albert Chan

We discuss select findings and compare them to those from prior weeks: July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

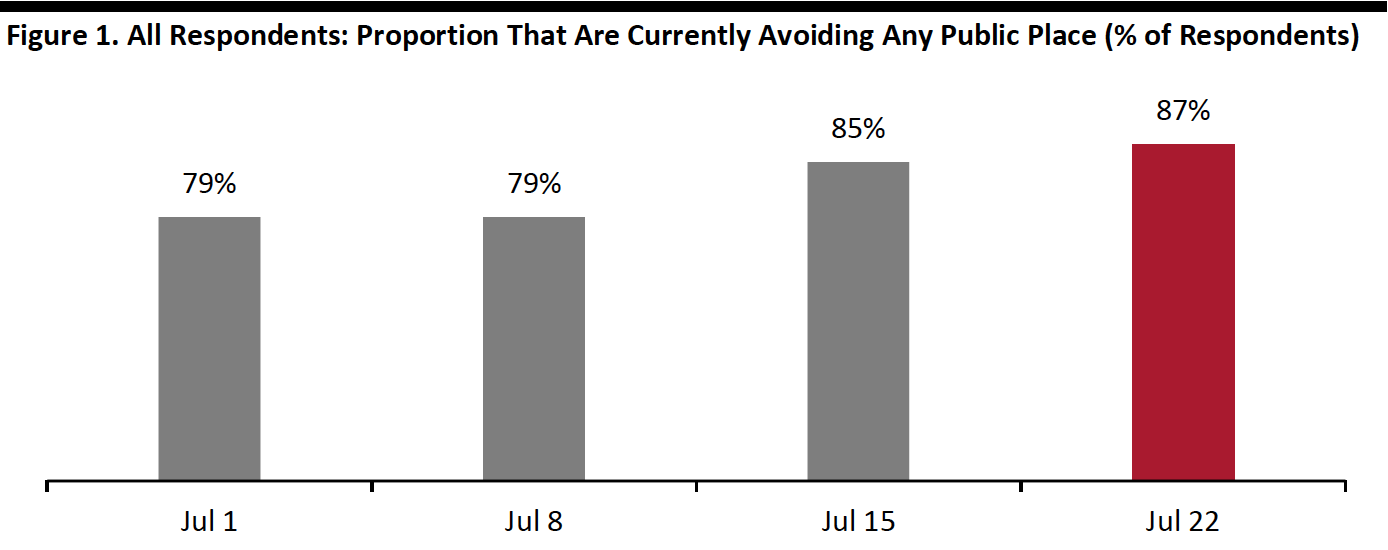

1. Avoidance Rate Continues To Rise This WeekThis week, we saw the proportion of consumers avoiding any kind of public place rise to 87%, from 85% last week, showing a near-consistent upward trend since the first week of July. Along with consumers’ increased wariness, the high avoidance rate could reflect reversals in reopening due to the resurgence of coronavirus cases in a growing number of states.

Avoidance rates increased in almost all of the 14 options we provided:

- The proportion of respondents that are currently avoiding shopping centers/malls went up slightly this week, after a seven-percentage-point spike last week. Two-thirds of consumers said they are currently avoiding these locations.

- Food-service locations are the second-most-avoided public places, with more than six in 10 respondents currently doing so, broadly level with proportion from last week.

- Workplaces saw the highest week-over-week jump in avoidance rate this week, of five percentage points, suggesting that people continue to work from home.

See our full report for complete results of what public places US consumers are currently avoiding.

[caption id="attachment_113433" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 2. Increases in Online Apparel Shopping

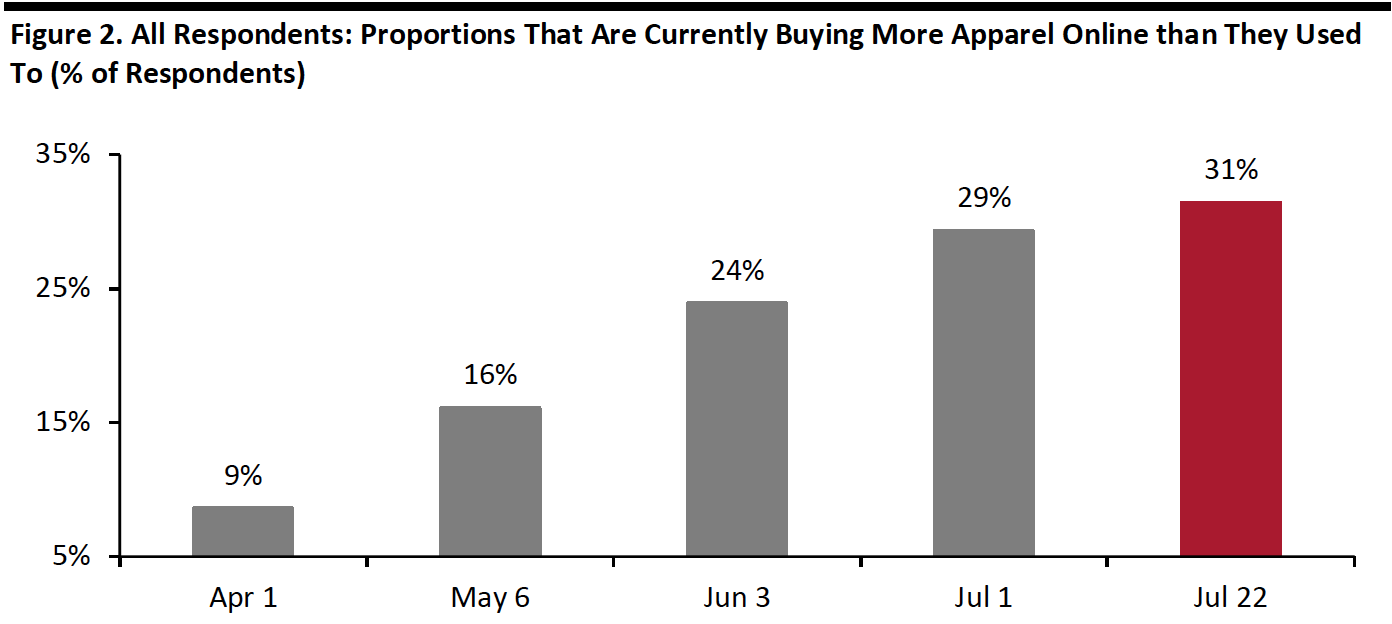

This week, the proportion of respondents buying more apparel online than they used to jumped again after slight dips in the past two weeks, with 31% of consumers saying they are currently doing so. The proportion has increased by around 22 percentage points since we started asking the question in the week of April 1.

From our questions asking consumers what they have done in the past two weeks, online apparel shopping remains the top spending-related activity, even though the proportion of respondents who had done this has plateaued at around one-third.

[caption id="attachment_113434" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 3. Fewer Consumers Expect To Retain Changed Behaviors

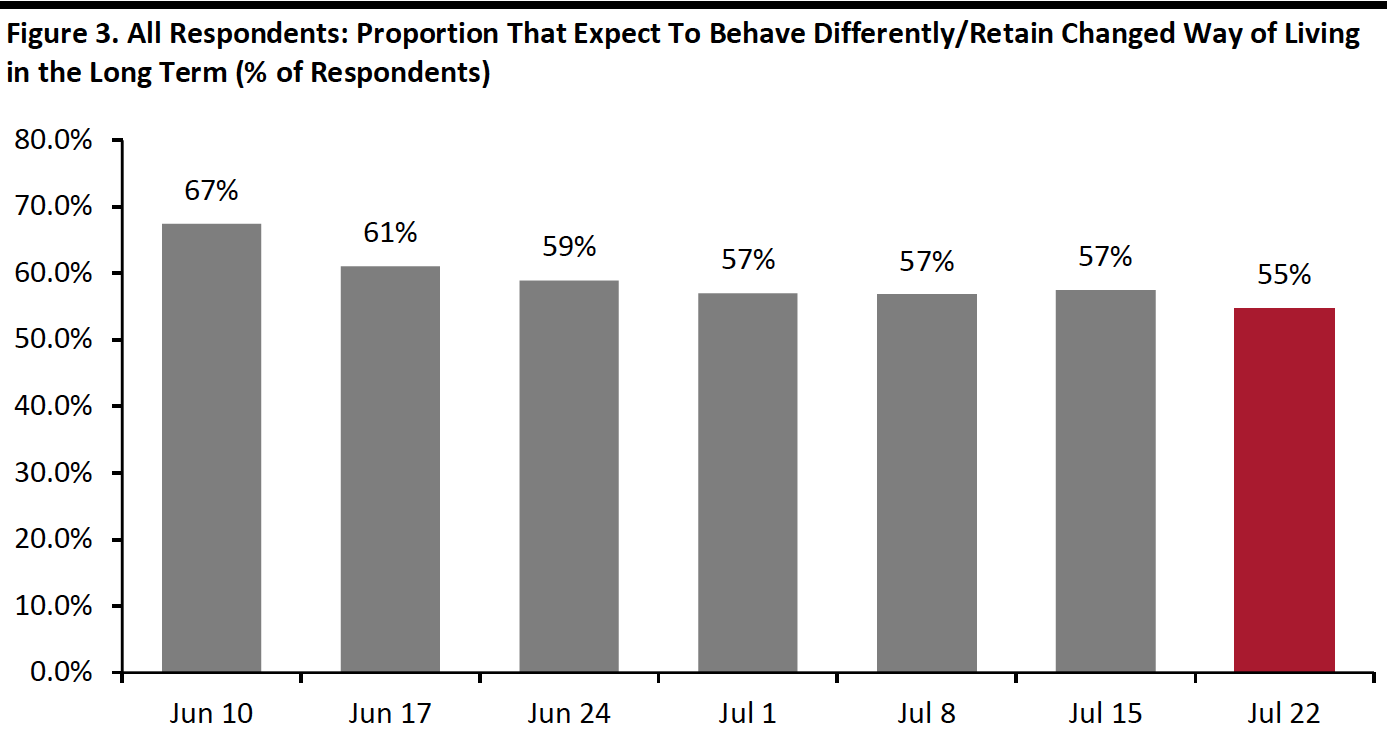

Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. This week, the proportion of respondents expecting to retain some changed behavior over the long term dropped to 55%. The near-consistent downward trend we have seen since the week of June 10 suggests that this trend is past its peak and consumers are slightly more willing to return to their regular activities than previously.

We have seen fluctuations over the past couple of weeks in the proportion of respondents who expect to shop less overall. Around one-fifth expect to do so this week, compared to roughly one in six last week.

The proportion of consumers expecting to shop more online in the long term has broadly leveled off in recent weeks, at around 28%.

[caption id="attachment_113435" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]