Nitheesh NH

We discuss select findings and compare them to those from prior weeks: October 13, October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

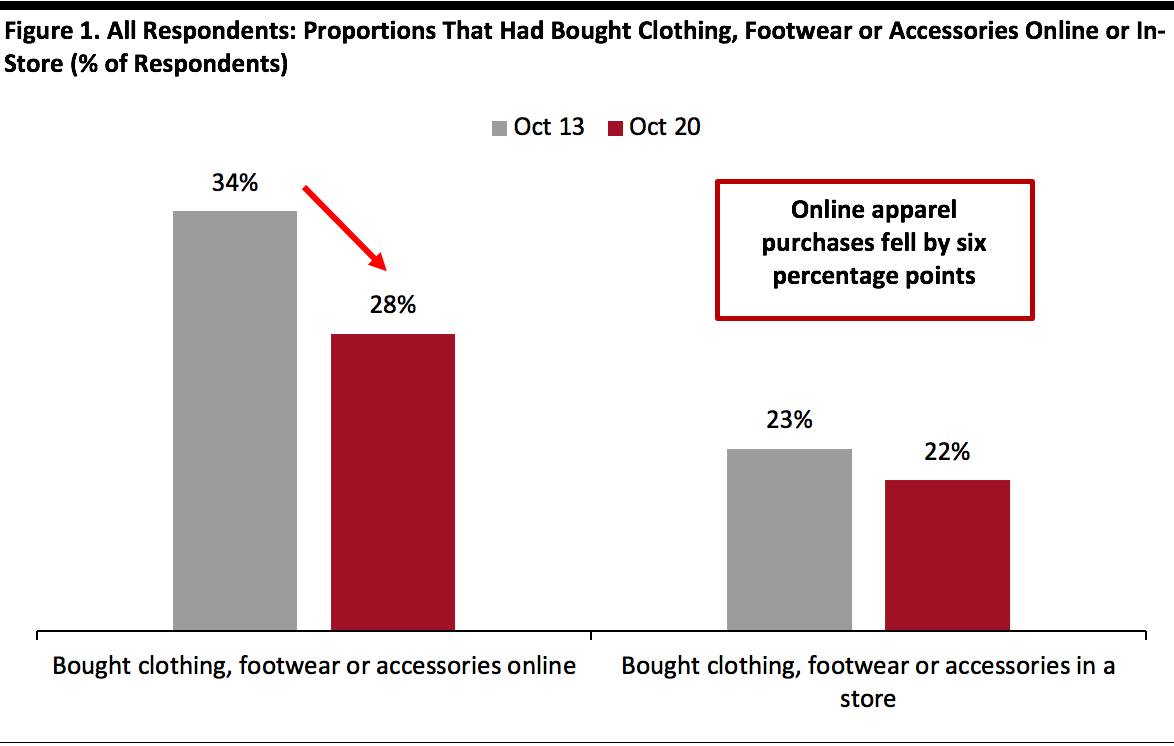

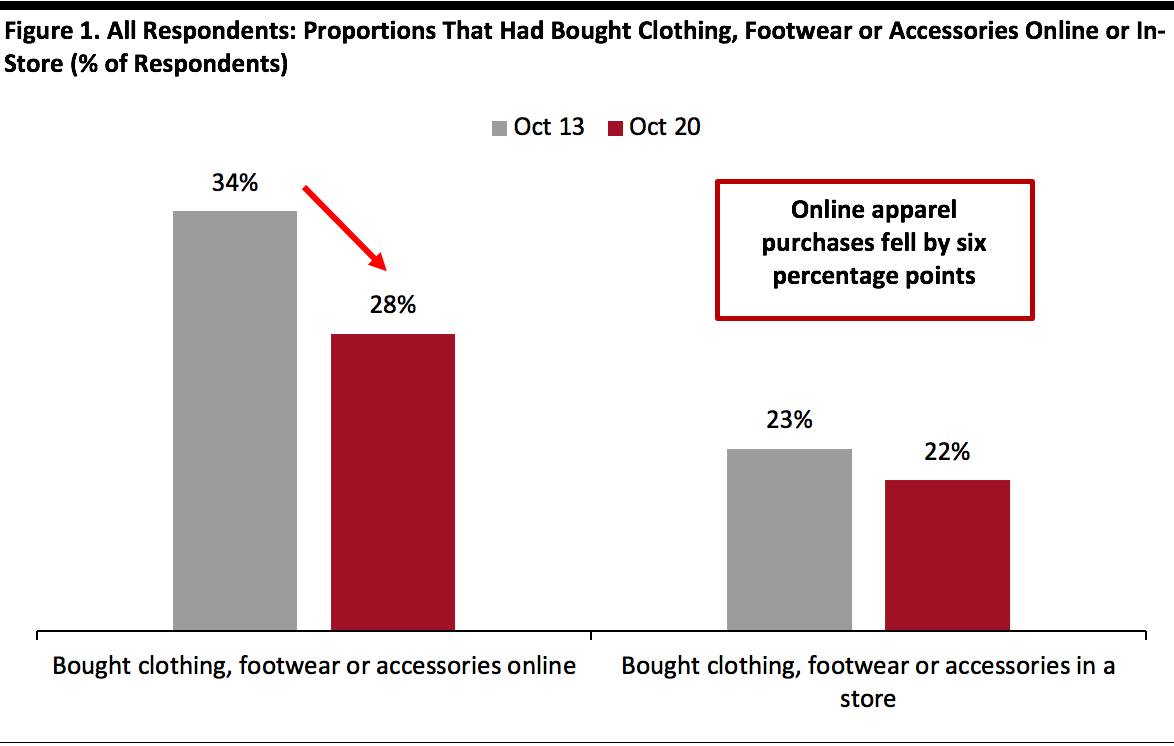

1. Fewer Consumers Are Buying Apparel Online

This week, we saw online apparel shopping taper off: The proportion of respondents that had bought clothing, footwear or accessories online in the past two weeks fell below 30% for the first time: Some 28% had done so, down six percentage points from 34% last week. This is the lowest level we have seen since June 17. The decline was driven by respondents aged 30–44.

In a separate survey question, we also found that the proportion of respondents currently buying more clothing, footwear or accessories online decreased to a new low since July, to 24%.

However, we did not see a shift of apparel purchases to the brick-and-mortar channel—The proportion that had bought apparel in a store stood at 22%, compared to 23% last week. This suggests that consumers are buying less clothing, footwear or accessories overall, possibly due to a switch of spending to other categories on Prime Day or during other promotional events.

[caption id="attachment_118134" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+

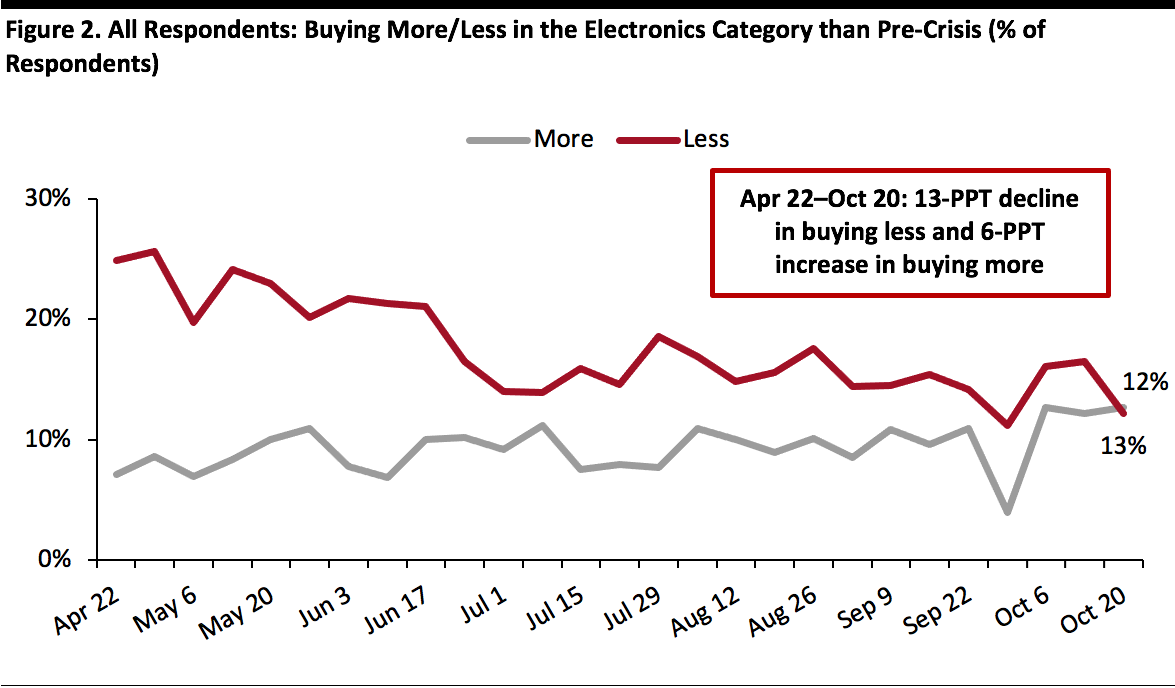

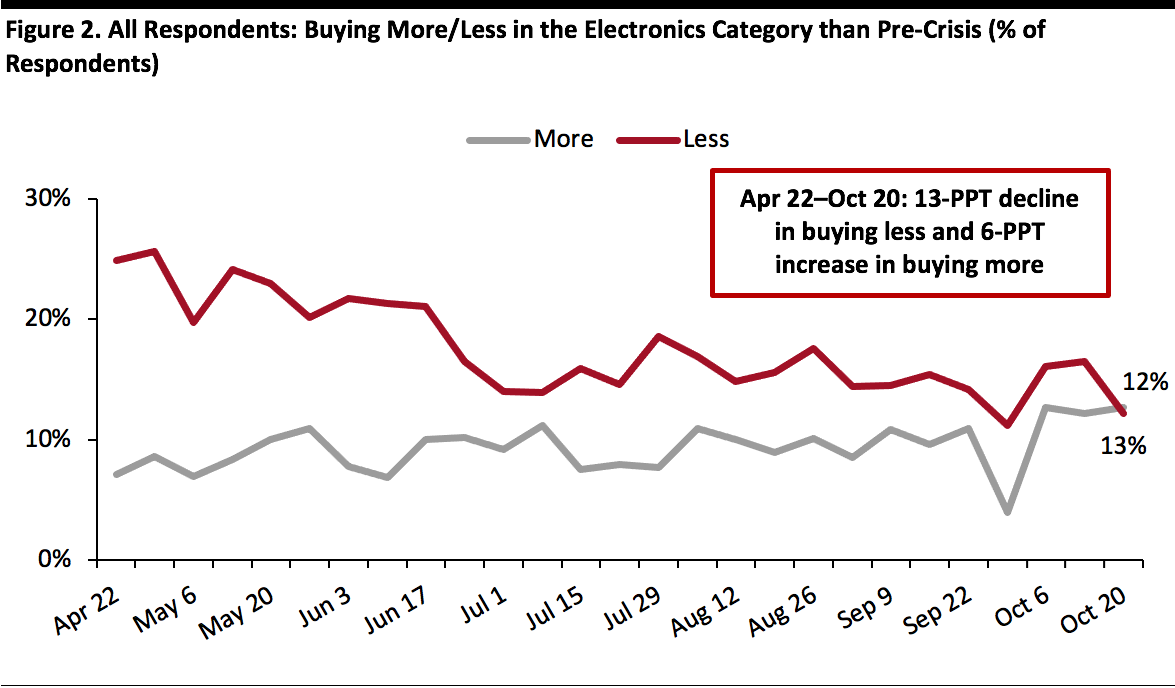

Source: Coresight Research[/caption] 2. Purchases in Electronics Improve For the first time, the proportion of respondents that are buying more in the electronics category than pre-crisis exceeded the proportion buying less, although only by very little. This week, some 13% said they are buying more in electronics, while the proportion buying less in this category declined to 12% from one-sixth last week. Base: US respondents aged 18+

Base: US respondents aged 18+

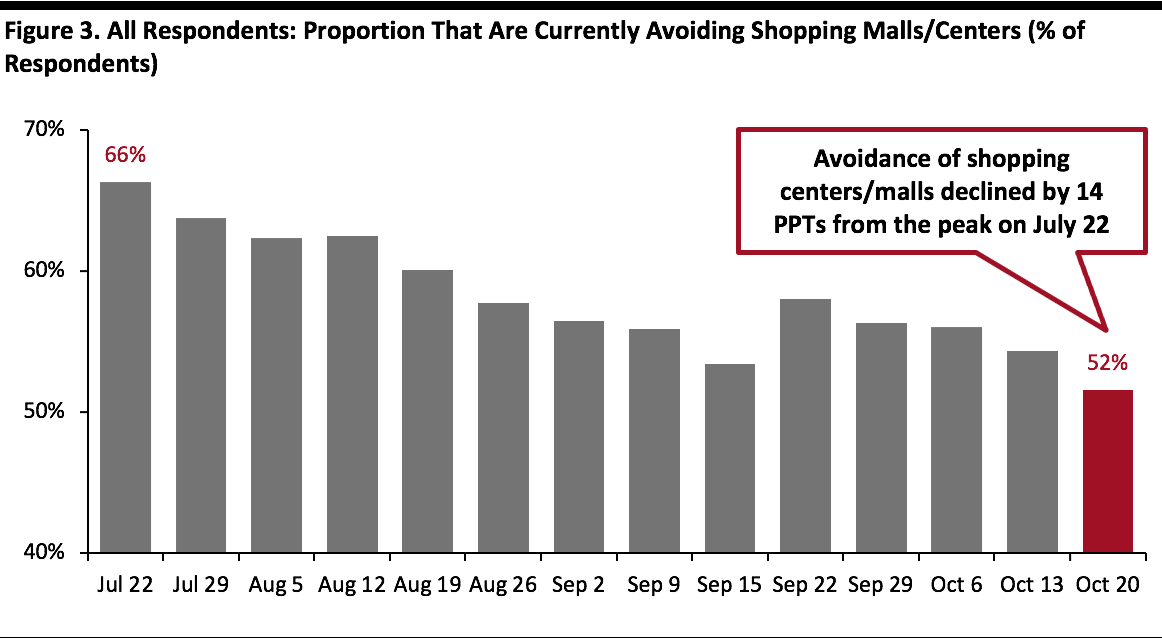

Source: Coresight Research[/caption] 3. Downward Trend in Avoidance of Shopping Malls/Centers This week, the proportion of respondents saying that they are avoiding any type of public place bounced back to over 80% again: Some 82% are currently avoiding such places, the highest in the past two months, versus 78% last week. Base: US respondents aged 18+

Base: US respondents aged 18+

Source: Coresight Research[/caption]

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption] 2. Purchases in Electronics Improve For the first time, the proportion of respondents that are buying more in the electronics category than pre-crisis exceeded the proportion buying less, although only by very little. This week, some 13% said they are buying more in electronics, while the proportion buying less in this category declined to 12% from one-sixth last week.

- Buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both.

- See our full report for complete results on what categories consumers are buying more or less of than before the pandemic.

Base: US respondents aged 18+

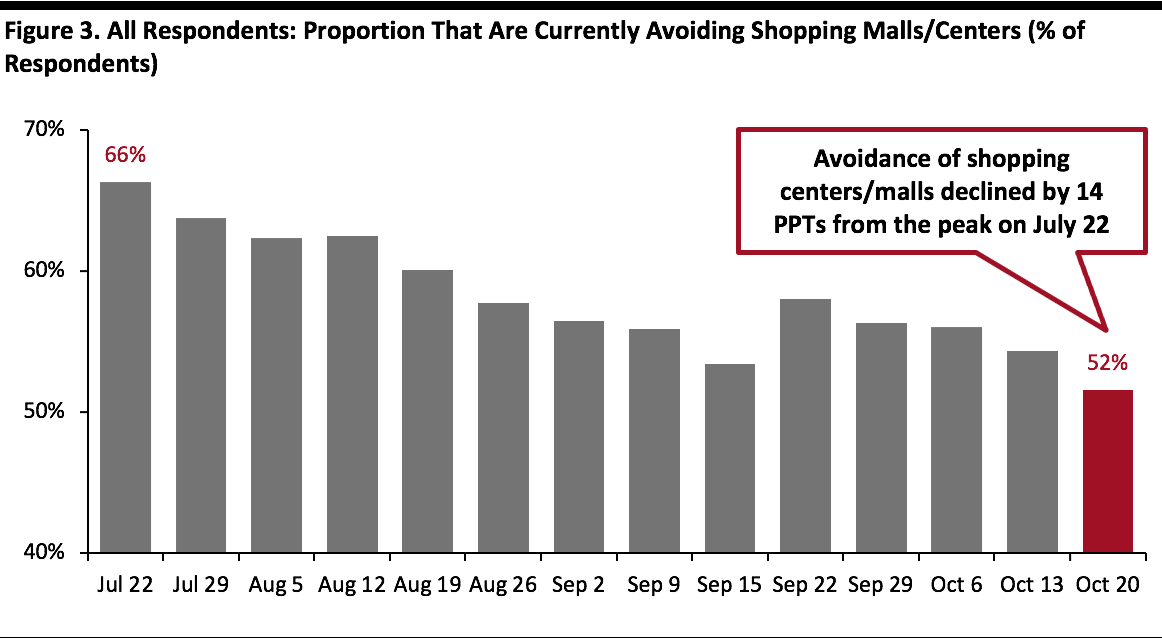

Base: US respondents aged 18+Source: Coresight Research[/caption] 3. Downward Trend in Avoidance of Shopping Malls/Centers This week, the proportion of respondents saying that they are avoiding any type of public place bounced back to over 80% again: Some 82% are currently avoiding such places, the highest in the past two months, versus 78% last week.

- The proportion of respondents that are currently avoiding shopping centers/malls fell for the fourth consecutive week (albeit only very slightly) to a new low this week. Some 52% are currently avoiding such places, compared to 54% last week. In terms of ranking, shopping centers became the second-most-avoided public places, following food-service locations.

- Avoidance of shops in general rebounded a little after reaching the lowest level last week, but still remained below 40%. Some 39% are currently avoiding such places, compared to 36% last week.

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]