Nitheesh NH

We discuss select findings from our US consumer survey and compare them to those from prior weeks: December 1, November 24, November 17, November 10, November 3, October 27, October 20, October 13, October 6, September 29, September 22, September 15, September 9, September 2, August 26, August 19, August 12, August 5, July 29, July 22, July 15, July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

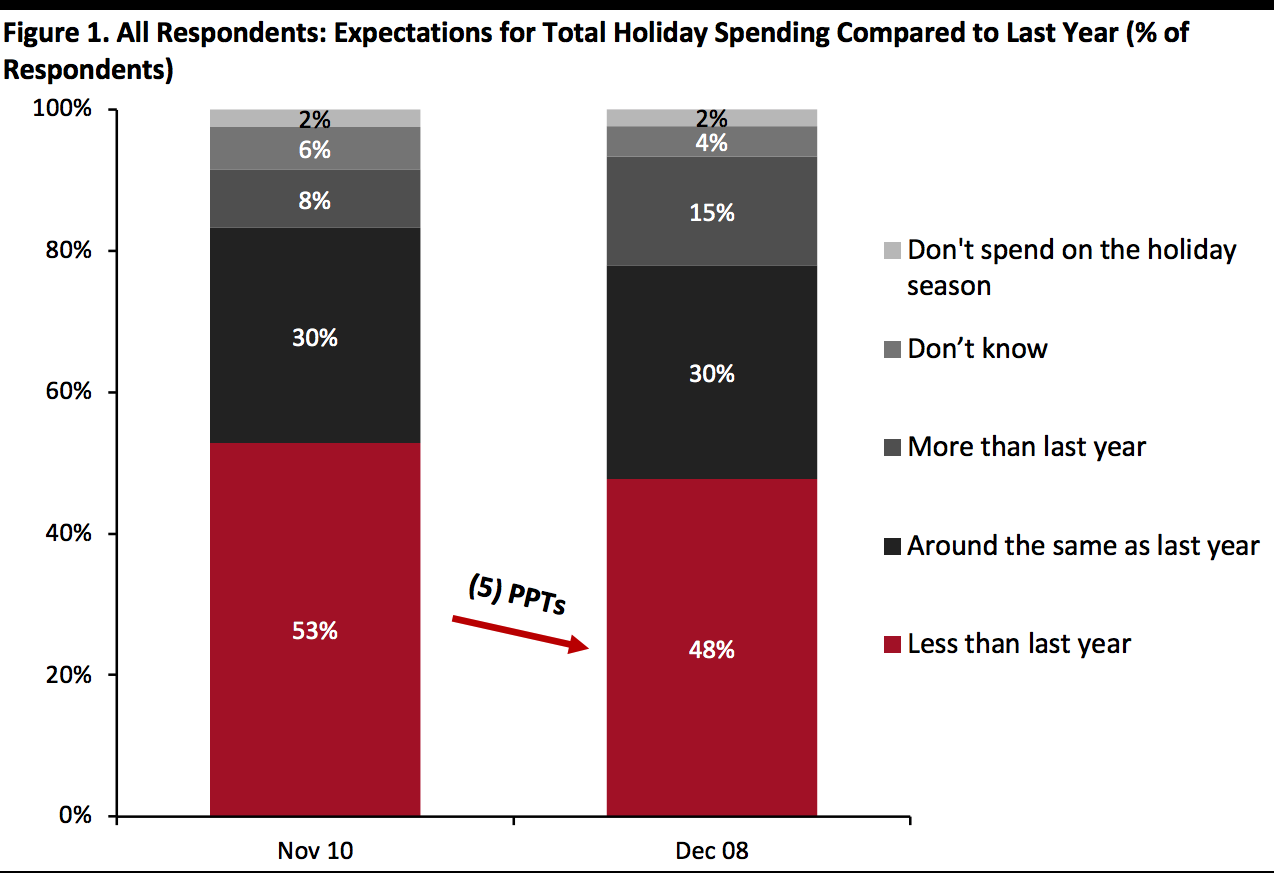

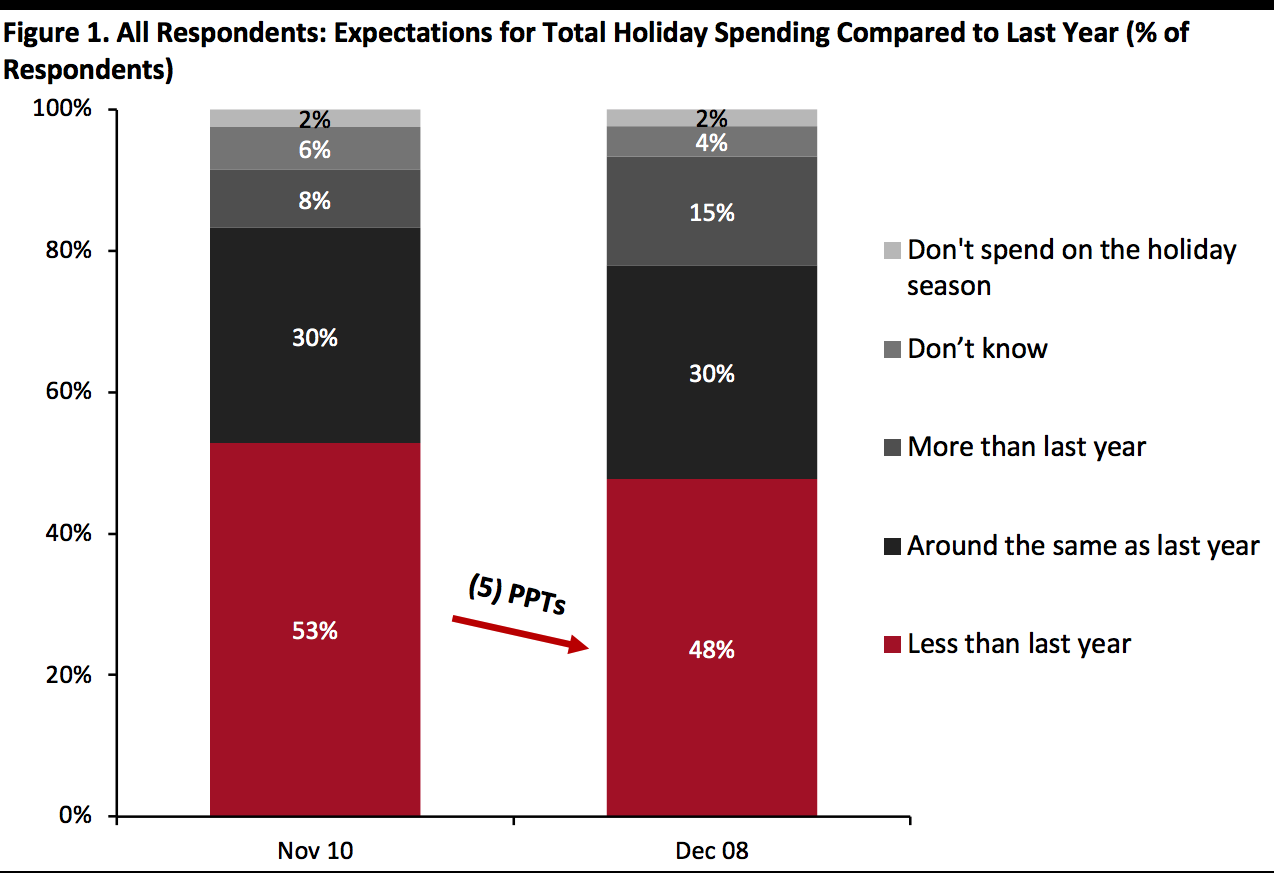

1. Less than Half Expect Their Total Holiday Spending To Be Lower

As we approach the homestretch in the holiday shopping season, we took a final reading of consumers’ shopping behaviors and expectations for the holiday season this week.

A substantial proportion of US consumers expect their total, final holiday spending to be lower than last year. However, the proportion decreased from last month when we asked this question. Some 48% expect their total holiday spending to be less than last year, down five percentage points from 53% last month, due to fewer consumers planning to spend a lot less.

Encouragingly, some 15% expect to spend more for the holiday season than last year, up seven percentage points from last month, and is the highest level we have seen since we started asking this question in July.

We asked respondents to think about their holiday spending overall—including retail purchases such as gifts, as well as spending driven by parties, social gatherings and getaways. For those that expect their total holiday spending to be less, we found the following:

Base: US respondents aged 18+

Base: US respondents aged 18+

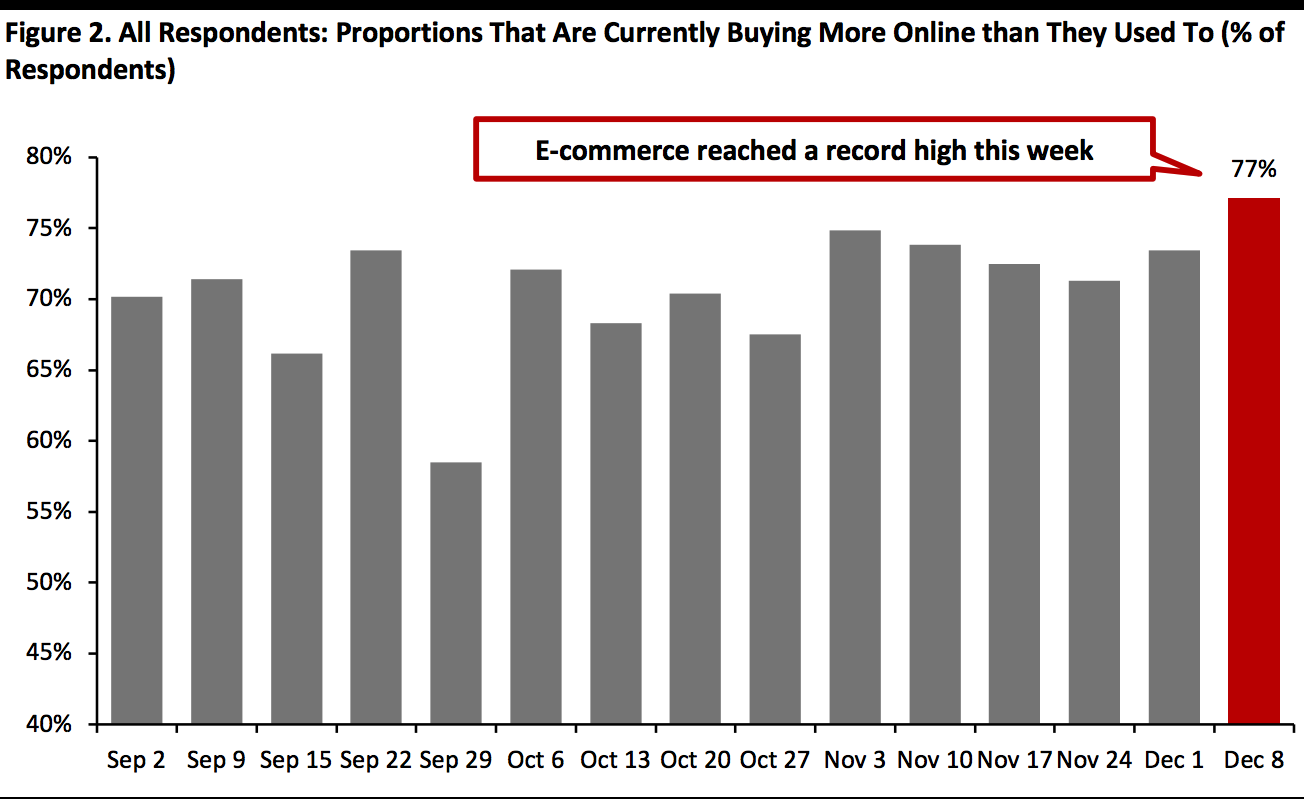

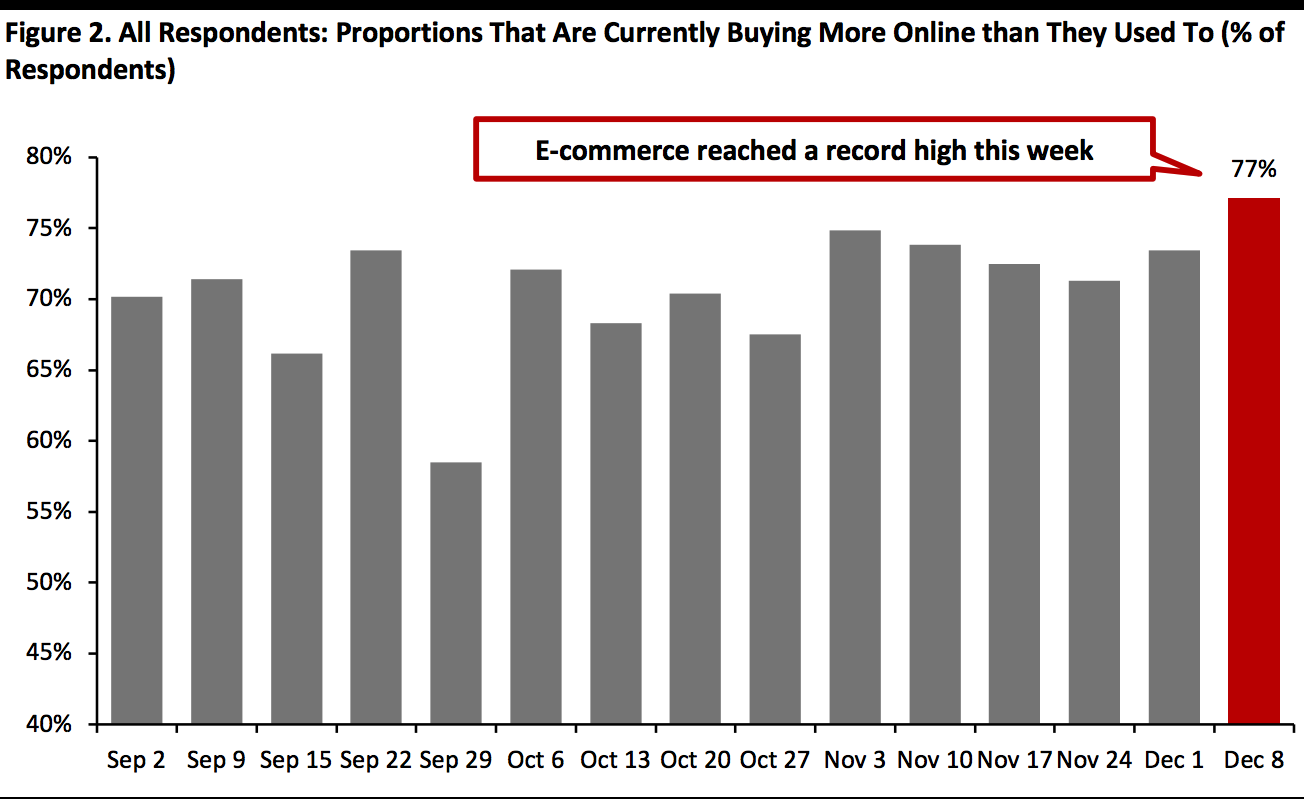

Source: Coresight Research[/caption] 2. Partial Consumer Shift from Early to Late Holiday Shopping Holiday shopping kicked off early in October this year, with the new 10.10 Shopping Festival and Amazon’s Prime Day. However, we saw a partial shift from early to late holiday shopping, compared to the results from last month. Some 28% of holiday shoppers expect to start or have started shopping earlier than usual—down from one-third in the previous month—versus almost 17% who expect to start or have started shopping later than usual. The near-12-percentage-point difference is the lowest since we started asking this question. This could suggest that there will still be some last-minute shopping, presenting opportunities for brands and retailers to boost sales. We consistently found that around three in 10 holiday shoppers have switched or are switching some or all of their holiday spending from stores to e-commerce. Discussed below, a record-high proportion of consumers are currently buying more online than they used to, implying an already-high e-commerce level during the holiday season. 3. Online Shopping Surges to Record High This week, the proportion of consumers buying more of any category online than they used to jumped to 77%—the highest level since we started asking this question in April, possibly supported by holiday-season shopping. This is also aligned with elevated avoidance of any public place, which stood at 84% this week. We expect total online sales to climb by around one-third in the holiday season. Looking at specific categories, household and personal care products continue to top the list of most-purchased products online. Among discretionary categories, online purchases of electronics remained high at 23%, despite the week-over-week decrease in the proportion that are buying more in this category overall. In the upcoming weeks, we could see demand for these discretionary categories fall back a little, as we may be past the peak of holiday shopping following Black Friday weekend. [caption id="attachment_120708" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+

Source: Coresight Research[/caption]

- Nonretail services are, once again, set to be the hardest-hit sector, especially food service. The proportion of consumers planning to spend less on or that have spent less on dining out or going to a bar/nightclub increased by nine percentage points, month over month.

- Among product categories, season decorations remained the most-cut products for the holiday season, reflecting the reduced number of events and parties in the context of the coronavirus pandemic this year.

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption] 2. Partial Consumer Shift from Early to Late Holiday Shopping Holiday shopping kicked off early in October this year, with the new 10.10 Shopping Festival and Amazon’s Prime Day. However, we saw a partial shift from early to late holiday shopping, compared to the results from last month. Some 28% of holiday shoppers expect to start or have started shopping earlier than usual—down from one-third in the previous month—versus almost 17% who expect to start or have started shopping later than usual. The near-12-percentage-point difference is the lowest since we started asking this question. This could suggest that there will still be some last-minute shopping, presenting opportunities for brands and retailers to boost sales. We consistently found that around three in 10 holiday shoppers have switched or are switching some or all of their holiday spending from stores to e-commerce. Discussed below, a record-high proportion of consumers are currently buying more online than they used to, implying an already-high e-commerce level during the holiday season. 3. Online Shopping Surges to Record High This week, the proportion of consumers buying more of any category online than they used to jumped to 77%—the highest level since we started asking this question in April, possibly supported by holiday-season shopping. This is also aligned with elevated avoidance of any public place, which stood at 84% this week. We expect total online sales to climb by around one-third in the holiday season. Looking at specific categories, household and personal care products continue to top the list of most-purchased products online. Among discretionary categories, online purchases of electronics remained high at 23%, despite the week-over-week decrease in the proportion that are buying more in this category overall. In the upcoming weeks, we could see demand for these discretionary categories fall back a little, as we may be past the peak of holiday shopping following Black Friday weekend. [caption id="attachment_120708" align="aligncenter" width="700"]

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]