albert Chan

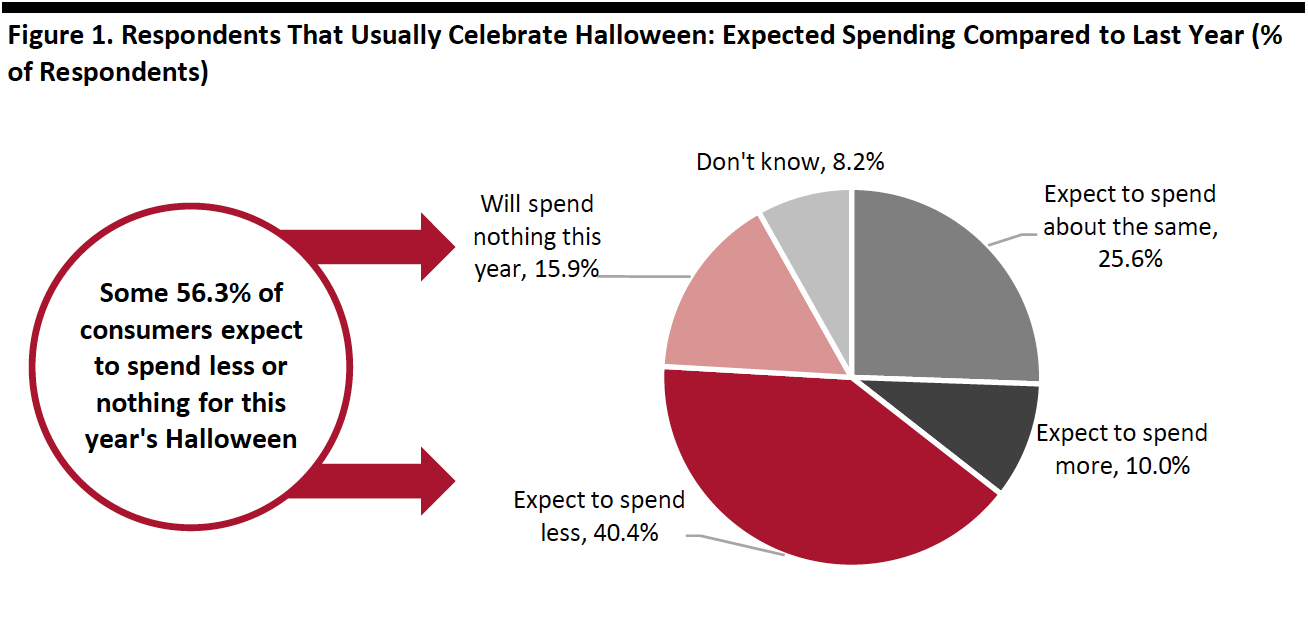

This week, we asked consumers how they expect to celebrate and spend for this year’s Halloween amid the coronavirus pandemic. Roughly two-thirds of all respondents said that they usually celebrate or take part in Halloween or have children that do so. Among them, four in 10 said they expect to spend less this year compared to last year—the most popular option. In addition, some 16% said they will spend nothing on Halloween this year. We are likely to see consumer spending on Halloween this year to be lower than last year.

- See our full report for complete results on how consumers will celebrate Halloween this year, and see our Halloween 2020 Preview, publishing this week, for more data and analysis.

Base: US Internet users aged 18+ who usually celebrate Halloween, or have children that do so

Base: US Internet users aged 18+ who usually celebrate Halloween, or have children that do soSource: Coresight Research[/caption] 2. Half Plan To Decorate Their House To Celebrate Halloween

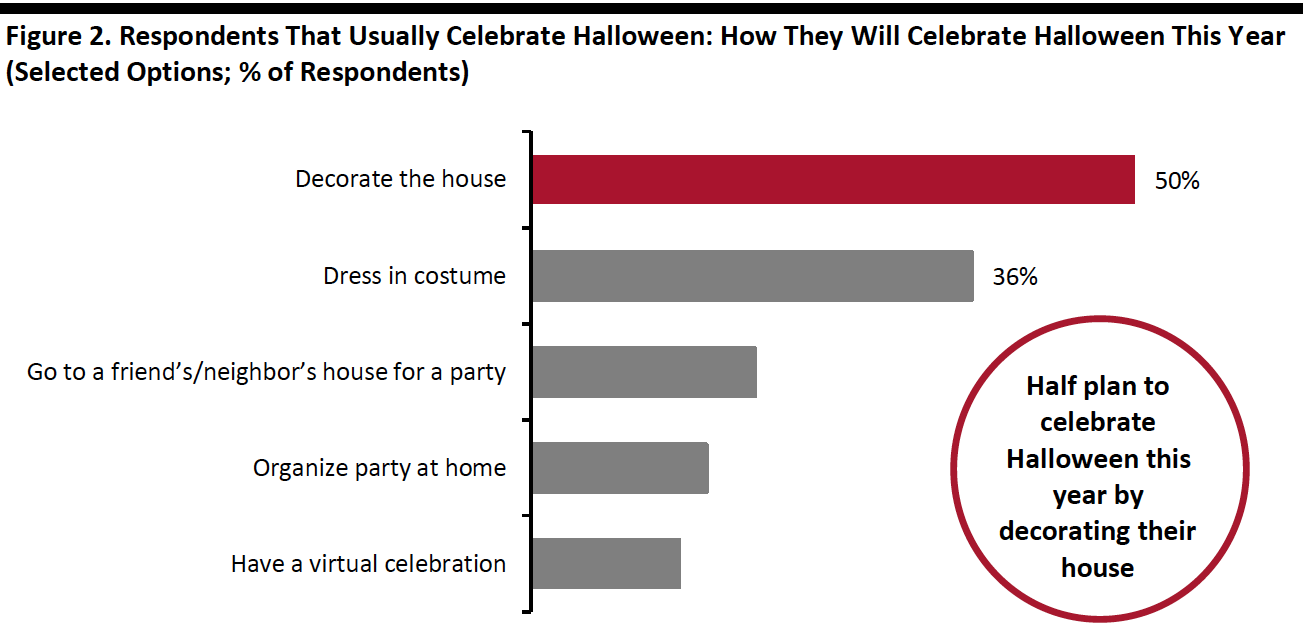

Consumers are still planning to celebrate Halloween this year despite the ongoing Covid-19 pandemic. Only one in 10 who typically celebrate Halloween said they do not plan to celebrate the holiday this year.

At-home activity ranked the highest among all celebration activity options we provided—half of consumers expect to decorate their house. This is followed by dressing in costumes, with some 36% planning to do so. These top two celebration activities suggest that seasonal home decorations and costumes will see relatively strong consumer demand in a year when total Halloween spending looks likely to fall.

Despite the ongoing pandemic, we saw higher proportions of consumers who said they will go to a friend’s/neighbor’s house for a party and who plan to organize party at home than those that expect to celebrate virtually.

[caption id="attachment_116742" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who usually celebrate Halloween, or have children that do so

Source: Coresight Research[/caption] 3. Avoidance Rates of Public Places Spiked This Week

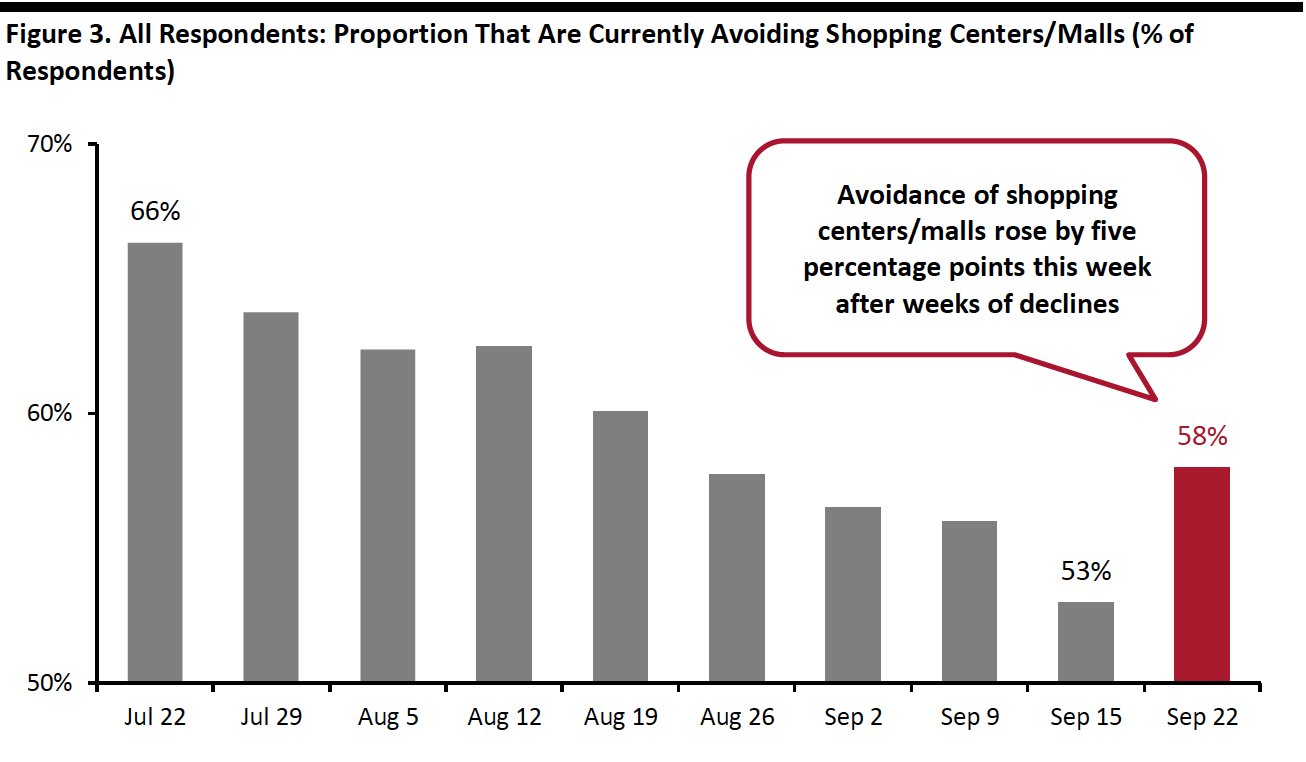

This week, the proportion of respondents saying that they are avoiding any type of public area spiked after weeks of a declining trend: Some 82% are currently avoiding any public place, up six percentage points from 76% last week. This could be due to rising coronavirus cases in some states, indicating a possible second wave of the virus this fall.

We saw increases in avoidance for almost all of the 12 options provided, although most of the week-over-week changes were within the margin of error.

- The proportion of respondents that are currently avoiding shopping centers/malls jumped after falling for five consecutive weeks. Some 58% are currently avoiding such places, up five percentage points from 53% last week. Although the avoidance rate rebounded this week, it was still below 60% and much lower than the peak of two-thirds on July 22.

- Avoidance of shops in general also went up to the level we saw three weeks ago after seeing a downward trend in the past few weeks. Some 42% are currently avoiding such places, versus 39% last week.

- Entertainment and leisure venues saw the largest decline, of almost six percentage points, in avoidance this week.

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]