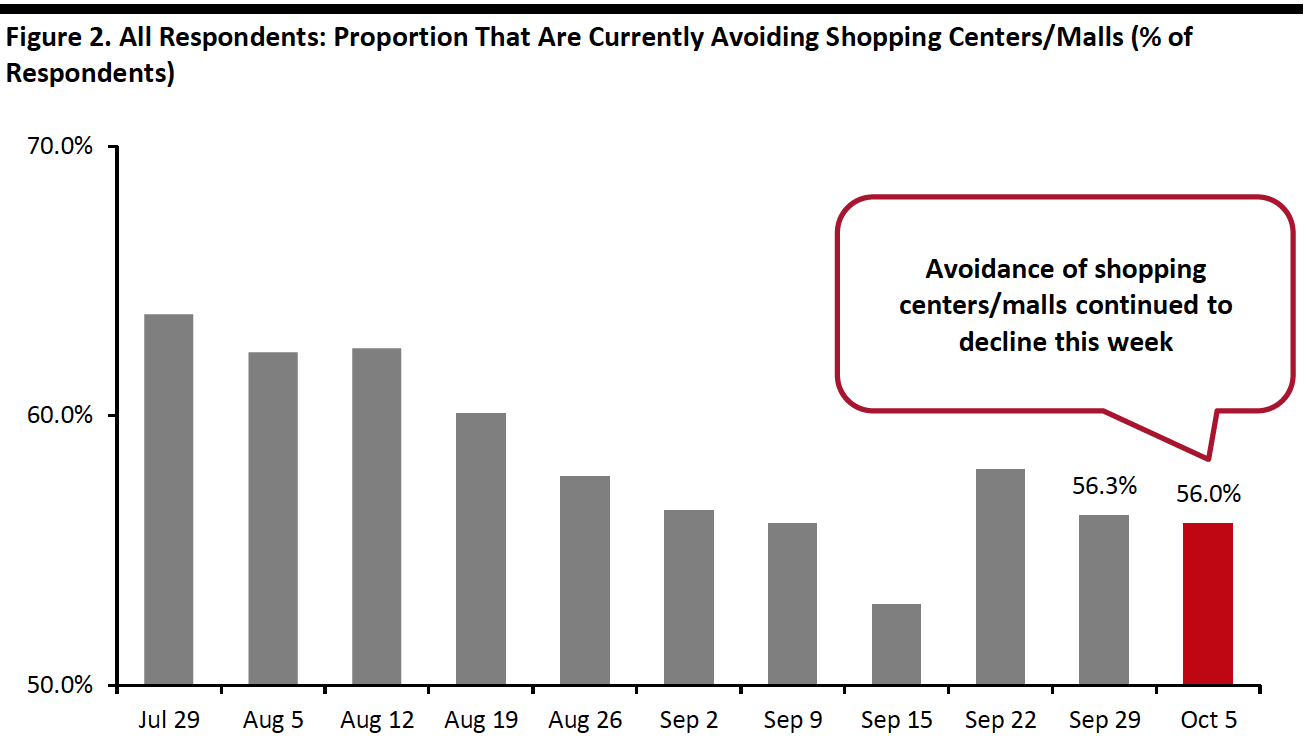

3. Avoidance Rates of Public Places Spiked This WeekThis week, the proportion of respondents saying that they are avoiding any type of public area returned to the level we saw two weeks ago: eight in 10 are currently avoiding any public place, up five percentage points from 75.0% last week and comparable with 81.8% recorded two weeks ago. The volatility could be due to rising coronavirus cases in some states. Encouragingly, we saw decreases in avoidance for six of the 12 options provided, although most of the changes were within the margin of error.

- The proportion of respondents that are currently avoiding shopping centers/malls fell for the third consecutive week (albeit only very slightly). Some 56.3% are currently avoiding such places, compared to 56.0% last week. Compared to the peak of two-thirds on July 22, the avoidance rate has dropped by 10 percentage points.

- Avoidance of shops in general also reached the lowest level we have seen since July. Around four in 10 respondents are currently avoiding such places. The avoidance rate has fallen 12 percentage points from the highest level of 54% on July 22. The gradual declines in avoidance of both shopping centers/malls and shops in general are an encouraging sign for retailers.

- Gym/sports centers saw the largest increase in avoidance this week, of almost six percentage points.

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]