DIpil Das

We discuss select findings and compare them to those from prior weeks: September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

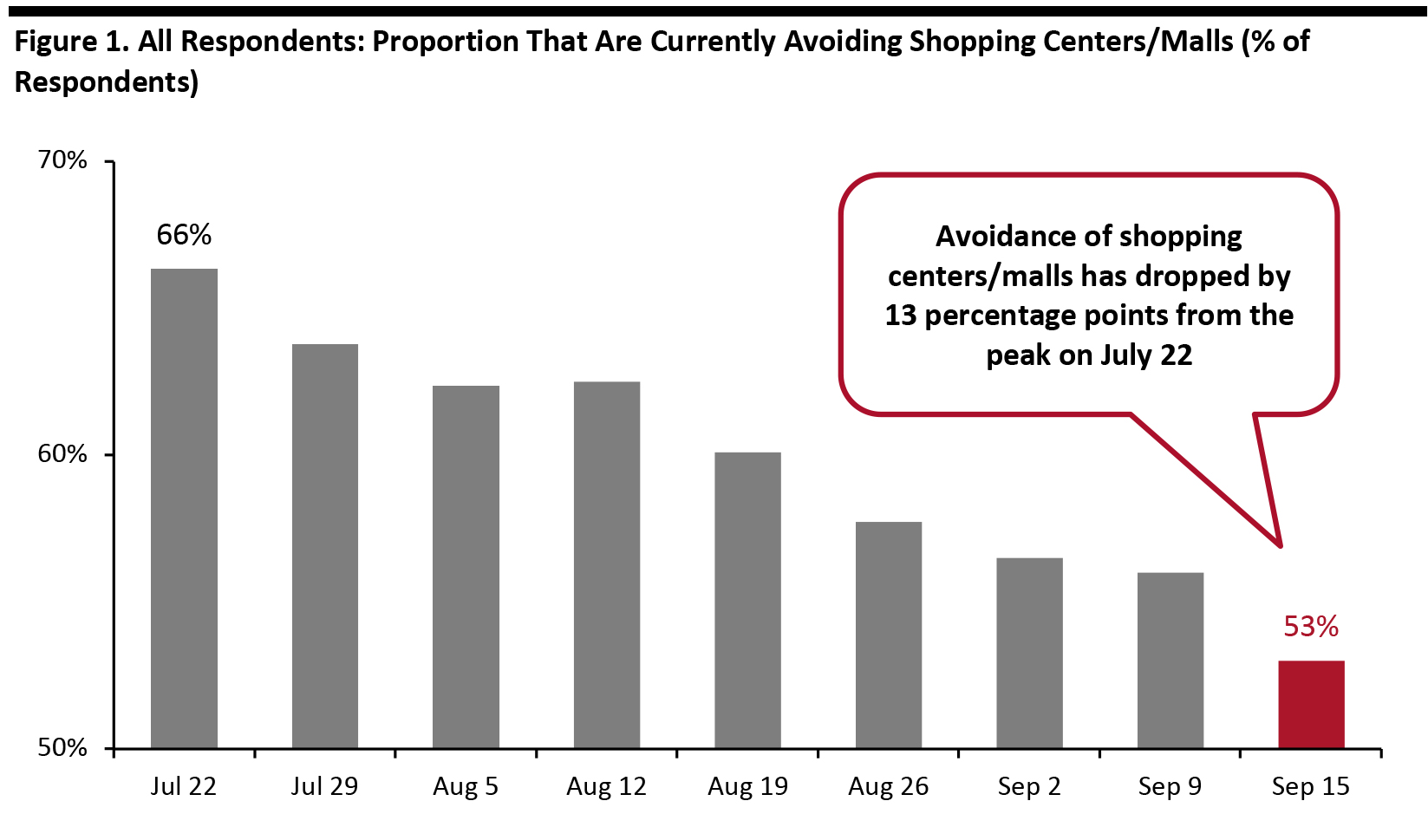

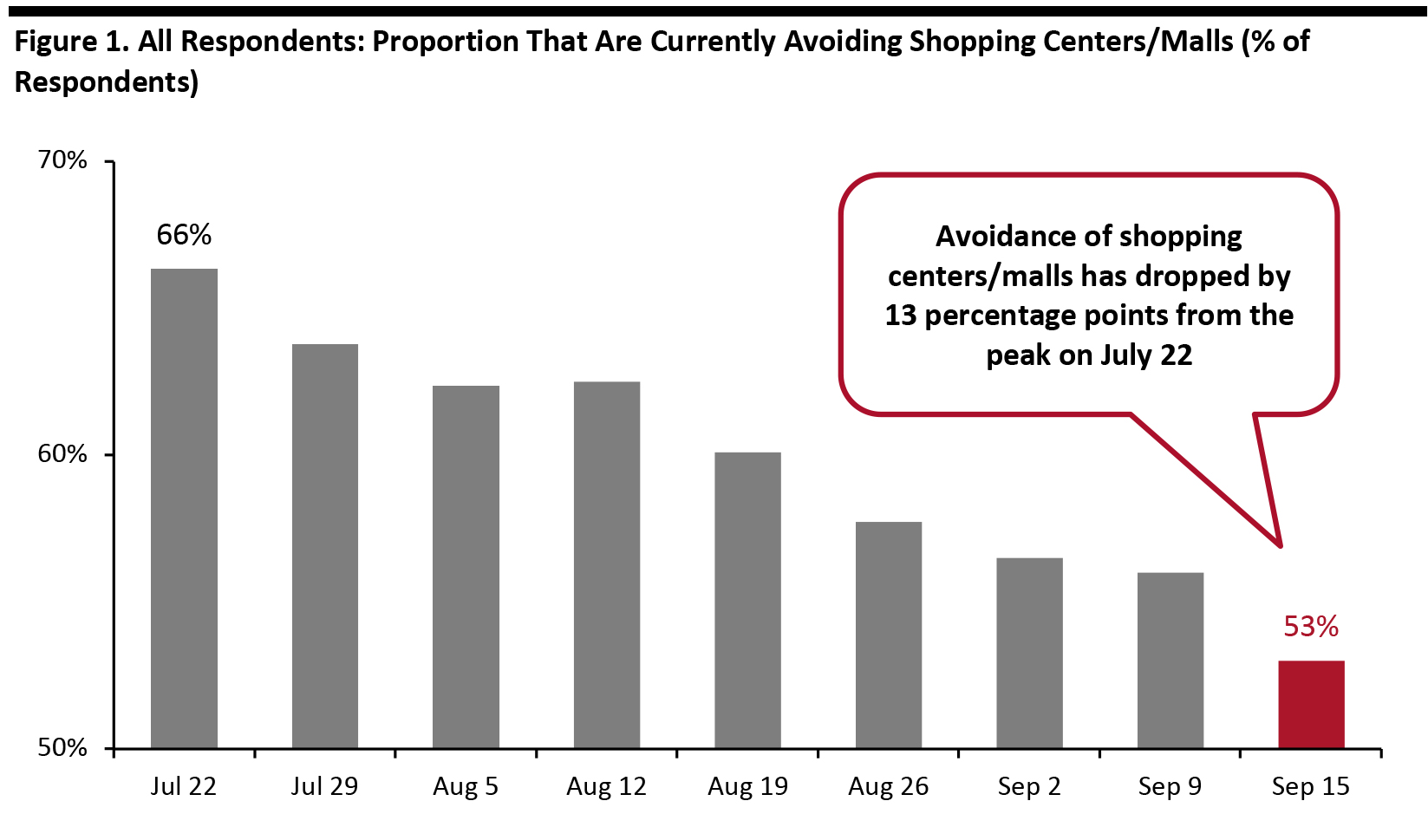

1. Declining Trends in the Avoidance of Both Shopping Centers/Malls and Shops in General

This week, the proportion of respondents saying that they are avoiding any type of public area dropped to a new low since July: 76% are currently avoiding any public place, versus around 80% in the past few weeks.

Encouragingly, we saw decreases in the avoidance rates of 10 of the 12 options provided, although most of the week-over-week changes were within the margin of error.

Base: US Internet users aged 18+

Base: US Internet users aged 18+

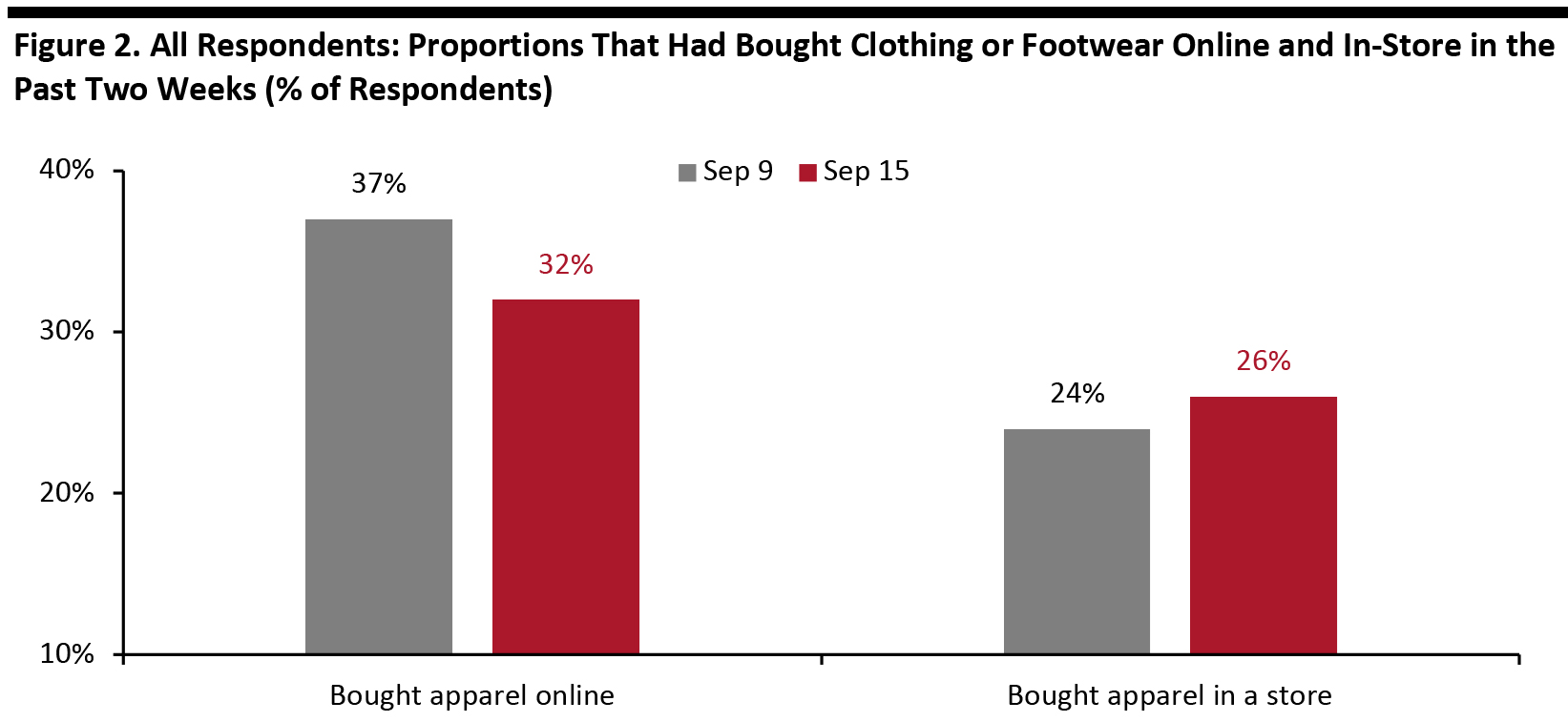

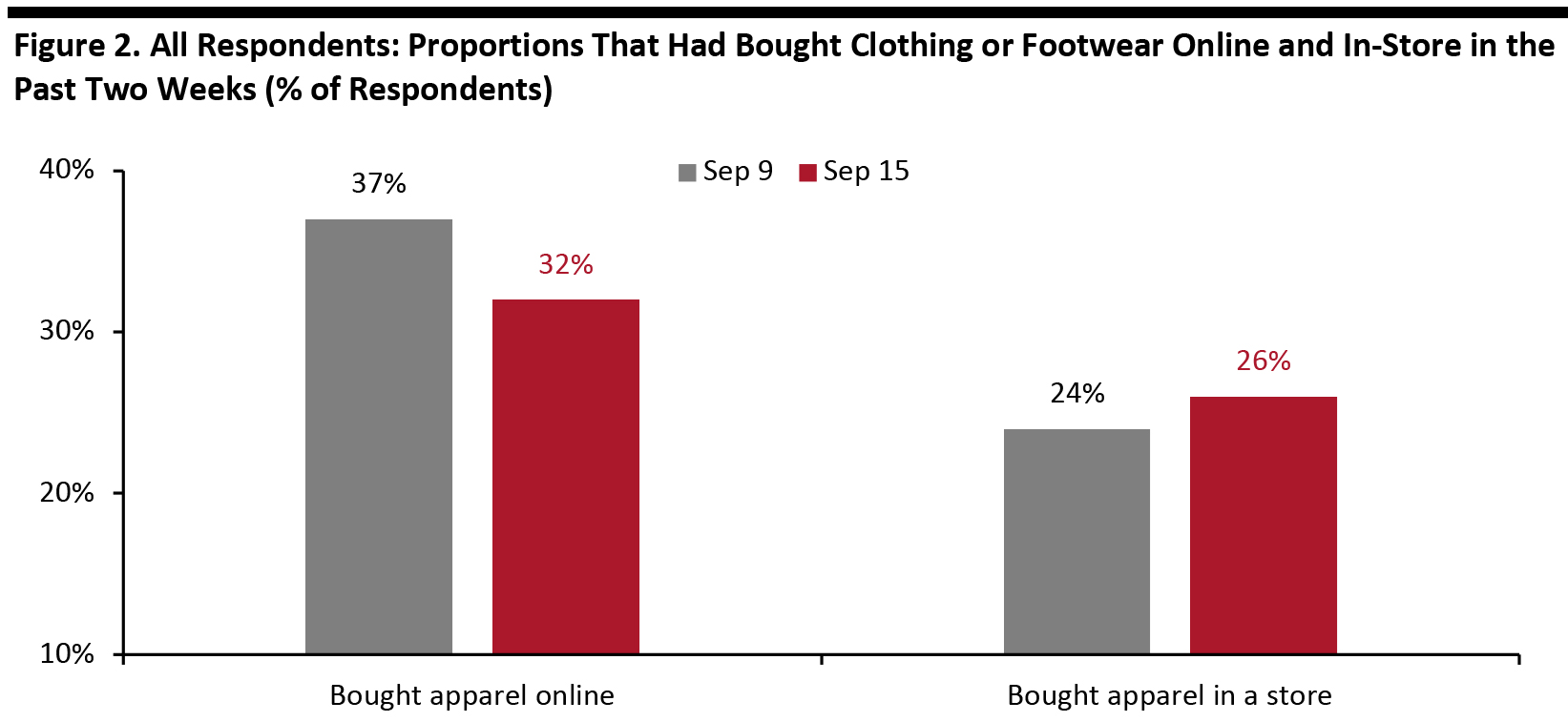

Source: Coresight Research [/caption] 2. In-Store Apparel Shopping Increases to a New High Each week, we ask consumers what they have done in the past two weeks, with this week’s survey showing that the proportion of consumers that had bought apparel in-store reached a new high. Some 26% had bought clothing or footwear in a store in the past two weeks. The proportion has increased by nine percentage points since we first started asking this question. By contrast, some 32% had bought apparel online, a decrease of five percentage points from the highest level of 37% last week, although it remained the top spending-related activity. In addition, the difference between the proportions that had done apparel shopping online and in-store fell to the lowest level since June 17. These data points further suggest an incremental return to brick-and-mortar retail among consumers. Base: US Internet users aged 18+

Base: US Internet users aged 18+

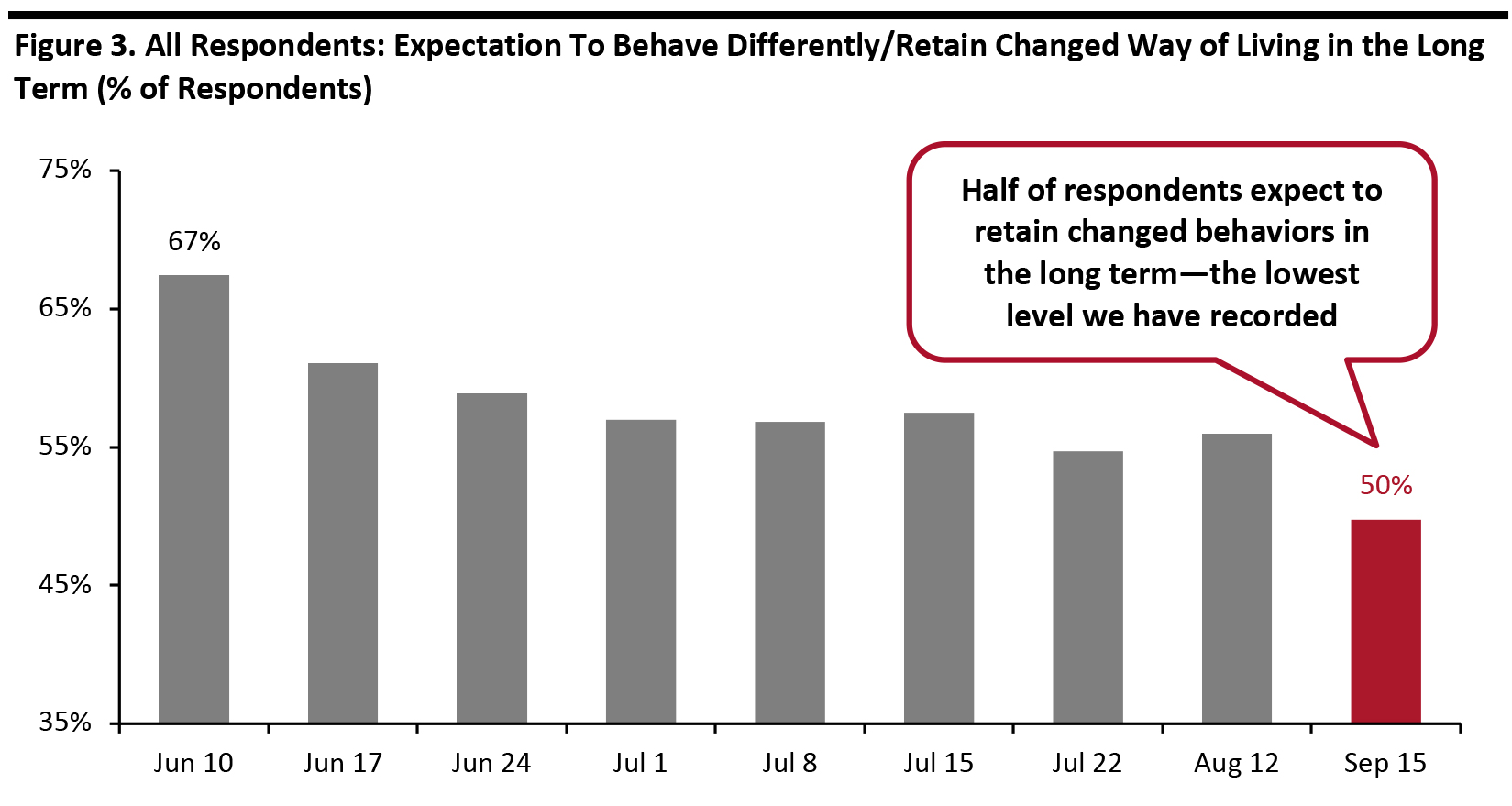

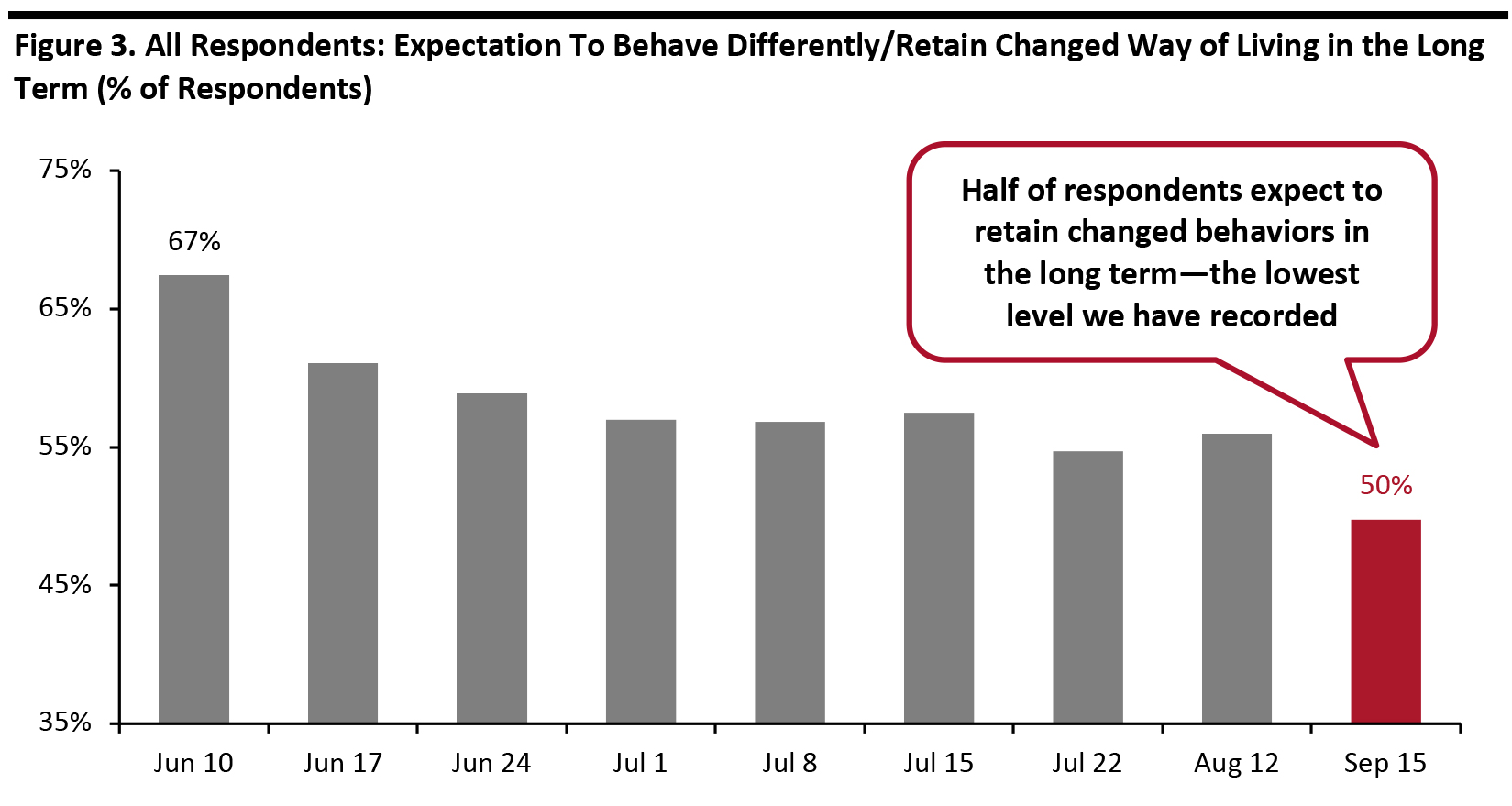

Source: Coresight Research [/caption] 3. Fewer Consumers Expect To Retain Changed Behaviors in the Long Term We ask respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis in the long term. This week, the proportion of respondents expecting to retain some changed behaviors declined by six percentage points to 50%, versus 56% a month ago and the peak of two-thirds on June 10. This is also the lowest level we have seen since we started asking the question at the end of March, suggesting that consumers are more willing to return to their regular activities than they previously expected. We saw declines in the proportions of respondents selecting nine of the 11 behavior options we provided, compared to a month earlier. Question not asked on July 29, August 5, August 19, August 26, September 2 or September 9

Question not asked on July 29, August 5, August 19, August 26, September 2 or September 9

Base: US Internet users aged 18+

Source: Coresight Research [/caption]

- The proportion of respondents that are currently avoiding shopping centers/malls fell slightly for the fifth consecutive week to 53%—the lowest level we have seen since July. Compared to the peak of two-thirds on July 22, the avoidance rate dropped by 13 percentage points this week.

- Avoidance of shops in general also went down below 40% for the first time since July; some 39% are currently avoiding such places. The avoidance rate has fallen by 15 percentage points from the highest level on July 22. The declining trends in avoidance of both shopping centers/malls and shops in general reflect a gradual return to in-store shopping.

- Food-service locations saw the largest decline, of six percentage points, in avoidance this week, with the rate reaching the lowest level since July.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 2. In-Store Apparel Shopping Increases to a New High Each week, we ask consumers what they have done in the past two weeks, with this week’s survey showing that the proportion of consumers that had bought apparel in-store reached a new high. Some 26% had bought clothing or footwear in a store in the past two weeks. The proportion has increased by nine percentage points since we first started asking this question. By contrast, some 32% had bought apparel online, a decrease of five percentage points from the highest level of 37% last week, although it remained the top spending-related activity. In addition, the difference between the proportions that had done apparel shopping online and in-store fell to the lowest level since June 17. These data points further suggest an incremental return to brick-and-mortar retail among consumers.

- See our full report for complete results on consumers’ activities in the past two weeks and their expected activities for the next two weeks.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 3. Fewer Consumers Expect To Retain Changed Behaviors in the Long Term We ask respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis in the long term. This week, the proportion of respondents expecting to retain some changed behaviors declined by six percentage points to 50%, versus 56% a month ago and the peak of two-thirds on June 10. This is also the lowest level we have seen since we started asking the question at the end of March, suggesting that consumers are more willing to return to their regular activities than they previously expected. We saw declines in the proportions of respondents selecting nine of the 11 behavior options we provided, compared to a month earlier.

- The proportion that expect to shop less overall fell to a new low since April. Only 13% of respondents plan to retain such behavior in the long term, versus the peak of one-fifth on June 10.

- The behavior of shopping more online and less in store has not seen much fluctuation since mid-May. The proportion of consumers expecting to shop more online in the long term stood at 26% this week.

Question not asked on July 29, August 5, August 19, August 26, September 2 or September 9

Question not asked on July 29, August 5, August 19, August 26, September 2 or September 9 Base: US Internet users aged 18+

Source: Coresight Research [/caption]