albert Chan

We discuss select findings and compare them to those from prior weeks: November 10, November 3, October 27, October 20, October 13, October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

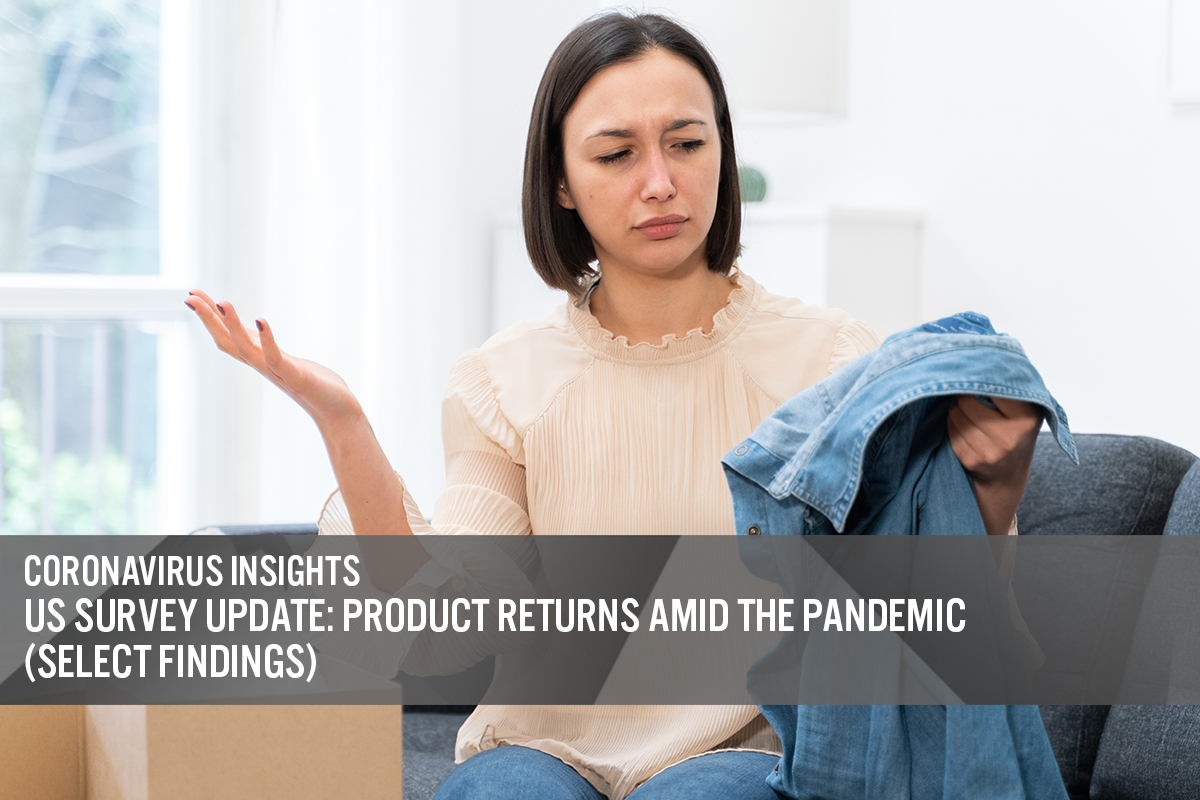

1. Consumers Prefer To Return Online Orders by Mail than in StoresAs consumers continue to shop online amid the pandemic, this week, we asked about their behavior and attitudes toward product returns.

We saw more shoppers favor shipping their online orders back than returning them in physical stores. Some 43% of respondents that had returned products in the past 12 months said they prefer to return online orders by mail. This compared to just one-quarter that prefer to return in-store.

When we asked all respondents about their expectations for post-holiday returns this year, some 26% expect to return unwanted online purchases by mail, well ahead of the 18% that plan to do so in-store.

This could spell bad news for brands and retailers as returns incur additional costs, including logistics and extra labor. The problem could be worse in the wake of pandemic this year, with consumers more likely to purchase products online for the holiday season.

- See our full report for complete results on consumers’ attitudes toward product returns.

Base: US respondents aged 18+ who had returned any unwanted purchases in the past 12 months (top); US respondents aged 18+ (bottom)

Base: US respondents aged 18+ who had returned any unwanted purchases in the past 12 months (top); US respondents aged 18+ (bottom)Source: Coresight Research[/caption] 2. Almost Four in 10 Would Like the Option To Return Purchases Through Contactless Drop-Off Points

Some 37% would like to have the option to return products through contactless drop-off points post holiday, and over one-quarter (26%) would like the option to return their in-store holiday purchases by mail. This suggests that brands and retailers should introduce more convenient and safer ways of returning products in the wake of Covid-19, just as they have rolled out services such as curbside pickup for purchase collection. For example, third-party returns platforms work with brands to offer contact-free returns: Happy Returns allows shoppers to simply use a QR code to drop off their products at over 2,500 Return Bars.

Product returns often peak during or post holiday season, but we could see fewer returns overall this year due to Covid-19. A higher proportion of consumers expect to return fewer items than last year’s holiday season, compared to those planning to return more.

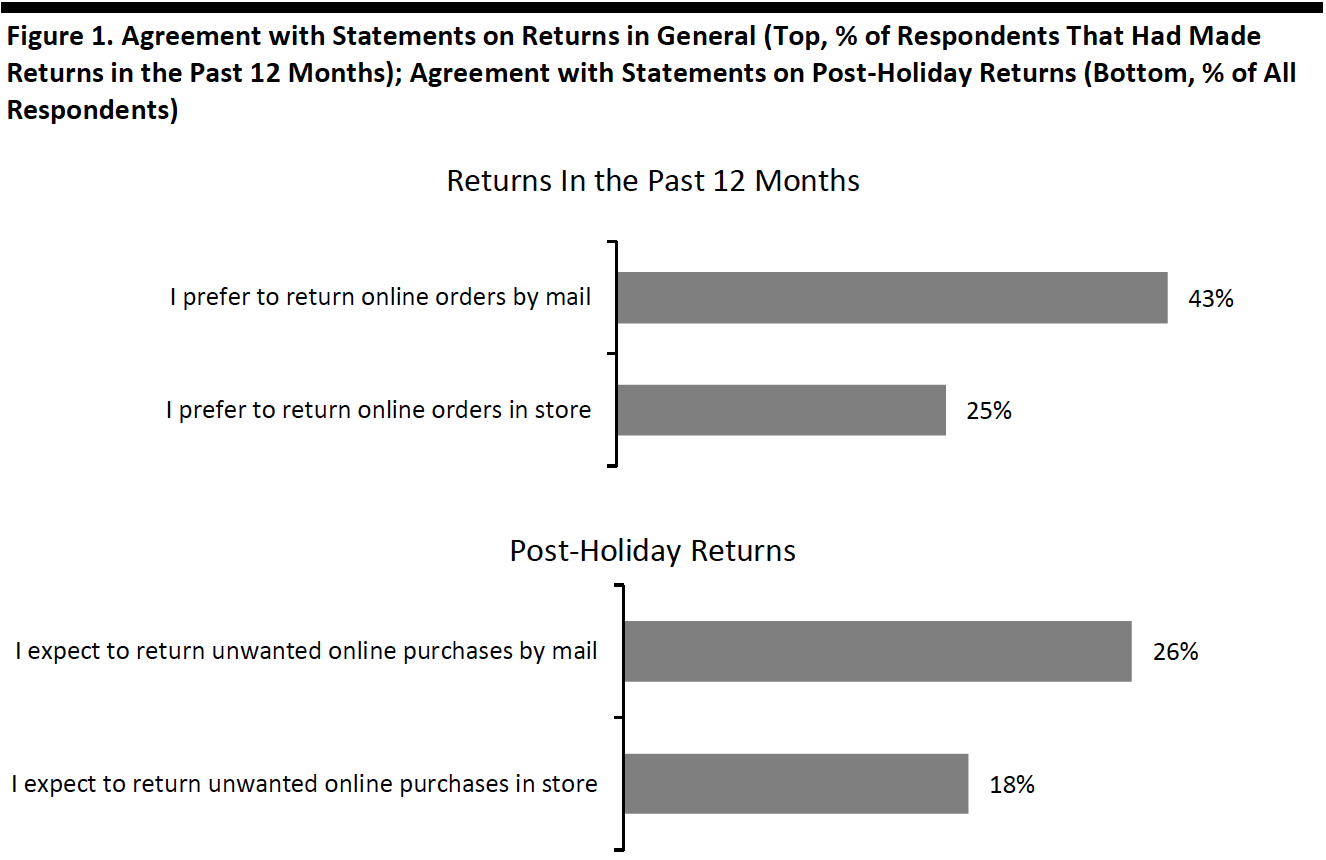

3. The Online Shopping Rate Remains High, as More Consumers Avoid StoresIn the past couple of weeks, we have seen a consistent proportion of almost three-quarters of consumers buying more online than they used to, despite fluctuation in the proportion that are buying more overall than pre-crisis.

E-commerce penetration could remain elevated, as avoidance of shopping centers/malls and shops in general both appear to be creeping up. Almost six in 10 consumers are currently avoiding shopping centers/malls, and some 45% are avoiding shops in general.

Looking at specific categories, the proportions of consumers buying more clothing, footwear or accessories and beauty online than pre-crisis both increased slightly, week over week. In a separate survey question, we also saw that the proportions that had bought apparel and beauty in the past two weeks had increased. Some 36% had bought clothing, footwear or accessories, up seven percentage points from last week.

[caption id="attachment_119705" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]