albert Chan

We discuss select findings and compare them to those from prior weeks: October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

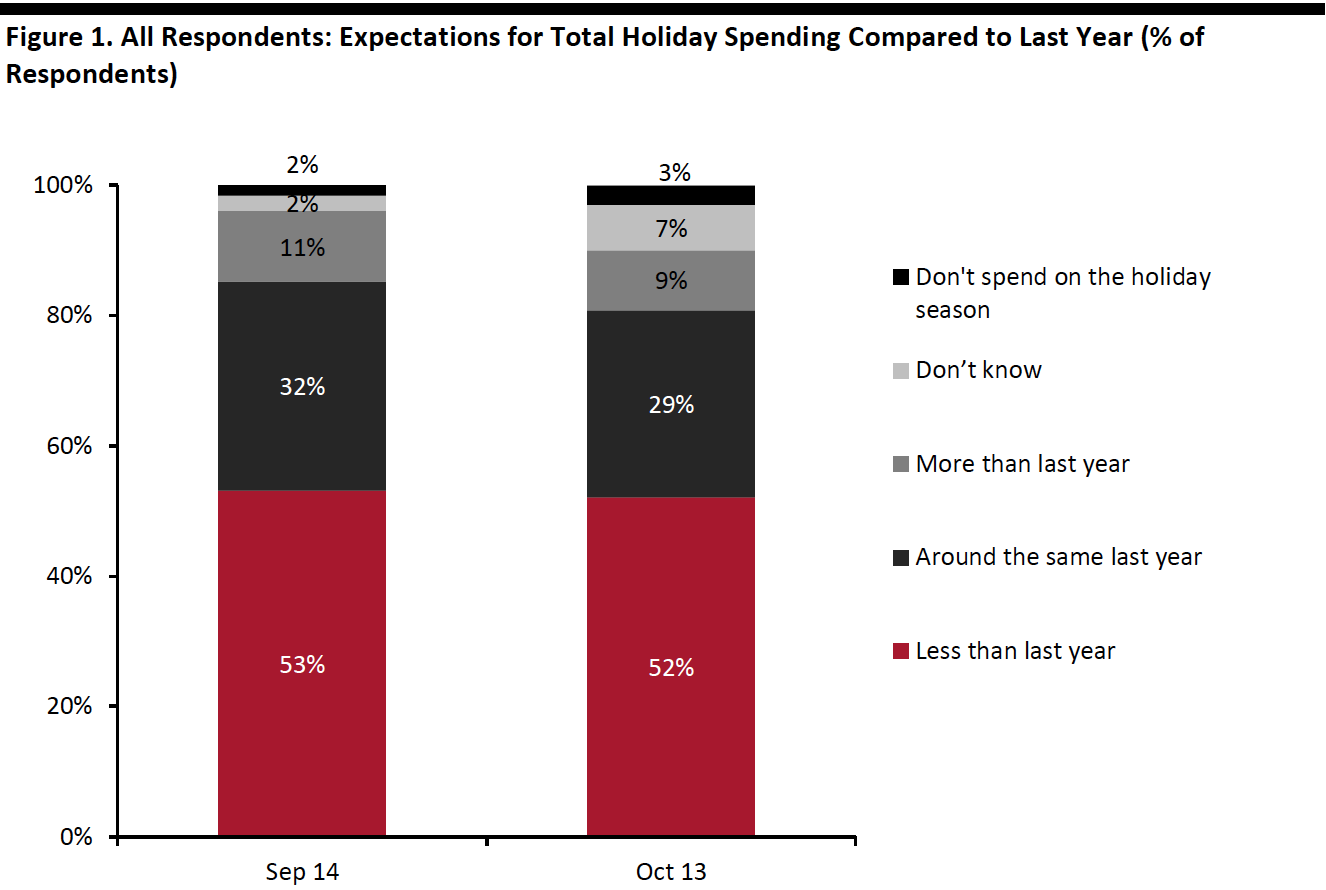

1. Half Expect To Spend Less for the Holiday SeasonThis week, we again asked consumers about their expected shopping behaviors for the holiday season 2020. We continue to see the majority of consumers planning to cut their total spending: Some 52% expect their total holiday spending to be less than last year, with 31% planning to spend a lot less and 21% expecting to spend slightly less. Only 9% said they will spend more than last year.

We asked respondents to think about their holiday spending overall, including retail purchases such as gifts, as well as spending driven by parties, social events and getaways. For those who expect to spend less for the holiday season:

- Nonretail services are set to be hit the hardest: Dining out, traveling to visit people and taking vacations are the top three categories that consumers expect to spend less on during the holiday.

- Among product categories, season decorations topped the list for cutbacks, as it has done when we have asked the question in prior months. Clothing and footwear recorded the sequential largest decline in expectations to spend less during the holiday season. Some 23% expect to spend less on the category, the lowest level we have seen since we started asking this question. Its ranking consequently fell from third place to the bottom half of the 12 product categories.

We expect to see holiday shoppers shift some spending from services to products, and this is one factor underpinning our estimate for a solid rise in total holiday retail sales.

- See our full report for complete results on consumers’ expected holiday shopping behaviors this year, and see our Holiday 2020: US Shopper Survey for more data and analysis.

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption] 2. Over One-Quarter of Holiday Shoppers Expect To Shop Early

The 10.10 Shopping Festival and Amazon’s Prime Day heralded the earliest start to the holiday season in an unpredictable shopping year. Some 24% of holiday shoppers said they expect to do their holiday shopping during Prime Day, which was much lower than in prior months. Our survey ran on the first day of Prime Day (October 13) and we noted this timing to respondents, so the numbers are likely to be a more accurate reflection of what shoppers actually did versus prior months’ expectations.

Over one-quarter of holiday shoppers said they expect to start holiday shopping earlier than usual this year, versus less than one in 10 expecting to start later. The 18-percentage-point difference is a positive sign for retailers, as early holiday sales could help ease the pressures on e-commerce fulfillment by extending the shopping season.

Some 22.1% of holiday shoppers expect to use curbside pickup services for some of their online purchases, and one-fifth plan to use in-store pickup services.

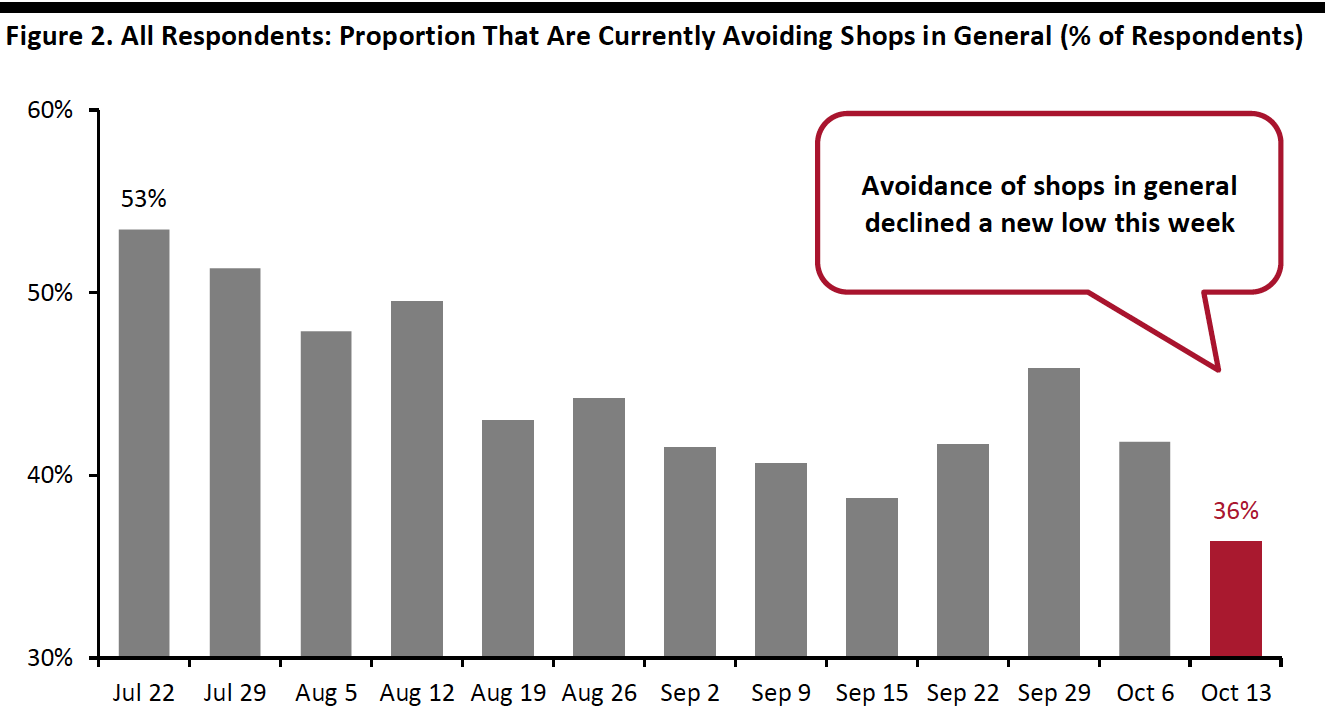

3. Avoidance Rate of Shops in General Falls to a New LowThis week, the proportion of respondents saying that they are avoiding any type of public place stood at 78%, versus eight in 10 last week. Encouragingly, we saw decreases in avoidance for 10 of the 12 options provided, although most of the changes were within the margin of error.

- The proportion of respondents that are currently avoiding shopping centers/malls fell for the third consecutive week (albeit only very slightly). Some 54% are currently avoiding such places, compared to 56% last week. Although still relatively high, the avoidance rate has remained under 60% since the week of August 26.

- Avoidance of shops in general also reached the lowest level we have seen since July. Some 36% are currently avoiding such places, down by almost six percentage points from 42% last week. The avoidance rate has fallen 17 percentage points from the highest level of 53% on July 22.

- Entertainment and leisure venues saw the largest increase in avoidance this week, of almost nine percentage points.

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]