DIpil Das

We discuss select findings and compare them to those from prior weeks: August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

1. Half of Consumers Expect To Spend Less for the Holiday Season

This week, we asked consumers about their expected shopping behaviors for the holiday season 2020. We compare the results with our findings from our survey four weeks ago, on July 15.

With the holiday season approaching, consumers’ spending cuts due to the pandemic are set to continue into the most critical sales period for retailers. Around half of respondents expect to spend less for the holiday season compared to last year.

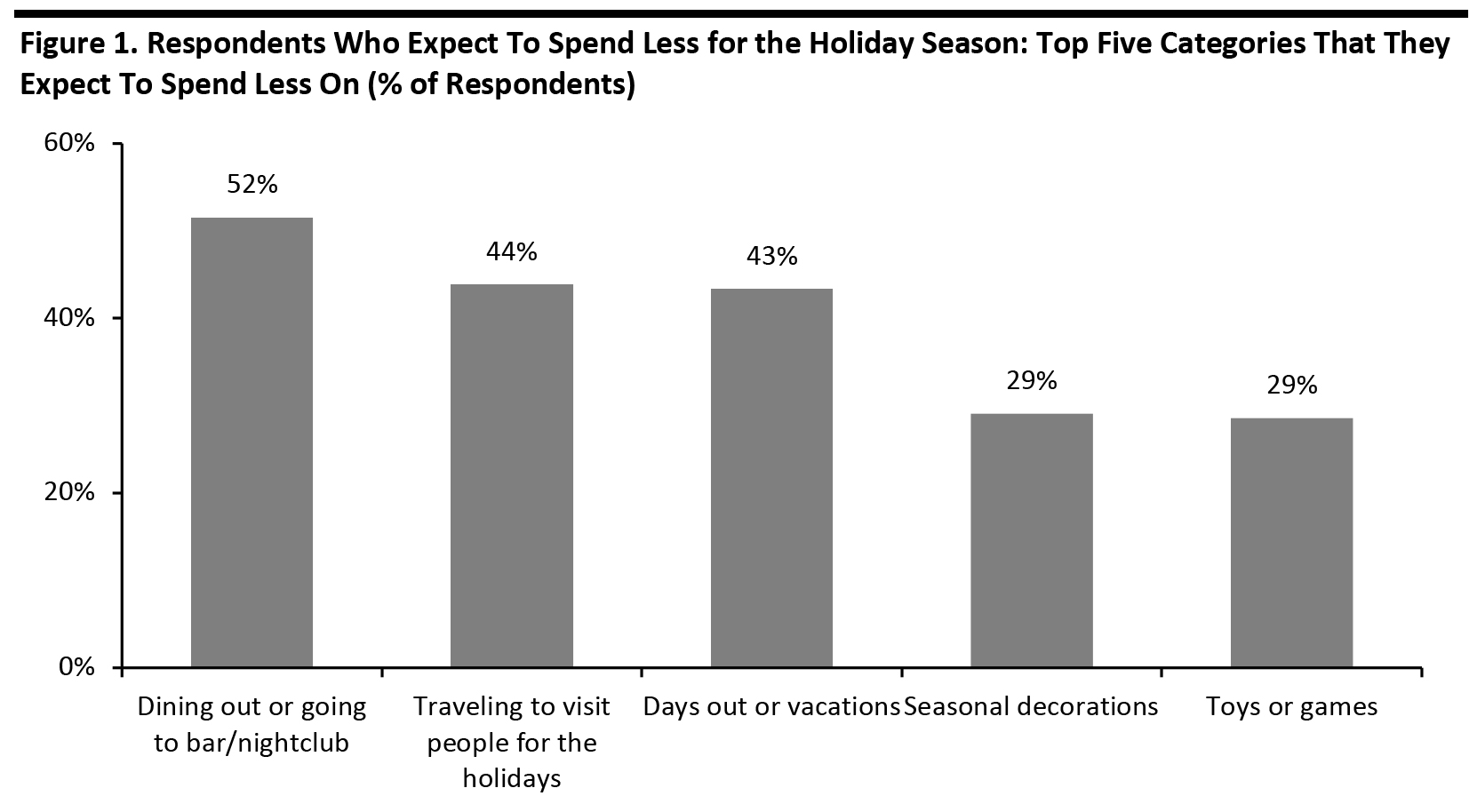

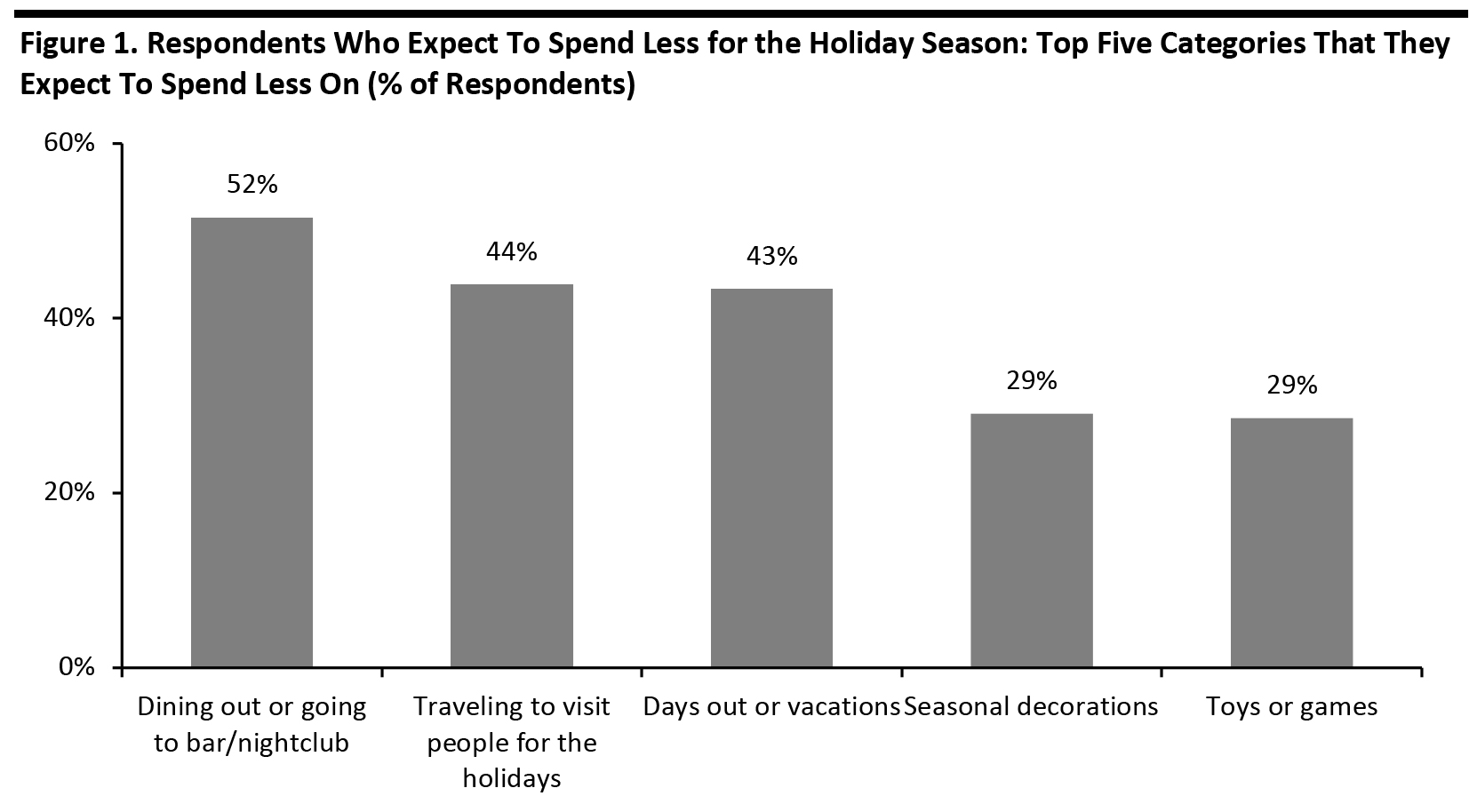

Around half of the 15 product and service category options saw increases in consumers’ expectations to spend less than last year, versus four weeks ago. Nonretail services remain the top categories in which consumers plan to spend less than last year—more than half said they will spend less on dining out or going to bars/nightclubs. The proportion of consumers that expect to spend less on vacations jumped five percentage points from July 15, to 43%.

Seasonal decorations and toys and games ranked the top product categories that consumers plan to spend less on for holiday—with the latter overtaking clothing and footwear this week. Around three in 10 said that they expect to cut their spending on decorations, but we saw a six-percentage-point decline compared to the proportion from four weeks earlier.

We asked respondents to think about their retail spending overall—so cutbacks in retail categories will reflect not just shoppers cutting gift spending but the effects of Covid-19 restrictions. For example, attending fewer or no parties, dining out less and working from home will all hit retail spending.

Base: US Internet users aged 18+ who expect to spend less on the 2020 holiday season than they did last year

Base: US Internet users aged 18+ who expect to spend less on the 2020 holiday season than they did last year

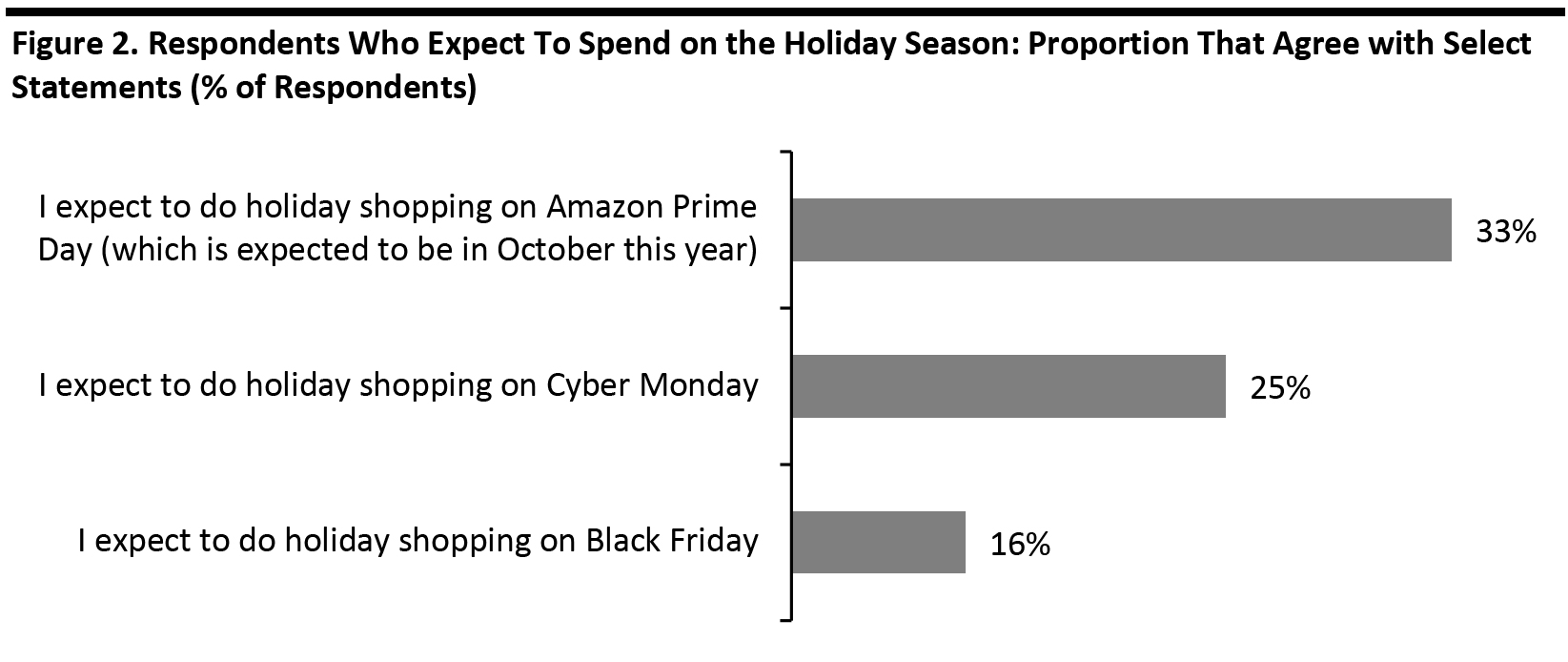

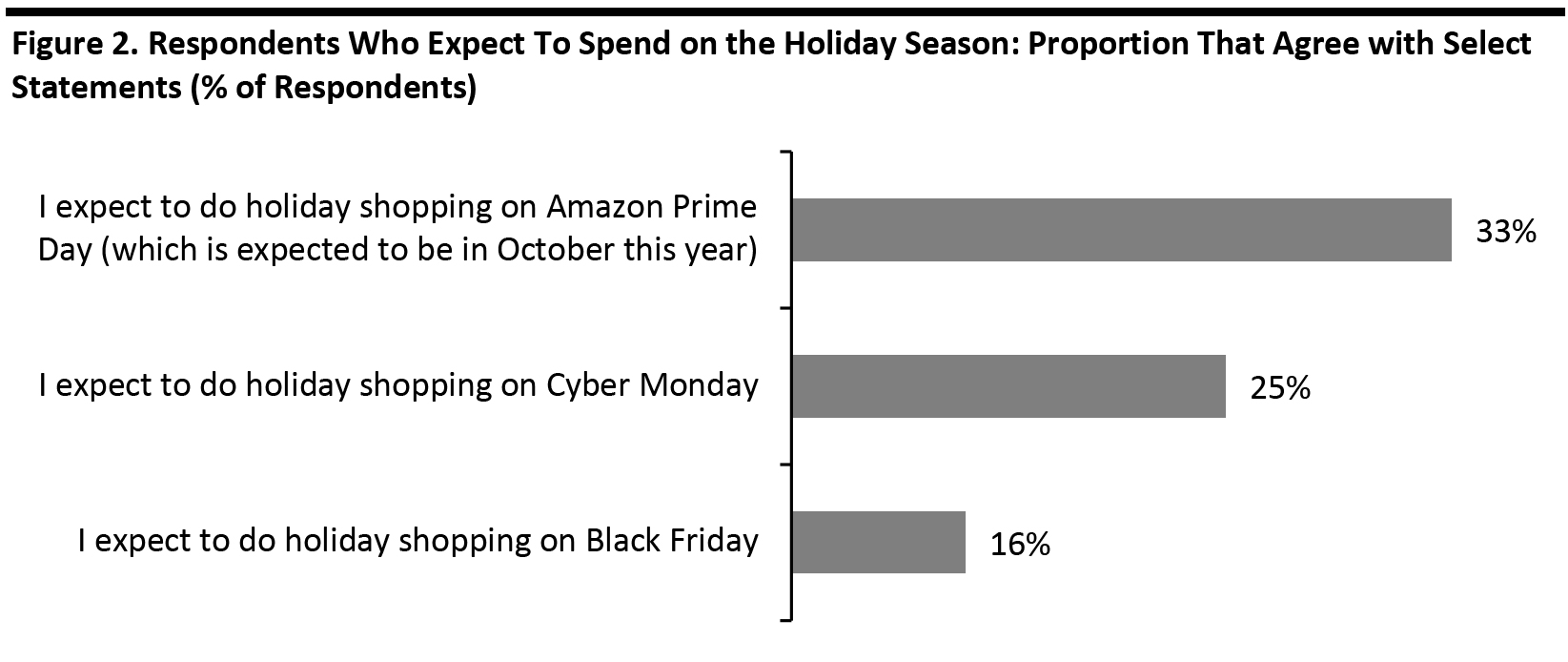

Source: Coresight Research [/caption] 2. Holiday Spending Is Pulled Forward We also asked consumers whether they agreed with any or all of 10 attitudinal and behavioral statements related to holiday-season shopping. Our findings confirmed that there will be a shift in the holiday spending timeline this year: Respondents could select multiple options

Respondents could select multiple options

Base: US Internet users aged 18+ who expect to spend on the holiday season

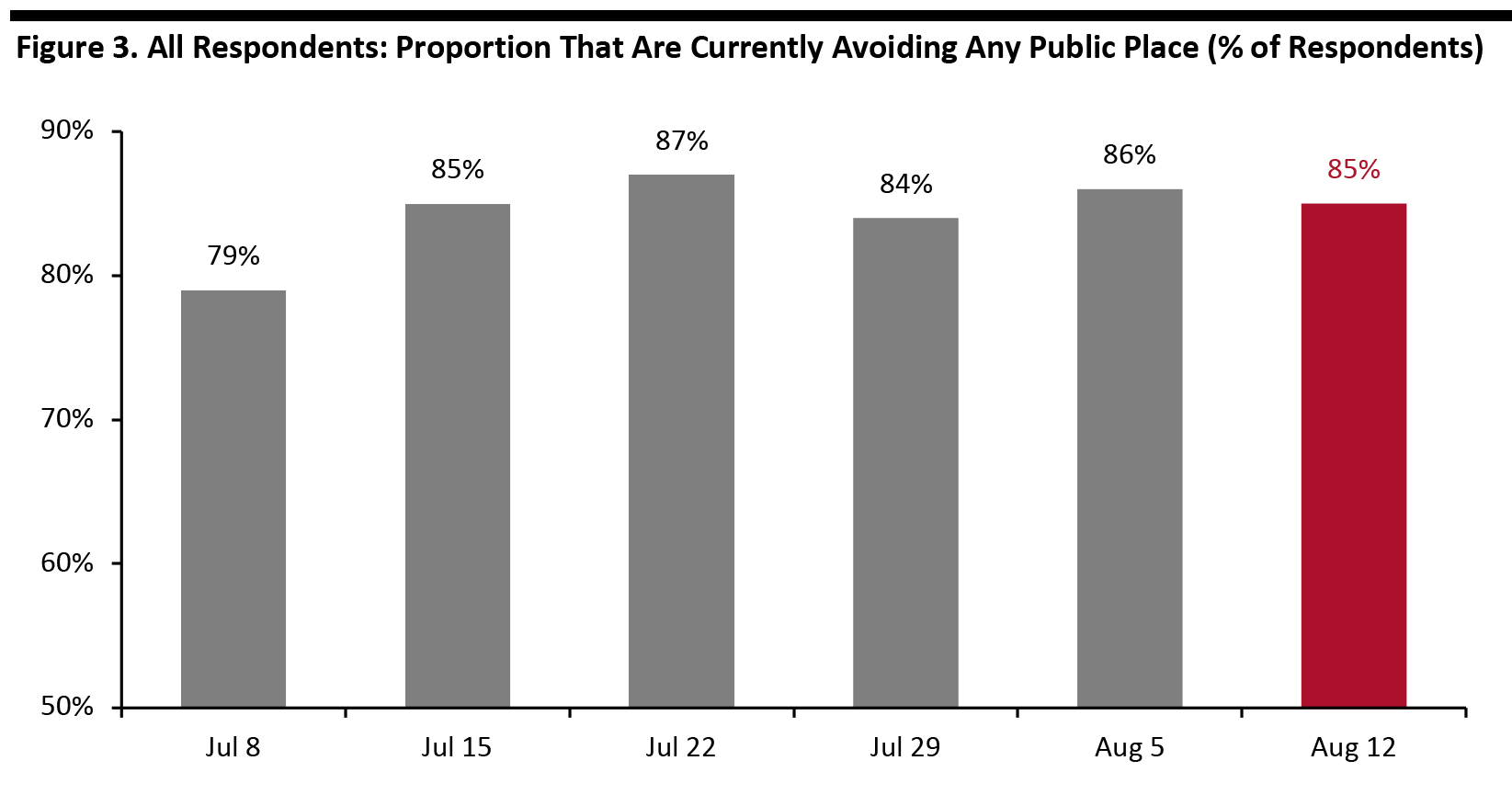

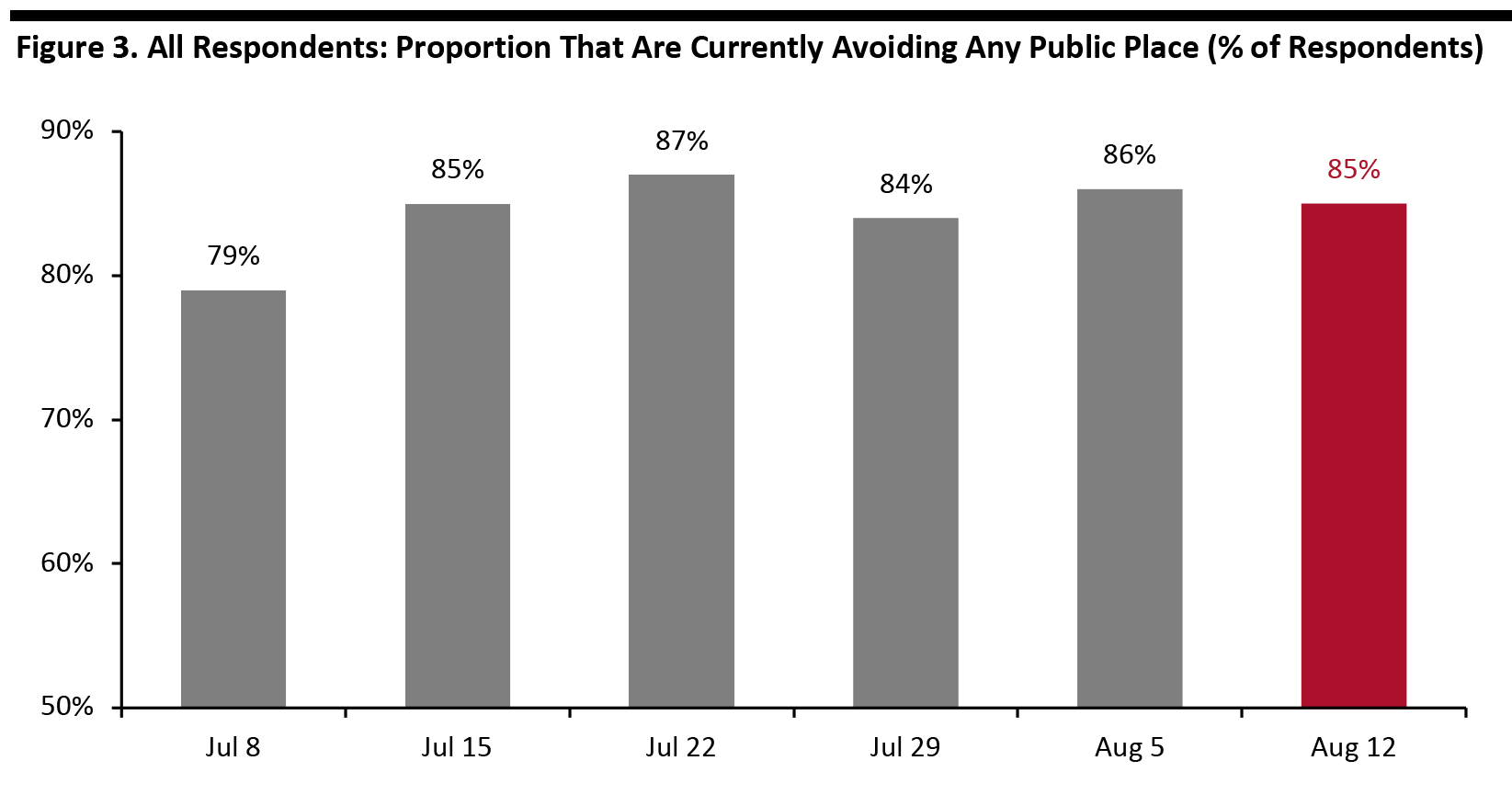

Source: Coresight Research [/caption] 3. Avoidance of Public Places Remains Above 80% This week, the proportion of respondents saying that they are avoiding any public area slightly decreased to 85%, from 86% last week. This is the fifth consecutive week that the avoidance rate has been above 80%. We saw slight increases of avoidance in around half of the 12 options provided: Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research [/caption]

- See our full report for complete results of the categories that consumers plan to spend less on for the holiday season and how Covid-19 is expected to impact consumers’ holiday shopping behaviors.

Base: US Internet users aged 18+ who expect to spend less on the 2020 holiday season than they did last year

Base: US Internet users aged 18+ who expect to spend less on the 2020 holiday season than they did last year Source: Coresight Research [/caption] 2. Holiday Spending Is Pulled Forward We also asked consumers whether they agreed with any or all of 10 attitudinal and behavioral statements related to holiday-season shopping. Our findings confirmed that there will be a shift in the holiday spending timeline this year:

- The proportion of holiday shoppers that expect to do holiday shopping on Amazon Prime Day remained stable at around one-third. This figure is much higher than those expecting to shop on Black Friday or Cyber Monday. Recent announcements by major retailers to keep stores closed on Thanksgiving and Amazon’s postponement of Prime Day to October are expected to pull holiday sales forward.

- Some 23% said that they will start their holiday shopping earlier than usual this year, slightly down from 28% a month ago.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to spend on the holiday season

Source: Coresight Research [/caption] 3. Avoidance of Public Places Remains Above 80% This week, the proportion of respondents saying that they are avoiding any public area slightly decreased to 85%, from 86% last week. This is the fifth consecutive week that the avoidance rate has been above 80%. We saw slight increases of avoidance in around half of the 12 options provided:

- The proportion of respondents who are currently avoiding shopping centers/malls remained stable this week, after reaching a peak of two-thirds three weeks ago. Some 63% said they are currently avoiding these places. The rate has remained high at above 60% for a month now.

- The proportion of respondents that are currently avoiding food-service locations jumped six percentage points to the highest level we have seen in months and is now the most-avoided place among consumers.

- Community centers saw the highest decline in avoidance rate this week, of seven percentage points.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]