DIpil Das

What’s the Story?

With strong growth expectations for 2021, we explore the US subscription e-commerce market, focusing on our three identified subscription models: Curated monthly subscription boxes, rental subscriptions, and replenishment-based subscriptions. We discuss our market outlook for 2021, the competitive landscape in US subscription e-commerce and opportunities related to four trends we are watching in the market. We also present insights into how the subscription e-commerce model is penetrating non-traditional categories for subscriptions, such as apparel and footwear, beauty and personal care, food and beverages, mass merchandise and pet products. We include Amazon’s Subscribe & Save offering as it is replenishment-based, and exclude Amazon’s other subscription services, such as Prime and technology solution subscriptions. Our coverage excludes auto subscriptions, gas subscriptions, streaming subscriptions and technology subscriptions. Walmart+ also falls out of our subscription e-commerce coverage (it offers unlimited delivery and discounts on gas and selected products).Why It Matters

We see 2021 as an important growth year for the US e-commerce subscription model as consumers retain some of the pandemic-induced shift to online spending. Moreover, retailers are increasingly recognizing that recurring sales models can lead to higher revenues and stronger customer relationships. We expect the US e-commerce subscription market to grow at a high-teens rate in 2021 and discuss key growth opportunities to inform brands and retailers that are looking to leverage subscription trends.The US Subscription E-commerce Market: In Detail

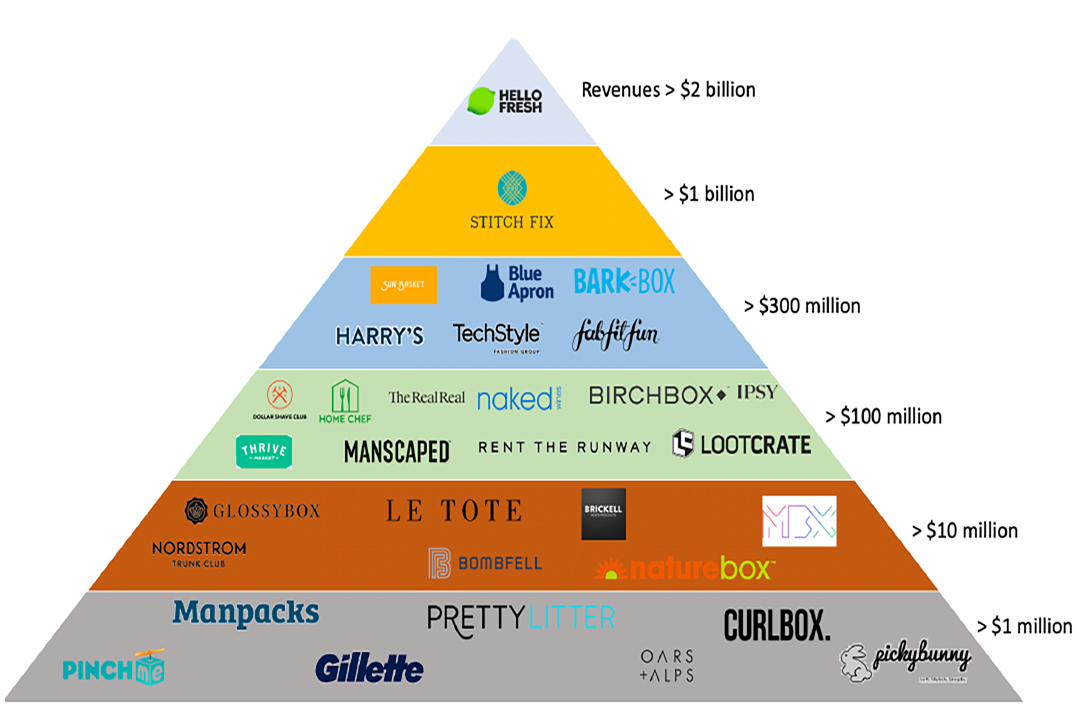

Market Overview Our coverage of the US subscription e-commerce market includes over 200 top e-commerce companies that offer subscription services. We estimate that the total US subscription e-commerce market was worth $11.5 billion in 2020 and expect it to grow at a high-teens rate in 2021. The e-commerce subscription market recorded average annual growth of 17.33% from 2014 to 2019, according to the Subscription Trade Association (SUBTA). The top 20 subscription e-commerce companies with the largest revenues accounted for approximately $8.0 billion in revenue in 2020. Figure 1 shows the competitive landscape of selected US subscription e-commerce companies, based on their reported revenues or third-party revenues estimations in 2020.Figure 1. US Subscription E-Commerce Market: Competitive Landscape by 2020 Revenue [caption id="attachment_127328" align="aligncenter" width="725"]

All revenues are US-based only. Our competitive landscape does not include companies that report revenue but do not provide a breakdown for subscription revenues, such as The Honest Company. For companies that do not publicly disclose revenues, we use third-party estimations for market sizing purpose only. Companies that have revenues of less than $0.2 million are not included.

All revenues are US-based only. Our competitive landscape does not include companies that report revenue but do not provide a breakdown for subscription revenues, such as The Honest Company. For companies that do not publicly disclose revenues, we use third-party estimations for market sizing purpose only. Companies that have revenues of less than $0.2 million are not included. Source: Owler/Zoominfo/Incfact/Company reports [/caption] With the e-commerce industry booming across discretionary categories, we believe that the formation of online shopping as a sustainable consumer habit will be the key growth driver for the subscription e-commerce market in 2021. Moreover, we expect consumers to continue to spend more time working and socializing at home in 2021 as pandemic-related concerns persist, making them more likely to sign up for repeat delivery of products and services. To capitalize on this opportunity, around 75% of global DTC companies will offer subscription services by 2023, according to SUBTA. Subscription Models We have seen a rise in the number of curated subscription boxes, as well as companies launching replenishment-based subscription services, such as Dollar Shave Club. There is also demand for rental subscriptions—a model used by Rent the Runway. Figure 2 covers three subscription models that we identify as representing the majority of subscription businesses today.

Figure 2. Three Subscription Models That Represent The Majority of Subscription Businesses [wpdatatable id=949 table_view=regular]

Source: Coresight Research Key Market Players In Figure 3, we chart guidance for 2021 from key players in the US subscription market, highlighting market trends identified by each company.

Figure 3. Key Industry Player’s Guidance for 2021 [wpdatatable id=950 table_view=regular]

Source: Company reports/Coresight Research Themes We Are Watching 1. Purchase Flexibility Key subscription e-commerce players are seeking to improve the flexibility of their offerings in their drive to acquire and retain clients and capture market share. Direct Buy Subscription e-commerce companies are looking to avoid consumers gravitating back to conventional retail, attracted by its typically greater flexibility, by complementing their recurring services with “buy now” options.

- Stitch Fix announced in late 2019 that it plans to launch a “direct buy” option, enabling the sale of individual items. In June 2020, the company opened up the individual purchase option to subscription clients for testing purposes, which helped the company to accelerate top line amid the pandemic, as stated by the company on its December 2020 earnings call. Management sees direct buy as a catalyst to attract new clients, convert prospective clients and reactivate lapsed clients and will continue to expand the option in 2021.

- As well as delivering razors on a monthly recurring basis to subscribers, Dollar Shave Club also offers home-delivery on additional grooming products to non-subscribers.

Figure 4. Selected Subscription E-Commerce Companies: Online Customer Experience Improvements in 2020 and 2021 [wpdatatable id=951 table_view=regular]

Source: Company reports/Coresight Research 3. Expanded Product Options Offering subscribers a wider product range improves customer retention and boosts spending. We expect product expansion to be a key theme in the subscription e-commerce market in 2021, building on initiatives we saw in 2020, which we detail in Figure 5.

Figure 5. A Summary of Subscription E-commerce Companies’ Product Expansion Initiatives [wpdatatable id=952 table_view=regular]

Source: Company reports/Coresight Research 4. Innovative Business Practices While the majority of subscription e-commerce companies follow one of the three key models we identified earlier, we see opportunities for subscription e-commerce companies to innovate their practices to succeed amid a changing retail environment. Community Building Subscription e-commerce companies should seek out unique community building opportunities within their brand niche. We identify two key engagement initiatives taken by hardcover book subscription e-commerce company Book of the Month that subscription e-commerce players can leverage to strengthen their brand communities.

- The company provides an online space for members to discuss the books sent out each month, fostering a community where members can communicate with like-minded readers and establish a more personal connection to the company’s products. This also provides Book of the Month with consumer insights into book preferences to inform product curation.

- Book of the Month partners with influencers to raise the profile of their subscription service through reviews and recommendations. Influencers can serve as key opinion leaders (KOLs) across social media platforms, impacting user preferences and purchasing behaviors. In our US social commerce survey, Coresight Research found that 26.5% of Instagram shoppers aged 18 to 34 said their shopping was “often/always” affected by Instagram influencers, highlighting the tangible impact of influencer partnerships on shopping.

- The company markets its model as facilitating furniture sustainability. In 2020, Fernish helped customers to save $20 million versus traditional furniture ownership through its low-cost rental services. By improving product circularity in the furniture market, the company also spared 247 tons of furniture from landfill, according to a Fernish press release.

- Fernish offers free assembly services upon delivery for customers in selected areas. Customers can either return or buy out their items when their subscription period ends, with Fernish employees handling the free removal and return process.

What We Think

Implications for Brands/Retailers- We expect the US subscription market to grow at a high-teens rate in 2021, driven by the formation of online shopping as a sustainable habit—indicating opportunities for retailers and brands to enter the market or expand their market share.

- Subscription e-commerce companies must look to retain customer loyalty among strong competition to reduce churn rates (the rate at which customers discontinue their subscriptions within a given time period). We believe that offering unique customer experiences will be a significant differentiator among subscription e-commerce companies in the market.

- While the majority of subscription e-commerce companies follow one of three key models we have identified, there are innovative practices that can be adopted to stand out. For example, brands and retailers should look to impact subscriber preferences and shopping behaviors through influencer partnerships.