albert Chan

We discuss select findings from our US consumer survey and compare them to findings from prior weeks: December 8, December 1, November 24, November 17, November 10, November 3, October 27, October 20, October 13, October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

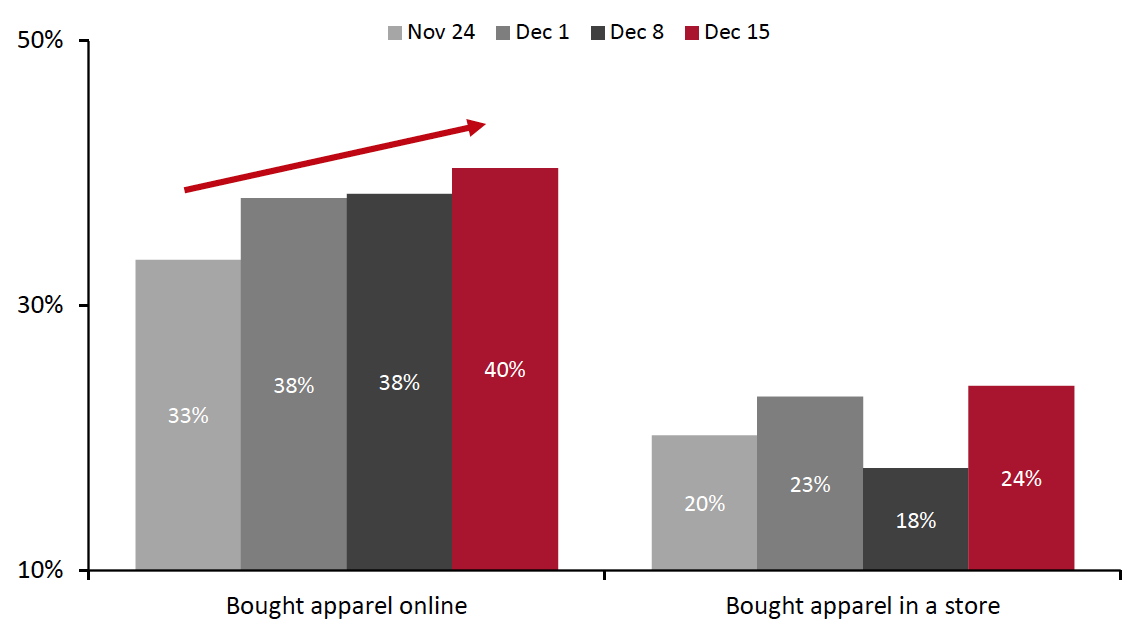

1. Online Apparel Shopping Continues To Gain MomentumAs we approach Christmas Day, online apparel shopping has maintained its appeal among consumers. This week, four in 10 respondents reported that they had bought clothing, footwear or accessories online, versus 38% last week. This is the highest level we have seen since we started asking the question in June, and online apparel shopping also became the top activity consumers had done in the past two weeks.

By age, we saw this activity peak among the youngest consumer group and decline by age thereafter.

In a separate survey question, we also saw that the proportion of consumers that are currently buying more clothing, footwear or accessories online than pre-crisis increased week over week.

The elevated level of online apparel purchases in the prior weeks is aligned with our holiday survey results, which showed clothing and footwear as the number-one category for holiday gifting.

In-store apparel shopping also rebounded after falling to the lowest level since September last week. This week, some 24% had bought apparel in-store in the past two weeks, up six percentage points from 18% last week.

- See our full report for complete results on what consumers have done in the past two weeks and expect to do in the next two weeks.

Figure 1. All Respondents: Proportions That Had Bought Apparel Online and in a Store in the Past Two Weeks (% of Respondents)

[caption id="attachment_121032" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption] 2. Eight in 10 Are Currently Avoiding Public Places

This week, the avoidance rate of any type of public place stood at 81%, versus 84% last week. Although the avoidance rate remained high, we have seen a slight downward trend in December.

- The proportion of respondents that are currently avoiding shopping centers/malls has broadly leveled off at 58% in the past few weeks.

- Avoidance of shops in general stood at 46%, versus 44% last week; this is the highest level we have seen for this location since October. The ongoing high avoidance rate of both shopping centers/malls and shops in general is aligned with consumers’ online shopping participation of over 70% in recent months.

- Food-service locations saw a week-over-week bounceback in avoidance rate, from 57% last week to 60% this week—roughly the same level as two weeks ago. Food-service locations again became the most-avoided public places this week.

We asked respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis in the long term. This week, some 48% expect to retain some changed behaviors post crisis, the lowest level we have seen since we started asking the question in late March, suggesting that consumers are more willing to return to their regular activities than previously expected.

Looking at specific behaviors to retain:

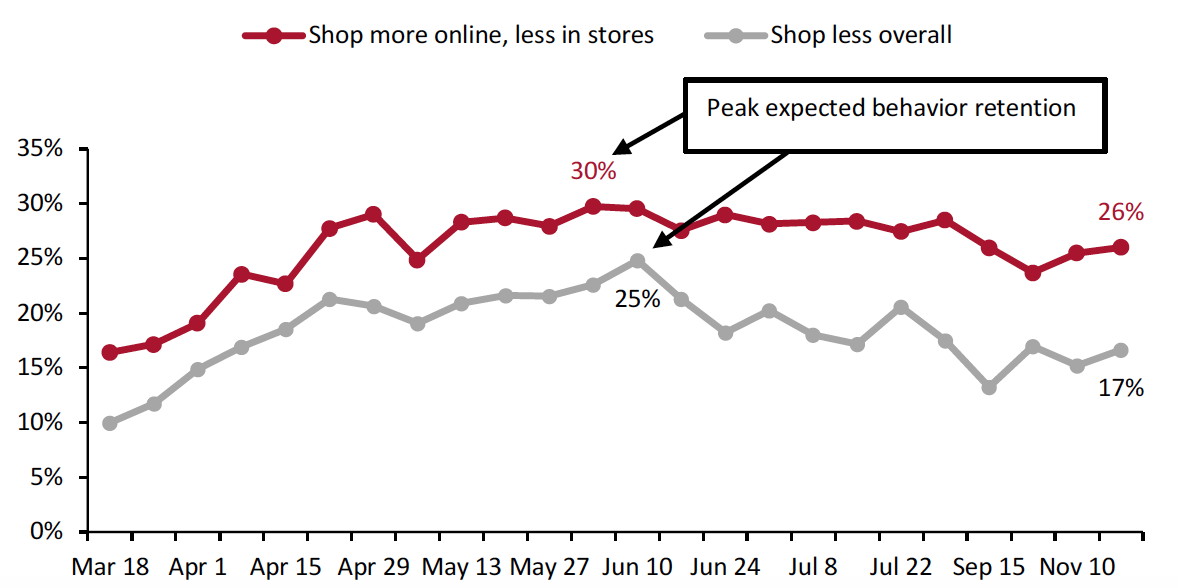

- Some 26% of respondents expect to shop more online, less in stores in the long term, level with the proportion last month. This week, the highest proportion of consumers expected to retain this behavior compared to other options. It also has the smallest difference between its peak and this week’s level, making it the most likely behavior to be retained in the long term.

- The proportion of consumers expecting to retain the behavior of shopping less overall returned to the level we saw two months ago, at around 17%. The medium-term trend still looks to be downward, which is encouraging for the retail industry.

Figure 2. All Respondents: Selected Behaviors They Expect To Retain (% of Respondents)

[caption id="attachment_121033" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]