Nitheesh NH

Store Tracker Extra: More Data Each Month

In our US Store Tracker Extra monthly series, we offer insight into retailers’ store closure and opening announcements on a monthly basis—supplementing our Weekly US and UK Store Openings and Closures Tracker report. We include retailer-level details on closures and openings as a percentage of total store base as well as square-footage impact. This report also offers a comparison between year-to-date announced closures and openings as of October 29, 2021 (corresponding to week 43 in our Weekly US and UK Store Openings and Closures Tracker) versus the comparable period in 2020 (the 44 weeks ended October 30, 2020).2021 Major US Store Closures: Proportion of Store Base and Square Footage

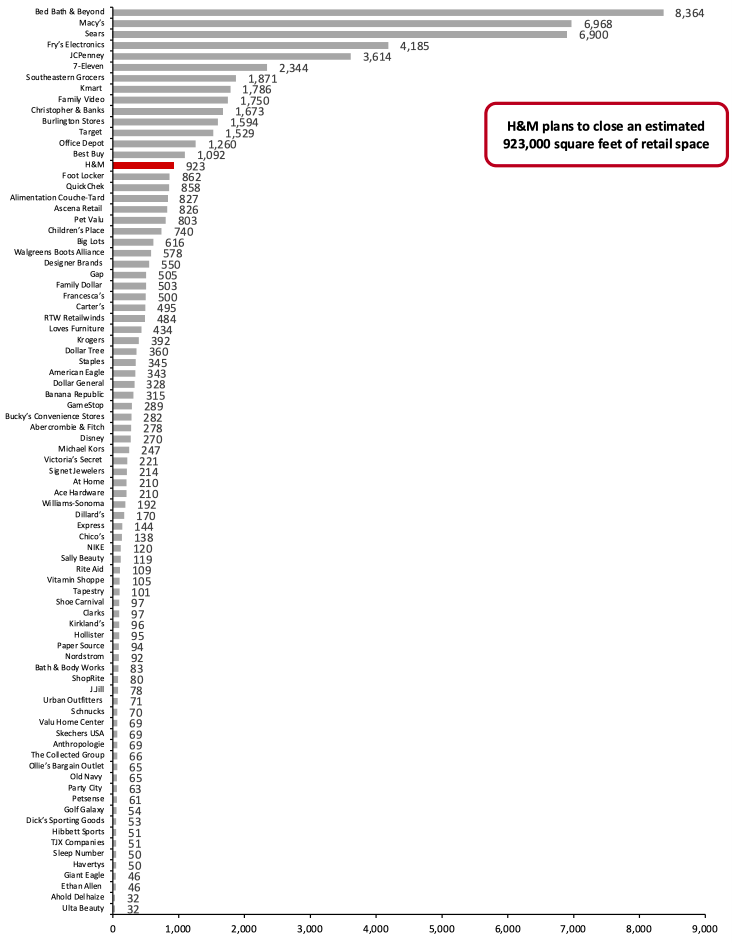

As of October 29, 2021, major US retailers have announced 5,001 store closures for this year. This compares to 7,959 announced closures in the comparable period of 2020, as we discuss later in this report. In October 2021, the following retailers made store closure announcements:- Barnes & Noble has closed two stores year to date in 2021, which represent less than 1% of its total store base of 610 stores. The closures account for an estimated 28,000 square feet of total retail space.

- Clarks has closed 47 stores year to date in 2021, which represent 22% of its total store base of 214 stores. The closures account for an estimated 97,000 square feet of total retail space.

- H&M plans to close 41 stores in 2021, which represent 7% of its total store base of 582 stores. The closures will account for an estimated 923,000 square feet of total retail space.

- NIKE has closed eight stores year to date in 2021, which represent 2% of its total store base of 338 stores. The closures account for an estimated 120,000 square feet of total retail space.

- ShopRite has closed two stores year to date in 2021, which represent less than 1% of its total store base of 324 stores. The closures account for an estimated 80,000 square feet of total retail space.

- Walgreens Boots Alliance has closed 37 stores year to date in 2021, which represent less than 1% of its total store base of 9,021 stores. The closures account for an estimated 578,000 square feet of total retail space.

Figure 1. Year-to-Date Announced US Store Closures Estimates for 2021, by Retailer, in Comparison to Total Store Base (Listed by Most to Least Closures) [wpdatatable id=1394]

Store-count information for retailers in the above list are based on the third quarter of the fiscal year ended January 2021 or the fourth quarter of the fiscal year ended December 2020 for most public companies. *Ascena Retail includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports and Foot Action stores. Williams-Sonoma includes Williams Sonoma and Pottery Barn store banners. TJX Companies includes HomeGoods, Homesense, Marmaxx (Marshalls and T.J. Maxx) and Sierra stores. Amazon includes Amazon Fresh and Amazon Go banners. **Total store base count represented for Genesco is global. For Aerie, Disney, Gap, Michaels Stores, Old Navy and Signet Jewelers the store count is for North America as a US-specific breakdown could not be obtained. Source: Company reports/Coresight Research

Overall, the announced year-to-date closures equate to over 63.2 million square feet in closed retail space, we estimate. In Figure 2, we show the estimated square-footage impact of various retailers’ year-to-date store closure announcements for 2021.Figure 2. Year-to-Date Announced 2021 US Store Closures Estimates in Gross Square Feet, by Retailer (Thous.) [caption id="attachment_135260" align="aligncenter" width="700"]

Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Amazon includes Amazon Fresh and Amazon Go banners. Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports and Foot Action stores.

Ascena Retail Group includes Justice, Catherines, Ann Taylor, Lane Bryant, LOFT and Lou & Grey. Amazon includes Amazon Fresh and Amazon Go banners. Foot Locker includes Foot Locker, Lady Foot Locker, Champs Sports and Foot Action stores.Note: The total includes a small number of retailers that will each close less than 32,000 square feet of retail space and so are not included in the chart.

Source: Company reports/Coresight Research[/caption]

2021 Major US Store Openings: Proportion of Store Base and Square Footage

As of October 29, 2021, major US retailers have announced 5,034 store openings. This compares to 3,169 announced openings in the comparable period of 2020, which we discuss later in this report. In October, the following retailers announced store openings for 2021:- 99 Ranch opened two stores in 2021, representing an expansion of 4% of its existing store fleet of 53 stores. The new openings will account for an estimated 88,000 square feet of total retail space.

- Allbirds opened two stores in 2021, representing a 12% expansion of its existing store fleet of 17 stores. The new openings will account for an estimated 6,000 square feet of total retail space.

- Aritzia opened eight stores in 2021, representing a 28% expansion of its existing store fleet of 29 stores. The new openings will account for an estimated 48,000 square feet of total retail space.

- Barnes & Noble opened three stores in 2021, representing an expansion of less than 1% of its existing store fleet of 610 stores. The new openings will account for an estimated 42,000 square feet of total retail space.

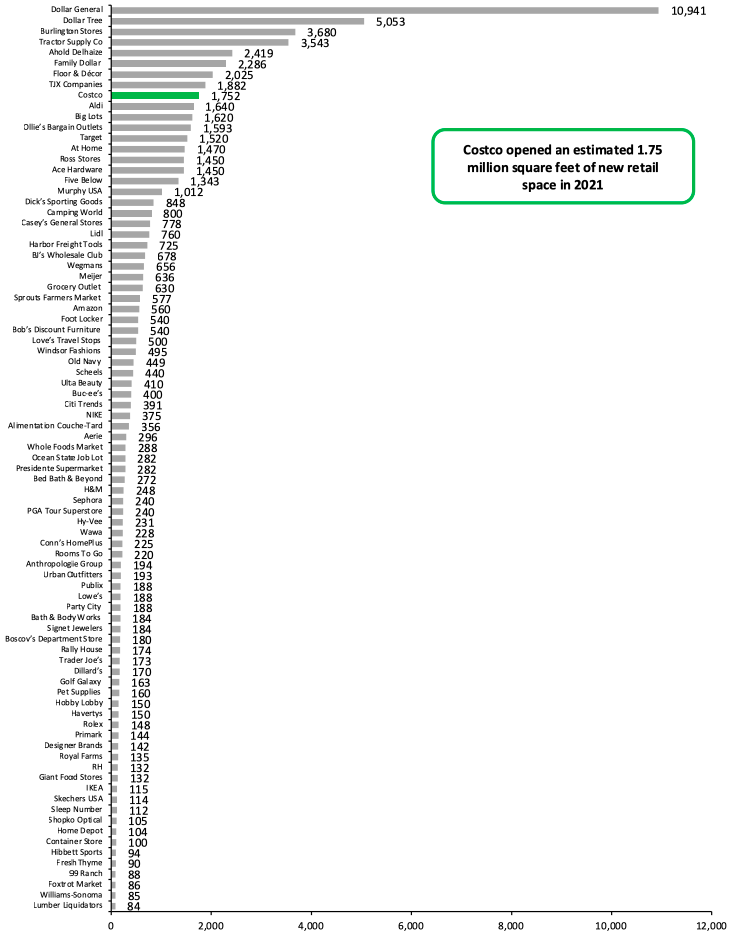

- Costco opened 12 stores in 2021, representing an expansion of 2% of its existing store fleet of 522 stores. The new openings will account for an estimated 1.75 million square feet of total retail space.

- Dillard’s opened one store in 2021, representing an expansion of less than 1% of its existing store fleet of 282 stores. The new opening will account for an estimated 170,000 square feet of total retail space.

- Fleet Feet acquired three stores from FITniche in 2021, representing an expansion of 2% of its existing store fleet of 185 stores. The new openings will account for an estimated 7,000 square feet of total retail space.

- Hermès opened three stores in 2021, representing an 8% expansion of its existing store fleet of 37 stores. The new openings will account for an estimated 16,000 square feet of total retail space.

- Hobby Lobby opened three stores in 2021, representing an expansion of less than 1% of its existing store fleet of 900 stores. The new openings will account for an estimated 150,000 square feet of total retail space.

- Hy-Vee opened three stores in 2021, representing a 1% expansion of its existing store fleet of 303 stores. The new openings will account for an estimated 231,000 square feet of total retail space.

- Meijer opened four stores in 2021, representing a 2% expansion of its existing store fleet of 254 stores. The new openings will account for an estimated 636,000 square feet of total retail space.

- Miniso plans to open 17 stores in 2021, representing a 47% expansion of its existing store fleet of 36 stores. The new openings will account for an estimated 68,000 square feet of total retail space.

- Moosejaw opened one store in 2021, representing a 9% expansion of its existing store fleet of 11 stores. The new opening will account for an estimated 6,000 square feet of total retail space.

- Ocean State Job Lot plans to open six stores in 2021, representing a 4% expansion of its existing store fleet of 141 stores. The new openings will account for an estimated 282,000 square feet of total retail space.

- Rooms To Go opened three stores in 2021, representing a 12% expansion of its existing store fleet of 25 stores. The new openings will account for an estimated 220,000 square feet of total retail space.

- Sears opened one Sears Hometown store in 2021, representing an expansion of less than 1% of its existing store fleet of 321 Sears Hometown stores. The new opening will account for an estimated 5,000 square feet of total retail space.

- Scotch & Soda opened two stores in 2021, representing a 5% expansion of its existing store fleet of 39 stores. The new openings will account for an estimated 4,000 square feet of total retail space.

- Trader Joe’s opened 15 stores in 2021, representing a 3% expansion of its existing store fleet of 514 stores. The new openings will account for an estimated 172,500 square feet of total retail space.

- Vineyard Vines opened one store in 2021, representing an expansion of less than 1% of its existing store fleet of 125 stores. The new opening will account for an estimated 3,400 square feet of total retail space.

- Vuori plans to open three stores in 2021, representing a 33% expansion of its existing store fleet of nine stores. The new openings will account for an estimated 9,000 square feet of total retail space.

- Whole Foods Market opened six stores in 2021, representing a 1% expansion of its existing store fleet of 506 stores. The new openings will account for an estimated 288,000 square feet of total retail space.

Figure 3. Year-to-Date Announced US Store Openings Estimates for 2021, by Retailer, in Comparison to Total Store Base (Listed by Most to Least Openings) [wpdatatable id=1395]

Store count information for retailers in the above list are based on reported counts from the third quarter of the fiscal year, ended January 2021 or the fourth quarter of the fiscal year, ended December 2020 for most public companies. *Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports and Foot Action stores. Aerie includes Aerie and OFFLINE stores. TJX Companies includes HomeGoods, Homesense, Marmaxx (Marshalls and T.J. Maxx) and Sierra stores. Amazon includes Amazon Fresh and Amazon Go banners. Williams-Sonoma includes Williams Sonoma and Pottery Barn store banners. **Total store base count for Genesco and Payless is global, while the store base count for Athleta, Old Navy and Signet Jewelers and Michaels Stores is for North America as a US-specific breakdown could not be obtained. Source: Company reports/Coresight Research

Overall, the announced year-to-date closures equate to over 63.2 million square feet in closed retail space, we estimate. In Figure 2, we show the estimated square-footage impact of various retailers’ year-to-date store closure announcements for 2021.Figure 2. Year-to-Date Announced 2021 US Store Closures Estimates in Gross Square Feet, by Retailer (Thous.) [caption id="attachment_135262" align="aligncenter" width="700"]

TJX Companies includes HomeGoods, Homesense, Marmaxx and Sierra stores. Amazon includes Amazon Fresh and Amazon GO banners. Aerie includes Aerie stores and OFFLINE stores. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports and Foot Action stores. The square footage for Target is calculated on the assumption that the majority of stores that the company expects to open in 2021 are small-format stores.

TJX Companies includes HomeGoods, Homesense, Marmaxx and Sierra stores. Amazon includes Amazon Fresh and Amazon GO banners. Aerie includes Aerie stores and OFFLINE stores. Foot Locker includes the Foot Locker, Lady Foot Locker, Champs Sports and Foot Action stores. The square footage for Target is calculated on the assumption that the majority of stores that the company expects to open in 2021 are small-format stores.Note: Total includes a small number of retailers that will each open less than 84,000 square feet of new retail space and so are not included in the chart.

Source: Company reports/Coresight Research[/caption]

2021 Versus 2020: A Year-to-Date Comparison

The charts below depict the week-by-week totals of announced US store closures and openings year to date in 2021, as well as the comparative figures for 2020. Compared to this time last year, openings announcement totals are ahead in 2021, while closures announcements are behind. Year-to-date announced store closures in October 2021 are led by apparel retailers, which account for 2,147 closures, representing 43% of total closures. The year-to-date equivalent closures for October 2020 were also led by apparel retailers, which accounted for 2,961 closures, representing 37% of total closures. Year-to-date announced store openings in October 2021 are led by discount store retailers, which account for 1,935 openings, representing 38% of total openings. The year-to-date equivalent openings for October 2020 were also led by discount store retailers, which accounted for 1,662 openings, representing 52% of total announced openings.Figure 5. US Announced Store Closures and Openings: Week-by-Week Comparison, 2021 (Top) vs 2020 (Bottom) [wpdatachart id=323] [wpdatachart id=324]

October 2021 spans weeks 39 to 43, while the comparable period in 2020 spans weeks 40 to 44: Our tracker counts map four weeks in January 2021, versus five weeks in January 2020. Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks. Source: Company reports/Coresight Research

US Retail Bankruptcies: 2021 Versus 2020

There were no major retail bankruptcies in October 2021. In the tables below, we offer a comparative view of year-to-date bankruptcy filings as of October 31, 2021, versus October 31, 2020. Our Retail Bankruptcies Databank offers a more detailed list of US and UK retail companies, restaurants and gyms that have filed for bankruptcy since March 2020.Figure 6. 2021 Major US Retail Bankruptcies as October 31, 2021 [wpdatatable id=1396]

*The Collected Group emerged from bankruptcy in June 2021 **Belk exited bankruptcy one day after filing N/A—Not Available Source: Company reports/Coresight Research

Figure 7. 2020 Major US Retail Bankruptcies as of October 31, 2020 [wpdatatable id=1397]

*J.Crew Group includes J.Crew and Madewell banners. Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant, and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners. **True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016. N/A – Not Available Source: Company reports/Coresight Research

Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross. Figures represent retail closures (i.e., B2C), so closures by solely B2B companies are excluded. Total square footage being opened or closed is typically estimated from retailers’ average gross store sizes.