Nitheesh NH

Store Tracker Extra: More Data Each Month

In our US Store Tracker Extra monthly series, we offer insight into retailers’ store closure and opening announcements on a monthly basis—supplementing our Weekly US and UK Store Openings and Closures Tracker report. We include retailer-level details on closures and openings as a percentage of total store base as well as square-footage impact. This report also offers a comparison between year-to-date announced closures and openings as of April 1, 2022 (corresponding to week 13 in our Weekly US and UK Store Openings and Closures Tracker) versus the comparable period in 2021 (the four weeks ended April 2, 2021).2022 Major US Store Closures: Proportion of Store Base and Square Footage

As of April 1, 2022, major US retailers have announced 1,385 store closures for this year. This compares to 3,097 announced closures in the comparable period of 2021, as we discuss later in this report. In March 2022, the following retailers made store closure announcements:- Abercrombie & Fitch has closed nine stores year to date in 2022, which represents 5% of its total store base of 173 stores. The closures account for an estimated 68,000 square feet of total retail space.

- Alimentation Couche-Tard has closed 45 stores year to date in 2022, which represents less than 1% of its total store base of 9,166 stores. The closures account for an estimated 117,000 square feet of total retail space.

- Amazon plans to close 57 stores in 2022, which represents 53% of its total store base of 107 stores. The closures will account for an estimated 165,000 square feet of total retail space.

- Banana Republic plans to close 38 stores in North America in 2022, which represents 8% of its total store base of 461 stores. The closures will account for an estimated 321,000 square feet of total retail space.

- Bath & Body Works has closed eight stores year to date in 2022, which represents 1% of its total store base of 1,672 stores. The closures account for an estimated 31,000 square feet of total retail space.

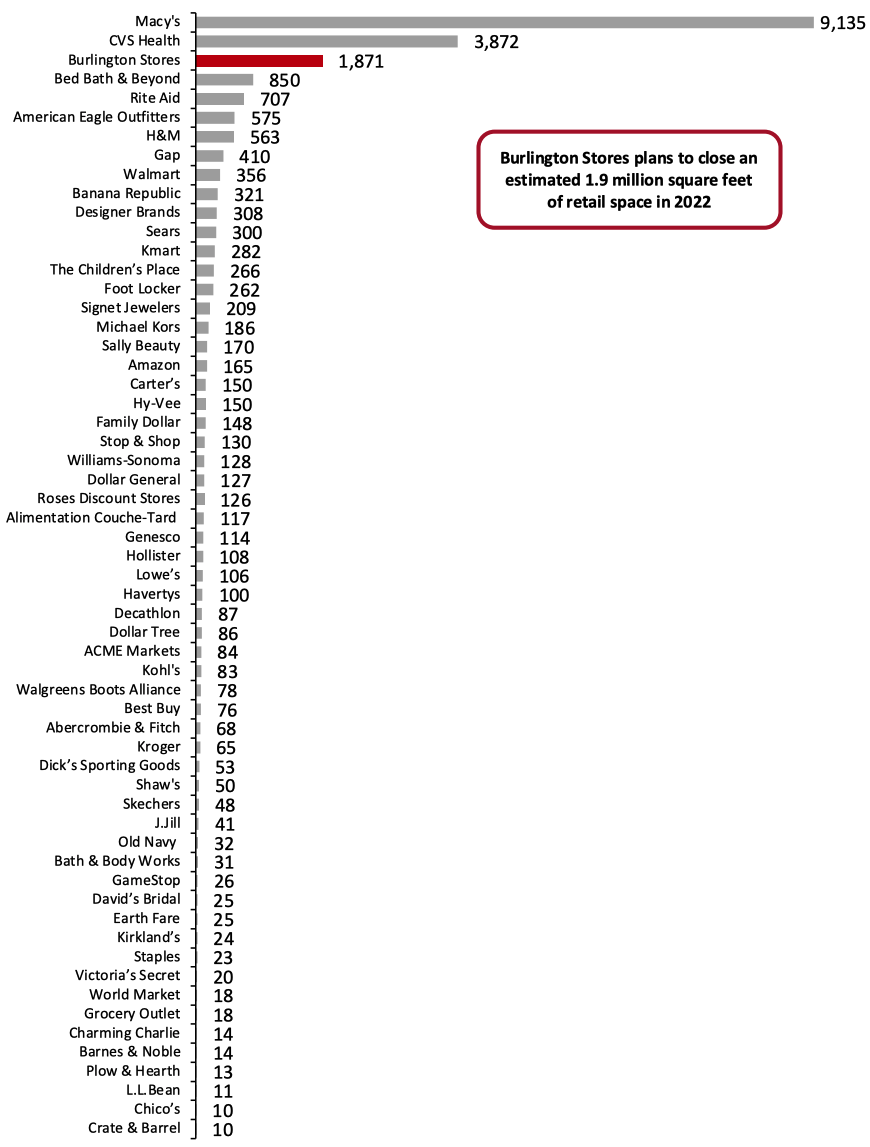

- Burlington Stores plans to close 27 stores in 2022, which represents 3% of its total store base of 832 stores. The closures will account for an estimated 1.9 million square feet of total retail space.

- Carter’s plans to close 30 stores in 2022, which represents 4% of its total store base of 751 stores. The closures will account for an estimated 150,000 square feet of total retail space.

- Crate & Barrel has closed one store year to date in 2022, which represents 1% of its total store base of 75 stores. The closure accounts for an estimated 10,000 square feet of total retail space.

- David’s Bridal plans to close one store in 2022, which represents less than 1% of its total store base of 297 stores. The closure will account for an estimated 25,000 square feet of total retail space.

- Dollar General has closed 12 stores year to date in 2022, which represents less than 1% of its total store base of 17,915 stores. The closures account for an estimated 127,000 square feet of total retail space.

- Dollar Tree has closed seven stores year to date in 2022, which represents less than 1% of its total store base of 7,984 stores. The closures account for an estimated 86,000 square feet of total retail space.

- Family Dollar has closed 14 stores year to date in 2022, which represents less than 1% of its total store base of 7,982 stores. The closures account for an estimated 148,000 square feet of total retail space.

- Foot Locker has closed 63 stores year to date in 2022, which represents 3% of its total store base of 1,987 stores. The closures account for an estimated 262,000 square feet of total retail space.

- GameStop has closed 15 stores year to date in 2022, which represents less than 1% of its total store base of 3,018 stores. The closures account for an estimated 25,500 square feet of total retail space.

- Gap plans to close 39 stores in North America in 2022, which represents 7% of its total store base of 538 stores. The closures will account for an estimated 410,000 square feet of total retail space.

- Genesco plans to close 39 stores in 2022, which represents 3% of its total store base of 1,210 stores. The closures will account for an estimated 114,000 square feet of total retail space.

- Hibbett Sports has closed one store year to date in 2022, which represents less than 1% of its total store base of 1,096 stores. The closure accounts for an estimated 6,000 square feet of total retail space.

- Hollister has closed 16 stores year to date in 2022, which represents 5% of its total store base of 351 stores. The closures account for an estimated 108,000 square feet of total retail space.

- J.Jill plans to close 11 stores in 2022, which represents 4% of its total store base of 260 stores. The closures will account for an estimated 41,000 square feet of total retail space.

- Kmart has closed three stores year to date in 2022, which represents 25% of its total store base of 12 stores. The closures account for an estimated 282,000 square feet of total retail space.

- Lowe’s has closed one store year to date in 2022, which represents less than 1% of its total store base of 1,971 stores. The closure accounts for an estimated 106,000 square feet of total retail space.

- Old Navy has closed two stores year to date in 2022, which represents less than 1% of its total store base of 1,257 stores. The closures account for an estimated 32,000 square feet of total retail space.

- The Children’s Place plans to close 47 stores in 2022, which represents 7% of its total store base of 702 stores. The closures will account for an estimated 266,000 square feet of total retail space.

- Williams-Sonoma has closed 12 stores year to date in 2022, which represents 2% of its total store base of 544 stores. The closures account for an estimated 128,000 square feet of total retail space.

- Walmart plans to close two stores in 2022, which represents less than 1% of its total store base of 5,342 stores. The closures will account for an estimated 356,000 square feet of total retail space.

Figure 1. Year-to-Date Announced US Store Closures Estimates for 2022, by Retailer, in Comparison to Total Store Base (Listed by Most to Least Closures) [wpdatatable id=1868]

Store-count information for retailers in the list above is based on the third quarter of the fiscal year, ended March 2022 for most public companies. *Total store base is for North America as a US-specific breakdown could not be obtained. **Macy’s includes Macy’s, Bloomingdale and Bluemercury banners. Amazon includes Amazon 4-star and Amazon Books store banners. Source: Company reports/Coresight Research

Overall, we estimate the announced year-to-date closures equate to over 23.5 million square feet in closed retail space. In Figure 2, we show the estimated square-footage impact of various retailers’ year-to-date store closure announcements for 2022.Figure 2. Year-to-Date Announced 2022 US Store Closures Estimates in Gross Square Feet, by Retailer (Thous.) [caption id="attachment_144930" align="aligncenter" width="700"]

Total includes a small number of retailers that will each close less than 10,000 square feet of retail space and are not included in the chart.

Total includes a small number of retailers that will each close less than 10,000 square feet of retail space and are not included in the chart.Source: Company reports/Coresight Research[/caption]

2022 Major US Store Openings: Proportion of Store Base and Square Footage

As of April 1, 2022, major US retailers have announced 3,694 store openings. This compares to 3,431 announced openings in the comparable period of 2021, which we discuss later in this report. In January, the following retailers announced store openings for 2022:- Alimentation Couche-Tard has opened 10 stores in 2022, representing a less than 1% expansion of its existing store fleet of 9,166 stores. The new openings account for an estimated 26,000 square feet of total retail space.

- Allbirds plans to open 11 stores in 2022, representing a 46% expansion of its existing store fleet of 24 stores. The new openings will account for an estimated 33,000 square feet of total retail space.

- Camping World plans to open 20 stores in 2022, representing a 11% expansion of its existing store fleet of 187 stores. The new openings will account for an estimated 1 million square feet of total retail space.

- Casey’s General Stores has opened 17 stores in 2022, representing a 1% expansion of its existing store fleet of 2,341 stores. The new openings account for an estimated 102,000 square feet of total retail space.

- Citi Trends plans to open 36 stores in 2022, representing a 6% expansion of its existing store fleet of 600 stores. The new openings will account for an estimated 485,000 square feet of total retail space.

- Dillard’s has opened one store in 2022, representing an expansion of less than 1% of its existing store fleet of 279 stores. The new opening accounts for an estimated 160,000 square feet of total retail space.

- Express plans to open nine stores in 2022, representing a 2% expansion of its existing store fleet of 364 stores. The new openings will account for an estimated 76,000 square feet of total retail space.

- Floor & Décor plans to open 32 stores in 2022, representing a 20% expansion of its existing store fleet of 160 stores. The new openings will account for an estimated 2.5 million square feet of total retail space.

- Foot Locker plans to open 11 stores in 2022, representing a 1% expansion of its existing store fleet of 1,987 stores. The new openings will account for an estimated 46,000 square feet of total retail space.

- Harbor Freight Tools has opened 15 stores in 2022, representing an expansion of 1% of its existing store fleet of 1,286 stores. The new openings account for an estimated 236,000 square feet of total retail space.

- Hobby Lobby has opened seven stores in 2022, representing a 1% expansion of its existing store fleet of 961 stores. The new openings account for an estimated 385,000 square feet of total retail space.

- Genesco plans to open 33 stores in 2022, representing a 3% expansion of its existing store fleet of 1,210 stores. The new openings will account for an estimated 96,000 square feet of total retail space.

- Guess? has opened one store in 2022, representing a less than 1% expansion of its existing store fleet of 245 stores. The new opening accounts for an estimated 5,000 square feet of total retail space.

- Lumber Liquidators plans to open 20 stores in 2022, representing a 5% expansion of its existing store fleet of 424 stores. The new openings will account for an estimated 140,000 square feet of total retail space.

- Ollie’s Bargain Outlet plans to open 42 stores in 2022, representing a 10% expansion of its existing store fleet of 426 stores. The new openings will account for an estimated 1.3 million square feet of total retail space.

- Nordstrom has opened two stores in 2022, representing a 1% expansion of its existing store fleet of 354 stores. The new openings account for an estimated 185,000 square feet of total retail space.

- Rally House has opened one store in 2022, representing an expansion of 1% of its existing store fleet of 102 stores. The new opening accounts for an estimated 6,000 square feet of total retail space.

- Shoe Carnival plans to open nine stores in 2022, representing a 2% expansion of its existing store fleet of 393 stores. The new openings will account for an estimated 97,000 square feet of total retail space.

- Sprouts Farmers Market plans to open 15 stores in 2022, representing a 4% expansion of its existing store fleet of 383 stores. The new openings will account for an estimated 447,000 square feet of total retail space.

- TJX Companies plans to open 133 stores across its brands in 2022, representing a 4% expansion of its existing store fleet of 3,321 stores. The new openings will account for an estimated 3.7 million square feet of total retail space

- Ulta Beauty plans to open 48 stores in 2022, representing a 4% expansion of its existing store fleet of 1,302 stores. The new openings will account for an estimated 505,000 square feet of total retail space

- Vera Bradley plans to open five stores in 2022, representing a 3% expansion of its existing store fleet of 147 stores. The new openings will account for an estimated 14,000 square feet of total retail space

- Warby Parker plans to open 40 stores in 2022, representing a 25% expansion of its existing store fleet of 158 stores. The new openings will account for an estimated 67,000 square feet of total retail space.

- Whole Foods Market has opened four stores in 2022, representing a 1% expansion of its existing store fleet of 512 stores. The new openings account for an estimated 192,000 square feet of total retail space.

- WinCo Foods has opened one store in 2022, representing a 1% expansion of its existing store fleet of 136 stores. The new opening accounts for an estimated 88,000 square feet of total retail space.

- Williams-Sonoma has opened one store in 2022, representing an expansion of less than 1% of its existing store fleet of 544 stores. The new opening accounts for an estimated 11,000 square feet of total retail space.

Figure 3. Year-to-Date Announced US Store Openings Estimates for 2022, by Retailer, in Comparison to Total Store Base (Listed by Most to Least Openings) [wpdatatable id=1869]

Store count information for retailers in the list above is based on reported counts from the third quarter of the fiscal year, ended March 2022 for most public companies. *Total store base count is for North America as a US-specific breakdown could not be obtained. **Aerie includes Aerie stores and OFFLINE stores. Amazon includes Amazon Fresh and Amazon Style banners. TJX Companies includes HomeGoods, Homesense, Marmaxx (Marshalls and T.J. Maxx) and Sierra stores. Macy’s includes Macy’s, Bloomingdale and Bluemercury banners. Source: Company reports/Coresight Research

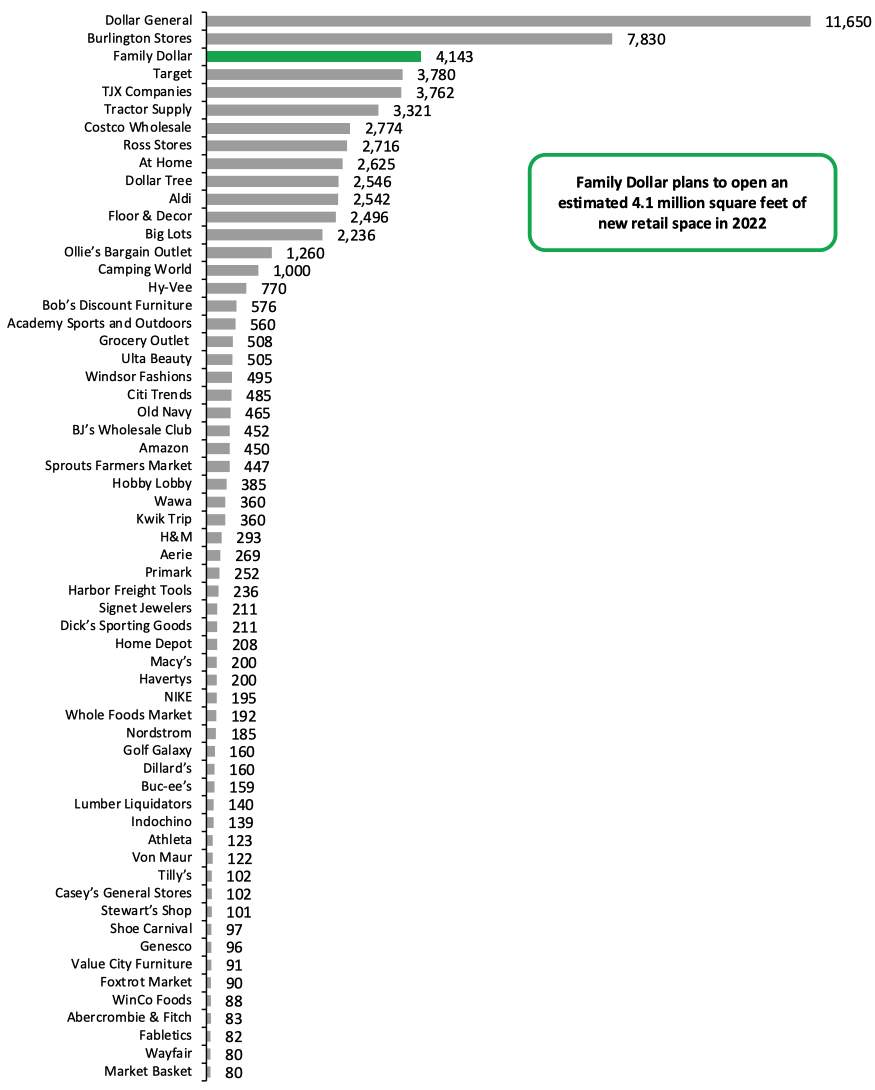

Overall, we estimate the announced year-to-date openings equate to over 67.6 million square feet in new retail space. In Figure 4, we show the square-footage impact of various retailers’ year-to-date store opening announcements for 2022.Figure 4. Year-to-Date Announced 2022 US Store Openings Estimates in Gross Square Feet, by Retailer (Thous.) [caption id="attachment_144932" align="aligncenter" width="700"]

Aerie includes Aerie stores and OFFLINE stores. Amazon includes Amazon Fresh and Amazon Style banners. TJX Companies includes HomeGoods, Homesense, Marmaxx and Sierra stores. Total includes a small number of retailers that will each open less than 80,000 square feet of new retail space and are not included in the chart.

Aerie includes Aerie stores and OFFLINE stores. Amazon includes Amazon Fresh and Amazon Style banners. TJX Companies includes HomeGoods, Homesense, Marmaxx and Sierra stores. Total includes a small number of retailers that will each open less than 80,000 square feet of new retail space and are not included in the chart.Source: Company reports/Coresight Research[/caption]

2022 Versus 2021: A Year-to-Date Comparison

The charts below depict the week-by-week totals of announced US store closures and openings year to date in 2022, as well as the comparative figures for 2021. Compared to this time last year, openings announcement totals are ahead in 2022, while closures announcements are behind. Year-to-date announced store closures in March 2022 are led by apparel retailers, which account for 476 closures, representing 34% of total closures. The year-to-date equivalent closures for March 2021 were also led by apparel retailers, which accounted for 990 closures, representing 32% of total closures. Year-to-date announced store openings in March 2022 are led by discount store retailers, which account for 1,815 openings, representing 49% of total openings. The year-to-date equivalent openings for March 2021 were also led by discount store retailers, which accounted for 1,856 openings, representing 54% of total openings.Figure 5. US Announced Store Closures and Openings: Week-by-Week Comparison, 2022 (Top) vs 2021 (Bottom) [wpdatachart id=411] [wpdatachart id=412]

March 2022 and 2021 span weeks 9 to 12. Coresight Research periodically updates the count for openings and closures when there are new updates or revisions to previous announcements from companies, and this could involve retrospective revisions of totals for some weeks. Source: Company reports/Coresight Research

US Retail Bankruptcies: 2022 Versus 2021

There were no major retail bankruptcies in March 2022. In the table below, we list bankruptcy filings for the comparable period of 2021, ended March 31, 2021. Our Retail Bankruptcies Databank offers a more detailed list of US and UK retail companies, restaurants and gyms that have filed for bankruptcy since March 2020.Figure 6. 2021 Major US Retail Bankruptcies as March 28, 2021 [wpdatatable id=1870]

*Belk emerged from bankruptcy in March 2021 Source: Company reports/Coresight Research

Notes Figures represent store openings and closures that occurred, or are expected to occur, in the respective calendar years. For some retailers, store opening and closure numbers are estimated, including from part-year data, global figures or announced closure/opening programs that span multiple years. Estimates are updated as companies announce details. Figures for openings and closures are gross. Figures represent retail (B2C) closures, so closures by solely B2B companies are excluded. Total square footage being opened or closed is typically estimated from retailers’ average gross store sizes.