albert Chan

We discuss select findings and compare them to those from prior weeks: August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

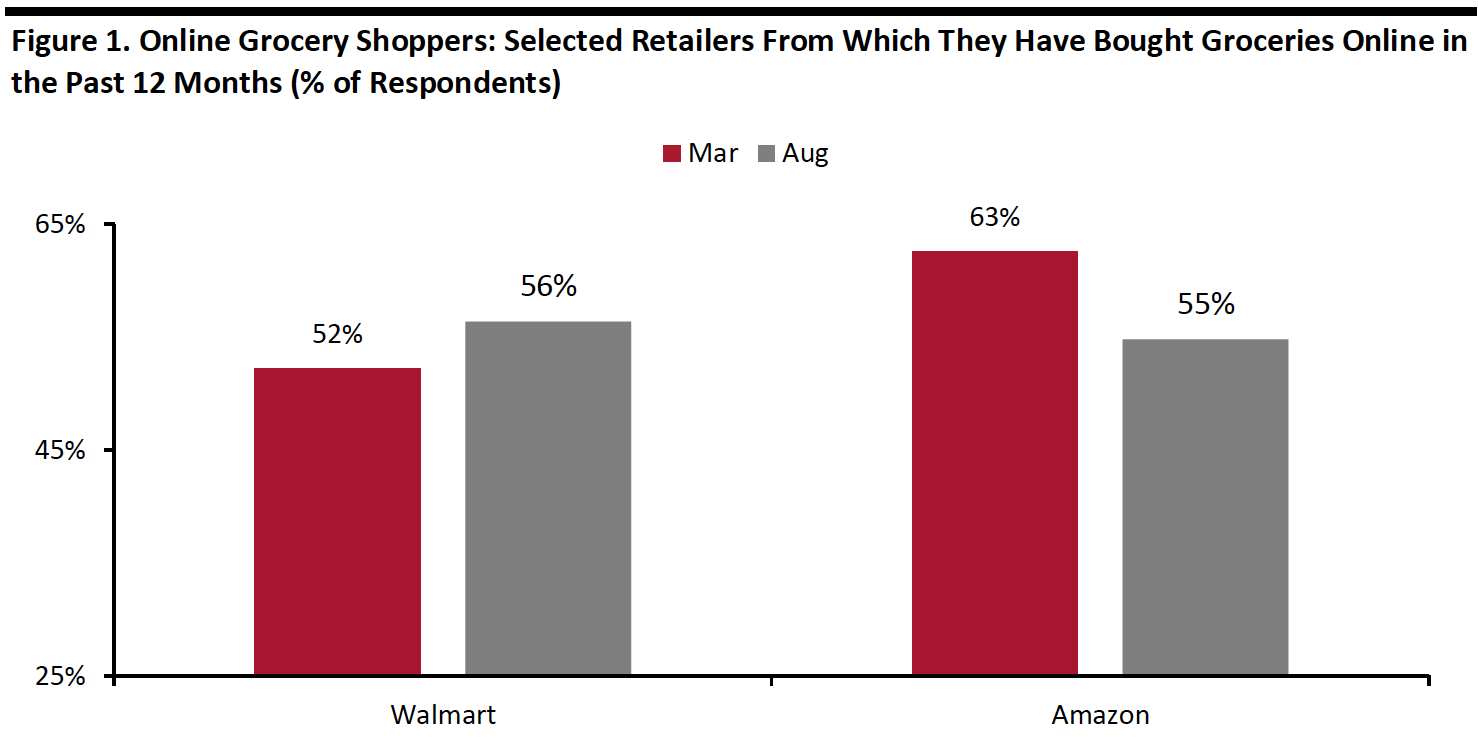

1. Walmart Overtakes Amazon as the Most-Shopped Online Grocery RetailerThis week, we asked consumers about their online grocery shopping behavior in the past 12 months and how the coronavirus has changed that behavior. We compare some of the results with findings from our main annual US online grocery survey, conducted five months earlier, on March 17–18, 2020.

Some 60% of respondents had bought groceries online in the past 12 months, up eight percentage points from 52% in March. By age, buying groceries online peaked in the 30–44 age group, the same as in March.

Our regular weekly question found that 35.6% of all respondents had bought groceries online in the past two weeks.

Among respondents who bought groceries online in the past 12 months, Walmart overtook Amazon as the most-shopped retailer: Some 56% have bought from Walmart, versus 52% in March, indicating that Walmart’s continued investment in online grocery is paying off in its battle with Amazon. The proportion of online grocery shoppers buying from Amazon declined by nearly eight percentage points to 55%, from 63% in March.

In the past week, Walmart reported 97% year-over-year growth in online sales at its Walmart US segment in its second quarter (including nongrocery orders). Amazon had previously reported a tripling in its global online grocery sales in its second quarter. Squaring these figures with our survey data implies that Amazon grew its US sales primarily through existing customers placing bigger-basket orders or more frequent orders, while Walmart’s growth may also have been fueled by attracting new online shoppers.

- See our full report for a complete ranking of which retailers consumers have bought from and how Covid-19 has changed their online grocery shopping behaviors.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who had bought groceries online in the past 12 months (599 in March, 250 in August)

Source: Coresight Research[/caption] 2. The Online Grocery Shopping Trend, Boosted by Covid-19, Is Likely To Stay

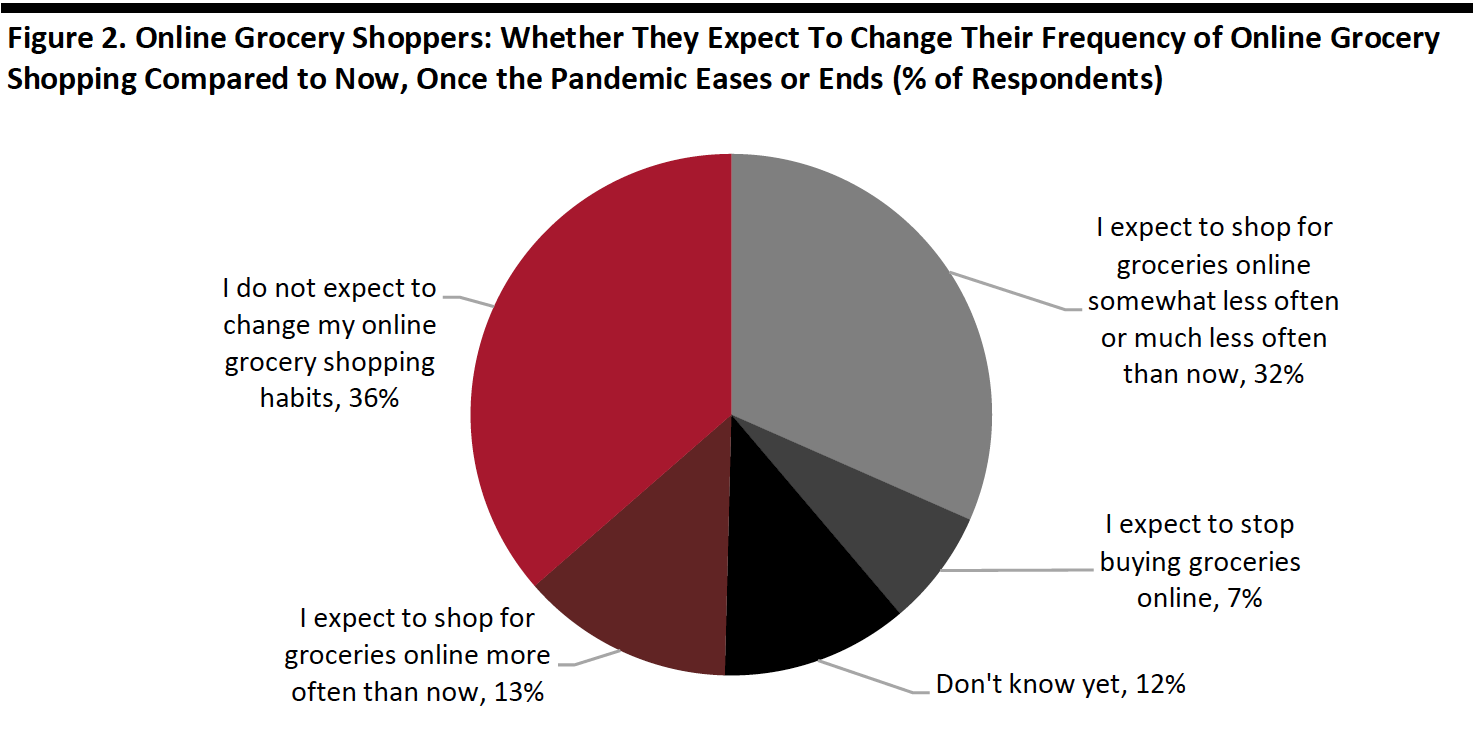

We asked online shoppers whether they expect to change their frequency of online grocery shopping compared to now, once the outbreak eases or ends:

- Some 36% of online grocery shoppers do not expect to change their online grocery shopping habits once the crisis eases or ends. We found that almost one-fifth of online grocery shoppers who started buying or buying more groceries online plan to retain their current purchase frequency.

- Only 7% plan to stop buying groceries online once the pandemic eases or ends.

Base: US Internet users aged 18+ who had bought groceries online in the past 12 months

Base: US Internet users aged 18+ who had bought groceries online in the past 12 monthsSource: Coresight Research[/caption] 3. Avoidance of Public Places Slides

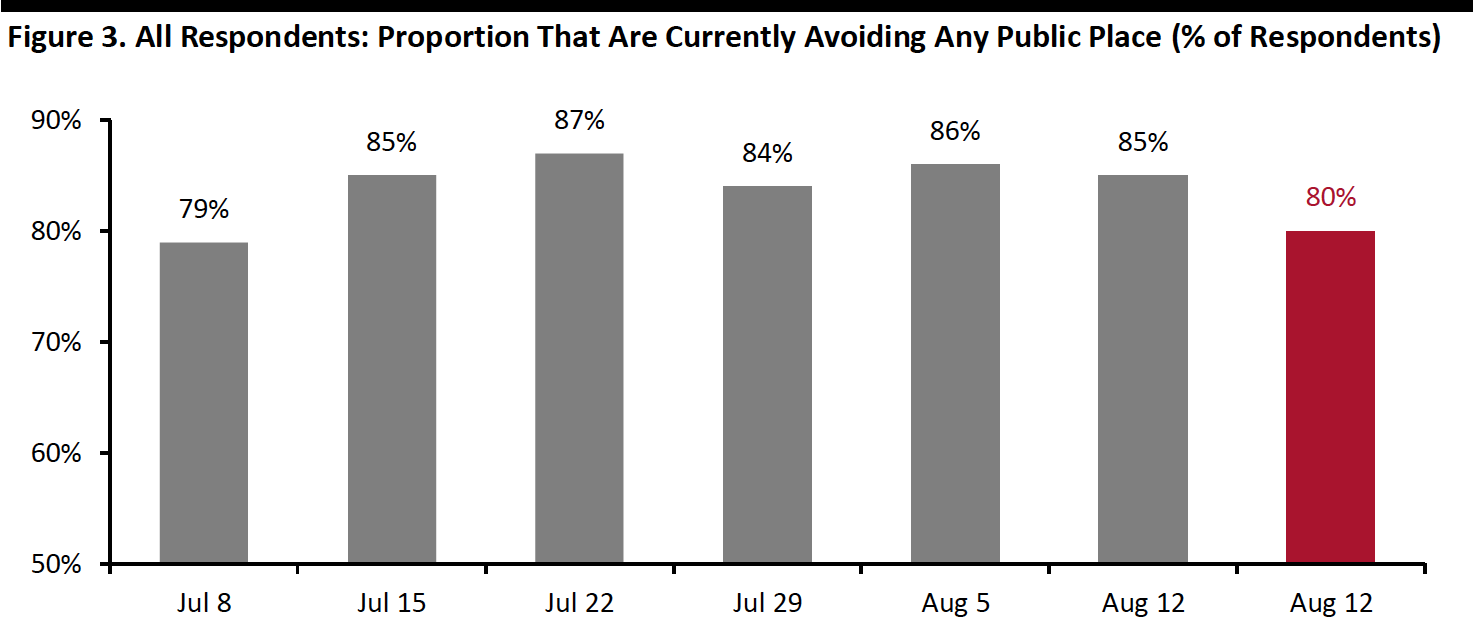

This week, the proportion of respondents saying that they are avoiding any public area dropped by five percentage points to 80%, from 85% last week. This is the lowest level we have seen for a month, although the rate remains high.

We saw slight decreases of avoidance in around half of the 12 options provided:

- The proportion of respondents that are currently avoiding shopping centers/malls fell slightly to six in 10 this week, compared to 63% last week. We have seen a gradual declining trend in avoidance of malls after reaching a peak of two-thirds a month ago. However, shopping centers/malls continue to be the most-avoided places among consumers.

- The proportion of respondents that are currently avoiding food-service locations fell by five percentage points to the level we saw two weeks ago, after jumping to the highest level last week.

- Shops in general saw the highest decline in avoidance rate this week, of almost seven percentage points.

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]