albert Chan

We discuss select findings and compare them to those from prior weeks: November 3, October 27, October 20, October 13, October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

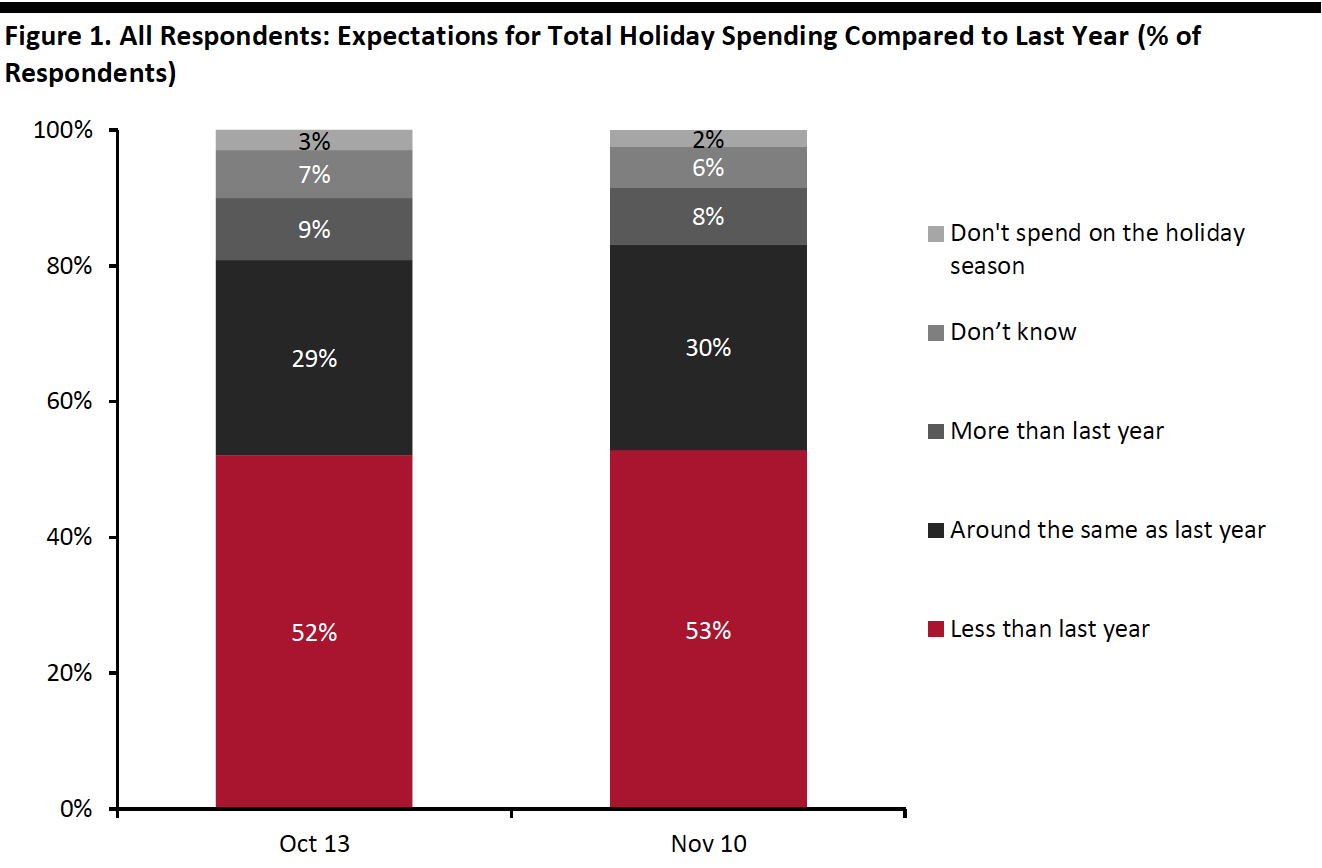

1. Over Half Expect To Spend Less for the Holiday SeasonAs we are now in the holiday season, we again asked consumers about their expected shopping behaviors for the holiday season 2020.

Overall expectations were fairly consistent with findings from previous months. The latest results confirmed that US consumers plan to scale back on total holiday spending: In total, some 53% expect their total holiday spending to be less than last year, with 32% planning to spend a lot less and 21% expecting to spend slightly less.

We asked respondents to think about their holiday spending overall—including retail purchases such as gifts, as well as spending driven by parties, social gatherings and getaways. For those who expect to spend less for the holiday season:

- Nonretail services once again are expected to take the hardest hit, although fewer consumers said they plan to spend less on dining out and days out, compared to a month ago.

- Almost half of the 12 product categories saw slight month-over-month declines, although some are within the margin of error. Electronics recorded the largest sequential decline from last month of almost seven percentage points in expectations to spend less. Home/kitchen products also fell to the second-to-last in ranking.

- See our full report complete results on consumers’ expected holiday shopping behaviors this year, and see our Holiday 2020: US Shopper Survey and our Five US Retail Predictions For Holiday 2020 for more data and analysis.

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption] 2. One-Third of Holiday Shoppers Expect To Shop, or Have Already Started Shopping, Early

The new 10.10 Shopping Festival and Amazon’s Prime Day kicked off an early holiday season in an unpredictable shopping year. With many retailers beginning to launch their promotional events for the season, we saw one-third of holiday shoppers report that they are expecting to start, or have already started, their holiday shopping earlier than usual, up six percentage points from a month ago. This compared to only 12% who expect to start their holiday shopping later, which results in a 20-percentage-point difference. The early and longer holiday season could not only help brands and retailers to boost sales in a challenging retail environment but also ease pressure on e-commerce fulfillment.

Almost three in 10 holiday shoppers plan to switch some or all of their holiday spending from stores to e-commerce, an improvement from one-quarter a month ago. As we discuss below, an elevated proportion of consumers are currently buying more online than they used to. The gap may reflect the already high e-commerce shopping rates during the holiday season. We expect holiday-quarter online sales to rise by around one-third year over year.

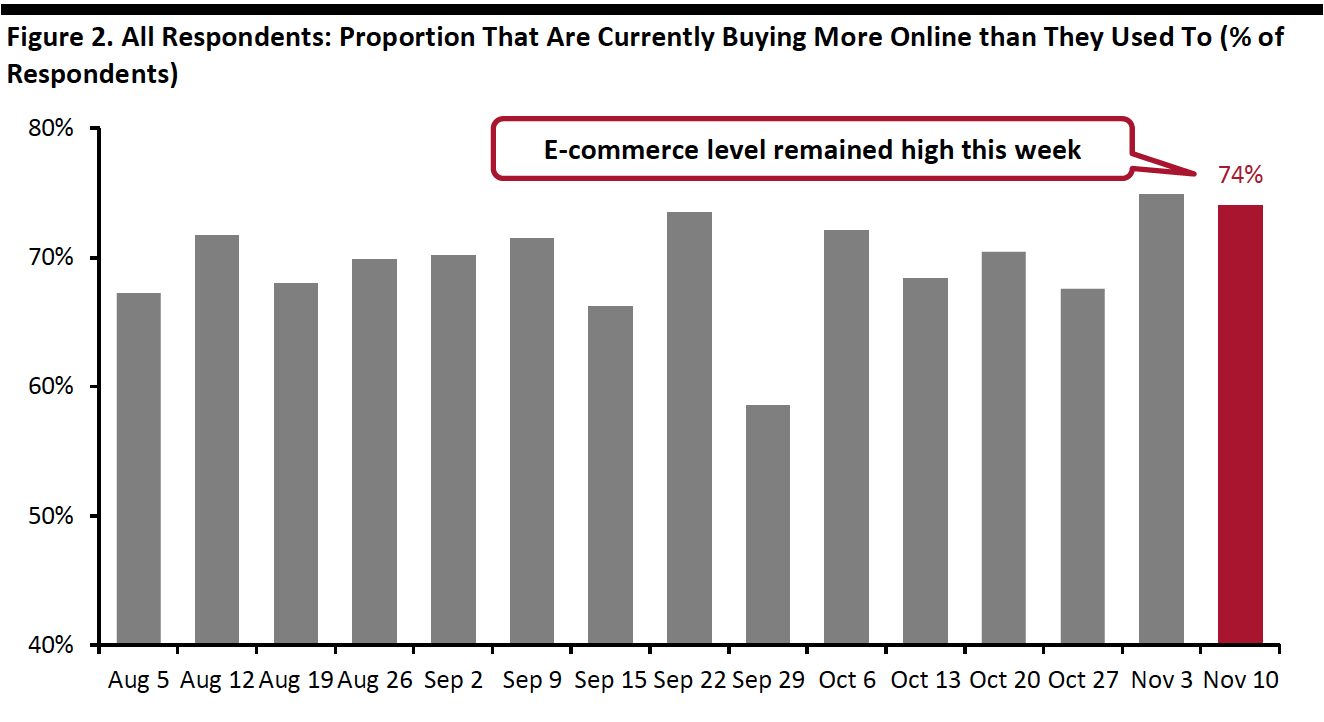

3. Online Shopping Rate Remains HighThis week, the proportion of consumers currently buying more online than they used to remained high at 74%, versus three-quarters last week, despite the week-over-week 11-percentage-point decline in the proportion of consumers buying more in any category overall than before the crisis.

Looking at specific categories, household products continued to be the most-purchased category online and saw the largest uptick this week, of seven percentage points over last week.

Some discretionary categories including clothing, footwear or accessories, beauty and home fell back a little this week, after peaking last week. We have seen a consistent upward trend in online electronics shopping in the past month. Compared to a month ago, the proportion has experienced a 6.5-percentage-point increase.

[caption id="attachment_119304" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]