albert Chan

We discuss select findings and compare them to those from prior weeks: October 20, October 13, October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

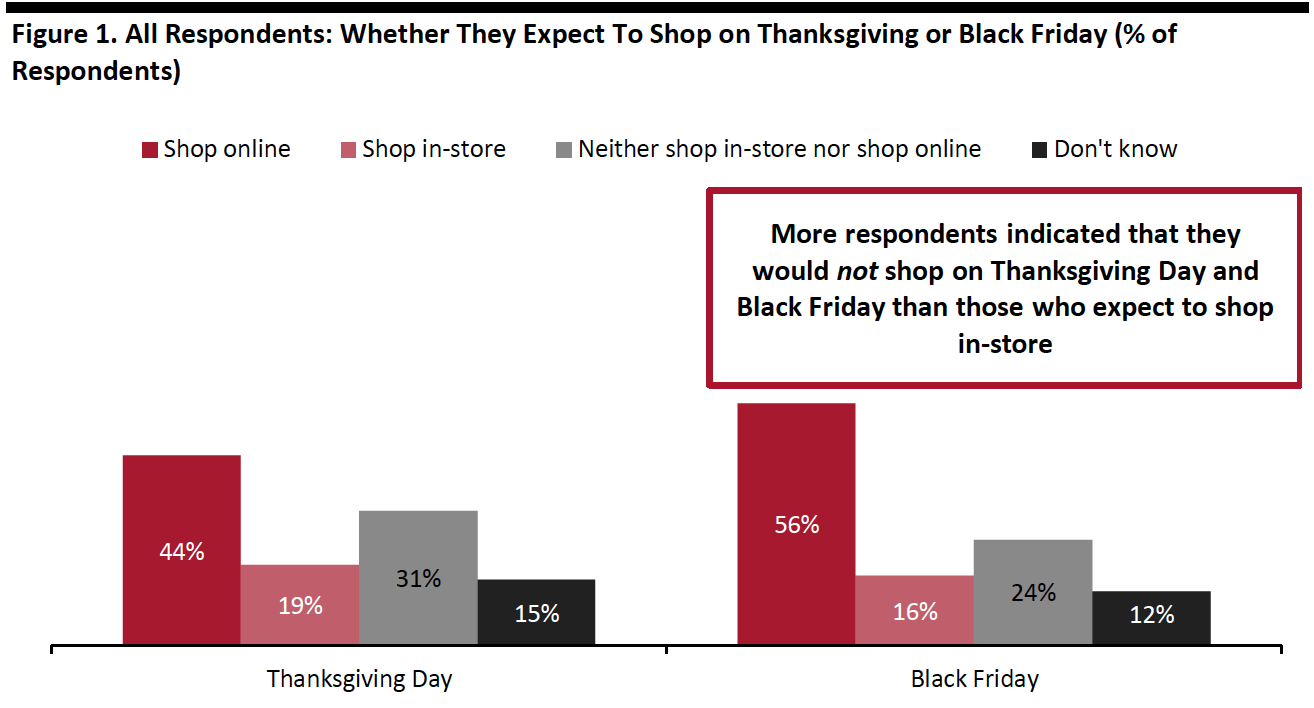

1. Consumers Prefer To Shop Online on Thanksgiving and Black FridayThis week, we asked consumers about their shopping plans for Thanksgiving and Black Friday. With a recent resurgence of coronavirus cases and the implementation of social-distancing measures in stores, high proportions of consumers expect to turn to e-commerce for Thanksgiving and Black Friday shopping: Some 44% said they expect to shop online on Thanksgiving, and 56% plan to do so on Black Friday. Coresight Research expects total online retail sales during the holiday period to rise by one-third year over year.

The popularity of Thanksgiving and Black Friday shopping is fading: Some 24% of respondents indicated that they would not shop at all on Black Friday, and that proportion is even higher (31%) for Thanksgiving. One factor could be the pull-forward of holiday shopping this year: Promotional events such as the new 10.10 Shopping Festival, Amazon’s Prime Day and Walmart’s “The Big Save” were held in in early October.

[caption id="attachment_118548" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+“Shopping” is defined as browsing or buying. Respondents could select both shop online and shop in-store.

Source: Coresight Research[/caption]

2. Shoppers Expect To Buy Apparel and Electronics on Thanksgiving and Black Friday

Clothing, footwear or accessories and electronics are two of the most popular products to shop, whether in-store or online, on either or both Thanksgiving and Black Friday. While clothing took the top spot for in-store shopping, electronics came in at number-one for online shopping. This is also consistent with a separate finding in our Holiday 2020: US Shopper Survey, in which we saw electronics and apparel remain the top gifting categories for the holiday.

We also asked those who expect to shop on Thanksgiving and/or Black Friday if they plan to use any collection services. Curbside pickup is expected to be the most-used pickup service.

- See our full report for complete results on what categories consumers plan to shop on Thanksgiving and Black Friday.

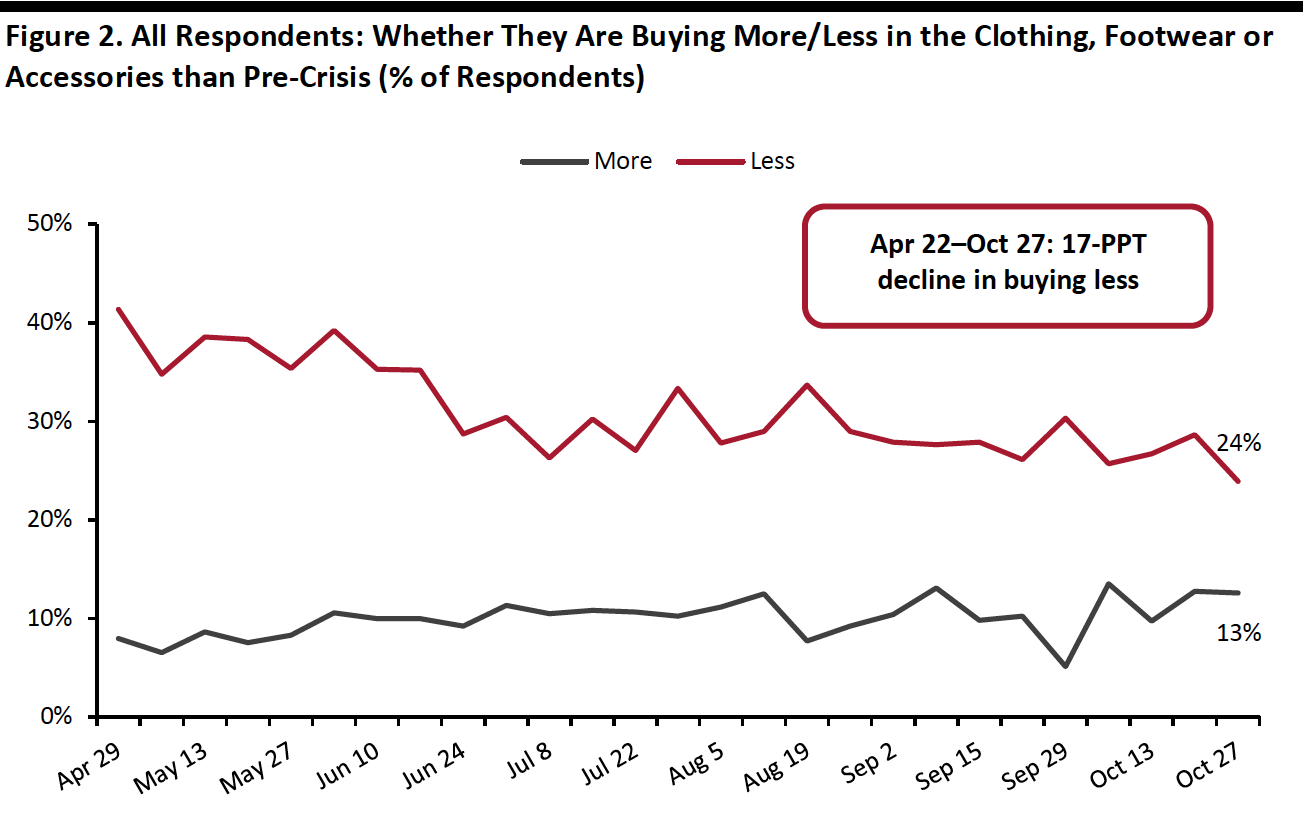

3. Uplift in Purchases of Apparel and Beauty

Although apparel and beauty remained the most-cut categories in our survey, with the highest proportions of consumers currently buying less of such products, we saw week-over-week improvements. The proportion of respondents that are buying less in the clothing, footwear or accessories category than pre-crisis declined by five percentage points to 24%—the lowest level we have seen since March. Compared to the peak we saw six months ago, the proportion has fallen by 17 percentage points. The proportion of consumers currently buying less in beauty also reached a record low of 16%.

As a result, the ratios of the proportions of respondents buying less to the proportions buying more in both apparel and beauty both decreased. The ratio for apparel went down to 1.9, from 2.3 last week and 2.7 two weeks before. The ratio for beauty dropped to its lowest, at 1.5, compared to 1.6 last week and 2.1 two weeks ago.

[caption id="attachment_118549" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]