albert Chan

We discuss select findings and compare them to those from prior weeks: October 27, October 20, October 13, October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

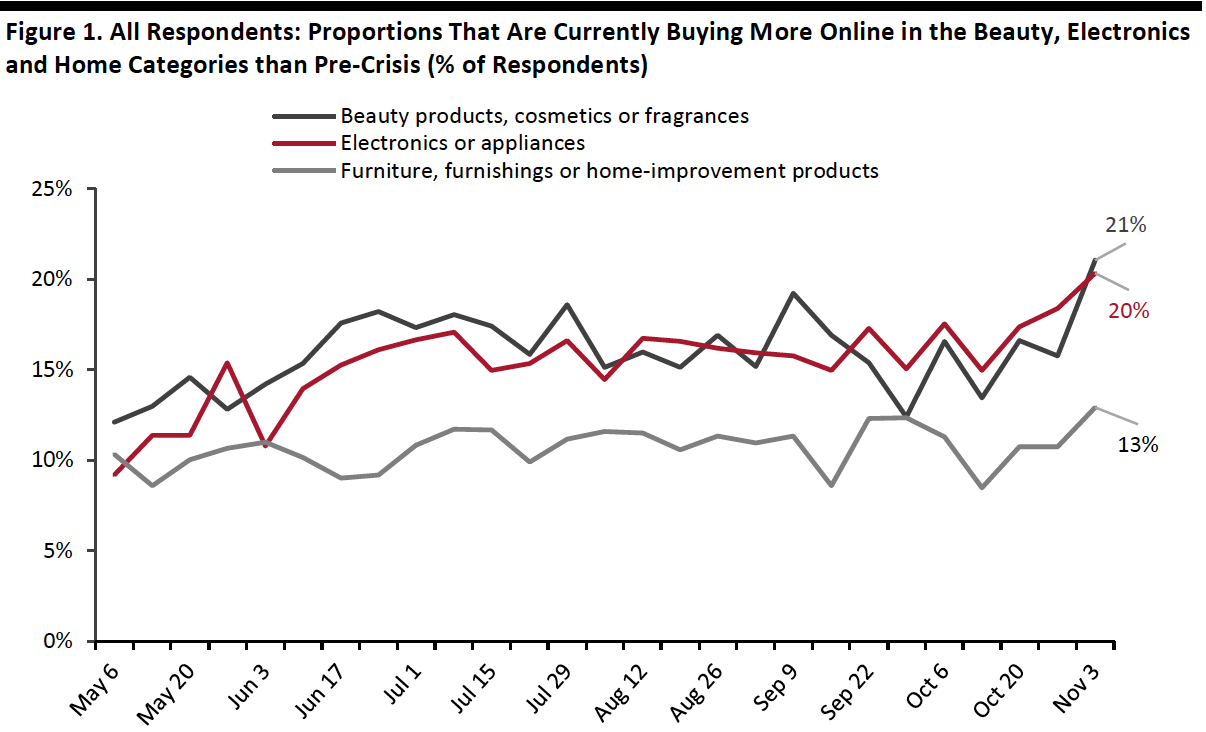

1. More Consumers Buy Discretionary Categories OnlineThis week, we saw upticks in the proportions of respondents that are currently buying more online in some discretionary categories than pre-crisis, likely reflecting early shopping for holiday gifts. Online purchases of beauty, electronics and home products all reached new highs this week.

Beauty saw the largest week-over-week increase of five percentage points: Some 21% are buying more beauty online than before, versus 16% last week. Compared to the beginning of May, when lockdowns began to ease in some states, the proportion buying more beauty has increased by almost nine percentage points.

Electronics has seen a near-consistent upward trend: The proportion of consumers buying more in this category has jumped 11 percentage points from the first week of May, to one-fifth this week.

- See our full report for complete results and ranking of the categories in which consumers are currently buying more online than pre-crisis.

Base: US respondents aged 18+

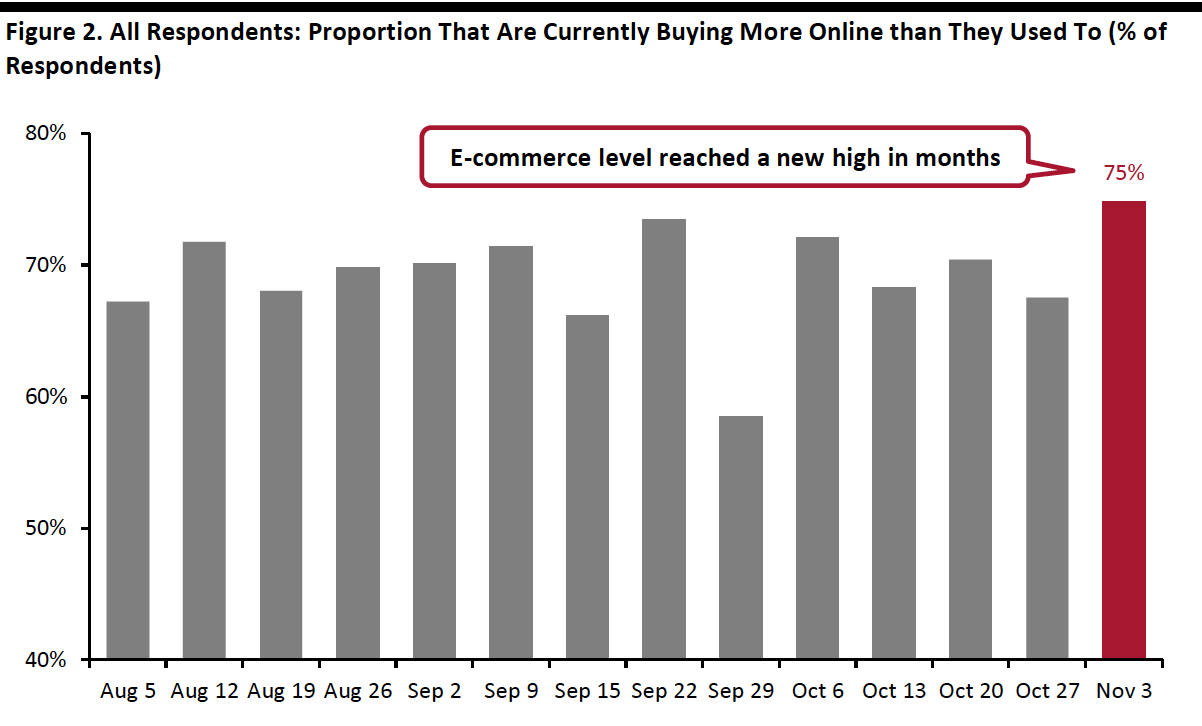

Base: US respondents aged 18+Source: Coresight Research[/caption] 2. Three-Quarters Are Switching Spending Online

The proportion of consumers buying more online overall than they used to surged to a new high in months this week: Three-quarters are currently doing so, up seven percentage points from 68% last week. This level is also higher than the October average of seven in 10. The spike could be due in part to a higher proportion of consumers buying more of any category overall than before the crisis, supported by early holiday shopping.

We saw week-over-week increases in almost all categories, except food. As discussed in the previous section, the proportions that are buying more beauty, home and electronics online than before the pandemic all jumped to record highs this week.

We expect the level of shopping online to remain elevated as we move further into the holiday season, and we estimate holiday-quarter online sales to rise by around one-third year over year.

[caption id="attachment_118982" align="aligncenter" width="700"] Base: US respondents aged 18+

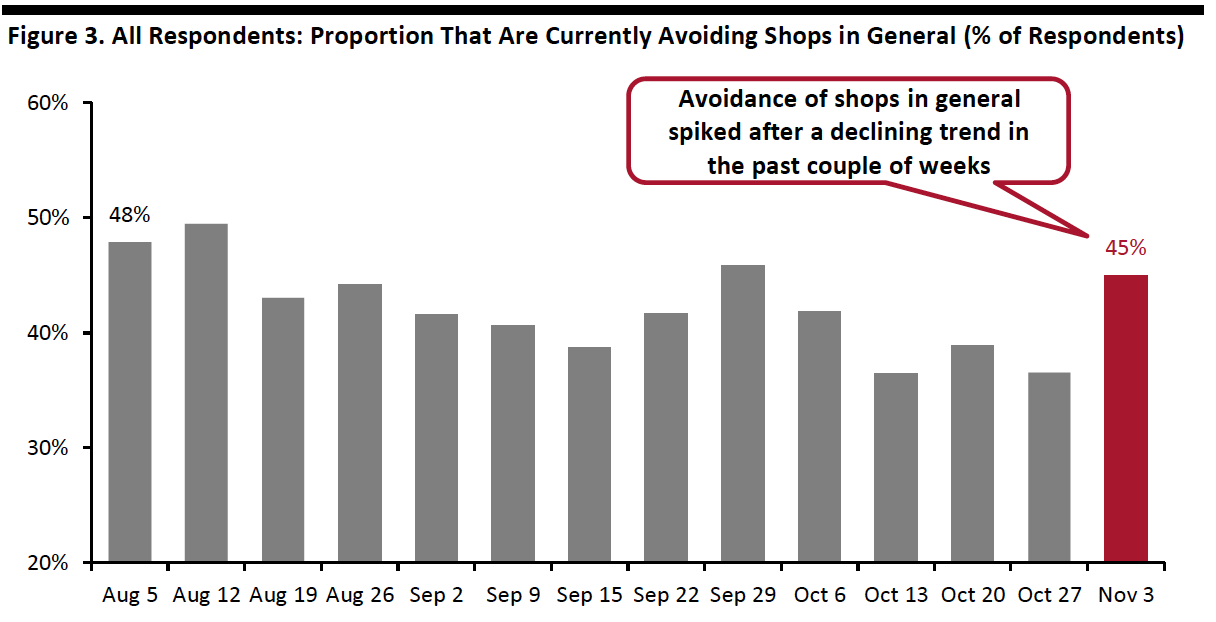

Base: US respondents aged 18+Source: Coresight Research[/caption] 3. Avoidance Rate of Any Public Areas Jump

This week, the avoidance rate for any type of public area reached a new high since August 19: Some 83% said that they are currently avoiding any public area, versus 80% last week. The high avoidance rate could be a result of continued surging Covid-19 cases across the US.

We saw increases in the avoidance rate for nine of the 13 options provided, although some changes were within the margin of error.

- The proportion of respondents that are currently avoiding shopping centers/malls remained fairly stable at 56% this week—remaining the most-avoided public place.

- Avoidance of shops in general saw the largest spike this week: Some 45% are currently avoiding such places, up eight percentage points from 37% last week. This is the highest level we have seen since October.

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]