albert Chan

What’s the Story?

This report presents the results of Coresight Research’s latest weekly survey of US consumers, including on the impacts of the coronavirus outbreak, undertaken on October 6, 2020. We explore the trends we are seeing from week to week, following prior surveys on September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Which Shopping Festival Consumers Expect to Join

This week, we asked consumers whether they will participate in retailers’ shopping festivals, as the 10.10 Shopping Festival takes place on October 9–12 and Amazon’s Prime Day will take place on October 13–14, as well as Target’s Deal Days on October 13–14 and Walmart’s Big Save event on October 11–15. The 10.10 Shopping Festival is a global shopping festival powered by Coresight Research in partnership with Shopkick and Fashwire. We asked:

- Whether respondents will purchase from or browse retailers’ shopping festival promotions.

- Which categories, if any, they will browse or purchase during any of these promotional events.

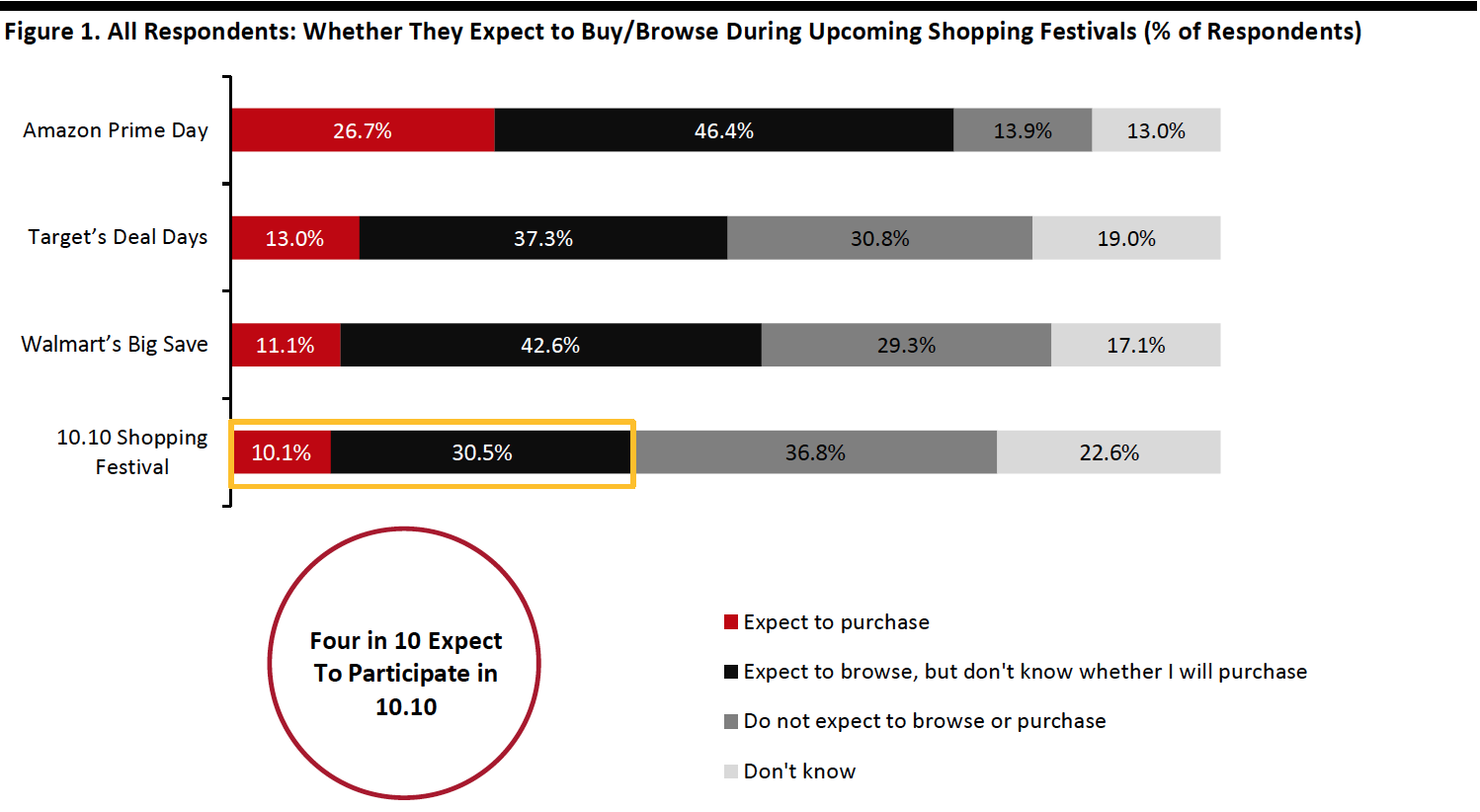

Seven in 10 Expect To Join Prime Day; Four in 10 Expect To Participate in 10.10

Retailers’ shopping festivals in October look set to pull forward holiday shopping, helping to alleviate supply-chain pressures—especially in the fulfillment of online orders amid surging demand. Seven in 10 respondents said that they expect to purchase from or browse Amazon’s Prime Day promotions.

The 10.10 Shopping festival is a new event, but it sees levels of purchase intent close to those for Target’s more established Deal Days and Walmart’s Big Save event, with around one in 10 shoppers expecting to buy from retailers’ promotions on 10.10. A total of around four in 10 expected to buy from or browse retailers’ 10.10 promotions. Major names participating in 10.10 include Guess? and Kroger.

As a still-new event, 10.10 sees the highest proportion of “don’t knows,” suggesting opportunities for greater participation than consumers expected.

[caption id="attachment_117444" align="aligncenter" width="700"] Base: 416 US Internet users aged 18+

Base: 416 US Internet users aged 18+Respondents were given brief details of events and their timings

Source: Coresight Research[/caption]

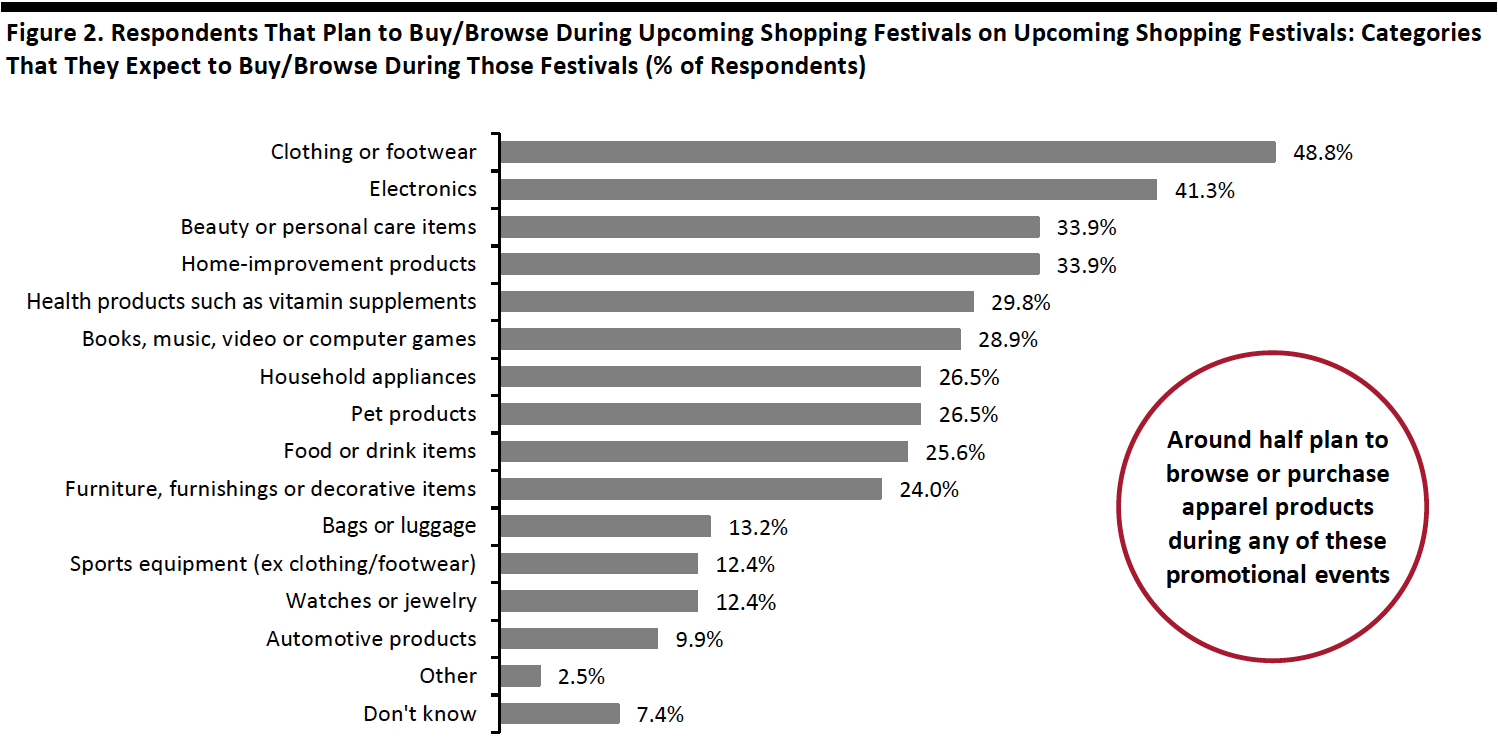

Half Expect To Browse or Purchase Apparel Products During Shopping Festivals

We asked those that expect to buy or browse during any of these events what categories they expect to be interested in. The top expected options include clothing and footwear, electronics, and beauty. Shoppers will likely use these festivals to pull forward their holiday purchases, and the top two categories reflect their popularity for gift purchases for the holidays—as our new holiday survey report outlined, the top four categories US shoppers expect to buy as gifts are (in descending order of popularity) clothing, footwear or accessories, gift cards and vouchers, electronics, and toys and games.

The high ranking of beauty and home-improvement (which rank lower for holiday gifts) for festival purchases implies that consumers are mixing up personal purchases with early holiday gift purchases during these shopping festivals.

- Apparel was the top expected browsing or purchasing category for these shopping festivals. Around half of respondents reported that they expect to browse or purchase clothing or footwear during the shopping festivals. As we show later in this report, the proportion of consumers that are currently buying less apparel this week than before the crisis fell to the lowest level we have seen since April. As noted above, it also reflects apparel’s position as the top gifting category for the holidays.

- Electronics was the second-most-expected browsing or purchasing category during any of these shopping festivals, with 41.3% of consumers planning to browse or purchase electronics products.

- Some 33.9% expect to browse or purchase beauty products during any of these promotional events.

Respondents could select multiple options or “don’t know”

Respondents could select multiple options or “don’t know”Base: US Internet users aged 18+ who expect to buy or browse on Prime Day, the 10.10 Shopping Festival, Target’s Deal Days or Walmart’s Big Save event

Source: Coresight Research[/caption]

What Shoppers Are Doing and Where They Are Going

Online Grocery Shopping Bounces Back

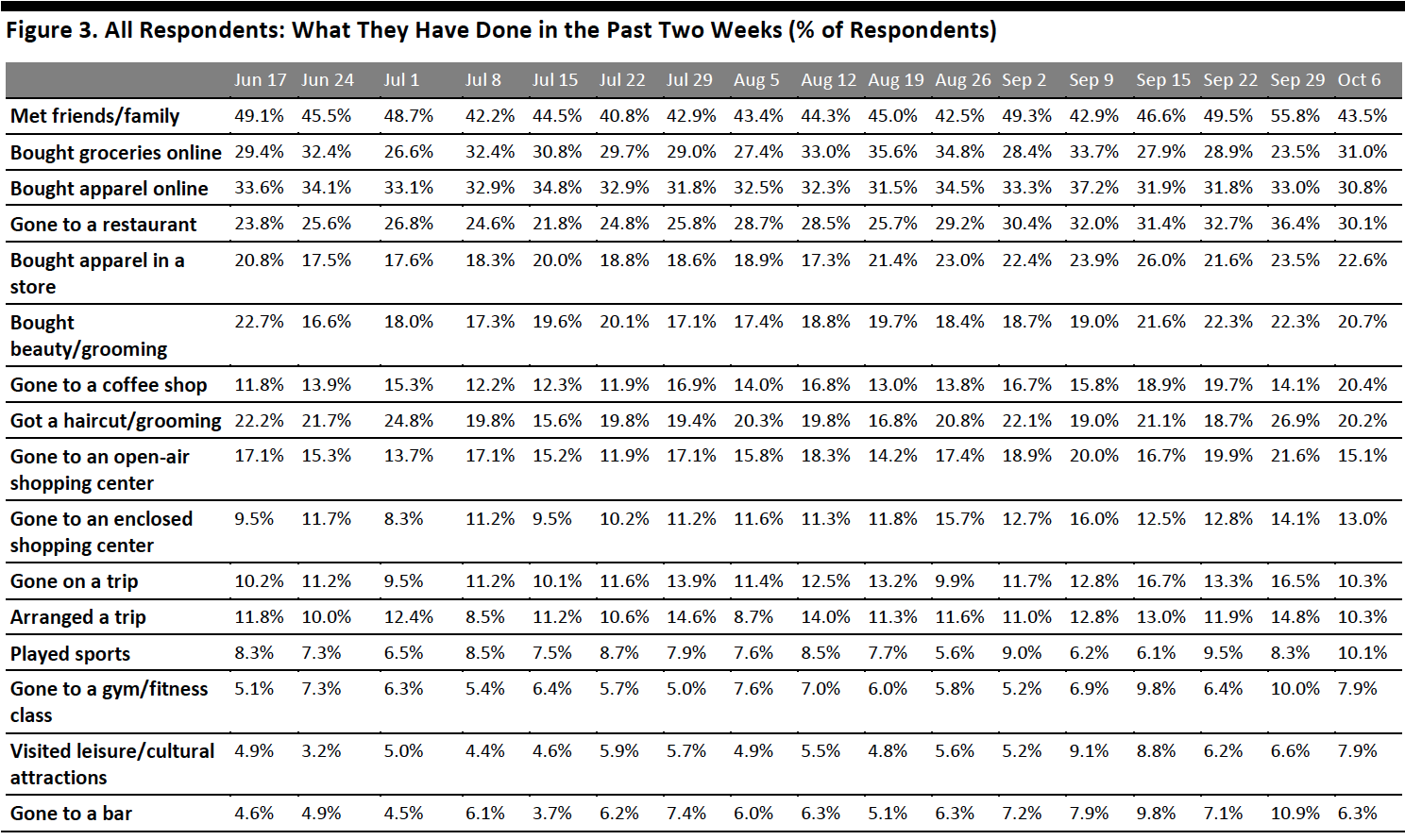

Each week, we ask consumers what they have done in the past two weeks. This week, the proportion of respondents decreased for 12 of the 16 options we provided for recent activity options. Although most of the week-over-week changes were within the margin of error, the directional trends, including over a number of weeks, can prove informative.

- Online grocery shopping bounced back after tapering off last week. The proportion of respondents that bought groceries online jumped by eight percentage points to 31.0%, from 23.5% last week. Its ranking also improved to the most-popular spending activity, from fourth position last week.

- The proportion of respondents that had bought clothing and footwear online in the past two weeks was down very slightly to 30.8% this week, after reaching the highest level of 37.2% a month ago. The proportion that had bought apparel in-store was similar to last week at 22.6%, but down from the peak of 26.0% three weeks ago. As we move into the holiday season, we would expect these metrics to increase in the coming weeks.

- Getting a haircut/grooming service experienced the greatest week-over-week decrease. Some 20.2% had got a haircut, down seven percentage points from 26.9% last week.

- The proportion of respondents that had visited an open-air shopping center tapered off this week after reaching its highest level last week. Some 15.1% had visited an open-air shopping center. The proportion of respondents that had visited an enclosed shopping center was more level with last week—some 13.0% had visited an enclosed center, versus 14.1% last week.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

More Consumers Expect To Go to a Bar in the Next Two Weeks

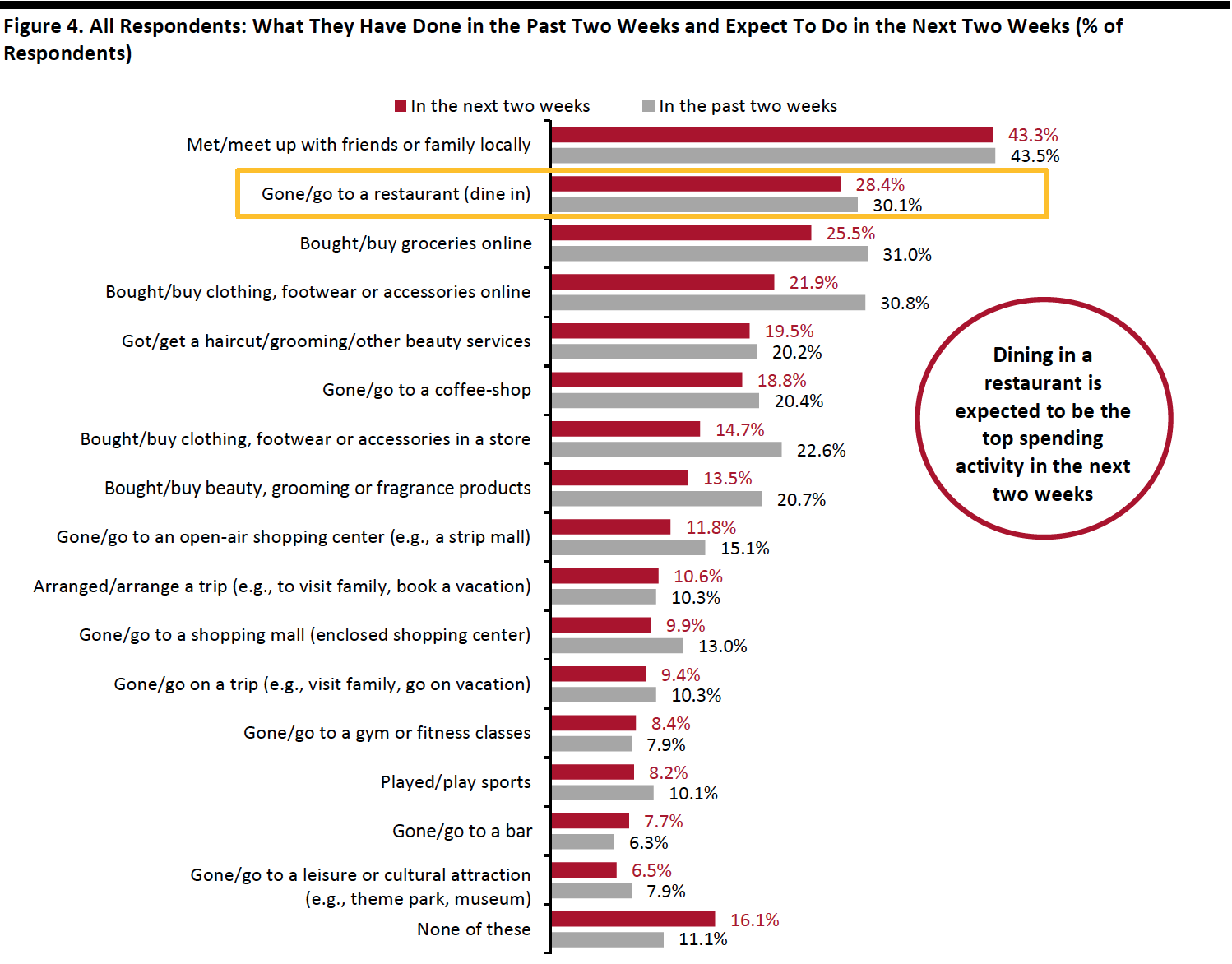

Each week, we ask consumers what they expect to do in the next two weeks, with a set of options comparable to those for the last two weeks. In the chart below, we compare these short-term expectations with recent actual behavior.

We saw slightly lower proportions of consumers expecting to do 13 of the 16 options we provided for activities in the next two weeks than actual behavior in the past two weeks.

- Dining in a restaurant continues to be the top expected spending-related activity for consumers to do in the next two weeks, with 28.4% planning to do so, though a little lower than the 30.1% of actual behavior in the past two weeks. We also saw fewer consumers planning to go to coffee shops than recent actual behavior of such activity.

- Online grocery shopping bounced back as the second most-expected spending-related activity for the next two weeks, from third position last week. Some 25.5% plan to buy groceries online, versus around one-third of actual behavior of such activity in the last two weeks.

- The proportion of respondents that expect to buy clothing or footwear online stood at 21.9%, while 14.7% of consumers plan to do so in a store. Some 13.5% of consumers expect to purchase beauty products. As we typically see actual behavior of these shopping activities exceed expected behavior, we expect much higher proportions in actual behavior of these activities.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

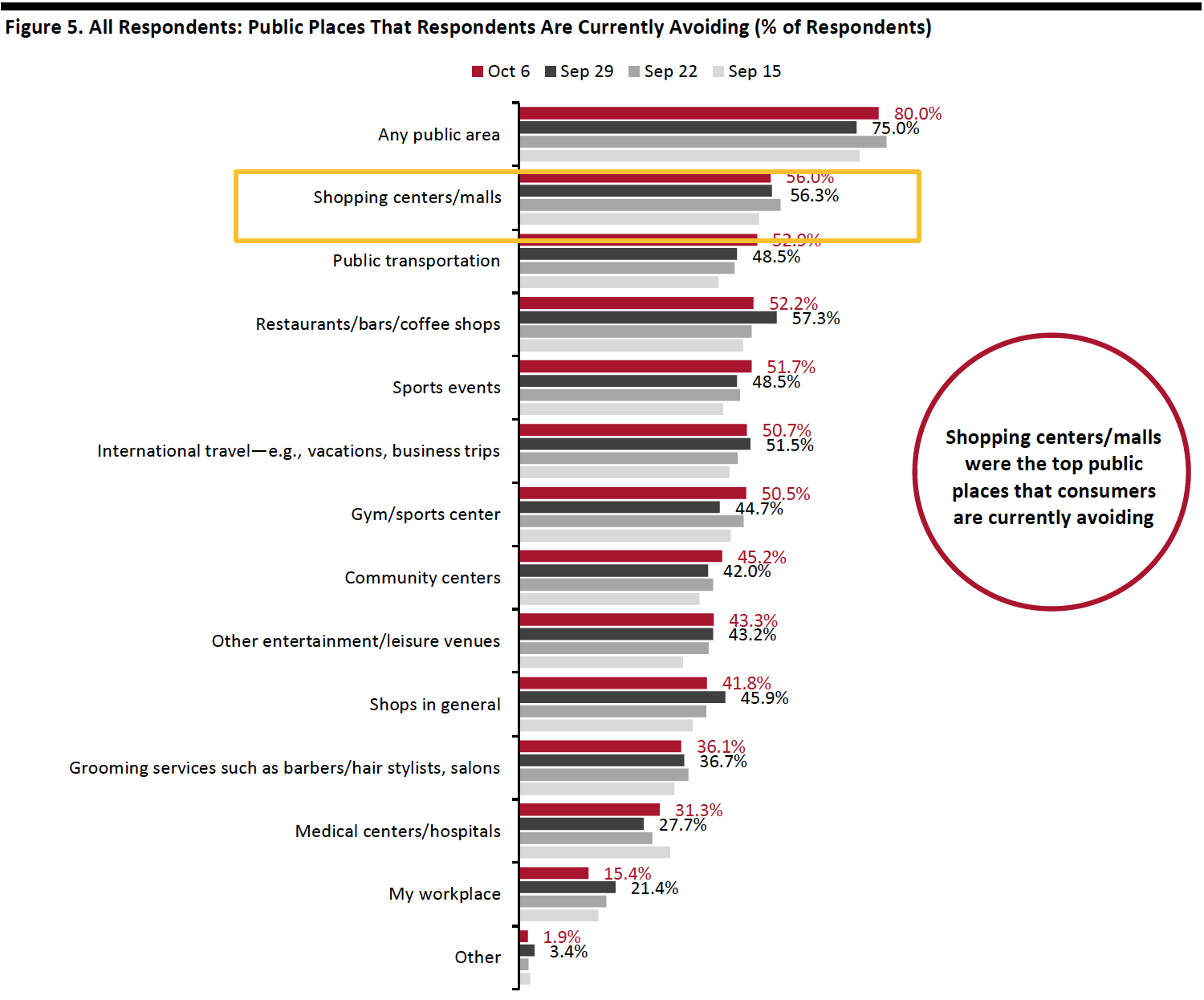

Eight in 10 Are Currently Avoiding Public Places

This week, the proportion of respondents saying that they are avoiding any type of public area returned to the level we saw two weeks ago: eight in 10 are currently avoiding any public place, up five percentage points from 75.0% last week and comparable with the 81.8% recorded two weeks ago. The volatility could be due to rising coronavirus cases in some states.

Encouragingly, we saw decreases in avoidance for six of the 12 options provided, although most of the changes were within the margin of error.

- The proportion of respondents that are currently avoiding shopping centers/malls fell for the third consecutive week. Some 56.0% are currently avoiding such places, compared to 56.3% last week. Compared to the peak of two-thirds on July 22, the avoidance rate has dropped by 10 percentage points this week.

- Avoidance of shops in general also reached the lowest level we have seen since July. Around four in 10 respondents are currently avoiding such places. The avoidance rate has fallen 12 percentage points from the highest level of 53.5% on July 22. The gradual declines in avoidance of both shopping centers/malls and shops in general are an encouraging sign for retailers.

- Gym/sports center saw the largest increase of avoidance this week, of almost six percentage points: some 50.5% of respondents are currently avoiding these places, versus 44.7% last week.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

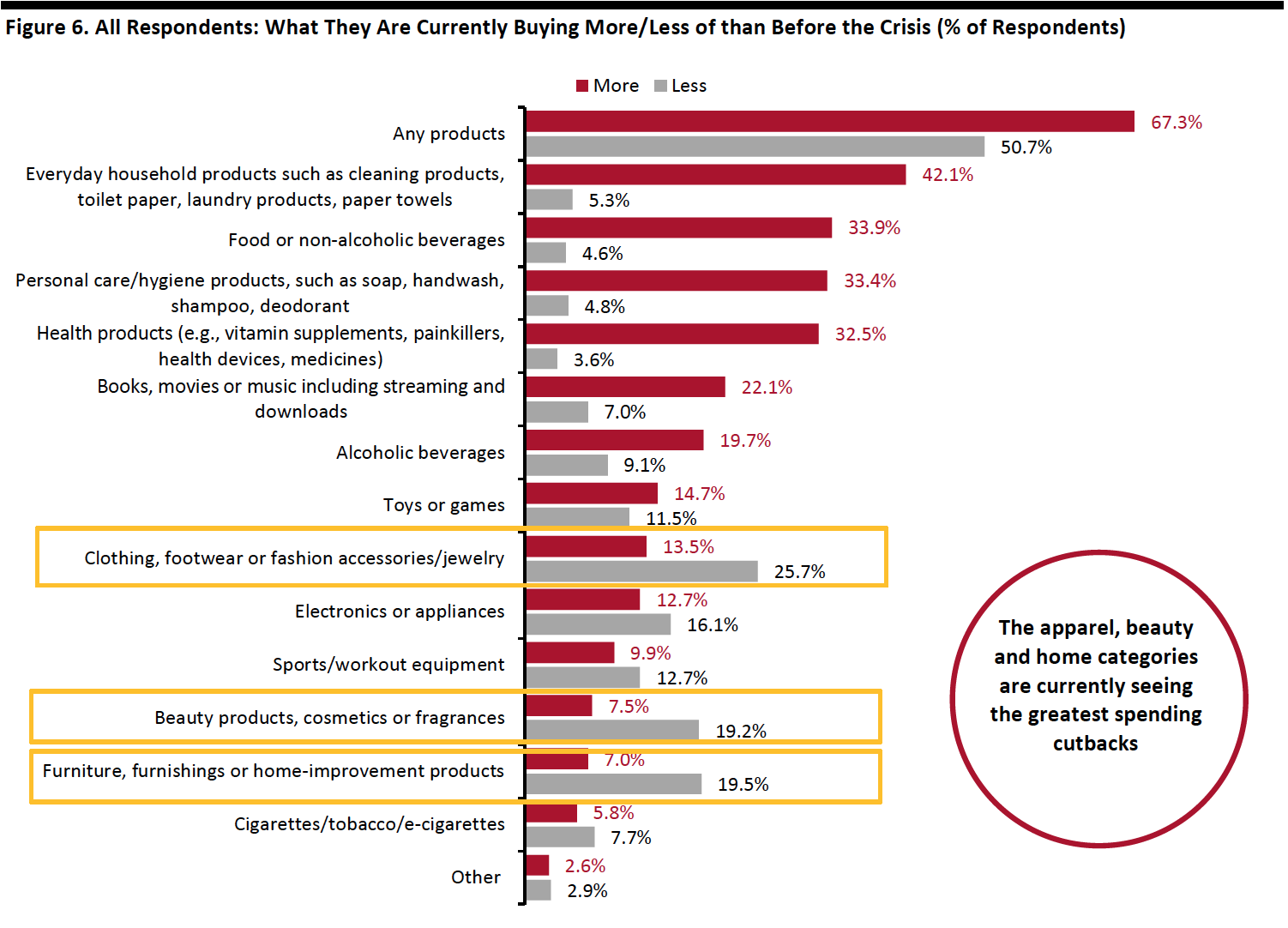

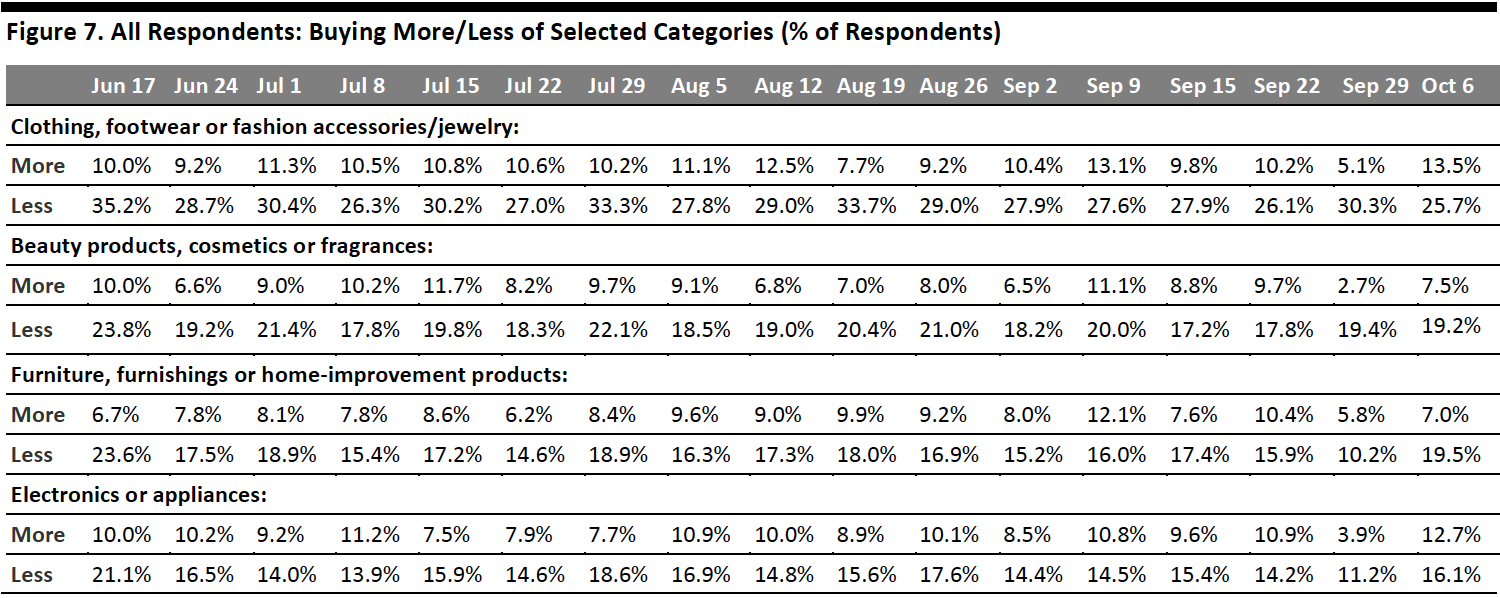

Reviewing Trend Data in Current Purchasing Behavior

What Consumers Are Currently Buying More of and Less of

This week, the proportion of respondents that are currently buying more of any products than before the crisis increased sharply, to 67.3% from 42.7% last week. This follows a sharp decline in this metric last week; two weeks ago, the figure stood at 61.4%.

The proportion of respondents that are currently buying less than pre-crisis also increased slightly this week to 51%, versus 44.7% last week.

- Buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both.

Buying more: We saw week-over-week growth in all categories that consumers are buying more of than pre-crisis. Essentials, including household products and food, continue to be the most-purchased categories while personal care products overtook health products as one of the top three categories of which consumers are currently buying more than pre-crisis.

Buying less: Discretionary categories—including clothing and footwear, beauty and home—remained the most-cut categories, with the highest proportions of consumers currently buying less of such products. Some 25.7% are currently buying less apparel; although clothing and footwear is still the most-cut category, this is the lowest level we have seen since April. The proportion of respondents that are currently buying less in home categories spiked to 19.5%, versus 10.2% last week.

Ratio of less to more: The ratios of the proportions of respondents buying less to the proportions buying more in home increased this week, as tracked in Figure 7. Beauty, electronics and apparel categories saw ratio decreases.

- The ratio for home increased to 2.8, compared to 1.8 last week.

- The ratio for beauty fell sharply to 2.6, versus 7.3 last week.

- The ratio for electronics came at 1.3, compared to 2.9 last week.

- The ratio for clothing and footwear dropped to 1.9, from 6.0 last week and 2.6 two weeks ago.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption] [caption id="attachment_117454" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

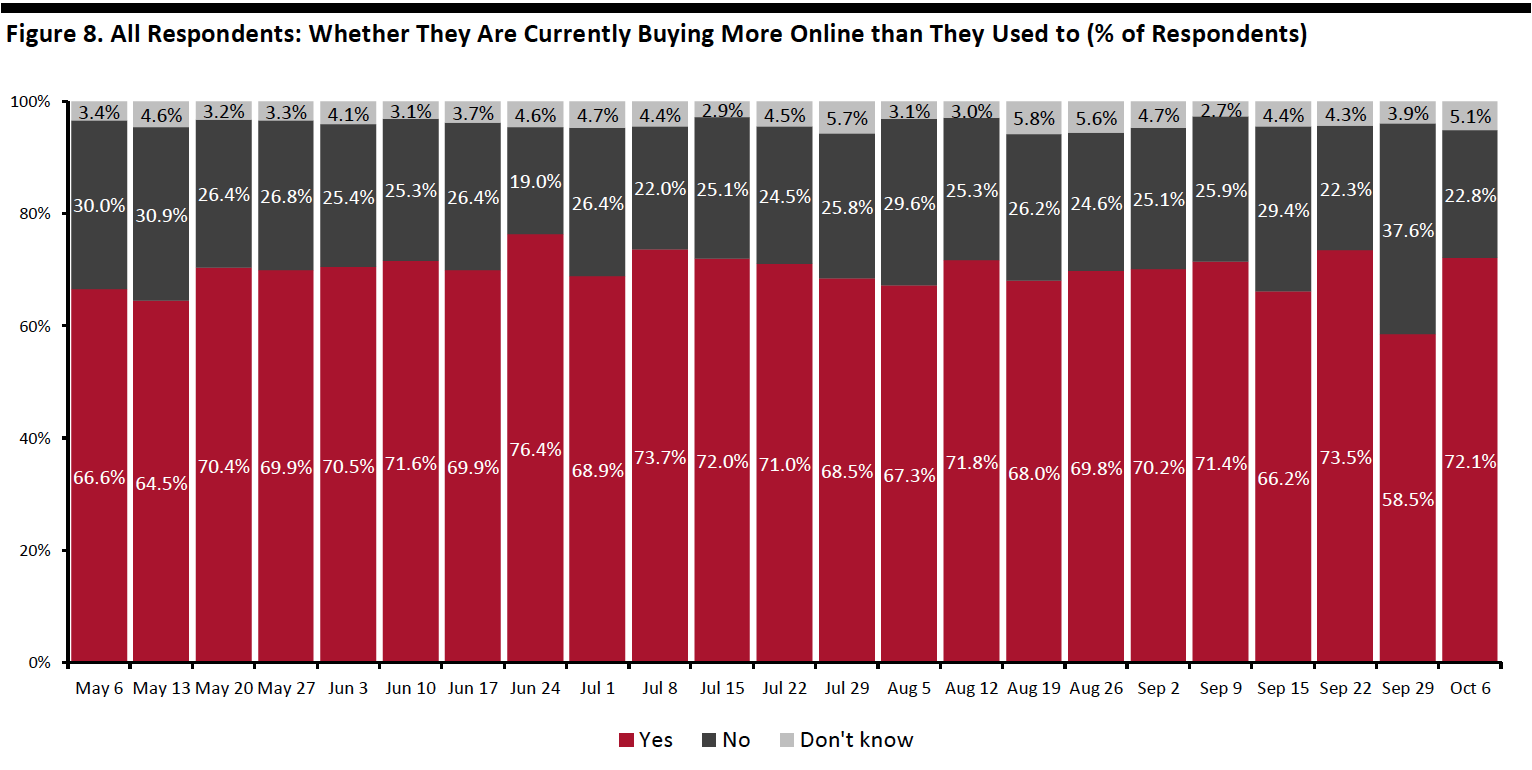

Seven in 10 Are Switching Spending Online

This week, we saw the proportion of consumers buying more online than they used to jumped—some 72.1% are currently buying more online, up 14 percentage points from 58.5% last week. This could be largely due to more consumers buying more of any category overall than before the crisis, discussed previously: Both metrics saw volatility last week and this week returned to levels closer to those of two weeks ago.

[caption id="attachment_117455" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

What Consumers Are Currently Buying More of Online

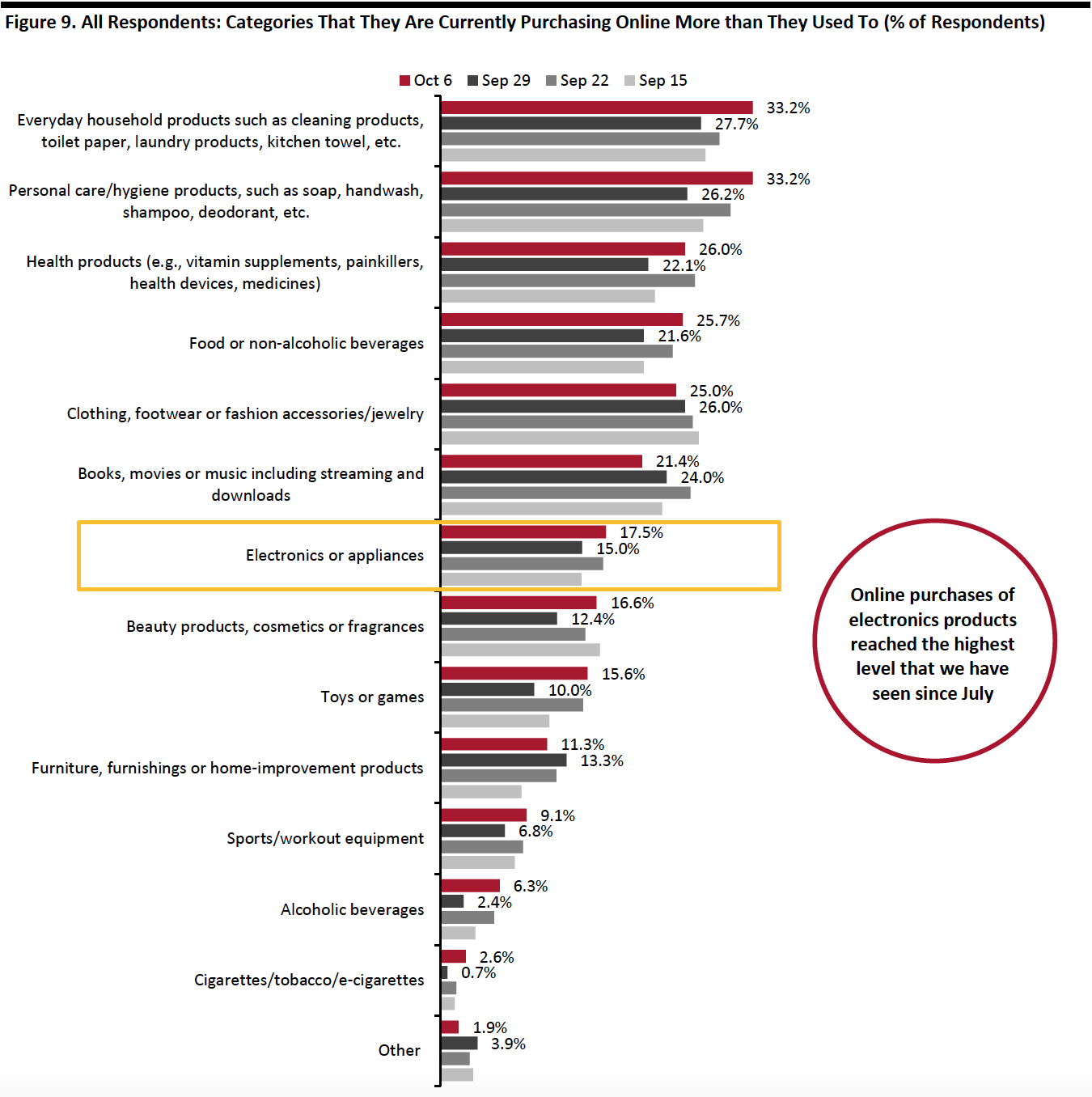

Looking at specific categories, 10 of the 13 categories we provided as options saw week-over-week increases in consumers buying more online than pre-crisis, although most of the changes were within a margin of error.

The household product and personal care categories remained the most-purchased categories online. Some 26.0% are buying more health products online than before the crisis, making it the third-most-purchased category online this week.

Online purchases of food rebounded a little, after declining last week to the lowest level we have seen in months. Some 25.7% are buying more food online, versus 21.6% last week. This mirrors the uptick in the proportion buying groceries online in the past two weeks, as shown earlier in this report.

The proportion of respondents that are currently buying more apparel online broadly leveled off this week at 25.0%, versus 26.0% last week. Online purchases of other discretionary categories, including electronics and beauty, both went up slightly. Some 17.5% are buying more electronics products online—the highest level we have seen since July.

[caption id="attachment_117456" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

What We Think

We expect consumers to use retailers’ upcoming shopping festivals for early holiday shopping. Seven in 10 of respondents said that they expect to purchase from or browse Amazon’s Prime Day promotions.

Although the 10.10 Shopping festival is a new event, it sees comparable levels of purchase intent to Target’s more established Deal Days and Walmart’s Big Save event—with around one in 10 shoppers expecting to buy from retailers’ promotions on each of these. All four events see high levels of consumer interest, providing further evidence that these are likely to pull forward meaningful volumes of holiday shopping.

The top two expected purchasing or browsing categories are also the top choices for gift purchases for the holidays, as shown in our new holiday survey report. This implies that consumers are doing holiday shopping during shopping festivals. Around half respondents reported that they expect to browse or purchase clothing or footwear during the shopping festivals, becoming the top expected purchasing or browsing option followed by electronics and beauty categories.

This week, we saw the following from our recurring weekly questions:

- Apparel: The proportion of consumers that are currently buying less in apparel fall to 25.7%—the lowest level we have seen since April. However, we saw the proportion of respondents that had bought clothing and footwear online in the past two weeks decline to 30.8% this week, after reaching a high of 37.2% a month ago. The proportion that had bought apparel in-store fell to 22.6%, from the peak of 26.0% three weeks ago.

- Online Grocery: Online grocery shopping rates recovered after tapering off somewhat last week—the proportion of respondents that bought groceries online in the past two weeks increased by eight percentage points to around one-third. We also saw more consumers say that they are currently buying more food online than pre-crisis. For more data on the trajectory of grocery e-commerce, see our latest monthly US CPG Sales Tracker. Our weekly survey report on August 19 also focuses on consumers’ online grocery shopping habits

- E-Commerce: We saw the proportion of consumers that are currently buying more online than they used to spike by 14 percentage points to the second-highest level we have seen since July. It reached 72.1%, compared to 58.5% last week (which had proved volatile for some metrics). We could see e-commerce remain at this elevated level as we move toward the holiday season. See our US E-Commerce: Post-Crisis Outlook report and Holiday 2020: US Shopper Survey—How Shifting Spending Patterns Will Impact Retail report for more data and analysis.

Methodology

We surveyed respondents online on October 6 (416 respondents), September 29 (412 respondents), September 22 (422 respondents), September 15 (408 respondents), September 9 (406 respondents), September 2 (402 respondents), August 26 (414 respondents), August 19 (416 respondents), August 12 (400 respondents), August 5 (449 respondents), July 29 (403 respondents), July 22 (404 respondents), July 15 (454 respondents), July 8 (410 respondents), July 1 (444 respondents), June 24 (411 respondents), June 17 (432 respondents), June 10 (423 respondents), June 3 (464 respondents), May 27 (422 respondents), May 20 (439 respondents), May 13 (431 respondents), May 6 (446 respondents), April 29 (479 respondents), April 22 (418 respondents), April 15 (410 respondents), April 8 (450 respondents), April 1 (477 respondents), March 25 (495 respondents) and March 17–18 (1,152 respondents). The most recent results have a margin of error of +/- 5%, with a 95% confidence interval. Not all charted week-over-week differences may be statistically significant.